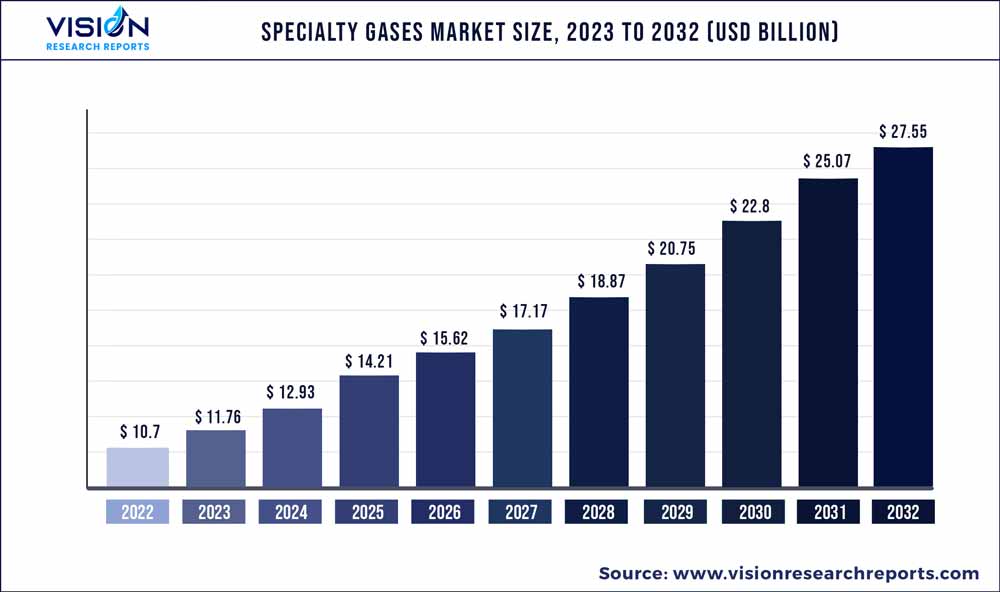

The global specialty gases market was valued at USD 10.7 billion in 2022 and it is predicted to surpass around USD 27.55 billion by 2032 with a CAGR of 9.92% from 2023 to 2032.

Key Pointers

Report Scope of the Specialty Gases Market

| Report Coverage | Details |

| Market Size in 2022 | USD 10.7 billion |

| Revenue Forecast by 2032 | USD 27.55 billion |

| Growth rate from 2023 to 2032 | CAGR of 9.92% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Linde plc; Air Liquide International S.A.; Messer Group GmbH; Air Products and Chemicals, Inc.; Weldstar, Inc.; Mesa Specialty Gases & Equipment; Norco Inc.; Taiyo Nippon Sanso Corporation; Showa Denko K.K. |

Increased preference for specialty gases in the healthcare sector owing to an increased rate of applicability in medical applications is a driving factor for the strong market growth.

Increased rate of applicability in key applications such as manufacturing (welding and cutting, lighting, laser, chemicals), healthcare (medical devices, pharmaceutical drugs manufacturing, anesthetic), electronics (flat panel displays, semiconductor devices), and analytical and calibration instruments are expected to drive market growth.

The manufacturing and electronics industries are flourishing at an increased rate in emerging economies of Asia Pacific. Government initiatives to strengthen analytical testing capabilities, growing expenditure on drugs and medical devices by public health organizations, technological advancement, and government investments in the healthcare and electronics industries are increasing the demand for specialty gas.

Prevailing energy and environment-friendly practices coupled with growing societal awareness towards green products and solutions are anticipated to develop more stringent environmental and emission norms over the forecasted period. Furthermore, key players such as Air Liquide, Praxair, Inc., Linde AG, etc. are developing clean technologies and introducing innovative solutions that will lower emissions and pollutants.

Product Insights

The carbon gas segment is anticipated to be a leading segment in the market with a revenue share of over 26.03% as of 2022, owing to increasing demand by various end-use industries such as manufacturing, electronics, healthcare, and chemicals as well as growing application scope for analytical purposes and instrument calibration. Increasing demand for noble gas from manufacturing and electronics industries is anticipated to propel the industry growth.

The ultra-high purity segment is anticipated to be the leading segment in the specialty gas industry owing to its increasing usage in applications such as manufacturing semiconductors, usage in laser technology, displays, photovoltaic products, welding and cutting, analytical instruments, stabilizing chemical processes, creating amplified light for hardening and marking, etc.

Noble gases are also expected to witness huge demand owing to the increasing requirement for non-reactive chemical reactions in the manufacturing process and industrial applications such as lighting, welding, laser equipment, and diving gear. Other specialty gases include zero air, silane, nitrous oxide, custom blends, and gas mixtures. Increasing demand for custom-blended mixtures by the food and beverage, healthcare, manufacturing, and chemical industry is anticipated to spur the market demand.

Noble/Inert gases under standard conditions have similar properties and are very low in chemical reactivity. It includes helium, neon, argon, krypton, xenon, and radioactive radon. These gases are extensively used for various industrial applications such as double glazing, lamp filling, and in laser technology

Application Insights

Healthcare application is anticipated to be the largest segment in the specialty gas market, accounting for over 26.05% in 2022. Increased preference in the healthcare sector owing to an increased rate of applicability in medical applications is driving industry growth.

Increasing demand by the healthcare industry has been a major driver for the application of specialty gas. With increased production and applications, the demand for specialty gas in the processed specialty gas segment will be propelled further, over the forecast period.

The manufacturing segment accounted for over 19.06% of the market share of the global demand in 2022. The large proportion can be accredited to the large manufacturing industry and the requirement of ultra-high purity and other specialty gas for specific applications.

Increasing demand due to new technologies and existing uses of display technologies such as OLED, 4K, curved and flexible displays is positively driving the display market. Large-scale production of displays owing to high demand is fostering the use of specialty gases.

Regional Insights

Asia Pacific was the largest regional market for specialty gas with a revenue share of 45.09% as of 2022, owing to the presence of numerous end-use industries such as healthcare, electronics, manufacturing, pharmaceutical, etc. Massive investments commenced in developing custom blending techniques and adoption of new technology for the production process, equipment, and packaging in the Asia Pacific is anticipated to surge preference for specialty gas products.

China is the largest market for specialty gas in the Asia Pacific region owing to the increasing demand for bulk and electronic specialty gases in this region. High purity gas production is done on large scale in this region due to increased preference toward the healthcare sector and application in the food and beverage, electronics, and pharmaceutical sector.

Increasing demand for specialty gases in Europe is positively influencing industry growth owing to the high rate of facility establishment, technological advancement in packaging, high disposable income, and increased standard of living. Supportive government investments for specialty gas production are projected to foster market growth.

Attribution to the institutional segment is largely due to its versatile properties, low chemical reactivity, low impurities, inertness, etc. which helps to optimize performance, lower costs and improve yields. This is expected to further boost the demand for these specialty gases in analytical applications as well as manufacturing, electronics, automotive, and healthcare industries in Asia-Pacific and North America regions.

Specialty Gases Market Segmentations:

By Product

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Specialty Gases Market

5.1. COVID-19 Landscape: Specialty Gases Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Specialty Gases Market, By Ultra-high Purity Gases

8.1. Specialty Gases Market, by Product, 2023-2032

8.1.1. Ultra-high Purity Gases

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Noble Gases

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Carbon Gases

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Halogen Gases

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Other Specialty Gases

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Specialty Gases Market, By Application

9.1. Specialty Gases Market, by Application, 2023-2032

9.1.1. Manufacturing

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Electronics

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Healthcare

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Institutional

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Other Application

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Specialty Gases Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Linde plc

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Air Liquide International S.A.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Messer Group GmbH

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Air Products and Chemicals, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Weldstar, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Mesa Specialty Gases & Equipment

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Norco Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Taiyo Nippon Sanso Corporation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Showa Denko K.K.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others