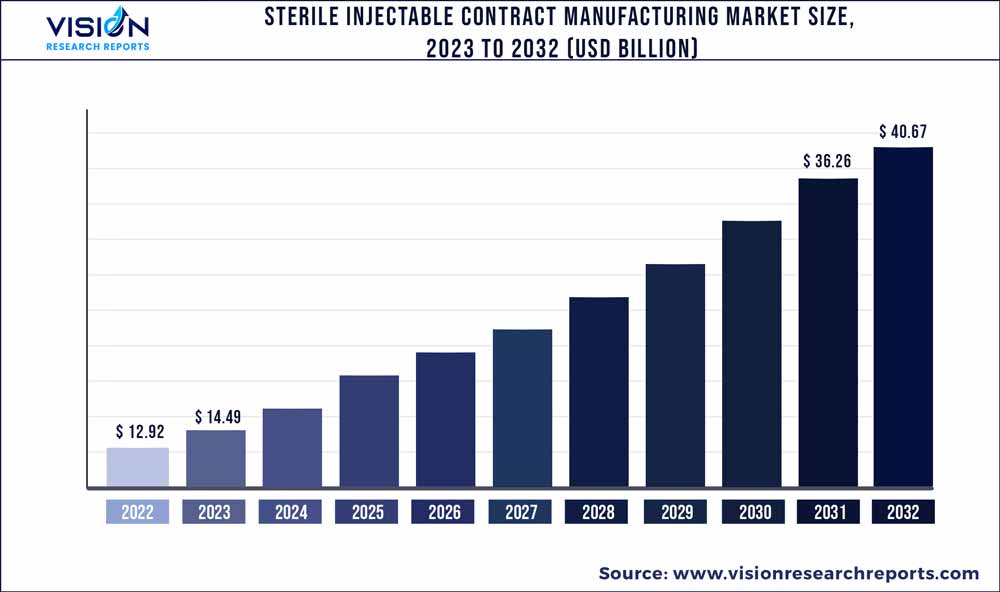

The global sterile injectable contract manufacturing market size was estimated at around USD 12.92 billion in 2022 and it is projected to hit around USD 40.67 billion by 2032, growing at a CAGR of 12.15% from 2023 to 2032. The sterile injectable contract manufacturing market in the United States was accounted for USD 3.7 billion in 2022.

Key Pointers

Report Scope of the Sterile Injectable Contract Manufacturing Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 37% |

| CAGR of Asia Pacific from 2023 to 2032 | 13.14% |

| Revenue Forecast by 2032 | USD 40.67 billion |

| Growth Rate from 2023 to 2032 | CAGR of 12.15% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Baxter; Catalent, Inc.; Vetter Pharma; Recipharm AB; Aenova Group; Fresenius Kabi; Unither Pharmaceuticals; Famar; Cipla Inc.; NextPharma Technologies |

The development of biopharmaceuticals, such as vaccines and cell and gene therapies, is boosting the production of injectable drug products in the global market. Moreover, the increasing prevalence rate of chronic illnesses, along with faster approval of sterile injectables compared to other drug types, are further supporting the need for injectables.

The high demand for sterile injectables has led to the growth in outsourced agreements amongst contract manufacturers and original drug sponsors, thereby augmenting the growth of the sterile injectable contract manufacturing industry. Rapid absorption, lower risk of drug degradation by gastric secretion, faster drug action, and less concentration of the drugs are among the parameters that support the demand for commercial injectable doses.

Pharmaceutical companies engaged in injectable manufacturing are gaining traction for offering development support for large molecule injectable drugs, monoclonal antibody therapies, and infectious disease treating drugs. Factors such as shorter and more economical research and development cycles of generic injectable and the increasing advancements in treatment options for rare diseases are augmenting the growth of injectable contract manufacturers in the global market.

The COVID-19 outbreak had a positive impact on the sterile injectable contract manufacturing industry. From 2020 to 2021, the demand for COVID-19 vaccines saw a significant surge because of the contagious and rapidly spreading infection. Thus, to satisfy the growing demand for COVID-19 vaccines, several contract manufacturers started to provide bulk manufacturing services for the therapeutic dosage.

Hence, the aforementioned factors led to a positive impact of the COVID-19 pandemic on the sterile injectable contract manufacturing industry. Furthermore, the market was considerably impacted by the geopolitical war between Ukraine and Russia. Russia’s invasion of Ukraine had a global effect on several industries including the pharmaceutical industry also.

Several pharmaceutical giants and other established contract manufacturers suffered various difficulties including delays throughout the drug development process, risk of non-compliance for on-market products, and loss of business continuity. Moreover, several global pharmaceutical companies have scaled down their manufacturing operations in Russia. The rising inflation globally is another significant macroeconomic factor leading to a decline in the number of drug approvals in 2022, thereby negatively affecting the pharmaceutical business.

This also implies that the decline in the new molecular entity (NME) approvals will result in a direct decrease in the commercial scale production agreements in 2023 for contract manufacturers. In 2022, the U.S. FDA approved approximately half of the most innovative drugs than that compared to 2021. The drop in these NMEs, both biologics and small molecules, was majorly due to rising inflation globally, which has been further triggered by the outbreak of the geopolitical war simultaneously.

Molecule Type Insights

The small molecule segment is anticipated to witness a stable CAGR of 11.93% from 2023 to 2032. The segment is driven by the globally increasing demand for generic-based injectables, which includes small molecules. The rising pipeline of small molecules is a prominent factor supporting the stable growth of the segment during the forecast period. However, the injectables such as vaccines majorly constitute large molecules. Thus, the small molecules segment held a limited market share in 2022. However, the increasing adoption of advanced technology has led to the growth of small molecule-based injectables in recent years, thereby augmenting the segment’s growth.

The large molecule segment dominated the sterile injectable contract manufacturing industry and accounted for the largest revenue share of 62% in 2022. The high growth of this segment is attributed to the rising investments by contract manufacturers in the development of large molecule-based therapeutics, the increasing pipeline of injectables in biologics, and a surge in the U.S. FDA approvals for biosimilars. Furthermore, the segment is anticipated to witness lucrative growth during the analysis period owing to an increasing number of biologics being in the pipeline, which is estimated to be launched between 2024 to 2027.

For instance, as per the U.S. FDA, biologics currently consume approximately 44% to 45% of the development pipeline from 2023 to 2024. Hence, the significant growth across the pipeline of large molecules categories is anticipated to augment the growth of the market for sterile injectable contract manufacturing. In addition, the rapid rise in the development pipeline of cell & gene therapies is among the most crucial factors supporting the demand for large molecule-based injectables across the globe.

Therapeutic Application Insights

The cancer segment dominated the market for sterile injectable contract manufacturing and accounted for the largest revenue share of 29% in 2022. The dominance of the segment is majorly due to the increasing focus on the development of anti-cancer therapeutics. The increasing pipeline of anti-cancer drugs, growing research & development activities for treating critical cancer types, and growing approval of oncology drugs are among the few considerable factors supporting the segment’s robust revenue shares in the sterile injectable contract manufacturing industry. For instance, in July 2022, Dr. Reddy’s laboratories announced the launch of Bortezomib for injection, used in treating multiple myeloma and mantle cell lymphoma.

The central nervous system diseases segment, on the other hand, is anticipated to witness a lucrative CAGR of 12.9% during the analysis period. The high growth of the segment is majorly due to the increasing number of clinical research in diseases associated with the central nervous system. For instance, in January 2023, Eisai Co., Ltd. and Biogen Inc. announced that the U.S. FDA has approved lecanemab-irmb 100 mg/mL injection for intravenous use for the treatment of Alzheimer's disease (AD). Moreover, an increasing number of biopharmaceutical companies penetrating the contract manufacturing industry is another significant factor supporting the growth of the segment.

Route Of Administration Insight

The intravenous (IV) category dominated the sterile injectable contract manufacturing industry with the largest revenue share of 33% in 2022. This is attributable to the large number of sterile injectables approved for administration through intravenous routes. The segment is also poised to witness stable growth across the forecast period owing to its robust pipeline of IV dosage, which is anticipated to be launched shortly. The FDA announced that the total volume of injectables launched in 2021 majorly constituted IV infusion dosages, which was approximately 30-35% of the total injectable volume. Hence, the aforementioned factors are strongly supporting the dominance of the segment.

On the other hand, the subcutaneous (SC) segment is anticipated to witness the fastest CAGR of 12.65% during the forecast timeframe. High growth is primarily due to its high demand, which is attributable to its ability to administer numerous types of medications for various medical conditions. As subcutaneous tissue has few blood vessels, the injected drug is diffused slowly at a sustained absorption rate. Therefore, it is highly effective in administering vaccines, growth hormones, and insulin, which require continuous delivery at a low dose rate. Hence, the associated benefits of the SC route of administration are the major factors promoting its demand, thereby augmenting the segment’s growth.

End-use Insight

Biopharmaceutical companies comprised the largest revenue share of 46% in 2022. This segment is expected to dominate the sterile injectable contract manufacturing industry during the analysis period owing to the increasing trend of end-to-end outsourcing services, especially among small- and mid-size pharmaceutical companies lacking expertise in bulk capacity manufacturing. Furthermore, the growing number of biologics in the pipeline, coupled with the rising trend of outsourcing in biopharmaceutical companies is expected to drive growth of this segment over the forecast period.

On the other hand, pharmaceutical companies are anticipated to witness a stable CAGR of 12.24% from 2023 to 2032. The segment's high growth is majorly due to the growing number of pharmaceutical companies penetrating the vaccine industry, thereby augmenting its share. Moreover, increasing investments across drug development by major pharmaceutical giants to manufacture novel rare disease therapeutics is another significant factor supporting the segment’s growth.

Regional Insight

North America accounts for the largest share of 37% in 2022, owing to the presence of established CMOs specializing in injectable manufacturing services, such as Baxter Biopharma and Catalent Inc. The U.S. is the biggest market for injectable outsourcing as several biopharmaceutical companies prefer outsourcing their manufacturing services to CMOs based in the U.S. due to their delivery of quality products/services. Moreover, stringent regulatory policies regarding the inspection of manufacturing facilities are anticipated to promote domestic contract manufacturing. In addition, growing R&D investments by life sciences and pharmaceutical companies are anticipated to increase the demand for sterile injectable contract manufacturing in the region.

Asia Pacific is anticipated to register the fastest CAGR of 13.14% during the forecast period. Asia Pacific is one of the most attractive markets for contract manufacturing. This is due to cost-saving opportunities in Asian countries and supportive regulatory reforms, especially in India and China. In 2016, as part of the Marketing Authorization Holder (MAH) system reforms, China’s FDA legalized contract manufacturing, thus allowing domestic biopharmaceutical & pharmaceutical companies access to contract manufacturers, significantly supporting the region’s market growth.

In addition, the presence of EMA- and FDA-approved facilities in the country is also anticipated to increase foreign investments. For instance, approximately 92 contract service organizations have headquarters in Jiangsu, with 72% of the facilities having EMA and FDA approval. Thus, the high number of EMA- and FDA-approved facilities is anticipated to boost the market growth of sterile injectable contract manufacturing.

Sterile Injectable Contract Manufacturing Market Segmentations:

By Molecule Type

By Therapeutic Application

By Route of Administration

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Sterile Injectable Contract Manufacturing Market

5.1. COVID-19 Landscape: Sterile Injectable Contract Manufacturing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Sterile Injectable Contract Manufacturing Market, By Molecule Type

8.1. Sterile Injectable Contract Manufacturing Market, by Molecule Type, 2023-2032

8.1.1. Small Molecule

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Large Molecule

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Sterile Injectable Contract Manufacturing Market, By Therapeutic Application

9.1. Sterile Injectable Contract Manufacturing Market, by Therapeutic Application, 2023-2032

9.1.1. Cancer

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Diabetes

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Cardiovascular Diseases

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Central Nervous System Diseases

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Infectious Disorders

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Musculoskeletal

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Anti-viral

9.1.7.1. Market Revenue and Forecast (2020-2032)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Sterile Injectable Contract Manufacturing Market, By Route of Administration

10.1. Sterile Injectable Contract Manufacturing Market, by Route of Administration, 2023-2032

10.1.1. Subcutaneous (SC)

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Intravenous (IV)

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Intramuscular (IM)

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Sterile Injectable Contract Manufacturing Market, By End-use

11.1. Sterile Injectable Contract Manufacturing Market, by End-use, 2023-2032

11.1.1. Pharmaceutical Companies

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Biopharmaceutical Companies

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Others

11.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Sterile Injectable Contract Manufacturing Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.1.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.1.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.1.4. Market Revenue and Forecast, by End-use (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.1.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.1.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.2.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.2.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.2.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.2.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.2.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.2.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.2.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.3.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.3.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.3.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.3.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.3.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.3.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.3.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.4.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.4.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.4.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.4.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.4.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.4.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.4.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.5.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.5.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.5.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Molecule Type (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Therapeutic Application (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.5.6.4. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 13. Company Profiles

13.1. Baxter

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Catalent, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Vetter Pharma

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Recipharm AB

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Aenova Group

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Fresenius Kabi

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Unither Pharmaceuticals

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Famar

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Cipla Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. NextPharma Technologies

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others