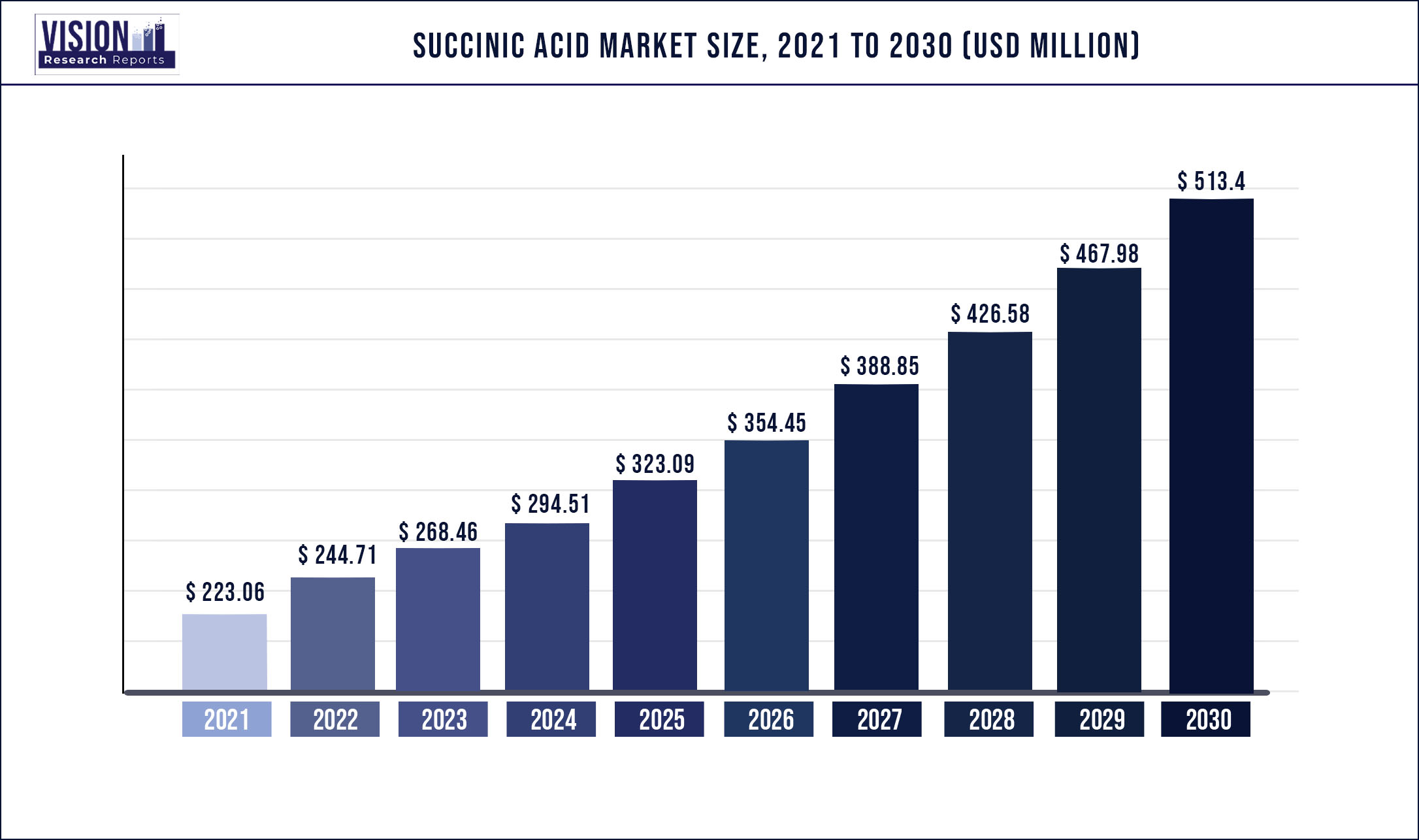

The global succinic acid market was valued at USD 223.06 million in 2021 and it is predicted to surpass around USD 513.4 million by 2030 with a CAGR of 9.7% from 2022 to 2030.

Report Highlights

The growth is attributed to a surge in demand from the end-use industries, such as food & beverages, pharmaceutical, and personal care & cosmetics. In the food & beverages industry, Succinic Acid (SA) is used as a food additive in dietary supplements and food preservation. In the pharmaceutical industry, the product finds application in the preparation of vitamin A and many anti-inflammatory products. It is also used in the formulation of cosmetics and personal care products, such as toothpaste, perfumes, nail polish, and liquid soaps.

Succinic acid is produced from Liquefied Petroleum Gas (LPG). Petroleum gas is often expensive. As an alternative to LPG-based production, succinic acid is generated by different microbes and is naturally formed by undertaking the process of anaerobic digestion. It is regarded as a common organic acid that is used in a variety of applications. Bio-based SA is similar in structure to petroleum-based products. However, it helps reduce carbon emission, as well as optimize and enhance the performance of the acid. Rising customer preference for biodegradable plastics and other greener materials is a key factor driving the market growth.

The COVID-19 pandemic crippled economies across the globe and severely impacted the supply chains across industries. The supply chain of raw materials for succinic acid production was drastically impacted, changing the production and consumption patterns globally. The industrial end-use segment dominated succinic acid consumption over the last decade. But a halt in the production of non-essential chemicals, ingredients, or industrial products during the pandemic hampered the demand for starting materials, adversely impacting the demand. However, with the lifting of lockdowns and movement restrictions, the market is expected to witness a steady rise in demand.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 223.06 million |

| Revenue Forecast by 2030 | USD 513.4 million |

| Growth rate from 2022 to 2030 | CAGR of 9.7% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, end use, region |

| Companies Covered |

BASF SE; Myriant Corporation; BioAmber; Parchem; Dow Chemicals; Ernesto Ventos S.A.; The Chemical Company; Kawasaki Kasei Chemicals Ltd.; Mitsubishi Chemical Corporation |

Type Insights

The petro-based type dominated the global market with a revenue share of more than 50.02% in 2021. This is attributed to the use of petro-based succinic acid as an alternative to adipic acid in polyurethane production. The petro-based variant is produced from the oxidation of methyl groups of butane to the corresponding carboxy group. It finds a wide range of applications including in the production of plasticizers and flavor enhancers in a variety of packaged food items. The increasing demand from industrial, personal care, and food & beverage industries is expected to fuel the segment growth.

The bio-based segment is the second-largest revenue contributor. Increasing health consciousness among consumers and the rising focus of the governments on environmental concerns have created a large barrier to the market growth of petro-based products. Increasing preference for succinic acid over butane-based maleic anhydride in the production of chemicals such as fumaric acid, succinic anhydride, plastics, diethylmaleate, polymers, and glyoxylic acid, which are conventionally manufactured from butane, is also anticipated to positively influence the demand for a bio-based product.

End-use Insights

The industrial -use segment dominated the succinic acid market with the largest revenue share of more than 39.11% in 2021. This significant share of the segment can be attributed to the increasing use of the products, such as 1,4-butanediol (BDO), polyurethane, and tetrahydrofuran, in various industries where succinic acid is the primary raw material. BDO is used for manufacturing tetrahydrofuran, which is not only used as a solvent in the chemical industry but also as a significant raw material for the production of spandex. Spandex has exceptional elasticity and strength. High demand for this material is in turn expected to contribute to the growth of this segment.

The coatings segment held the second-largest revenue share in 2021, attributed to the rising demand from the construction and automotive industries. Succinic acid is widely used as a raw material in coatings as it provides hardness, a quick cure ratio, and shine to the surface. Improving infrastructure due to increased government spending in countries like the U.S., India, and China is expected to further fuel the demand. Rising construction activities and rapid urbanization are also expected to drive the demand. The shifting of the automotive manufacturing industry from Europe to parts of Asia Pacific is likely to develop the automotive industry in this region and propel the demand for coatings.

Regional Insights

Europe dominated the market in 2021 and accounted for the largest revenue share of more than 35.65% 2021. This growth is attributed to the rising healthcare and agricultural sectors in the region. Europe is expected to witness a stagnant product demand due to the growing preference for bio-based products among consumers as a drop-in replacement.

In Europe, succinic acid is extensively used in the personal care & cosmetics industry. Europe is home to many cosmetic brands, such as Unilever and P&G, which is a key contributing factor to the growth of this regional market. The strong presence of aircraft manufacturers in various parts of Germany and the U.K. has led to the growth of the aerospace sector.

North America accounted for the second-largest revenue share of the global market in 2021. This can be attributed to the presence of various opportunities to build and expand new production facilities in the region. The production of succinic acid from the microbial conversion of renewable feedstock has piqued interest in North America as a means to achieve sustainable development in this era of petroleum scarcity.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Succinic Acid Market

5.1. COVID-19 Landscape: Succinic Acid Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Succinic Acid Market, By Type

8.1. Succinic Acid Market, by Type, 2022-2030

8.1.1. Petro-based

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Bio-based

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Succinic Acid Market, By End-use

9.1. Succinic Acid Market, by End-use, 2022-2030

9.1.1. Food & Beverages

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Pharmaceutical

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Coatings

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Industrial

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Personal Care & Cosmetics

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Succinic Acid Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2017-2030)

10.1.2. Market Revenue and Forecast, by End-use (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type (2017-2030)

10.1.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2017-2030)

10.1.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2017-2030)

10.2.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type (2017-2030)

10.2.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type (2017-2030)

10.2.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type (2017-2030)

10.2.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type (2017-2030)

10.2.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2017-2030)

10.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type (2017-2030)

10.3.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type (2017-2030)

10.3.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type (2017-2030)

10.3.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type (2017-2030)

10.3.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2017-2030)

10.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type (2017-2030)

10.4.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type (2017-2030)

10.4.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type (2017-2030)

10.4.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type (2017-2030)

10.4.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2017-2030)

10.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type (2017-2030)

10.5.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type (2017-2030)

10.5.4.2. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 11. Company Profiles

11.1. BASF SE

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Myriant Corporation

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. BioAmber

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Parchem

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Dow Chemicals

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Ernesto Ventos S.A.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. The Chemical Company

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Kawasaki Kasei Chemicals Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Mitsubishi Chemical Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others