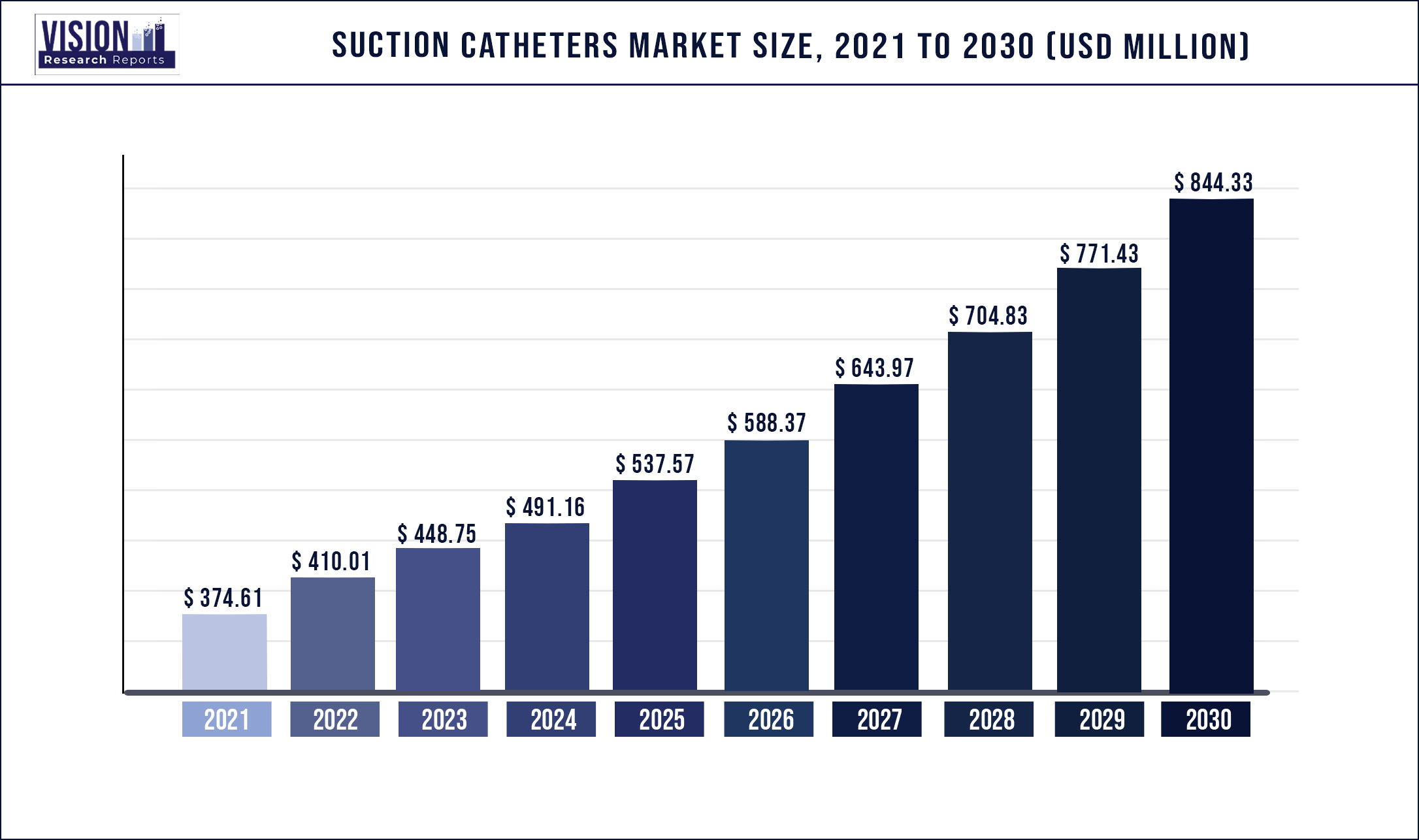

The global suction catheters market was valued at USD 374.61 million in 2021 and it is predicted to surpass around USD 844.33 million by 2030 with a CAGR of 9.45% from 2022 to 2030.

Report Highlights

Suction catheters help in clearing the respiratory tract of ventilator-dependent patients or patients suffering from respiratory disorders. The rise in the number of people suffering from chronic respiratory illness is proliferating the demand for suction catheters. For instance, as per the Irish Thoracic Society, in 2016, there were 643,580 inpatient hospitalizations in Ireland. Out of which, 32% of inpatients were older than 65 years and over. Respiratory diseases accounted for 19.1% of inpatient hospitalizations in Ireland.

The Covid-19 pandemic has highlighted the importance of respiratory medical devices owing to the rise in the number of ventilator-supported patients during the pandemic. In addition, factors such as rising cases of chronic diseases, and an increase in pollution levels are also contributing to heightened demand for suction catheters. In March 2020, U.S. Food and Drug Administration (FDA), granted emergency approval for Vesper, a device developed by Prisma Health that supports patients on ventilators.

In addition, during the pandemic, several governments across the globe and healthcare companies were improving medical treatment to treat patients suffering from Covid-19 patients. This in turn increased the use of catheters in emergency clinics and hospitals during the pandemic thereby positively impacting the demand for suction catheters. The rise in investments by the government and players to improve the healthcare industry is also boosting the demand for suction catheters. For instance, as per UK Government, close to 10,000 ventilators were added to the stock. Additionally, Rolls Royce, Ford, and Honda in the UK started manufacturing ventilators to cope with the increasing demand due to the COVID-19 outbreak

The major organizations use strategic alliances, such as partnerships and acquisitions, R&D investments, product launches, and approvals, to reinforce their competitive power while expanding their global reach. For instance, in March 2022, Cardinal Health expanded its medical distribution center in Columbus, Ohio. The distribution center is expected to help in streamlining the supply chain and improve operational efficiency. The distribution center will help the company to meet consumer needs.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 374.61 million |

| Revenue Forecast by 2030 | USD 844.33 million |

| Growth rate from 2022 to 2030 | CAGR of 9.45% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, material, end-use, region |

| Companies Covered |

Medline Industries L.P.; B Braun SE; BD; Aminso International Inc.; Cardinal Health; Dynarex Corporation; PFM Medical AG; Ivor Shaw T/A Pennine Healthcare; Smiths Group Plc |

Type Insights

The closed suction catheter segment dominated the market and accounted for a revenue share of 73.06% in 2021. The segment is also expected to witness the fastest CAGR of 9.65% over the forecast period. Closed suction catheters help in reducing pain and minimize the risk of infection. Further, as per a study by Respiratory Care, the combination of a T-piece closed suction catheter with a bidirectional catheter provides an efficient delivery.

Further, advances in closed suction catheters are also driving the demand for the suction catheters market. For example, Avanos Medical Inc., a provider of medical devices offers a closed suctioning system that is equipped with an isolated cleaning chamber. The cleaning chamber helps in reducing the risk of contamination and reduces colonization within the circuit.

Material Insights

The latex-free segment dominated the market and accounted for a revenue share of 69.74% in 2021. The segment is also expected to witness the fastest CAGR of 9.82% over the forecast period. The rise in the number of people suffering from latex allergies coupled with the high demand for cost-effectiveness is also propelling the demand for latex-free suction catheters.

The rise in the number of latex-induced allergies among the populace is driving the demand for latex-free suction catheters. For example, as per Occupational Safety & Health Administration (OSHA), close to 8-12% of health workers are latex-sensitive. Latex-free catheters offer an alternative to latex catheters. Several catheter manufacturers are offering silicone catheters as they are softer and enable easy insertion. Latex-free catheters constitute a high number of materials to overcome the loss of flexibility.

End-use Insights

The hospital segment dominated the market and held the majority of the revenue share of 65.63% in 2021 and is likely to retain its dominance during the forecast period. Hospitals provide respiratory medical devices and equipment for performing airway management procedures. The high number of inpatient admissions in hospitals is anticipated to drive the demand for suction catheters in hospitals.

On the other hand, the ambulatory care centers segment is expected to witness the fastest growth of 10.97% during the forecast period from 2022 to 2030, owing to the flexibility benefits. The rise in the number of outpatients is driving the demand for the ambulatory care centers segment. The growing need for specialized treatments is driving several patients to opt for rapid diagnosis at ambulatory care centers. The rise in the usage of suction procedures in dental clinics is also driving the demand for suction catheters in clinics. Furthermore, as per NHS Supply Chain, healthcare consumables are mostly found in ward settings and clinics.

Regional Insights

North America dominated the suction catheters market and held a revenue share of 45.14% in 2021. The factors driving the suction catheters market in the region include a rise in the number of initiatives and awareness taken by players paired with an increase in business expansion by companies in the market. BD, one of the players operating in the suction catheters market has partnered with Advanced Medical Technology Association (AdvaMed) to accelerate diversity in the medical technology industry in the U.S.

In Asia Pacific, the suction catheters market is expected to expand at the fastest growth of 9.44% during the forecast period, due to expanding healthcare infrastructure, rising government backing, and a cumulative number of startups in this region. Growing economic growth and urbanization of Asian countries, initiatives taken by the local governments, such as healthcare awareness programs and collaborations with the NGO's create healthcare awareness, are contributing toward the change in demand patterns, which are driving the suction catheters market in the Asia-Pacific region.

Further, the China government is facilitating the registration of medical devices for frequently occurring diseases. Some of the devices include portable ICUs, and wearable devices, among others. In addition, medical device firms such as Covidien, Medtronic, and GE Healthcare are expanding their R&D centers and manufacturing sites in the country to expand their market research.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Suction Catheters Market

5.1. COVID-19 Landscape: Suction Catheters Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Suction Catheters Market, By Type

8.1. Suction Catheters Market, by Type, 2022-2030

8.1.1 Closed Suction Catheters

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Yankauer Suction Catheters

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Suction Catheters Market, By Material

9.1. Suction Catheters Market, by Material, 2022-2030

9.1.1. Latex

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Latex Free

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Suction Catheters Market, By End-use

10.1. Suction Catheters Market, by End-use, 2022-2030

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Ambulatory Care Centers

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Suction Catheters Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Material (2017-2030)

11.1.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Material (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Material (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Material (2017-2030)

11.2.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Material (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Material (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Material (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Material (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Material (2017-2030)

11.3.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Material (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Material (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Material (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Material (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Material (2017-2030)

11.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Material (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Material (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Material (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Material (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Material (2017-2030)

11.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Material (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Material (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 12. Company Profiles

12.1. Medline Industries L.P.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. B Braun SE

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. BD

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Aminso International Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cardinal Health

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Dynarex Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. PFM Medical AG

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Ivor Shaw T/A Pennine Healthcare

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Smiths Group Plc

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others