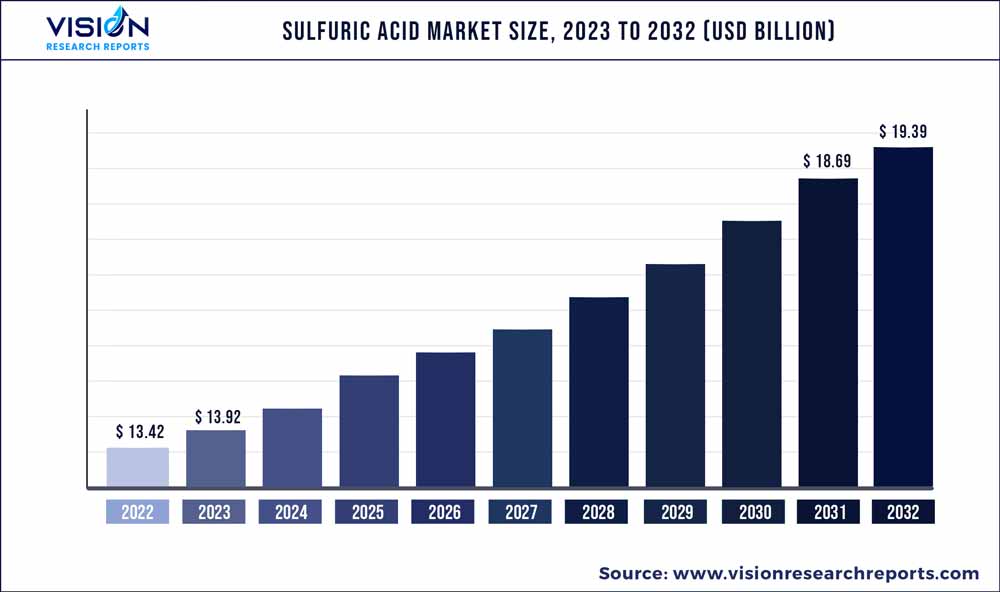

The global sulfuric acid market was surpassed at USD 13.42 billion in 2022 and is expected to hit around USD 19.39 billion by 2032, growing at a CAGR of 3.75% from 2023 to 2032. The sulfuric acid market in the United States was accounted for USD 1 billion in 2022.

Key Pointers

Report Scope of the Sulfuric Acid Market

| Report Coverage | Details |

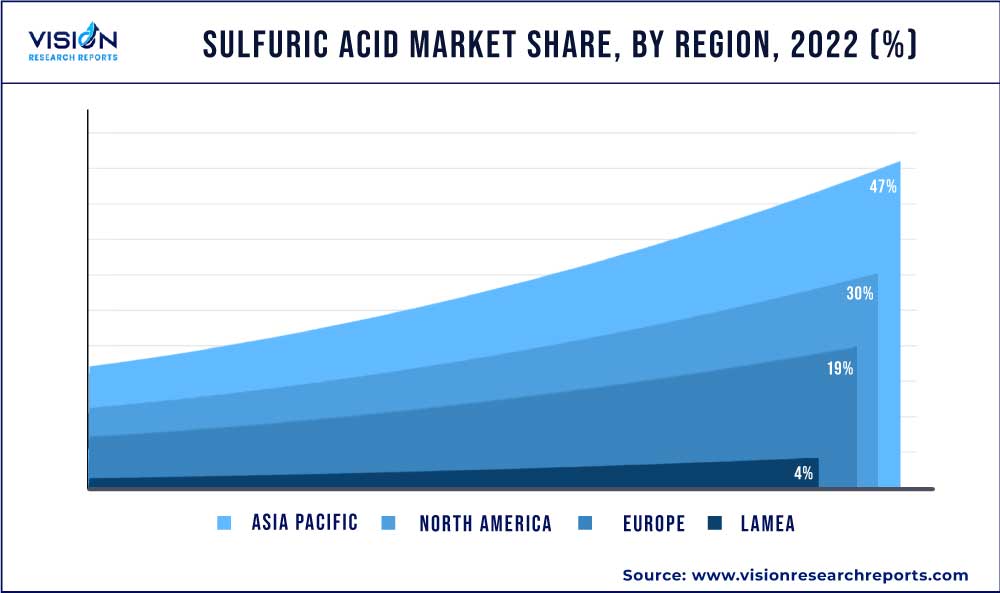

| Revenue Share of Asia Pacific in 2022 | 47% |

| Revenue Forecast by 2032 | USD 19.39 billion |

| Growth Rate from 2023 to 2032 | CAGR of 3.75% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | The Mosaic Company; AkzoNobel N.V.; BASF SE; PVS Chemical Solution; Solvay; Agrium Inc.; INEOS |

The growing demand for sulfuric acid (H2SO4) from the metal processing industry in the removal of rust and other contaminants from different metal surfaces including iron, steel, copper, and aluminum is anticipated to positively impact the market growth over the forecast period. Sulfuric acid is a highly corrosive and strong mineral acid that is extensively used in various industries, including chemical manufacturing, fertilizers, metal processing, textile production, pulp and paper, and automobile manufacturing. It is composed of the elements sulfur, oxygen, and hydrogen, and is sometimes referred to as oil of vitriol.

The use of H2SO4 in the production of phosphate fertilizers improves the efficiency and effectiveness of fertilizers. In addition, the production of high-quality phosphate fertilizers ensures that crops get the necessary nutrients for growth and development. Moreover, increasing investments in plant facilities due to the rising production capacity of phosphate fertilizer and tightening environmental regulations are anticipated to spur the market over the foreseeable period. However, the production of sulfuric acid releases toxic emissions, which are harmful to the environment and humans. The sulfur emissions result in acid rains, which lead to environmental problems. Acid rains cause the degradation of cement and limestone along with leaching critical soil nutrients, which affects plants, and thus, it acts as a restraining factor in the growth of the product market.

The U.S. is the largest consumer of H2SO4 in the North America region with a revenue share of 48.2% in 2022. The increasing demand for H2SO4 in the textile industry, phosphate fertilizer industry, steel pickling, and petroleum refinery applications is expected to spur market growth in the region over the forecast period. According to the National Council of Textile Organization, the U.S. is the third-largest exporter of textiles where total textile exports accounted for USD 65.80 billion in 2022. The textile industry in the U.S. invested USD 20.90 billion in new textile plants and equipment in 2021. The advancing textile industry in the U.S. is anticipated to drive the demand forH2SO4over the forecast period.

Raw Material Insight

The elemental sulfur segment dominated the market with a revenue share of 54% in 2022. This growth is attributed to its easy accessibility & abundant availability, low cost, and less emission than pyrite ore & base metal smelters. In addition, the use of solid sulfur allows for more precise control in the reaction process, which can improve efficiency and reduce waste. The pyrite ore raw material segment is also anticipated to witness significant growth over the forecast period. This mineral resource is used to produce H2SO4, specifically when elemental sulfur is not easily accessible. To manufacture H2SO4, pyrite undergoes a process called the "contact process," where sulfur dioxide gas is oxidized to sulfur trioxide, which then dissolves in water to produce sulfuric acid.

While pyrite is vital in multiple industrial applications, using it as a raw material for H2SO4 production poses environmental hazards. The primary concern with pyrite usage is the risk of acid mine drainage (AMD), which occurs when pyrite-containing rocks react with water and air, leading to the production of H2SO4. AMD can cause significant damage to the ecosystem by harming plant and animal life and increasing soil and water pollution. Despite these concerns, pyrite remains a valuable resource for producing H2SO4. Hence, it is imperative to manage its usage cautiously to minimize any potential harm to the environment. Thus, the critical objective is the optimal utilization of pyrite while preventing its harmful environmental consequences.

Application Insight

The fertilizers segment dominated the market with a revenue share of 55% in 2022. This growth is attributed to the fact that H2SO4 is commonly used in the production of fertilizers due to its strong acidic properties and capacity to break down raw materials and create the necessary nutrients for plant growth. The process involves combining H2SO4 with other substances, such as ammonia, to create ammonium sulfate and other types of nitrogen and phosphate-based fertilizers. Chemical manufacturing is another segment anticipated to witness growth over the forecast period. H2SO4 is one of the most widely used acids in the chemical industry.

It is used in numerous manufacturing processes across a broad range of industries. This strong acid is utilized for its highly reactive chemical properties, which can facilitate the production of many essential chemicals. This includes the production of plastics and polymers, as well as the synthesis of industrial chemicals, such as hydrofluoric acid, nitric acid, phosphoric acid, and aluminum sulfate. The textile industry is also anticipated to witness rapid growth over the forecast period. One of the primary uses of H2SO4 in the textile industry is as a catalyst in dyeing natural fibers, such as wool, silk, and cotton. It activates the dye molecule, making it more likely to bond with the fibers, improving the colorfastness and dye uptake of the fabric. This process is commonly known as acid dyeing. In addition, sulfuric acid is also used to prepare synthetic materials, such as polyester and nylon.

Regional Insight

The Asia Pacific region dominated the market with a revenue share of 47% in 2022. This growth is attributed to increasing strategic developments, such as the setting up of production plants owing to the booming chemical industry and ease of availability of raw materials for sulfuric acid production, which is projected to propel the market growth over the forecast period. According to the Organization for Economic Cooperation and Development and Food and Agricultural Organization (FAO), Asia Pacific is the largest producer of agricultural commodities and is anticipated to account for 53% of global agricultural product and fish output by 2032. The region's arable land is shrinking, and food demand is rising due to the growing population. Therefore, farmers are increasingly using phosphate fertilizers to increase crop yield, in turn, boosting the product demand in the region.

Europe is also anticipated to witness considerable growth over the forecast period. According to the European Federation of Pharmaceutical Industries and Associations, Germany, Switzerland, and Italy are the leading hubs for pharmaceutical production accounting for Euro 32.3 billion, 53.2 billion, and 34.3 billion, respectively, in 2021. Moreover, according to the European Federation of Pharmaceutical Industries and Associations, the region witnessed a sale of 23.42% of the global pharmaceutical sales in 2021 with total spending on healthcare accounting for 9.3% of the region’s GDP. Thus, the advancing end-use industry in the region is anticipated to drive the demand for the product over the forecast period.

Sulfuric Acid Market Segmentations:

By Raw Material

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Sulfuric Acid Market

5.1. COVID-19 Landscape: Sulfuric Acid Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Sulfuric Acid Market, By Raw Material

8.1. Sulfuric Acid Market, by Raw Material, 2023-2032

8.1.1. Elemental Sulfur

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Base Metal Smelters

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Pyrite Ore

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Other Raw Materials

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Sulfuric Acid Market, By Application

9.1. Sulfuric Acid Market, by Application, 2023-2032

9.1.1. Fertilizers

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Chemical Manufacturing

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Metal Processing

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Petroleum Refining

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Textile Industry

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Automotive

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Pulp & Paper

9.1.7.1. Market Revenue and Forecast (2020-2032)

9.1.8. Other Applications

9.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Sulfuric Acid Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. The Mosaic Company

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. AkzoNobel N.V.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. BASF SE

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. PVS Chemical Solution

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Solvay

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Agrium Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. INEOS

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others