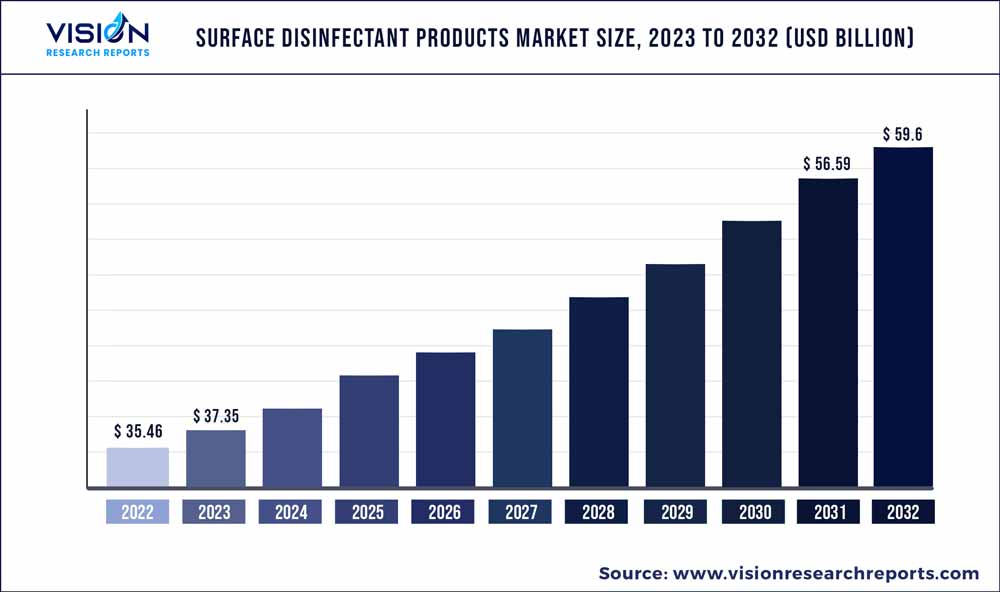

The global surface disinfectant products market was estimated at USD 35.46 billion in 2022 and it is expected to surpass around USD 59.6 billion by 2032, poised to grow at a CAGR of 5.33% from 2023 to 2032.

Key Pointers

Report Scope of the Surface Disinfectant Products Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 34% |

| Revenue Forecast by 2032 | USD 59.6 billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.33% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | 3M; GOJO Industries, Inc.; Reckitt Benckiser Group PLC; BODE Chemie GmbH; Ecolab; Procter & Gamble; The Clorox Company; Whiteley Corp.; Lonza; BASF SE; Evonik Industries AG |

This is attributable to the increasing awareness regarding health & hygiene owing to the growing incidences of infectious diseases. The COVID-19 pandemic has increased the consciousness among consumers about keeping homes and workplaces clean and free from harmful germs along with the usage of sanitizer wet wipes for skin. Public spaces, such as hospitals, schools, and offices, are in greater need of infection control measures. Surface disinfection is a critical component of infection control in hospitals.

Hospitals are high-risk environments for the spread of infectious diseases due to the presence of large numbers of vulnerable patients, as well as the high traffic of healthcare personnel and visitors. While product use can be beneficial for reducing the spread of infectious diseases, it is important to use these products safely and appropriately. Overuse or improper use of disinfectants can lead to health and environmental hazards. In addition, it is important to choose disinfectants that are appropriate for the specific application and to consider the potential environmental impacts of these products.

Raw materials for manufacturing the products include active ingredients, surfactants, chelating agents, stabilizers, and fragrances. Active ingredients are the chemicals that kill or inactivate the microorganisms that cause infection. Common active ingredients in surface disinfectants include Quaternary Ammonium Compounds (QACs), hydrogen peroxide, sodium hypochlorite (bleach), and alcohol. Surfactants help improve the spread and wetting of the disinfectant on the surface being treated. Surfactants can also help solubilize and emulsify dirt and other organic matter, making it easier to remove.

Raw Material Insights

The synthetic segment dominated the market with a revenue share of over 88% in 2022. This is attributed to their broader spectrum efficacy as compared to their counterparts. However, they may be toxic or harmful to humans and the environment. Bio-based disinfectants may require longer contact times to achieve maximum efficacy, while synthetic disinfectants typically work faster. Bio-based products are expected to grow at a higher CAGR over the forecast period owing to the increasing adoption of green products across the globe. They are produced from natural, non-toxic ingredients but may have limited efficacy against certain types of microorganisms.

It may be a better choice for those who are concerned about the potential health and environmental impacts of chemicals. Blends combine the advantages of both bio-based ingredients and chemical disinfectants. These products are designed to provide effective disinfection while also incorporating elements of sustainability. Blending bio-based ingredients with chemicals allows for reduced reliance on petroleum-based chemicals and promotes the use of renewable resources.

Product Insights

The liquid segment dominated the market with a revenue share of over 64% in 2022. This is attributed to its usage in a variety of applications, such as cleaning floors, walls, and other large surfaces. Liquid disinfectants are easy to apply with a mop, cloth, or sprayer, and can be used in combination with other cleaning products to achieve a higher level of cleanliness. The wipes segmentis expected to grow at a higher CAGR over the forecast period as wipesare easy to use and do not require any additional equipment or tools.

Users simply need to spray the disinfectant onto the surface and allow it to air dry. They can provide even coverage over surfaces. Surface disinfectant sprays often have rapid kill times, meaning, they can quickly eliminate pathogens on surfaces. This can help reduce the risk of cross-contamination and promote a safer environment. They typically come in spray bottles or aerosol cans, allowing for convenient and targeted application.

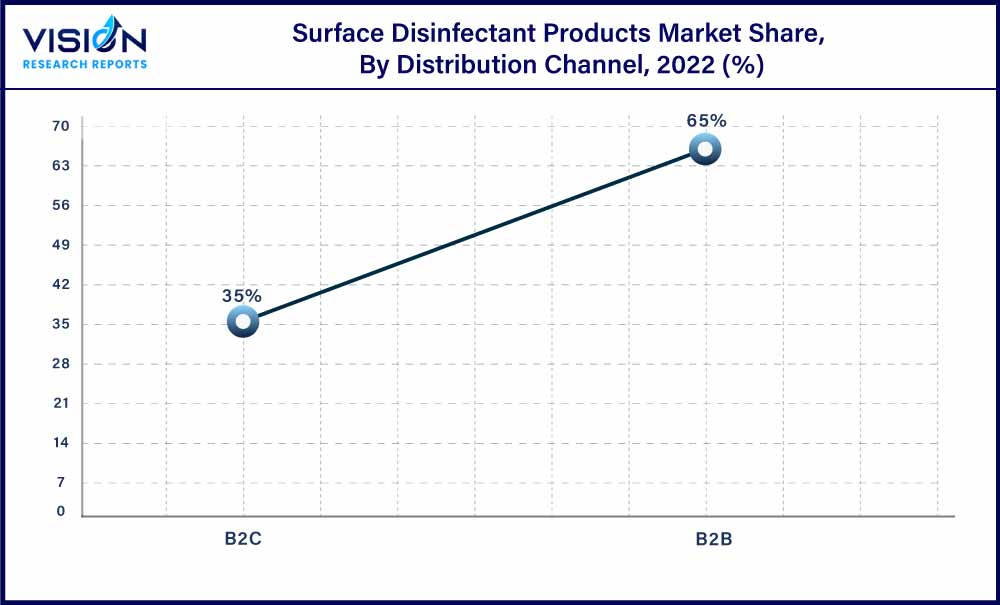

Distribution Channel Insights

The B2B distribution channel dominated the market with a revenue share of over 65% in 2022. This is attributed to the growing demand for disinfection from hospitals, medical laboratories, and nursing homes since the outbreak of COVID-19. Hospitals and laboratories are at the forefront of identifying and managing infectious disease outbreaks. Rapid and effective disinfection of surfaces is crucial in containing outbreaks, limiting the spread of pathogens, and protecting the wider community. According to the Centers for Disease Control, Healthcare Acquired Infections (HAIs) in American hospitals account for an estimated 1.7 million infections and 99,000 deaths annually.

HAIs occur in healthcare settings including surgical centers, hospitals, ambulatory clinics, rehabilitation facilities, and others. The B2C segment is predicted to grow at a CAGR of 5.12% over the forecast period. This is attributed to the growing adoption rate of disinfectant products owing to the increasing health awareness amongconsumers across the globe. Hypermarkets and supermarkets are the most popular channels as they usually offer a wide range of product and brand options. Customers can choose from different formulations, scents, sizes, and price ranges based on their preferences and needs.

Regional Insights

North America was the dominating region and accounted for a revenue share of over 34% in 2022. The growth is attributed to increasing health-related spending along with the presence of a large number of surface disinfectant formulators in the region. The product usage in North America is not limited to healthcare settings. Several businesses and households also use these products to maintain a clean and hygienic environment. In the U.S., the Environmental Protection Agency (EPA) regulates surface disinfectants as pesticides under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA).

The EPA maintains a list of registered disinfectants that have been tested and found to be effective against specific pathogens, such as bacteria and viruses. Asia Pacific is expected to grow at a higher CAGR over the forecast period. This is attributed to the increasing awareness about the importance of maintaining clean and hygienic environments. Several hospitals and clinics in the region now use surface disinfectants as part of their standard infection prevention and control protocols. For instance, in India, the Ministry of Health and Family Welfare has issued guidelines on the use of disinfectants in healthcare settings.

Surface Disinfectant Products Market Segmentations:

By Raw Material

By Product

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Raw Material Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Surface Disinfectant Products Market

5.1. COVID-19 Landscape: Surface Disinfectant Products Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Surface Disinfectant Products Market, By Raw Material

8.1. Surface Disinfectant Products Market, by Raw Material, 2023-2032

8.1.1 Synthetic

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Biobased

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Blends

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Surface Disinfectant Products Market, By Product

9.1. Surface Disinfectant Products Market, by Product, 2023-2032

9.1.1. Liquid

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Wipes

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Sprays

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Surface Disinfectant Products Market, By Distribution Channel

10.1. Surface Disinfectant Products Market, by Distribution Channel, 2023-2032

10.1.1. B2B

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. B2C

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Surface Disinfectant Products Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.1.2. Market Revenue and Forecast, by Product (2020-2032)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.2.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.3.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 12. Company Profiles

12.1. 3M

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. GOJO Industries, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Reckitt Benckiser Group PLC

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. BODE Chemie GmbH.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Ecolab

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Procter & Gamble

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. The Clorox Company

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Whiteley Corp.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Lonza.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. BASF SE

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others