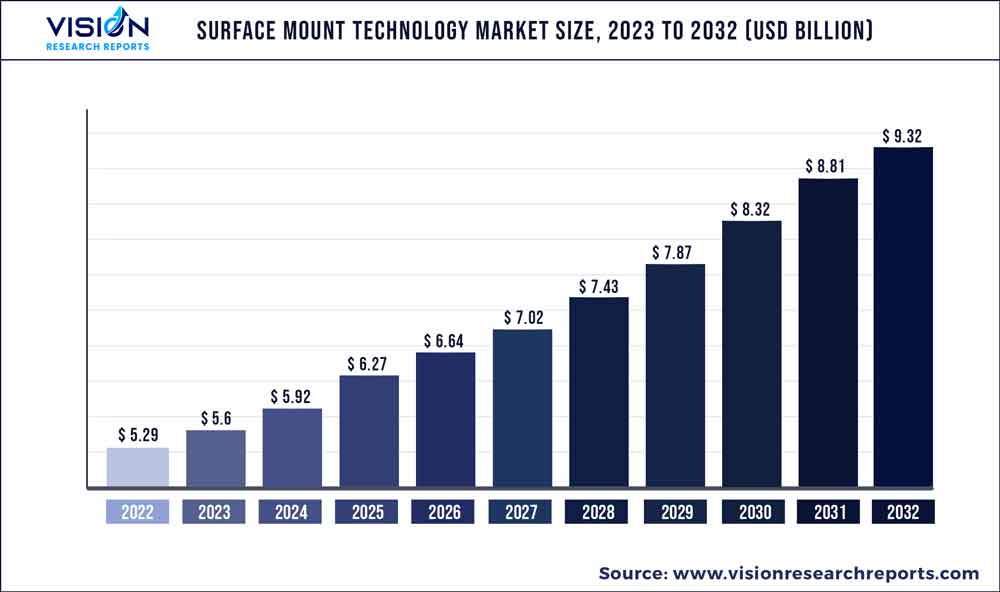

The global surface mount technology market was valued at USD 5.29 billion in 2022 and it is predicted to surpass around USD 9.32 billion by 2032 with a CAGR of 5.83% from 2023 to 2032.

Key Pointers

Report Scope of the Surface Mount Technology Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 24.36% |

| CAGR of Asia Pacific from 2023 to 2032 | 6.47% |

| Revenue Forecast by 2032 | USD 9.32 billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.83% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | ASM Pacific Technology; Seika Corporation; Panasonic; Nordson Corporation; Cognex Corporation; Fuji Machine Manufacturing Co., Ltd.; Teradyne Inc.; Mycronic; Kulicke & Soffa Industries, Inc.; Neoden SMT |

Surface mount technology (SMT) is a method of electronic component assembly used to build electronic circuits on printed circuit boards (PCBs). In SMT, electronic components such as resistors, capacitors, and integrated circuits (ICs) are mounted directly onto the surface of the PCB rather than being inserted through holes in the board (as in through-hole technology).In SMT, the components are typically much smaller and more compact than through-hole components, which allows for a greater degree of miniaturization in electronic devices. SMT also allows for higher component density on PCBs, meaning that more complex electronic circuits can be designed and manufactured in smaller, more efficient packages. The market's growth is expected to be driven by the miniaturization of electronic devices across the globe. The trend towards smaller and more portable electronic devices has increased demand for smaller components, which can only be manufactured using SMT. Miniaturization involves reducing the size of various electronic components, such as resistors, capacitors, and transistors, and integrating them into smaller, more densely packed circuit boards. This is typically achieved through the use of surface mount technology (SMT), which allows for smaller components to be placed closer together on the circuit board, making the overall device smaller.

Moreover, the increasing adoption of electric vehicles (EVs) across the globe is another major factor driving the market's growth. This is because EVs require various electronic components, including power electronics, batteries, and sensors. These are typically smaller and more compact than components used in traditional combustion engine vehicles. SMT components are more suitable for EV use due to their smaller size and higher component density. This has increased demand for SMT components and equipment in the automotive industry. Furthermore, as EVs are designed to be more energy efficient than traditional vehicles, every component in an EV needs to be optimized for efficiency. SMT components are known for their high efficiency and reliability, making them ideal for use in EVs.

The COVID-19 pandemic has significantly impacted the global economy, and the surface-mount technology market has not been immune to its effects. The pandemic caused disruptions in global supply chains, leading to delays in delivering components and equipment for SMT manufacturing. Owing to this, manufacturers of SMT equipment have faced challenges in meeting production targets, which has affected the growth of the SMT market. Moreover, the pandemic has caused a shift in consumer behavior, resulting in a surge in demand for electronic devices, such as laptops, smartphones, and gaming consoles. This has led to an increase in demand for SMT services, as these devices require a high degree of electronic component integration.

Equipment Insights

In terms of equipment, the market is classified into inspection equipment, soldering equipment, screen printing equipment, placement equipment, cleaning equipment, and repair and work equipment. The placement equipment segment dominated the overall market in 2022 with a revenue share of 27.72%. This dominance can be attributed to the rising need for improving product technology, reliability, responsiveness, and inspection quality. Furthermore, the rising need for this equipment in telecommunications, automotive, consumer electronics, computing, and storage will likely fuel the segment's growth over the forecast period. Placement equipment is a critical surface mount technology SMT market component. These machines accurately and efficiently place electronic components onto printed circuit boards (PCBs). There are various types of placement equipment, such as pick and place machines, screen printers, solder paste inspection machines, and dispensing machines. Placement equipment plays a critical role in the SMT manufacturing process, as it directly affects the quality and efficiency of PCB assembly.

The inspection equipment segment is expected to emerge at a significant CAGR of 6.75% over the forecast period. Inspection equipment is used to inspect and detect defects in the manufacturing process, such as misplaced or missing components, solder defects, and other issues that can affect the device's functionality. Manufacturers are increasingly adopting automated inspection equipment to improve production efficiency, reduce costs, and ensure consistent quality. Integrating artificial intelligence (AI) and machine learning (ML) technologies in inspection equipment has enabled the machines to self-adjust and optimize their performance, further enhancing accuracy and speed. Inspection equipment ensures the quality and reliability of electronic components and printed circuit boards (PCBs) during the manufacturing process. There are various types of inspection equipment available in the market, including Automated Optical Inspection (AOI) machines, X-ray inspection machines, and solder paste inspection machines.

Service Insights

In terms of service, the market is classified into designing, testing & prototype, supply chain services, manufacturing, and aftermarket services. Among these, the designing segment dominated the overall market in 2022 and accounted for a market share of 35.13%. The growth of the segment can be attributed to the increasing demand for PCB design, electronic circuit design, and design for manufacturing (DFM) services for consumer electronics. Additionally, designing services providers can help manufacturers to optimize their designs for cost, reducing the overall cost of manufacturing and improving profitability. Moreover, designing involves the creation of the layout and design of printed circuit boards (PCBs) that are used in an electronic device. PCB design is a critical aspect of the SMT process as it directly affects the quality and functionality of the final product. Designing involves selecting the appropriate components and determining their placement on the PCB. This requires a deep understanding of the electrical properties of each component and how they interact with each other.

The supply chain services segment is anticipated to register the fastest CAGR of 6.84% over the forecast period. The supply chain services comprise various services, including sourcing & procurement, inventory management, logistics & transportation, and warehousing & distribution. The supply chain process starts with component sourcing, which involves identifying the right components from manufacturers and distributors. This involves selecting the right components based on specifications, quality, and cost-effectiveness. Once the components have been sourced, the procurement process begins. This involves placing orders, negotiating prices, and managing inventory levels to ensure that the required components are available when needed. It also involves ensuring that the components meet the required quality standards. The delivery process is the final stage of the supply chain. This involves ensuring the components are delivered on time and in the correct quantity to the manufacturing facility. Supply chain services may also involve logistics and distribution management, including customs clearance and transportation. For instance, Surface Mount Technology Corp, a firm based in Wisconsin, U.S.A., offers end-to-end supply chain solutions to manufacturers, thereby offering them faster time to market, reducing inventory, delays, and critical downtime.

Application Insights

In terms of application, the market is classified into consumer electronics, IT & telecommunication, automotive, industrial, aerospace & defense, healthcare, and others. Among these, the consumer electronics segment dominated the market in 2022 and accounted for a market share of 32.57%. SMT is widely used in consumer electronics manufacturing owing to its advantages over traditional through-hole technology, such as smaller form factors, faster production times, and increased efficiency. Additionally, SMT is used extensively in manufacturing mobile devices, smart wearables, television, gaming consoles, and home appliances. The small form factor of SMT components enables manufacturers to produce smaller, lightweight devices that are easier to carry around. SMT is also efficient, allowing for fast and high-volume production of consumer electronics. Automated assembly lines can handle high volumes of PCBs, enabling manufacturers to produce consumer electronics at scale. Moreover, SMT allows for integrating multiple components on a single PCB, reducing the overall size and weight of devices. This makes consumer electronics more portable and convenient for users.

The industrial segment registered the fastest CAGR of 7.71% over the forecast period. SMT is used to manufacture automation equipment, medical equipment, power electronics, and photovoltaic systems such as robots and control systems. The small size and high performance of SMT components make them ideal for use in these applications. Moreover, the increasing demand for high-performance electronics is rising in many industrial applications, including control systems, sensors, and communication devices. SMT offers superior performance and reliability compared to traditional through-hole components, driving their adoption in the industrial segment. Furthermore, SMT is preferred in industrial automation manufacturing due to its ability to handle a wide range of components, including small and complex components, such as BGAs, CSPs, and QFNs, that are commonly used in industrial automation applications.

Regional Insights

The North America region gained a significant share of the overall market in 2022, with a market share of 24.36%. This can be attributed to the presence of prominent surface mount technology providers in North America, including CyberOptics, Naprotek, LLC., and Teradyne, Inc., among others. Key players focus on strategic growth through mergers and acquisitions and new product releases. For instance, in July 2022, GJD made an agreement to purchase a new top-of-the-line Hanwha Techwin SM482 plus SMT equipment. The brand-new equipment will provide high-speed automation throughout the electronic assembly process, as well as increase efficiency and reduce GJD's carbon footprint. Moreover, the demand for digital streaming content has also encouraged the manufacture of a variety of high-performance internet-connected gadgets and other comparable technologies, which has propelled the broader semiconductor industry's expansion across the region.

The Asia Pacific region is anticipated to grow at the fastest CAGR of 6.47% throughout the forecast period. The regional growth can be attributed to the increase in demand for 5G networks and the increase in wireless communication standards boost demand for SMT in this region's telecommunication sector. Additionally, favorable government policies is also catering to the market growth. For instance, China's "Made in China 2025" initiative is aimed at upgrading the nation’s manufacturing capabilities and promoting the use of advanced technologies such as SMT. Similarly, Japan's "Society 5.0" initiative is focused on promoting the use of advanced technologies in various sectors, including electronics manufacturing.

Surface Mount Technology Market Segmentations:

By Equipment

By Service

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Equipment Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Surface Mount Technology Market

5.1. COVID-19 Landscape: Surface Mount Technology Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Surface Mount Technology Market, By Equipment

8.1. Surface Mount Technology Market, by Equipment, 2023-2032

8.1.1 Equipment

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Placement Equipment

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Soldering Equipment

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Screen Printing Equipment

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Cleaning Equipment

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Repair & Rework Equipment

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Surface Mount Technology Market, By Service

9.1. Surface Mount Technology Market, by Service, 2023-2032

9.1.1. Designing

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Test & Prototyping

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Supply Chain Services

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Manufacturing

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Aftermarket Services

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Surface Mount Technology Market, By Application

10.1. Surface Mount Technology Market, by Application, 2023-2032

10.1.1. Consumer Electronics

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. IT & telecommunication

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Automotive

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Industrial

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Aerospace & Defense

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Healthcare

10.1.6.1. Market Revenue and Forecast (2020-2032)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Surface Mount Technology Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.1.2. Market Revenue and Forecast, by Service (2020-2032)

11.1.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Service (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Service (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.2.2. Market Revenue and Forecast, by Service (2020-2032)

11.2.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Service (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Service (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Service (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Service (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.3.2. Market Revenue and Forecast, by Service (2020-2032)

11.3.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Service (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Service (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Service (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Service (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.4.2. Market Revenue and Forecast, by Service (2020-2032)

11.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Service (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Service (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Service (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Service (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.5.2. Market Revenue and Forecast, by Service (2020-2032)

11.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Service (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Service (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Application (2020-2032)

Chapter 12. Company Profiles

12.1. ASM Pacific Technology

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Seika Corporation

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Panasonic

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Nordson Corporation

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cognex Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Fuji Machine Manufacturing Co., Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Teradyne Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Mycronic

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Kulicke & Soffa Industries, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Neoden SMT

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others