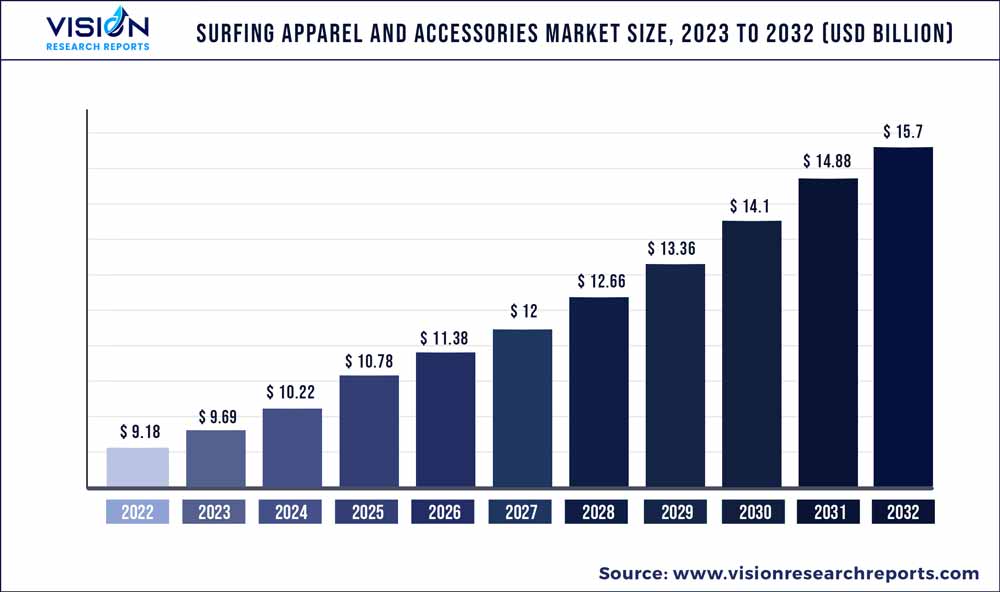

The global surfing apparel and accessories market was valued at USD 9.18 billion in 2022 and it is predicted to surpass around USD 15.7 billion by 2032 with a CAGR of 5.51% from 2023 to 2032.

Key Pointers

Report Scope of the Surfing Apparel And Accessories Market

| Report Coverage | Details |

| Market Size in 2022 | USD 9.18 billion |

| Revenue Forecast by 2032 | USD 15.7 billion |

| Growth rate from 2023 to 2032 | CAGR of 5.51% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Billabong; Hurley, Inc.; O’Neill; RVCA; Volcom, LLC; GLOBE INTERNATIONAL LIMITED; REEF; Roxy, Inc.; Curl. Ltd.; Quiksilver, Inc. |

Surfing is gaining popularity among water adventurers as people could follow all the social distancing guidelines while surfing. Surfing clothes and accessories are also gaining popularity because surfing was one of the only sports that people could participate in during the pandemic.

In 2020, the surf apparel product segment held the largest market share, and this trend is likely to continue throughout the forecast period. The development of novel materials and technical textiles for the creation of fashionable and high-performance surfwear or apparel has aided market expansion. Furthermore, as the number of female surfers has increased, so does the demand for surfing-inspired clothing such as bikinis, swimsuits, shorts, t-shirts, short onesies, and vests made of water-resistant fabrics, such as polyester.

In the surf apparel industry, a recent trend has been the increase in the number of sustainable items. Consumers are choosing environmentally-friendly surf apparel that does not pollute the environment. The majority of surf clothing and accessory producers are based in Europe, Asia Pacific, and North America, where the necessary raw materials are readily available.

Since stand-alone shops were authorized to reopen in June, board-sports businesses have reported a surge in hard goods sales. On July 13, 2020, the state government issued a decree requiring stores in indoor malls in certain California counties to remain closed. According to Bob Abdel, co-owner and buyer of Huntington Beach, Calif.-based Jack's Surfboards, the business is good, the only issue is with the inventory. He stated that Surfboards, skateboards, and wetsuits are coveted commodities. Orders take five weeks to come to retailers and a lot of businesses were caught off guard. As a result, finding items has been quite difficult for consumers. Soft-goods sales have also been hampered by supply-chain problems. During the shutdown of non-essential industries, many surf apparel companies suspended manufacturing. There have also been issues with staffing industries and warehouses in the United States since some workers sought to avoid being exposed to COVID-19.

Channel Islands Surfboards, Quiksilver, Firewire Surfboards, and Billabong International Limited, among other prominent surf apparel manufacturers, have been concentrating on the production and design of innovative materials and technical fabrics for trendy and high-performance surfwear or apparel, which has positively impacted market growth.

Product Insights

The surf tees product segment is anticipated to register the largest CAGR of 6.62% over the forecast period. Surf tees are typically made from synthetic materials like polyester or nylon, which are highly durable and resistant to fading and damage from exposure to saltwater, sun, and chlorine.

They may also be treated with UV protection to help protect the wearer from the sun's harmful rays. Surf tees are often worn as a standalone top, but can also be layered under a wetsuit for added warmth and protection. In addition to their functional properties, surf tees also often feature unique and colorful designs that reflect surf lifestyle and culture. They may include graphics, logos, or slogans that celebrate the ocean, waves, and coastline.

The surfboard leash segment of the surfing accessories market is anticipated to have the highest CAGR of 7.62% over the forecast period of 2023-2032.Surfboard leashes come in a variety of lengths and thicknesses, depending on the size and type of the surfboard being used, as well as the skill level and experience of the surfer.

They are an essential piece of equipment for surfers of all levels and are typically required at most surf breaks for safety reasons. As it is one of the most important accessories for a surfer, the players in the industry are offering security perspectives and innovative accessories to surfers.

Distribution Channel Insights

The offline distribution channel held the largest revenue share of 82.94% in 2022. Offline stores offer a tangible experience, where customers can see, touch, and try on the apparel (depending on the shop’s policies), helping them make an informed decision. Moreover, offline stores often offer services such as appraisals and valuations, which can be important when buying surfing apparel and accessories in bulk. Consumers prefer to look around and compare prices in larger retail stores as different retailers offer different deals and promotions.

The online distribution channel segment is anticipated witness a considerable CAGR of 6.81% over the forecast period. Online retailers offer a broad variety of international brands, steep discounts, free shipping, and straightforward return policies, all of which tempt customers to buy surfing apparel and accessories. Online stores make it easier to meet the requirements of a wide range of customers, especially those on a budget, by providing a diverse selection of surfing goods at different prices.

Regional Insights

North America dominated the surfing apparel and accessories market with a share of 39.44% in 2022. The industry for surfing equipment and accessories is expanding in North America due to surfing's rising appeal among adventure seekers. The United States has the world's longest beaches, which contributes to its popularity as a surfing and other water activities destination.

Asia Pacific is anticipated to register the highest CAGR of 6.16% over the forecast period. Asia Pacific is one of the most lucrative markets for surfing apparel & accessories, owing to the growing awareness and the availability of new and more effective products in the region. The growing popularity of surfing and other adventure sports among adventure enthusiasts and youngsters in countries like Cambodia, Indonesia, the Maldives, Thailand, Japan, and Vietnam are expected to drive market growth.

Surfing Apparel And Accessories Market Segmentations:

By Product

By Distribution Channel

By Regional

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others