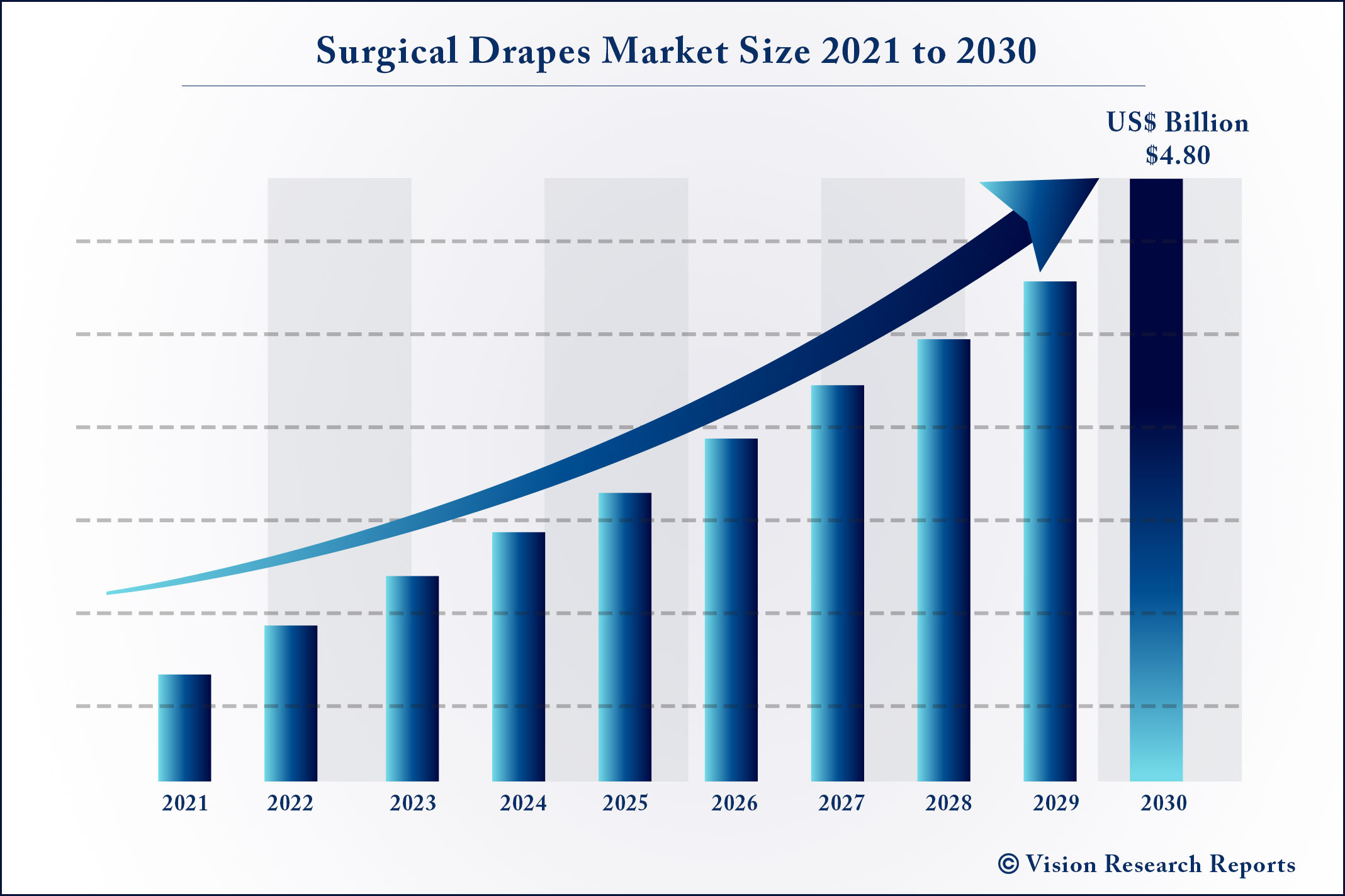

The surgical drapes market size is expected to be worth around US$ 4.80 billion by 2030, according to a new report by Vision Research Reports.

The global surgical drapes market size was valued at US$ 2.30 billion in 2020 and is anticipated to grow at a CAGR of 5.18% during forecast period 2021 to 2030.

Report Coverage

| Report Scope | Details |

| Market Size | US$ 4.80 Bn by 2030 |

| Growth Rate | CAGR of 5.18% From 2021 to 2030 |

| Base Year | 2021 |

| Forecast Period | 2021 to 2030 |

| Segments Covered | Type, risk type, end use |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Mentioned | 3M; Cardinal Health; Molnlycke Health Care AB; Steris; Paul Hartmann AG; Standard Textile Co.; Medline Industries, Inc.; Priontex; OneMed; Medic |

Growth Factors

An increasing number of surgeries and hospitalizations are fueling the growth of the market. Moreover, the rising prevalence of nosocomial infections is expected to upsurge the market growth over the forecast period. For instance, the Centers for Disease Control (CDC) predicted that HAIs account for around 1.7 million infections and 99,000 related deaths every year in American hospitals. Of these infections, urinary tract infections accounted for 32%, surgical site infections (SSI) accounted for 22%, lung infections accounted for 15%, and bloodstream infections accounted for 14%. Thereby, increasing nosocomial infections will surge the demand for surgical drapes, leading to market growth.

Sterile surgical drapes are used during surgery to prevent contact with unprepared surfaces, and to maintain the sterility of environmental surfaces, equipment, and patient’s surroundings. Nonwoven and woven materials are used in the manufacture of surgical drapes. Nonwoven material includes polypropylene, polyethylene, and polyamide & polyester. The global surgical drapes market is driven by rise in the number of surgical procedures and increase in the global geriatric population with major chronic diseases.

Overview

Drivers

Innovative Materials Increasing Availability of ISO-certified Products

In order to avoid infections caused by reusable drapes, companies in the surgical drapes market are manufacturing disposable drapes. Welmed— a provider of disposable medical products, is delivering disposable surgical drapes in a variety of materials such as polyethylene (PE), Tri-Lam Heavy Duty, Protect5, and ClearView options to meet clinical needs.

Manufacturers in the surgical drapes market are increasing their production capabilities in orthopedic drapes, cystoscopy drapes, and obstetric drapes, among others. This explains why the market is projected to reach the revenue of US$ 4.1 Bn by 2030. ISO (International Organization for Standardization)-certified products are being preferred by surgeons.

Iodophor-impregnated Adhesive Drapes Prevent Incidences of SSIs in Patients

Adhesive plastic incise drapes impregnated with antimicrobial agents are used in a patient’s skin after the completion of the surgical site preparation. This drape acts as a microbial barrier to prevent the migration of microorganisms from the skin to the operative site. However, it has been found that these drapes also lead to increased recolonization of the skin, resulting in antiseptic preparation underneath the adhesive drapes compared to the use of no drapes.

Surgical sight infections (SSI) are inhibiting the growth for the surgical drapes market. Hence, companies in the surgical drapes market are recommending the use of iodophor-impregnated adhesive drapes to prevent incidences of SSIs in patients. They are adhering to the guidelines issued by the United Kingdom (UK) National Institute for Health and Care Excellence (NICE) to boost their credibility credentials.

Standardized Absorbent Reinforcement Materials in Drapes Provide Enhanced Protection

Disposable robotic surgical drapes are a breakthrough innovation in the surgical drapes market. These drapes are especially designed for patient safety, and are gaining prominence in minimally invasive robotic surgeries and computer-assisted surgeries. Manufacturers in the surgical drapes market are increasing their R&D in sterile and robotic friendly clear leggings.

On the other hand, manufacturers are introducing triple access angiography drapes. Patent approved designs in these drapes are helping manufacturers to capitalize on incremental opportunities. Cardinal Health, Inc.— a U.S. multinational healthcare services company is offering standardized absorbent reinforcement material in drapes to provide a more consistent look, feel, and experience to clinicians. Manufacturers are complying with the guidelines issued by the Association for the Advancement of Medical Instrumentation (AAMI) to meet industry’s protection standards.

Incise Drapes to Dominate Surgical Drapes Market

In terms of type, the global surgical drapes market has been divided into incise, sheets, laproscopy, lithotomy, laparotomy, leggings, and others. The incise segment dominated the global surgical drapes market in 2020. This trend is expected to continue during the forecast period. Rise in application of incise surgical drapes on wounds and incision, and utilization in a large number of surgical procedures are key factors driving the segment. Laproscopy was the second-largest segment, in terms of market share, in 2019. The expansion of the segment can be attributed to increase in the demand for laparoscopic and laparotomy surgical drapes, owing to the rise in the number of laparoscopic surgeries. According to the Centers for Disease Control and Prevention (CDC), an estimated 3.5 million laparoscopic surgeries are conducted annually in the U.S. alone.

Disposable Surgical Drapes to Offer Lucrative Opportunities

In terms of usability, the global surgical drapes market has been categorized into disposable and reusable. The disposable segment accounted for a prominent share of the global surgical drapes market in 2020. Extensive usage of disposable surgical drapes in countries, such as the U.S., and increase in awareness about these drapes in other developing countries are expected to boost the segment during the forecast period.

Nonwoven Surgical Drapes to be Preferred to Woven

In terms of material, the global surgical drapes market has been bifurcated into nonwoven and woven. The nonwoven segment has been further sub-segmented into polypropylene, polyethylene, polyamide & polyester, and others. The nonwoven segment accounted for a prominent share of the global surgical drapes market in 2020. The expansion of the segment can be attributed to increase in awareness about the use of nonwoven surgical drapes. These surgical drapes do not cause discomfort to patients, and there are less chances of transferring infections in the hospital environment. Furthermore, nonwoven surgical drapes have four levels of barrier performance depending on the material used and hence, proven to be the best option during surgical procedures and even while recovery.

High Demand for Surgical Drapes in Hospitals

In terms of end user, the global surgical drapes market has been classified into hospitals, specialty clinics, ambulatory surgical centers, nursing homes, and others. The hospitals segment led the global surgical drapes market, in terms of revenue, in 2019. The trend is expected to continue during the forecast period. Hospitals are an important channel for usage of surgical drapes. Rise in number of hospitals in countries, such as India and China, is projected to boost the demand for surgical drapes. The growth of the segment can be attributed to increase in the number of surgeries and hospital facilities across the world.

North America to Dominate Surgical Drapes Market

The global surgical drapes market has been segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America dominated the global surgical drapes market in 2020, followed by Europe. Prominent market share held by North America can be ascribed to increase in the number of people with major chronic diseases, new product launches, and presence of major players in the region. The surgical drapes market in Asia Pacific is anticipated to expand at a high CAGR from 2020 to 2030. This can be ascribed to the presence of developing countries with commercial hubs, expanding business organizations, rise in awareness about surgical drapes, improving healthcare infrastructure, and high investments by companies in R&D.

Competition Landscape of Surgical Drapes Market

The global surgical drapes market is fragmented in terms of number of players. Key players operating in the global market include 3M, Cardinal Health, PAUL HARTMANN AG, Mölnlycke Health Care AB, Medica Europe BV, OneMed, Priontex, Guardian, STERIS plc., and Medline Industries, Inc.

Global Surgical Drapes Market: Segmentation

Surgical Drapes Market, by Type

Surgical Drapes Market, by Usability

Surgical Drapes Market, by Material

Surgical Drapes Market, by End User

Surgical Drapes Market, by Region

Scope of the Report

VRR’s report on the global surgical drapes market studies past as well as current growth trends and opportunities to gain valuable insights of these indicators of the market during the forecast period from 2021 to 2030. The report provides revenue of the global surgical drapes market for the period 2017–2030, considering 2020 as the base year and 2030 as the forecast year. The report also provides the compound annual growth rate (CAGR) for the global surgical drapes market during the forecast period.

The report has been prepared after primary and secondary researches. Primary research involved bulk of research efforts, wherein analysts carried out interviews with industry leaders and opinion makers. Secondary research involved referring to key players’ product literature, annual reports, press releases, and relevant documents to understand the global surgical drapes market.

Secondary research also included Internet sources, statistical data from government agencies, websites, company presentations, sales data, and trade associations. Analysts employed a combination of top-down and bottom-up approaches to study various phenomenon in the global surgical drapes market.

The report includes an elaborate executive summary, along with a snapshot of the growth behavior of various segments included in the scope of the study. Furthermore, the report sheds light on the changing competitive dynamics in the global surgical drapes market. These indices serve as valuable tools for existing market players as well as for entities interested in entering the global surgical drapes market.

The report delves into the competition landscape of the global surgical drapes market. Key players operating in the global surgical drapes market have been identified, and each one of these has been profiled for distinguishing business attributes. Company overview, financial standings, recent developments, and SWOT are some of the attributes of players in the global surgical drapes market that have been profiled in this report.

Key Questions Answered in Surgical Drapes Market Report

Research Methodology

A unique methodology has been utilized by VRR to conduct a comprehensive research on the growth of the global surgical drapes market and arrive at conclusions on its growth prospects. This research methodology is a combination of primary and secondary research, which helps analysts warrant the accuracy and reliability of the drawn conclusions.

Secondary research sources referred to by analysts during the production of the global surgical drapes market report include statistics from company annual reports, SEC filings, company websites, investor presentations, regulatory databases, government publications, and industry white papers. Analysts have also interviewed senior managers, product portfolio managers, CEOs, VPs, and market intelligence managers, who contributed to the production of VRR’s study on the surgical drapes market as primary methods.

These primary research respondents have provided exclusive information during interviews, which serves as a validation from the surgical drapes market leaders. Access to an extensive internal repository and external proprietary databases enabled this report to address specific details and questions about the global surgical drapes market with accuracy. The study also uses the top-down approach to assess the revenue of each segment and the bottom-up approach to counter-validate them. This has helped in reaching VRR’s estimates on future prospects of the global surgical drapes more reliably and accurately.

Table of Contents

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Surgical Drapes Market

4. Market Overview

4.1. Introduction

4.1.1. Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Surgical Drapes Market Analysis and Forecast, 2018–2030

5. Key Insights

5.1. Key Industry Events (Mergers, Acquisitions, Collaborations, Partnerships, etc.)

5.2. COVID-19 Pandemic Impact on Industry (Value Chain and Short / Mid / Long Term Impact)

6. Global Surgical Drapes Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Global Surgical Drapes Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Type, 2018–2030

6.3.1. Incise

6.3.2. Sheets

6.3.3. Laparoscopy

6.3.4. Lithotomy

6.3.5. Laparotomy

6.3.6. Leggings

6.3.7. Others

6.4. Global Surgical Drapes Market Attractiveness Analysis, by Type

7. Global Surgical Drapes Market Analysis and Forecast, by Usability

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Global Surgical Drapes Market Value (US$ Mn) Forecast, by Usability, 2018–2030

7.3.1. Disposable

7.3.2. Reusable

7.4. Global Surgical Drapes Market Attractiveness Analysis, by Usability

8. Global Surgical Drapes Market Analysis and Forecast, by Material

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Global Surgical Drapes Market Value (US$ Mn) Forecast, by Material, 2018–2030

8.3.1. Nonwoven

8.3.2. Woven

8.4. Global Surgical Drapes Market Attractiveness Analysis, by Material

9. Global Surgical Drapes Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Global Surgical Drapes Market Value (US$ Mn) Forecast, by End-user, 2018–2030

9.3.1. Hospitals

9.3.2. Specialty Clinics

9.3.3. ASCs

9.3.4. Nursing Homes

9.3.5. Others

9.4. Global Surgical Drapes Market Attractiveness Analysis, by End-user

10. Global Surgical Drapes Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Global Surgical Drapes Market Value (US$ Mn) Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Global Surgical Drapes Market Attractiveness Analysis, by Country/Region

11. North America Surgical Drapes Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. North America Surgical Drapes Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Type, 2018–2030

11.2.1. Incise

11.2.2. Sheets

11.2.3. Laparoscopy

11.2.4. Lithotomy

11.2.5. Laparotomy

11.2.6. Leggings

11.2.7. Others

11.3. North America Surgical Drapes Market Value (US$ Mn) Forecast, by Usability, 2018–2030

11.3.1. Disposable

11.3.2. Reusable

11.4. North America Surgical Drapes Market Value (US$ Mn) Forecast, by Material, 2018–2030

11.4.1. Nonwoven

11.4.2. Woven

11.5. North America Surgical Drapes Market Value (US$ Mn) Forecast, by End-user, 2018–2030

11.5.1. Hospitals

11.5.2. Specialty Clinics

11.5.3. ASCs

11.5.4. Nursing Homes

11.5.5. Others

11.6. North America Surgical Drapes Market Value (US$ Mn) Forecast, by Country, 2018–2030

11.6.1. U.S.

11.6.2. Canada

11.7. North America Surgical Drapes Market Attractiveness Analysis

11.7.1. By Type

11.7.2. By Usability

11.7.3. By Material

11.7.4. By End-user

11.7.5. By Country

12. Europe Surgical Drapes Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Europe Surgical Drapes Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Type, 2018–2030

12.2.1. Incise

12.2.2. Sheets

12.2.3. Laparoscopy

12.2.4. Lithotomy

12.2.5. Laparotomy

12.2.6. Leggings

12.2.7. Others

12.3. Europe Surgical Drapes Market Value (US$ Mn) Forecast, by Usability, 2018–2030

12.3.1. Disposable

12.3.2. Reusable

12.4. Europe Surgical Drapes Market Value (US$ Mn) Forecast, by Material, 2018–2030

12.4.1. Nonwoven

12.4.2. Woven

12.5. Europe Surgical Drapes Market Value (US$ Mn) Forecast, by End-user, 2018–2030

12.5.1. Hospitals

12.5.2. Specialty Clinics

12.5.3. ASCs

12.5.4. Nursing Homes

12.5.5. Others

12.6. Europe Surgical Drapes Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Europe Surgical Drapes Market Attractiveness Analysis

12.7.1. By Type

12.7.2. By Usability

12.7.3. By Material

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Surgical Drapes Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Asia Pacific Surgical Drapes Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Type, 2018–2030

13.2.1. Incise

13.2.2. Sheets

13.2.3. Laparoscopy

13.2.4. Lithotomy

13.2.5. Laparotomy

13.2.6. Leggings

13.2.7. Others

13.3. Asia Pacific Surgical Drapes Market Value (US$ Mn) Forecast, by Usability, 2018–2030

13.3.1. Disposable

13.3.2. Reusable

13.4. Asia Pacific Surgical Drapes Market Value (US$ Mn) Forecast, by Material, 2018–2030

13.4.1. Nonwoven

13.4.2. Woven

13.5. Asia Pacific Surgical Drapes Market Value (US$ Mn) Forecast, by End-user, 2018–2030

13.5.1. Hospitals

13.5.2. Specialty Clinics

13.5.3. ASCs

13.5.4. Nursing Homes

13.5.5. Others

13.6. Asia Pacific Surgical Drapes Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Asia Pacific Surgical Drapes Market Attractiveness Analysis

13.7.1. By Type

13.7.2. By Usability

13.7.3. By Material

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Surgical Drapes Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Latin America Surgical Drapes Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Type, 2018–2030

14.2.1. Incise

14.2.2. Sheets

14.2.3. Laparoscopy

14.2.4. Lithotomy

14.2.5. Laparotomy

14.2.6. Leggings

14.2.7. Others

14.3. Latin America Surgical Drapes Market Value (US$ Mn) Forecast, by Usability, 2018–2030

14.3.1. Disposable

14.3.2. Reusable

14.4. Latin America Surgical Drapes Market Value (US$ Mn) Forecast, by Material, 2018–2030

14.4.1. Nonwoven

14.4.2. Woven

14.5. Latin America Surgical Drapes Market Value (US$ Mn) Forecast, by End-user, 2018–2030

14.5.1. Hospitals

14.5.2. Specialty Clinics

14.5.3. ASCs

14.5.4. Nursing Homes

14.5.5. Others

14.6. Latin America Surgical Drapes Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Latin America Surgical Drapes Market Attractiveness Analysis

14.7.1. By Type

14.7.2. By Usability

14.7.3. By Material

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Surgical Drapes Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Middle East & Africa Surgical Drapes Market Value (US$ Mn) and Volume (Thousand Units) Forecast, by Type, 2018–2030

15.2.1. Incise

15.2.2. Sheets

15.2.3. Laparoscopy

15.2.4. Lithotomy

15.2.5. Laparotomy

15.2.6. Leggings

15.2.7. Others

15.3. Middle East & Africa Surgical Drapes Market Value (US$ Mn) Forecast, by Usability, 2018–2030

15.3.1. Disposable

15.3.2. Reusable

15.4. Middle East & Africa Surgical Drapes Market Value (US$ Mn) Forecast, by Material, 2018–2030

15.4.1. Nonwoven

15.4.2. Woven

15.5. Middle East & Africa Surgical Drapes Market Value (US$ Mn) Forecast, by End-user, 2018–2030

15.5.1. Hospitals

15.5.2. Specialty Clinics

15.5.3. ASCs

15.5.4. Nursing Homes

15.5.5. Others

15.6. Middle East & Africa Surgical Drapes Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

15.6.1. GCC

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Middle East & Africa Surgical Drapes Market Attractiveness Analysis

15.7.1. By Type

15.7.2. By Usability

15.7.3. By Material

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Company Profiles

16.1.1. 3M

16.1.1.1. Company Overview

16.1.1.2. Company Financials

16.1.1.3. Growth Strategies

16.1.1.4. SWOT Analysis

16.1.2. Cardinal Health

16.1.2.1. Company Overview

16.1.2.2. Company Financials

16.1.2.3. Growth Strategies

16.1.2.4. SWOT Analysis

16.1.3. PAUL HARTMANN AG

16.1.3.1. Company Overview

16.1.3.2. Growth Strategies

16.1.3.3. SWOT Analysis

16.1.4. Mölnlycke Health Care AB

16.1.4.1. Company Overview

16.1.4.2. Growth Strategies

16.1.4.3. SWOT Analysis

16.1.5. Medica Europe BV

16.1.5.1. Company Overview

16.1.5.2. Growth Strategies

16.1.5.3. SWOT Analysis

16.1.6. OneMed

16.1.6.1. Company Overview

16.1.6.2. Company Financials

16.1.6.3. Growth Strategies

16.1.6.4. SWOT Analysis

16.1.7. Priontex

16.1.7.1. Company Overview

16.1.7.2. Company Financials

16.1.7.3. Growth Strategies

16.1.7.4. SWOT Analysis

16.1.8. Guardian

16.1.8.1. Company Overview

16.1.8.2. Company Financials

16.1.8.3. Growth Strategies

16.1.8.4. SWOT Analysis

16.1.9. STERIS plc.

16.1.9.1. Company Overview

16.1.9.2. Company Financials

16.1.9.3. Growth Strategies

16.1.9.4. SWOT Analysis

16.1.10. Medline Industries, Inc.

16.1.10.1. Company Overview

16.1.10.2. Company Financials

16.1.10.3. Growth Strategies

16.1.10.4. SWOT Analysis

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others