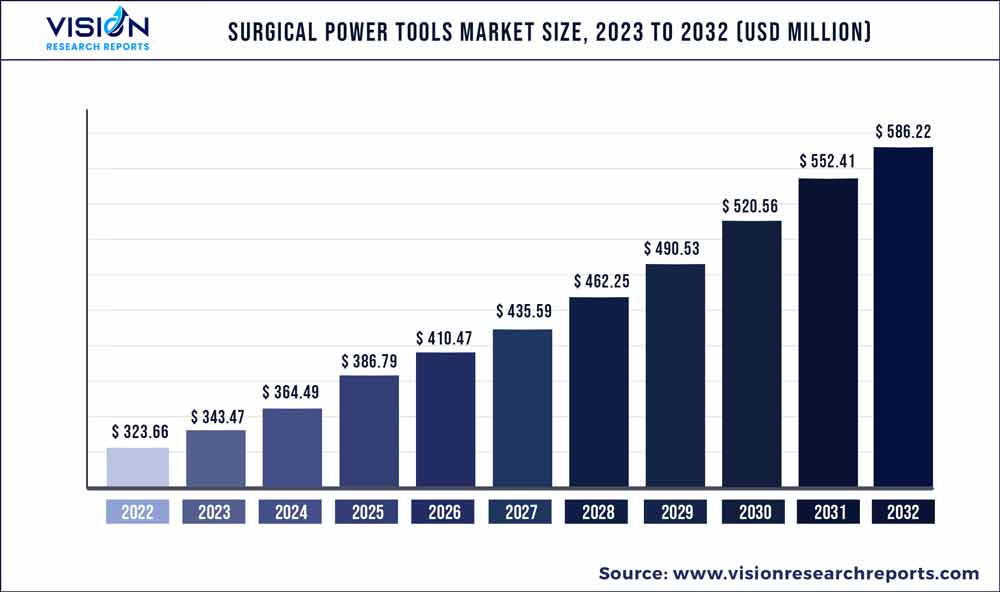

The global surgical power tools market was surpassed at USD 323.66 million in 2022 and is expected to hit around USD 586.22 million by 2032, growing at a CAGR of 6.12% from 2023 to 2032.

Key Pointers

Report Scope of the Surgical Power Tools Market

| Report Coverage | Details |

| Market Size in 2022 | USD 323.66 million |

| Revenue Forecast by 2032 | USD 586.22 million |

| Growth rate from 2023 to 2032 | CAGR of 6.12% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | DePuy Synthes (Johnson & Johnson); Orthopromed Inc.; B Braun; CONMED Corporation; Zimmer Biomet; Stryker; KLS Martin Group; Medtronic |

Technological advancements in surgical devices, and an increasing number of facial and head injuries, followed by the rise in global geriatric population are some of the major factors driving the growth of market. However, the adoption of patient-specific devices can be limited due to a lack of suitable reimbursement, as healthcare providers may be unsure about adopting these devices due to cost-related concerns.

The surgical power tools are used in a variety of surgical procedures, including the treatment of facial fractures, cranial defects, and tumors, which include procedures such as reconstructive surgery, orthognathic surgery, & trauma surgery. During the pandemic, many elective surgeries were postponed or canceled, resulting in a decline in the demand. For instance, in 2021, around 10 million people in the U.K. were waiting for surgical treatments, which was an increase from 4 million prior to the pandemic. Similarly, over 28 million surgical procedures were canceled or postponed during the pandemic, creating a backlog that took a year to clear, and this figure could have been worse if the global lockdown was extended.

Product Insights

The surgical drill segment dominated the market and held the largest revenue share of 84.36% in 2022. Surgical drills are a crucial tool in Surgical surgeries and are used in a wide range of surgical procedures. These procedures include craniotomy, neurosurgery, orthognathic surgery, maxillofacial surgery, dental implant surgery, etc. Surgical drills are used to cut and shape bone and other hard tissues, allowing surgeons to perform precise and accurate surgeries with minimal tissue damage. Advancements in technology have resulted in the development of more efficient and advanced surgical drills, such as high-speed electric drills and pneumatic drills, which have further increased the demand for these tools in the market.

The electric pen drive segment is anticipated to witness the fastest CAGR of 6.32% over the forecast period. Electric pen drives offer a high precision and control in surgeries, making them an ideal choice for delicate procedures. They are designed to operate at high speeds, allowing the surgeons to perform accurate and precise cuts with minimal tissue damage. This results in faster healing times for patients and reduces the risk of complications. These tools are lightweight, compact, and easy to handle, which makes them highly versatile and easy to use in different surgical settings. They are also quieter than traditional pneumatic or electric drills, which can help reduce the stress and anxiety associated with surgical procedures. Furthermore, technological developments have resulted in the development of more advanced and efficient electric pen drives, such as those with variable speed settings, oscillating tips, and improved battery life.

End-use Insights

The hospitals segment dominated the market and held the largest revenue share of 56.54% in 2022. Hospitals are the primary location where most surgeries are performed. As a result, they are the primary purchasers of power tools for these surgeries. Hospitals have well-equipped operation theaters and skilled staff to handle complicated surgical procedures, which require sophisticated tools like surgical power tools. Many hospitals also have long-term relationships with manufacturers, which can result in favorable pricing and better customer support. Additionally, hospitals have strict protocols for maintaining and sterilizing surgical instruments, including power tools. Manufacturers often must meet these standards to sell their products to hospitals. Hospitals also have strict regulations and standards to follow when it comes to the quality and safety of medical devices.

The others segment is expected to witness the fastest growth rate of 6.4% over the forecast period. It includes dental clinics, research institutes, and private practices that use power tools in various procedures related to the skull, jaw, and face. Dental clinics are one of the primary users of power tools. These tools are used in dental implant surgeries to prepare the jawbone for implant insertion. Furthermore, technological advancements in dental implant procedures have led to an increase in demand for specialized surgical power tools, such as guided surgery systems, which require precision and accuracy for better results. Additionally, dental clinics have a growing patient base, and as more people seek dental implant procedures, the demand for surgical power tools in the dental industry is expected to increase.

Regional Insights

North America has dominated the global market and held the largest revenue share of 39.57% in 2022. The North American surgical power tools market is a dynamic and evolving industry that is driven by technological advancements, growing demand for these surgical tools, increasing awareness about facial deformity correction surgical procedures, and the presence of recognized healthcare facilities and services are some of the factors that contributed to the notable market growth. These technologies allow for better precision and accuracy in surgery, which can lead to improved outcomes and minimize complications. Furthermore, encouraging government initiatives, such as the establishment of the American Society of Craniofacial Surgery (ASCFS), for increasing awareness about CMF surgical procedure and their associated advantages among the population is likely to increase the demand for the CMF power tools market during the forecast period.

Asia Pacific is anticipated to witness the fastest CAGR of 6.51% in the forecast period. Asia Pacific has seen significant developments in the healthcare infrastructure in recent years, driven by increasing demand, technological advancements, and an increasing geriatric population. These developments are expected to continue in the coming years, further strengthening the region's position as a leading player in the global CMF power tools market. Additionally, many countries in the Asia Pacific region, such as Japan, China, India, South Korea, and Singapore, have invested heavily in their healthcare infrastructure. These countries have well-developed healthcare systems, with advanced medical facilities and highly skilled healthcare professionals. This has enabled them to provide high-quality care to patients. Furthermore, the Asia Pacific region has become a hub for medical tourism, with many patients traveling to countries such as India, Thailand, and Malaysia for surgical procedures as the services are offered at a low cost.

Surgical Power Tools Market Segmentations:

By Product

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Surgical Power Tools Market

5.1. COVID-19 Landscape: Surgical Power Tools Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Surgical Power Tools Market, By Product

8.1. Surgical Power Tools Market, by Product, 2023-2032

8.1.1. Surgical Drills

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Electric Pen Drive

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Surgical Power Tools Market, By End-use

9.1. Surgical Power Tools Market, by End-use, 2023-2032

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Ambulatory Surgical Centers

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Surgical Power Tools Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by End-use (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 11. Company Profiles

11.1. DePuy Synthes (Johnson & Johnson)

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Orthopromed Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. B Braun

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. CONMED Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Zimmer Biomet

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Stryker

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. KLS Martin Group

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Medtronic

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others