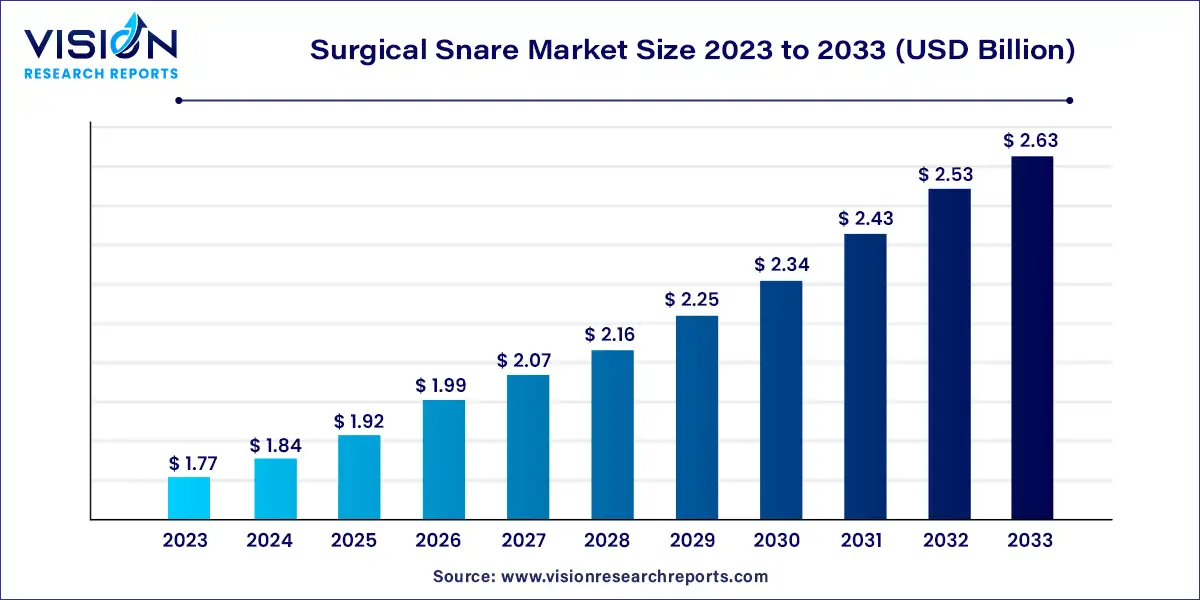

The global surgical snare market size was valued at USD 1.77 billion in 2023 and it is predicted to surpass around USD 2.63 billion by 2033 with a CAGR of 4.05% from 2024 to 2033.

The global surgical snare market has witnessed significant growth in recent years, driven by factors such as increasing prevalence of gastrointestinal disorders, rising demand for minimally invasive surgical procedures, and advancements in technology. Surgical snares are widely utilized in endoscopic procedures for the removal of polyps, tumors, and other abnormal tissues.

The growth of the surgical snare market is propelled by an increasing prevalence of gastrointestinal disorders, including colorectal cancer and inflammatory bowel disease, has led to a higher demand for surgical snares, which are essential tools for the removal of polyps and tumors during endoscopic procedures. Secondly, advancements in endoscopic techniques and instrument technology have significantly enhanced the efficacy and safety of procedures involving surgical snares, driving their adoption among healthcare providers. Additionally, the rising trend towards minimally invasive surgeries, characterized by shorter recovery times and reduced post-operative complications, has further fueled the demand for surgical snares.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 46% |

| CAGR of Asia Pacific from 2024 to 2033 | 4.96% |

| Revenue Forecast by 2033 | USD 2.63 billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.05% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The single-use segment accounted for the largest revenue share of over 63% in 2023. The single-use snares include soft wire oval, crescent-shaped, oval, and hard wire oval snares. Various shapes and wire characteristics are required in various application areas, including thick wires for higher coagulation and hard snares for flat polyps. Increasing adoption of single-use instruments in healthcare facilities to ensure convenience and safety is expected to accelerate the growth of the segment.

The reusable segment is expected to witness the fastest growth at a CAGR of 4.25% over the forecast period. The rising demand for cost-effective and sustainable medical devices, coupled with the increasing focus on reducing medical waste and environmental impact, has fueled the adoption of reusable surgical snares. These devices offer advantages such as durability, ease of sterilization, and long-term cost savings for healthcare facilities.

The hospital's segment captured the largest revenue share of over 79% in 2023. The hospital segment is the largest revenue-generating segment due to the high surgery volume. According to the CDC, a steep increase in surgical procedures, such as angioplasty and kidney and liver transplants, has been observed in the past few years. Coupled with the growing incidence of trauma, hospitals' demand for surgical equipment has significantly increased in recent years.

The Ambulatory Surgical Centers (ASCs) segment is anticipated to register the fastest CAGR of 4.14% over the forecast period. It can be attributed to lower out-of-pocket costs, better patient accessibility, and decreased facility costs.

The GI endoscope segment held the largest revenue share of over 33% in 2023 and is expected to maintain its dominance over the forecast period. The increasing number of gastroscopies, the rising adoption of endoscopes for diagnosing and treating gastrointestinal (GI) diseases, and the availability of advanced products for gastroscopy are some of the factors boosting the use of gastroscopy.

The arthroscopy is expected to expand at the fastest CAGR of 4.46% over the forecast period. The adoption of arthroscopic procedures is expected to increase owing to the rising geriatric population at risk of age-related disorders, such as arthritis, and rising incidence of joint injuries, such as knee and shoulder. According to the Centers for Disease Control and Prevention estimates, about one in four adults, or about 58.5 million people in the U.S., have been diagnosed with arthritis by doctors.

Moreover, according to the estimates published by the Arthritis Foundation, the number of people with doctor-diagnosed arthritis is expected to be over 78 million by 2040. Hence, such factors are anticipated to provide significant growth opportunities for the market in the upcoming years.

North America accounted for the largest revenue share of over 46% in 2023. An increase in the adoption of new and advanced devices, a rise in the demand for minimally invasive surgical procedures, and a growth in chronic disease burden are among the factors driving the market. The growing burden of gastrointestinal disorders and cancer in the region is also one of the significant factors propelling the market growth. Rising cancer incidence and the availability of advanced diagnostic procedures are expected to boost market growth.

Furthermore, favorable reimbursement policies and well-established healthcare infrastructure in North America facilitate the adoption of surgical snares. The reimbursement coverage provided by the government and private insurance companies for endoscopic procedures, including the use of surgical snares, encourages healthcare facilities to invest in these devices.

The Asia Pacific region is experiencing rapid growth, exhibiting the highest CAGR of 4.96% over the forecast period. The region's increasing prevalence of gastrointestinal diseases and colorectal cancer has led to rising demand for surgical snares for effective diagnosis and treatment. Moreover, the growing geriatric population in countries like China and India has increased the need for minimally invasive surgical procedures, driving the demand for surgical snares.

By Usability

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Usability Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Surgical Snare Market

5.1. COVID-19 Landscape: Surgical Snare Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Surgical Snare Market, By Usability

8.1. Surgical Snare Market, by Usability, 2024-2033

8.1.1 Single-use

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Reusable

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Surgical Snare Market, By Application

9.1. Surgical Snare Market, by Application, 2024-2033

9.1.1. GI Endoscope

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Laparoscopy

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Urology Endoscopy

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Gynecology Endoscopy

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Arthroscopy

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Bronchoscopy

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Mediastinoscopy

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Laryngoscopy

9.1.8.1. Market Revenue and Forecast (2021-2033)

9.1.9. Others

9.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Surgical Snare Market, By End-use

10.1. Surgical Snare Market, by End-use, 2024-2033

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Ambulatory Surgical Centers

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Surgical Snare Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Usability (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Usability (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Usability (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Usability (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Usability (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Usability (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Usability (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Usability (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Usability (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Usability (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Usability (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Usability (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Usability (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Usability (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Usability (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Usability (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Usability (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Usability (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Usability (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Usability (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Usability (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Medtronic.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Boston Scientific Corporation.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Medline Industries, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Olympus Corporation.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cook.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. CONMED Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Steris (U.S.)

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Merit Medical Systems

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Avalign Technologies.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Hill-Rom Holdings, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others