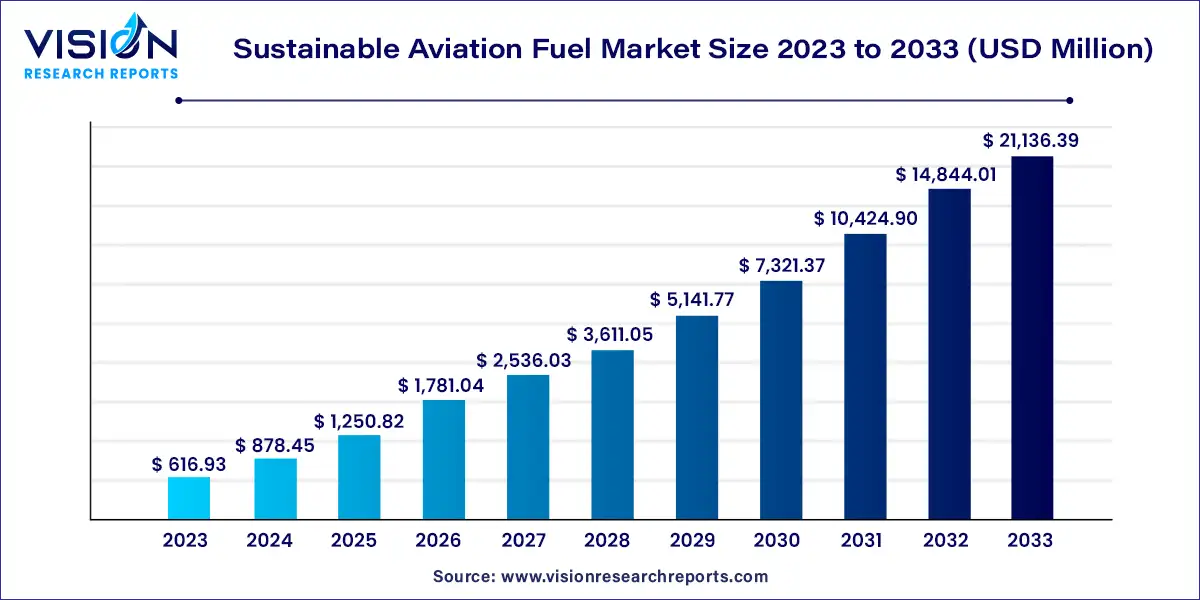

The global sustainable aviation fuel market was valued at USD 616.93 million in 2023 and it is predicted to surpass around USD 21,136.39 million by 2033 with a CAGR of 42.41% from 2024 to 2033. The sustainable aviation fuel market is driven by the urgent need to reduce carbon emissions and mitigate environmental impact. One of the key strategies gaining traction in this regard is the adoption of Sustainable Aviation Fuel (SAF). This overview delves into the dynamics of the sustainable aviation fuel market, examining its growth drivers, challenges, and future prospects.

The growth of the sustainable aviation fuel (SAF) market is underpinned by several key factors. Firstly, heightened environmental consciousness across the aviation industry has spurred a pressing need to reduce carbon emissions, driving the demand for sustainable alternatives to conventional jet fuels. Secondly, regulatory initiatives at both national and international levels are incentivizing airlines and fuel producers to adopt SAF, through policies and mandates aimed at curbing greenhouse gas emissions. Thirdly, the commitment of airlines and aircraft manufacturers to meet ambitious sustainability goals is fueling the demand for SAF, as they seek to mitigate their environmental impact and achieve carbon neutrality. Additionally, ongoing technological advancements in SAF production processes are enhancing efficiency and reducing costs, making sustainable aviation fuels increasingly competitive in the market. Lastly, collaborative efforts between industry stakeholders, governments, and research institutions are accelerating innovation and market growth, fostering a conducive environment for the widespread adoption of SAF.

| Report Coverage | Details |

| Market Size in 2023 | USD 616.93 million |

| Revenue Forecast by 2033 | USD 21,136.39 million |

| Growth rate from 2024 to 2033 | CAGR of 42.41% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Based on fuel type, the market is segmented into Biofuel, Hydrogen Fuel, power to liquid fuel, and gas-to-liquid fuel type. The biofuel segment is the largest in the global sustainable aviation fuel market as it is used in commercial and technological pathways as the alternative fuel to jet fuel. Developed regions like Norway, the Netherlands, and the UK invest big in building these infrastructures.

Based on technology, the market has been classified into HEFA-SPK, FT-SPK, HFS-SIP, ATJ-SPK. The HEFA-SPK segment dominated the global market with a 95.35% share in 2023. The HEFA-SPK pathway uses fatty feedstock such as vegetable oils or waste fats, which first undergoes an oxygenation reaction, followed by the addition of hydrogen to break down the fatty compounds into hydrocarbons. These fatty compounds are further refined into a mix of various liquid fuels that can be blended up to 50%.

Based on biofuel blending capacity, the market is segmented into below 30%, 30% to 50%, and above 50% capacity. 30% to 50% segment performs better than any other segments of this category. The factor behind this segment's growth is moderate blend capacity, drop-in-facility in existing fuel systems, and supply logistics infrastructure. The other aspect that leads to research and development growth is technological pathways.

During the forecast period, the market for sustainable aviation fuel in North America is expected to expand at the fastest CAGR. Countries in North America, such as the United States and Canada, are focusing on various projects to use renewable aviation fuel to meet the requirement for reduced carbon footprints due to increased air traffic and flying passengers.

The North American sustainable aviation fuel market is considered one of the most critical demand areas for sustainable aircraft fuel due to supportive legislation and measures to reduce aviation emissions.

Commercial Aviation Alternative Fuel Initiative (CAAFI), Midwest Aviation Sustainable Biofuels Initiative (MASBI), and Canada’s Biojet Supply Chain Initiative are just a few of the sustainable aviation fuel projects undertaken by countries in the region, including the United States and Canada.

By Fuel Type

By Technology

By Aircraft Type

By Biofuel Blending Capacity

By Aircraft Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Sustainable Aviation Fuel Market

5.1. COVID-19 Landscape: Sustainable Aviation Fuel Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Sustainable Aviation Fuel Market, By Fuel Type

8.1. Sustainable Aviation Fuel Market, by Fuel Type, 2024-2033

8.1.1. Biofuel

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Power-to-Liquid

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Gas-to-Liquid

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Sustainable Aviation Fuel Market, By Technology

9.1. Sustainable Aviation Fuel Market, by Technology, 2024-2033

9.1.1. HEFA-SPK

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. FT-SPK

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. HFS-SIP

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. ATJ-SPK

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Sustainable Aviation Fuel Market, By Biofuel Blending Capacity

10.1. Sustainable Aviation Fuel Market, by Biofuel Blending Capacity, 2024-2033

10.1.1. Above 50%

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. 30% to 50%

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Below 30%

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Sustainable Aviation Fuel Market, By Aircraft Type

11.1. Sustainable Aviation Fuel Market, by Aircraft Type, 2024-2033

11.1.1. Commercial

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Regional Transport Aircraft

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Military Aviation

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Business & General Aviation

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Unmanned Aerial Vehicles

11.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Sustainable Aviation Fuel Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.1.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.2.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.3.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.4.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.5.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.5.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Fuel Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Biofuel Blending Capacity (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Aircraft Type (2021-2033)

Chapter 13. Company Profiles

13.1. Northwest Advanced Biofuels, LLC.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Red Rock Biofuels

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Fulcrum BioEnergy, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Aemetis, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. TotalEnergies SE

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. OMV Aktiengesellschaft

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Neste Oyj

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. SKYNRG

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Gevo Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Eni SPA

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others