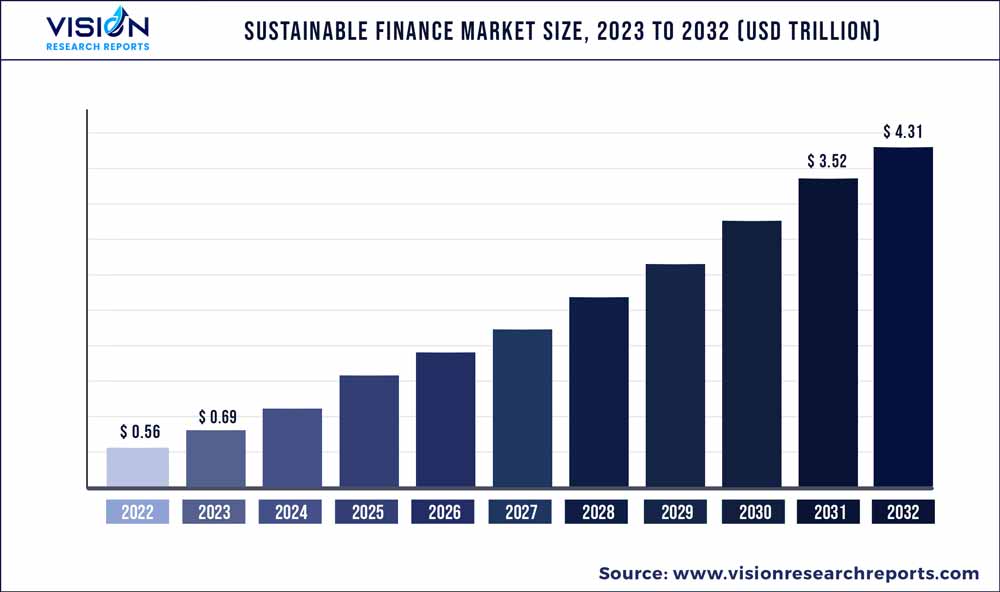

The global sustainable finance market size was estimated at around USD 0.56 trillion in 2022 and it is projected to hit around USD 4.31 trillion by 2032, growing at a CAGR of 22.65% from 2023 to 2032. The sustainable finance market in the United States was accounted for USD 151.7 billion in 2022.

Key Pointers

Report Scope of the Sustainable Finance Market

| Report Coverage | Details |

| Revenue Share of Europe in 2022 | 40% |

| Revenue Forecast by 2032 | USD 4.31 trillion |

| Growth Rate from 2023 to 2032 | CAGR of 22.65% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | BlackRock, Inc.; State Street Corporation; Morgan Stanley; UBS; JPMorgan Chase & Co.; Franklin Templeton Investments; Amundi US; The Bank of New York Mellon Corporation; Deutsche Bank AG; Goldman Sachs |

The sustainable finance Asset Under Management (AUM) was valued at USD 37.80 trillion in 2022. The growing awareness and concern about environmental and social issues, such as climate change, resource depletion, and social inequality, is expected to boost the market’s growth. This heightened awareness has increased the demand for sustainable finance solutions as individuals, businesses, and institutions seek to align their investments with their values and contribute to a more sustainable future. Moreover, regulatory frameworks and government initiatives are playing a crucial role in driving the market’s growth.

Many countries have implemented policies and regulations encouraging sustainable investment practices, such as tax incentives, disclosure requirements, and sustainability reporting standards. These regulatory measures create a supportive environment for sustainable finance and incentivize market participants to incorporate sustainability factors into their investment decisions. Furthermore, investors are increasingly recognizing the financial benefits of sustainable finance. It is no longer seen as just an ethical choice but also a strategic one.

Sustainable investments have demonstrated competitive financial performance and risk mitigation potential, attracting investors seeking financial returns and positive environmental and social impacts. This shift in investor preferences has resulted in a surge in sustainable investment products and strategies, driving the growth of the sustainable finance industry. In addition, technological advancements and data analytics have played a significant role in driving the market. The availability of data on Environmental, Social, and Governance (ESG) factors has improved, enabling investors and financial institutions to assess the sustainability performance of companies and investment portfolios more accurately.

Technological tools and platforms have also facilitated the integration of ESG considerations into investment processes, making sustainable finance more accessible and efficient. In addition, companies and organizations increasingly recognize the importance of sustainability in their long-term business strategies. The adoption of sustainable practices not only helps mitigate risks but also enhances brand reputation, customer loyalty, and employee engagement. This corporate sustainability trend has increased the demand for sustainable finance solutions to support green projects, sustainable supply chains, and responsible business practices.

However, the market is restrained by the lack of standardized and globally recognized definitions, metrics, and reporting frameworks for sustainability. This creates challenges in comparing and evaluating the sustainability performance of different companies and investment products. To overcome this restraint, efforts are being made to develop common standards and frameworks. For instance, initiatives like the Task Force on Climate-related Financial Disclosures (TCFD) and Global Reporting Initiative (GRI) have provided guidelines for companies to disclose their sustainability-related information. In addition, collaborations among financial institutions, industry associations, and regulatory bodies are working towards harmonizing sustainability reporting requirements and promoting the adoption of globally recognized frameworks.

Asset Class Insights

The equities segment dominated the market in 2022 and accounted for a revenue share of more than 49%. Equities allow investors to actively engage in sustainable investing and support companies that demonstrate strong ESG practices. Moreover, equities offer a higher liquidity level than other asset classes in the sustainable finance industry. Investors can easily buy and sell equity securities, allowing for greater flexibility and responsiveness to market conditions. This liquidity makes equities an attractive choice for both institutional and individual investors seeking exposure to sustainable investments.

The multi-asset segment is anticipated to register significant growth over the forecast period. Multi-asset strategies offer investors diversification across different asset classes, including equities, fixed income, real estate, and alternative investments. This diversification helps mitigate risk and provides a more balanced portfolio, appealing to investors seeking a comprehensive approach to sustainable investing. Moreover, multi-asset strategies allow for flexible capital allocation to various sustainable investment opportunities.

Offerings Insights

The equity funds segment dominated the market in 2022 and accounted for a revenue share of more than 33%. The sustainable equity fund has emerged as a critical driver in the growth of the sustainable finance industry. This fund strategically invests in the stocks of large- and mid-cap companies that demonstrate strong financial performance and adhere to specific social and sustainability criteria. By focusing on sustainable business practices and considering ESG factors, the sustainable equity fund aims to achieve positive long-term capital appreciation while promoting sustainability characteristics. This fund exemplifies the increasing demand for investment options prioritizing ESG factors and aligning with investors' sustainability goals.

The ETFs/index funds segment is anticipated to register significant growth over the forecast period. These index funds offer a diversified portfolio of securities that track a specific sustainable index or theme. ETFs/Index funds provide investors with a convenient and cost-effective way to gain exposure to a broad range of sustainable assets across various sectors and regions. The increasing popularity of these funds can be attributed to their transparency, liquidity, and flexibility, which attract both individual and institutional investors. Moreover, ETFs/Index funds allow investors to align their investments with their sustainability goals, as they focus on companies with strong ESG performance.

Investment Style Insights

The active segment dominated the market in 2022 and accounted for a revenue share of over 64%. Active investment strategies involve portfolio managers actively selecting and managing investments based on their expertise and analysis. In the context of sustainable finance, active managers play a crucial role in identifying companies that not only meet financial objectives but also adhere to sustainable principles and practices. By conducting in-depth research and analysis, active managers can identify sustainable investment opportunities and make informed decisions that align with ESG considerations. This approach allows investors to have a more targeted and tailored exposure to sustainable assets, allowing them to make a positive impact while pursuing financial returns.

The passive segment is anticipated to register significant growth during the forecast period. Passive investment involves tracking an index or a benchmark, aiming to replicate its performance rather than actively selecting individual securities. In the context of sustainable finance, passive investing is gaining traction due to the increasing popularity of sustainable indexes and ESG benchmarks. Investors are drawn to passive strategies because they offer broad exposure to a diversified portfolio of sustainable companies, aligning with their values and sustainability goals. Passive investment products such as ESG-focused ETFs and index funds have seen significant inflows driven by the desire for transparent, low-cost, and easily accessible sustainable investment options.

Investor Type Insights

The institutional investors segment dominated the market in 2022 and accounted for a global revenue share of over 79%. Institutional investors, such as pension funds, sovereign wealth funds, and insurance companies, play a crucial role in driving sustainable investment practices. They have the financial capacity and long-term investment horizons to allocate substantial capital toward sustainable investment strategies. Institutional investors increasingly recognize the importance of integrating ESG factors into their investment decisions to manage risks and achieve sustainable long-term returns.

The retail investors segment is anticipated to register significant growth over the forecast period. Retail investors, which include individual investors, high-net-worth individuals, and retail investment funds, are increasingly becoming aware of the importance of sustainable investing and seeking investment opportunities aligned with their values and sustainability goals. There is a rising awareness of the environmental and social challenges faced by the world, such as climate change and social inequality, which has led individuals to seek investment options that can make a positive impact. In addition, technological advancements and increased accessibility to information have empowered retail investors to research and access sustainable investment products easily.

Regional Insights

Europe dominated the sustainable finance market in 2022 and accounted for a revenue share of more than 40%. The region has witnessed strong governmental support and regulatory frameworks that incentivize sustainable finance initiatives. European countries have introduced various policies and regulations that require financial institutions to incorporate ESG factors into their investment decisions. The European Union's action plan on sustainable finance has played a crucial role in driving the growth of sustainable finance by setting clear guidelines and standards for sustainable investment products.

Asia Pacific is anticipated to emerge as the fastest-growing market from 2023 to 2032. There is a growing recognition among businesses and governments in the region about the importance of sustainable development and addressing environmental and social challenges. Countries like China, Japan, and South Korea have implemented ambitious sustainability goals and initiatives, creating a conducive environment for sustainable finance to thrive. Moreover, there is an increasing awareness and demand for sustainable investment products among investors in the Asia Pacific region.

Sustainable Finance Market Segmentations:

By Asset Class

By Offerings

By Investment Style

By Investor Type

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Sustainable Finance Market

5.1. COVID-19 Landscape: Sustainable Finance Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Sustainable Finance Market, By Asset Class

8.1. Sustainable Finance Market, by Asset Class, 2023-2032

8.1.1. Equities

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Fixed-income

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Multi-asset

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Alternatives

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Sustainable Finance Market, By Offerings

9.1. Sustainable Finance Market, by Offerings, 2023-2032

9.1.1. Equity Funds

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Bond Funds

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. ETFs/Index Funds

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Alternatives/Hedged Funds

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Sustainable Finance Market, By Investment Style

10.1. Sustainable Finance Market, by Investment Style, 2023-2032

10.1.1. Active

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Passive

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Sustainable Finance Market, By Investor Type

11.1. Sustainable Finance Market, by Investor Type, 2023-2032

11.1.1. Institutional Investors

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Retail Investors

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Sustainable Finance Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.1.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.1.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.1.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.2.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.2.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.2.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.3.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.3.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.3.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.4.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.4.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.4.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.5.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.5.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.5.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Investor Type (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Asset Class (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Offerings (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Investment Style (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Investor Type (2020-2032)

Chapter 13. Company Profiles

13.1. BlackRock, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. State Street Corporation

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Morgan Stanley

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. UBS

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. JPMorgan Chase & Co.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Franklin Templeton Investments

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Amundi US

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. The Bank of New York Mellon Corporation

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Deutsche Bank AG

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Goldman Sachs

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others