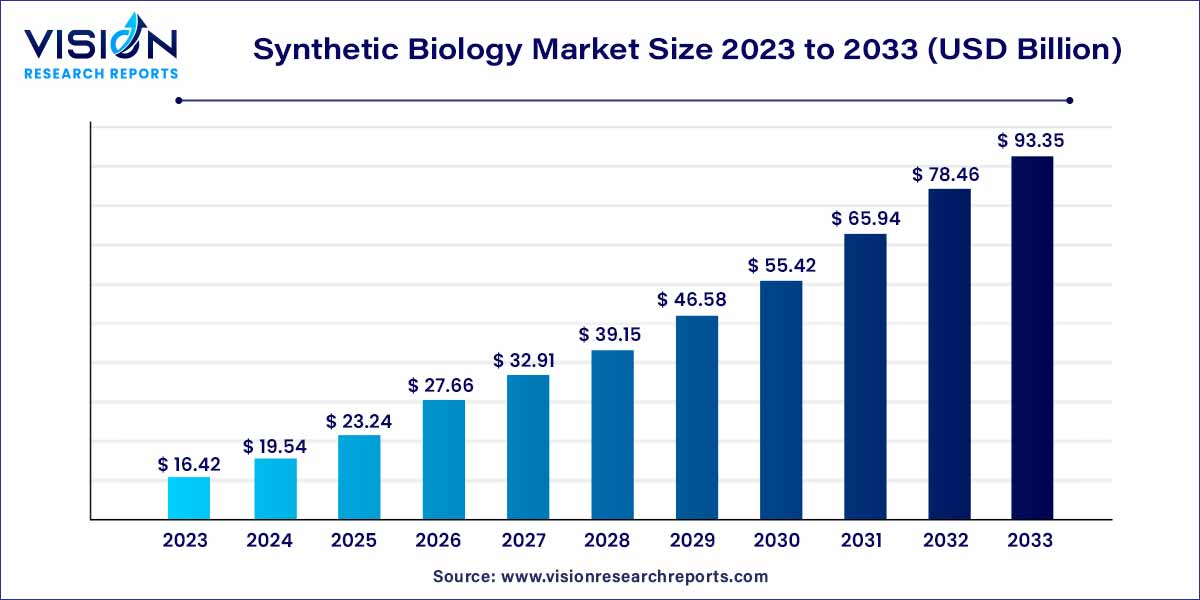

The global synthetic biology market size was valued at USD 16.42 billion in 2023 and it is predicted to surpass around USD 93.35 billion by 2033 with a CAGR of 18.98% from 2024 to 2033.

Synthetic biology, a cutting-edge interdisciplinary field, has emerged as a pivotal player in the realm of life sciences and technology. This market overview aims to delve into the key facets of the synthetic biology market, offering a comprehensive understanding of its current state and future potential.

The growth of the synthetic biology market is propelled by a convergence of factors that collectively contribute to its expanding influence across diverse industries. Firstly, advancements in DNA synthesis technology have fueled a rising demand for customized DNA sequences, particularly in healthcare and biotechnology applications. Additionally, the increasing application of synthetic biology in agriculture, where genetically modified organisms enhance crop characteristics, contributes significantly to market expansion. Breakthroughs in genome editing tools, such as CRISPR-Cas9, play a pivotal role in revolutionizing the field, offering precise and efficient modification of DNA sequences with broad implications. Moreover, the market's growth is underpinned by continuous innovation and research, with companies at the forefront investing in cutting-edge technologies. These factors, coupled with a growing recognition of synthetic biology's potential, position the market for sustained expansion and transformative impact across various sectors.

In 2023, the PCR segment dominated the market, holding the highest share at 29%, and this trend is projected to persist throughout the forecast period. Polymerase Chain Reaction (PCR) has emerged as a pivotal technology for detecting and analyzing specific gene sequences. Real-time PCR assays, known for their high sensitivity and specificity, have become the preferred method for numerous genomic studies relying on PCR. This versatile technique finds extensive use in areas such as forensic research, DNA cloning, molecular diagnostics, and genomics.

Conversely, genome editing technology is poised for substantial growth, expected to experience a significant Compound Annual Growth Rate (CAGR) during the forecasted period. The projected expansion of gene-editing tools can be attributed to the manifold advantages associated with synthetic and genetically modified organisms. The capability of gene editing techniques to produce products with desired traits has brought about a revolution in various sectors, including human and animal healthcare, as well as the agricultural industry.

In 2023, the Oligonucleotide/Oligo Pools and Synthetic DNA segment recorded a revenue of USD 4,655.86 million. Oligonucleotides play a pivotal role in various molecular and synthetic biology applications, serving as a cornerstone in these fields. The segment's growth is propelled by the increasing adoption of targeted Next-Generation Sequencing (NGS), mutagenesis experiments, DNA computing, and CRISPR gene editing. An exemplary product in this realm is OligoMix, an innovative and personalized solution for genomics discoveries. It synthesizes numerous oligonucleotide sequences in massive parallel, offering a cost-effective solution at less than 0.8 cents per base.

Conversely, the enzymes segment is poised to grow at a notable Compound Annual Growth Rate (CAGR) of 19.28% during the forecast period. Enzymes act as catalysts in biochemical reactions, and the potential application of enzymatic synthesis, enabling the creation of longer genes within a limited timeframe, is expected to drive market expansion. However, it's crucial to note that this technology is still in its developmental stage and has not yet been commercialized.

The healthcare segment has emerged as the market leader and is poised to exhibit a remarkable Compound Annual Growth Rate (CAGR) of 19.25% throughout the forecast period. Synthetic biology-based diagnostics within healthcare offer a highly specific, sensitive, real-time, and non-invasive approach for detecting infectious agents, cancer cells, and therapeutics. Researchers leverage rational engineering techniques to craft innovative bio-sensing systems characterized by dynamic components, including a processor, sensor, and reporter.

The segment's momentum is further fueled by the growing incidence of neurological disorders, such as multiple sclerosis. Notably, in July 2023, experts in synthetic biology at the University of Toronto Engineering initiated pioneering research involving the development of custom stem cells derived from patients' tissues for disease treatment. These research endeavors are anticipated to be instrumental in augmenting the growth trajectory of the healthcare segment.

In 2023, the biotechnology and pharmaceutical companies segment secured the largest revenue share at 53%. Synthetic biology has proven instrumental for these entities, facilitating the development of novel therapeutics aimed at addressing chronic diseases. A notable example is Merck's utilization of synthetic biology techniques in the creation of Januvia (sitagliptin), a diabetes medication. Similarly, Novartis introduced Kymriah (Tisagenlecleucel) for treating B-cell acute lymphoblastic leukemia, showcasing the impactful contributions of synthetic biology in pharmaceutical breakthroughs.

Concurrently, the academic and government research institutes segment is anticipated to exhibit steady growth in the forecast period. The Research and Development (R&D) sector, characterized by its capital-intensive nature due to prolonged development periods and approval cycles, is witnessing a continuous uptrend in expenditure and funding. As per a September 2020 article, R&D spending in the life sciences industry experienced a notable 22% surge from 2018 to 2019, emphasizing the sustained growth in this segment.

In 2023, North America emerged as the dominant force in the regional market, securing a substantial share of 43%. This prominent position is ascribed to the escalating investments in private enterprises, supportive regulatory frameworks, and government aid. The United States, in particular, directs significant efforts into research areas such as proteomics, drug screening and discovery, and genomics structure prediction, thereby contributing significantly to the expansion of the synthetic biology market.

Conversely, the Asia Pacific region is projected to witness the most rapid growth. This trajectory is driven by notable developments spurred by increased investments in Asia Pacific nations, augmented partnerships and funding in the Chinese market, and heightened collaborations in the realm of synthetic biology. Furthermore, various Asian countries have recently established national institutes, state-sponsored research programs, and collaborations between academia and industry, all aimed at fostering technological innovation for the advancement of synthetic biology.

By Technology

By Product

By Application

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others