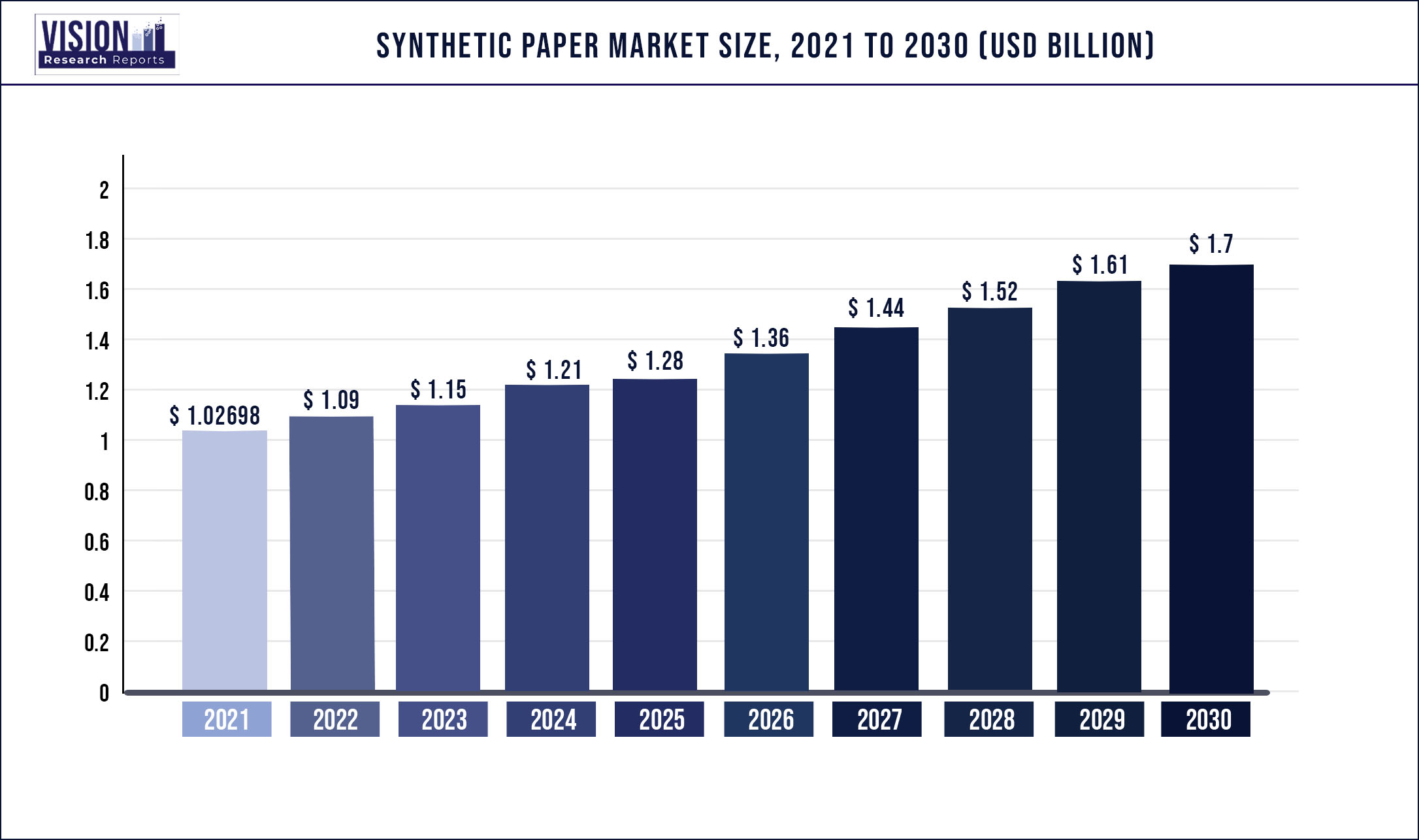

The global synthetic paper market size was estimated at around USD 1026.98 million in 2021 and it is projected to hit around USD 1.7 billion by 2030, growing at a CAGR of 5.76 % from 2022 to 2030.

Increasing awareness about climate change and the growing shift towards eco-friendly and recyclable packaging materials are expected to drive market growth.

The major drivers of the market growth are the global increasing demand for paper and the efforts made to decrease the dependency on plant-based paper. Its sustainable production and recyclable nature are expected to notably drive the demand for synthetic paper materials in the coming years.

The Covid-19 pandemic had disrupted the global supply chain thus severely impacting the end-use industries for the product in 2020. However, the post-pandemic era has brought in bright prospects due to a boost in the economies, which are expected to accelerate the market.

The synthetic resin, which acts as raw material for synthetic paper happens to be crude oil’s refined product. With fluctuating prices of crude oil, the demand for synthetic paper is bound to be hampered directly. Also, looking at the current geopolitical scenario, the crude oil prices seem to remain high for quite a long period, ultimately affecting the market.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1026.98 million |

| Revenue Forecast by 2030 | USD 1.7 billion |

| Growth rate from 2022 to 2030 | CAGR of 5.76% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, application,End-use, Non-Label End-use, region |

| Companies Covered | Formosa Plastics Group; SIHL Group; B & F Plastics Inc.; Jindal Poly Films Ltd.; Cosmo Films Ltd.; Granwell Products, Inc.; Transcendia, Inc.; Valéron Strength Films; Toyobo Co., Ltd.; TechNova |

Product Insights

The BOPP product segment led the market and accounted for 57.5% of the global revenue in 2021. It is expected to witness a notable CAGR of 5.3% from 2022 to 2030 owing to the better strength offered by the material which makes them suitable for packaging perishable items such as snacks, fast food, vegetables, fruits, and confectionery. The superior properties exhibited by BOPP have resulted in its extensive use in the packaging of chemicals, textiles, cosmetics, and food and beverages. The growth of the above-mentioned application industries in emerging economies such as India and China are expected to result in high demand for BOPP film in the Asia Pacific over the forecast period.

HDPE-based synthetic papers, majorly used in the packaging of powder, cheese, frozen food, and electronic parts, are expected to be the fastest-growing product segment over the forecast period, growing at over 6.1% from 2022 to 2030. The papers exhibit high moisture barrier, and temperature resistance properties, and are non-abrasive, non-scratch, and acid-resistant. HDPE is expected to gain popularity over the forecast period in emerging economies such as Brazil, China, India, and Russia mainly due to its low cost and extensive application scope. HDPE films are also used as release liners and interleaving sheeting, foam-in-place, and box liners owing to their better release property without silicone coating.

Application Insights

The non-labeling application segment led the market and accounted for approximately 60.0% of the global revenue in 2021. Exceptional durability and tensile strength to hold heavy items positions synthetic paper as a suitable material for non-labeling applications such as packaging. Moreover, the superior resistance to moisture and extreme heat offered by the material is further expected to drive its growth in the packaging application segment.

The convenience of fine printing over synthetic paper using ink and adhesives contributes to its higher demand in various industries. Ease of printability on the surface of synthetic papers contributes to its application in printing over the packaged item. Moreover, they are scratch and stain-resistant and thus facilitate the usage in the packaging of delicate materials.

The labeling application segment is also expected to witness a CAGR of 5.9% over the forecast period. The medical tags in the label application segment are expected to witness a CAGR of over 7.3% from 2022 to 2030. Medical tags are used in applications such as blood bags, test samples in pathological labs, test tubes, pharmaceuticals, medical devices, medical machinery, bottles, and first aid. The Healthcare sector is one of the largest growing industries globally and its expansion is expected to surge the demand for medical tags. Synthetic papers are used for medical tags because of their reliable performance in conditions such as tampering and extreme cryogenic temperature.

Regional Insights

The Asia Pacific dominated the market and accounted for 35.9% of the global revenue in 2021. The demand for the product in the Asia Pacific was valued at over USD 389.2 million in 2021 on account of the growing demand in the pharmaceutical, printing, and packaging industry. In addition, the exponential growth witnessed by the eCommerce retail in the region is expected to be a major growth factor for synthetic paper over the forecast period. The growth in the Asia Pacific can be attributed to the growing end-user industries like pharmaceuticals, cosmetics, consumer goods, and food and beverages due to the increasing disposable income and improved standard of living of the working-class population in the developing countries such as India and China.

Europe accounted for a significant revenue share of over 28.0% in 2021. The demand for synthetic paper in the U.K. is likely to register the fastest growth in label application on account of the increasing use of the product in the food and beverage and pet food labeling industries. Numerous companies including Harrier Packaging are using synthetic paper for the packaging of pet food. In North America, the market accounted for a revenue share of over 23.0% in 2021. Wrap-around labels are increasingly used in beverage packaging including fruit juices and functional drinks, diversifying from bottled water, which is expected to drive the growth of the label industry in North America, thus positively affecting the growth of the market.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Synthetic Paper Market

5.1. COVID-19 Landscape: Synthetic Paper Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Synthetic Paper Market, By Product

8.1. Synthetic Paper Market, by Product, 2022-2030

8.1.1. BOPP

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. HDPE

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. PET

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Synthetic Paper Market, By Application

9.1. Synthetic Paper Market, by Application e, 2022-2030

9.1.1. Label

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Non-Label

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Synthetic Paper Market, By End-use

10.1. Synthetic Paper Market, by End-use, 2022-2030

10.1.1. Hand Tags

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Medical Tags

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Synthetic Paper Market, By Non-Label End-use

11.1. Synthetic Paper Market, by Non-Label End-use, 2022-2030

11.1.1. Packaging

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Documents

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Others

11.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Synthetic Paper Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2017-2030)

12.1.2. Market Revenue and Forecast, by Application (2017-2030)

12.1.3. Market Revenue and Forecast, by End-use (2017-2030)

12.1.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

12.1.5.3. Market Revenue and Forecast, by End-use (2017-2030)

12.1.5.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Application (2017-2030)

12.1.6.3. Market Revenue and Forecast, by End-use (2017-2030)

12.1.6.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.2. Market Revenue and Forecast, by Application (2017-2030)

12.2.3. Market Revenue and Forecast, by End-use (2017-2030)

12.2.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

12.2.5.3. Market Revenue and Forecast, by End-use (2017-2030)

12.2.5.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

12.2.6.3. Market Revenue and Forecast, by End-use (2017-2030)

12.2.6.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

12.2.7.3. Market Revenue and Forecast, by End-use (2017-2030)

12.2.7.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Application (2017-2030)

12.2.8.3. Market Revenue and Forecast, by End-use (2017-2030)

12.2.8.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.2. Market Revenue and Forecast, by Application (2017-2030)

12.3.3. Market Revenue and Forecast, by End-use (2017-2030)

12.3.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

12.3.5.3. Market Revenue and Forecast, by End-use (2017-2030)

12.3.5.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

12.3.6.3. Market Revenue and Forecast, by End-use (2017-2030)

12.3.6.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

12.3.7.3. Market Revenue and Forecast, by End-use (2017-2030)

12.3.7.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Application (2017-2030)

12.3.8.3. Market Revenue and Forecast, by End-use (2017-2030)

12.3.8.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.2. Market Revenue and Forecast, by Application (2017-2030)

12.4.3. Market Revenue and Forecast, by End-use (2017-2030)

12.4.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

12.4.5.3. Market Revenue and Forecast, by End-use (2017-2030)

12.4.5.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

12.4.6.3. Market Revenue and Forecast, by End-use (2017-2030)

12.4.6.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

12.4.7.3. Market Revenue and Forecast, by End-use (2017-2030)

12.4.7.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Application (2017-2030)

12.4.8.3. Market Revenue and Forecast, by End-use (2017-2030)

12.4.8.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.5.2. Market Revenue and Forecast, by Application (2017-2030)

12.5.3. Market Revenue and Forecast, by End-use (2017-2030)

12.5.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

12.5.5.3. Market Revenue and Forecast, by End-use (2017-2030)

12.5.5.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Application (2017-2030)

12.5.6.3. Market Revenue and Forecast, by End-use (2017-2030)

12.5.6.4. Market Revenue and Forecast, by Non-Label End-use (2017-2030)

Chapter 13. Company Profiles

13.1. Formosa Plastics Group

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. SIHL Group

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. B&F Plastics, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Jindal Poly Films Ltd.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Cosmo Films Ltd.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Granwell Products, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Transcendia, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Valéron Strength Films

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Toyobo Co., Ltd.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. TechNova

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others