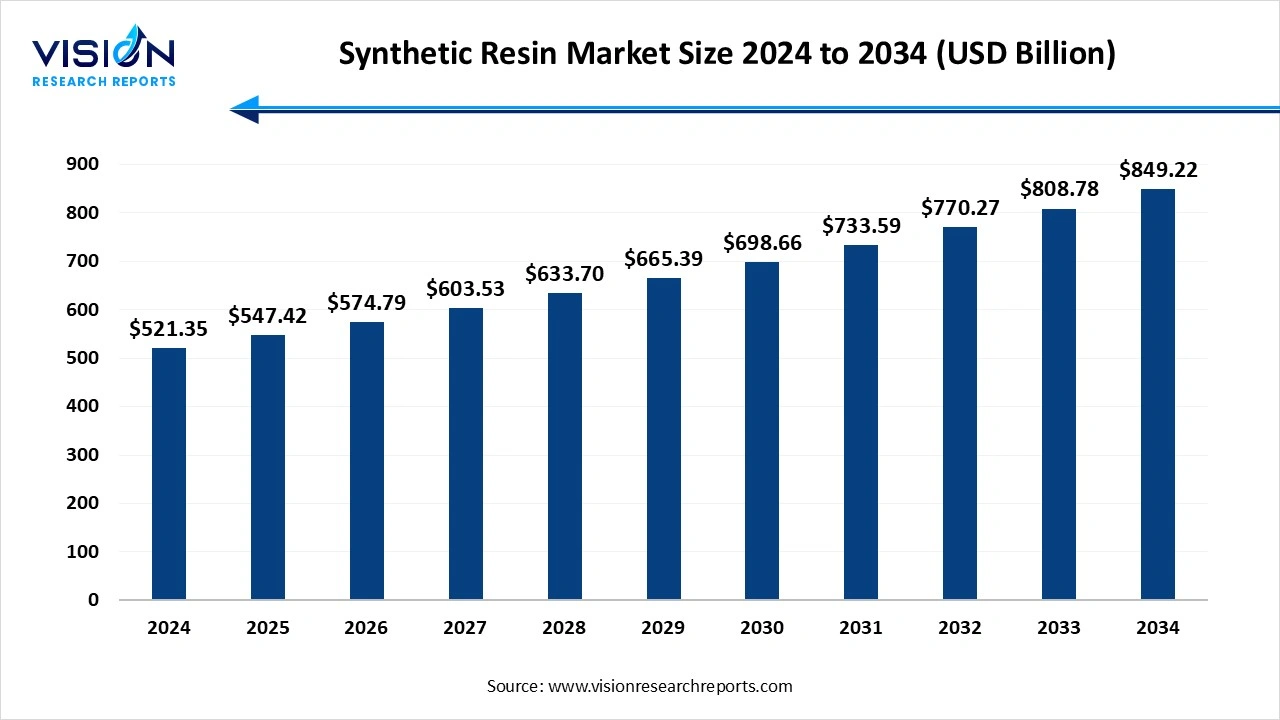

The global synthetic resin market size was surpassed at around USD 521.35 billion in 2024 and it is projected to hit around USD 849.22 billion by 2034, growing at a CAGR of 5% from 2025 to 2034.

The synthetic resin market plays a vital role in various industries, including automotive, construction, packaging, and electronics, due to its versatility, durability, and cost-efficiency. Synthetic resins are man-made polymers that mimic the properties of natural resins but offer enhanced performance and consistency. These materials are primarily used as key ingredients in plastics, adhesives, coatings, and sealants. With the global push toward lightweight and durable materials, synthetic resins have become essential in manufacturing processes across both developed and developing economies.

The growth of the synthetic resin market is primarily driven by the expanding demand from end-use industries such as construction, automotive, packaging, and electronics. In the construction sector, synthetic resins are widely used in paints, coatings, adhesives, and insulation materials due to their high durability and resistance to environmental conditions. Similarly, the automotive industry increasingly adopts lightweight and high-performance resins to improve fuel efficiency and reduce emissions, contributing to a surge in market demand. Moreover, advancements in infrastructure development, particularly in emerging economies, are boosting the consumption of synthetic resins for various structural and protective applications.

Another significant growth factor is the rising demand for flexible and sustainable packaging solutions. As e-commerce continues to expand globally, manufacturers are relying on synthetic resins to produce durable, lightweight, and cost-effective packaging materials. Furthermore, increasing environmental awareness and regulatory pressures have prompted innovations in bio-based and recyclable resins, offering new growth avenues for the market. The combination of technological advancements, changing consumer preferences, and the pursuit of sustainability is expected to drive consistent growth in the synthetic resin market over the coming years.

One of the most prominent trends in the synthetic resin market is the growing emphasis on sustainability and environmental responsibility. Manufacturers are increasingly investing in the development of bio-based and recyclable resins to reduce their carbon footprint and comply with stricter environmental regulations. Consumers and industries alike are showing a preference for eco-friendly alternatives, which has accelerated research and innovation in biodegradable and non-toxic resin formulations. This shift not only addresses environmental concerns but also opens up new market segments, particularly in packaging and consumer goods.

Another key trend is the rapid technological advancement in resin processing and application methods. Improved production technologies are enabling the creation of resins with enhanced properties such as higher heat resistance, improved flexibility, and greater tensile strength. These advancements are expanding the scope of synthetic resins across high-performance applications in the aerospace, medical devices, and electronics sectors. In particular, the electronics industry is witnessing a rise in demand for high-grade resins used in circuit boards, insulation, and encapsulation.

The market is experiencing increasing consolidation through strategic partnerships, mergers, and acquisitions. Major players are focusing on expanding their global footprint and diversifying product portfolios to cater to a broader range of industries. This trend is fostering a more competitive landscape, encouraging innovation and improved customer service across the synthetic resin supply chain.

The synthetic resin market faces significant challenges related to environmental concerns and regulatory compliance. As global awareness of plastic pollution and chemical waste grows, synthetic resins many of which are derived from petroleum-based feedstocks are coming under scrutiny for their contribution to non-biodegradable waste and carbon emissions. Governments and international bodies are enforcing stricter regulations on production practices, disposal, and emissions, which adds complexity and cost to manufacturing processes. Compliance with evolving environmental standards is becoming increasingly burdensome, especially for small and medium-sized producers.

Another major challenge is the volatility in raw material prices. Synthetic resins are primarily produced from petrochemicals, making them vulnerable to fluctuations in crude oil prices. These price swings can disrupt supply chains, affect profit margins, and create uncertainty in production planning. In addition, global supply chain disruptions exacerbated by geopolitical tensions, trade restrictions, or natural disasters can result in material shortages and delivery delays, impacting overall market stability and growth.

The Asia Pacific region led the global synthetic resin market, capturing the highest revenue share of 48% in 2024. Countries like China, India, Japan, and South Korea are key contributors, driven by strong demand from construction, automotive, electronics, and packaging industries. The availability of raw materials, lower manufacturing costs, and favorable government policies have made the region a global hub for synthetic resin production and consumption. Rapid urbanization and increased investment in industrial development further support the growth of the market across Asia Pacific.

.webp) North America represents a mature yet dynamic market for synthetic resins, with high demand fueled by advanced manufacturing technologies and widespread application in sectors such as automotive, healthcare, construction, and packaging. The region is also witnessing a growing emphasis on environmentally sustainable materials, leading to increased investments in research and development of bio-based and recyclable resins. The United States, being a major producer and consumer, dominates the regional landscape with a strong presence of key market players and a well-established supply chain.

North America represents a mature yet dynamic market for synthetic resins, with high demand fueled by advanced manufacturing technologies and widespread application in sectors such as automotive, healthcare, construction, and packaging. The region is also witnessing a growing emphasis on environmentally sustainable materials, leading to increased investments in research and development of bio-based and recyclable resins. The United States, being a major producer and consumer, dominates the regional landscape with a strong presence of key market players and a well-established supply chain.

The solid form segment led the synthetic resin market by form, contributing the highest revenue share of 72% in 2024. Solid synthetic resins, typically thermoplastic or thermosetting polymers, are favored for their excellent mechanical strength, chemical resistance, and thermal stability. These resins are widely applied in automotive parts, electrical appliances, construction materials, and packaging products. Their ease of processing through molding and extrusion techniques makes them suitable for large-scale industrial applications.

The liquid form segment is projected to expand at a notable CAGR of 4.09% over the forecast period. Liquid synthetic resins offer versatility and ease of application across various surfaces, making them essential in the construction, electronics, and furniture industries. They provide excellent bonding strength, flexibility, and aesthetic finishes, which are crucial for protective and decorative purposes. The liquid form is particularly valuable in creating water-resistant and corrosion-resistant coatings, enhancing the durability and performance of end products.

The thermosetting resins led the synthetic resin industry in terms of application-based revenue, capturing a dominant market share of 78% in 2024. Once hardened, these resins cannot be re-melted or re-shaped, making them ideal for use in high-performance applications such as electronics, automotive components, adhesives, and coatings. Their resistance to deformation under heat and pressure enhances product longevity and safety in demanding environments. Common types of thermosetting resins include epoxy, phenolic, and melamine resins, which are essential in creating rigid and heat-resistant structures.

The thermoplastic resins segment is projected to experience steady growth over the forecast period, registering a CAGR of 2.95%. This quality makes them highly attractive for applications requiring recyclability and design versatility. Thermoplastic resins are widely used in packaging, consumer goods, medical devices, and construction due to their lightweight, impact resistance, and ease of processing. Popular variants such as polyethylene, polypropylene, and polyvinyl chloride are staples in everyday products and industrial applications. The growing focus on sustainable and recyclable materials further supports the increasing adoption of thermoplastic resins, particularly in regions with stringent environmental regulations.

The packaging segment dominated the synthetic resin market by application, holding the largest revenue share at 43% in 2024. Synthetic resins play a crucial role in the production of flexible and rigid packaging solutions, particularly in food and beverage, pharmaceuticals, personal care, and industrial goods. Their excellent barrier properties, resistance to moisture and chemicals, and ability to preserve product integrity make them indispensable in modern packaging. Materials such as polyethylene, polypropylene, and polyethylene terephthalate are extensively used for manufacturing containers, films, pouches, and wraps.

The printing inks segment is projected to grow at a robust CAGR of 5.68% throughout the forecast period. Resins serve as the binding agents that hold pigment particles together and help them adhere effectively to various substrates, including paper, plastics, and metal. With the expansion of the packaging and publishing industries, the demand for high-performance printing inks has grown, driving the consumption of synthetic resins in this application. Additionally, the shift toward water-based and UV-curable inks, which require specialized resin formulations, reflects the market’s adaptation to environmental regulations and the need for sustainable printing solutions.

The transportation sector emerged as the leading end-use segment in the synthetic resin industry, contributing the highest revenue share of 25% in 2024. Synthetic resins are extensively used in automotive and aerospace manufacturing to produce components such as dashboards, bumpers, interior panels, and under-the-hood parts. These materials help reduce overall vehicle weight, enhance fuel efficiency, and improve safety through better impact resistance. Thermosetting and thermoplastic resins alike are preferred for their excellent mechanical strength, corrosion resistance, and design flexibility.

The food and beverage segment is expected to record a notable CAGR of 5.19% throughout the forecast period. They are used to manufacture a wide range of containers, films, trays, and bottles that protect food products from contamination, moisture, and spoilage. The superior sealing properties, transparency, and structural integrity of synthetic resins like polyethylene, polypropylene, and PET make them ideal for both perishable and non-perishable items.

By Form

By Product Type

By Application

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Synthetic Resin Market

5.1. COVID-19 Landscape: Synthetic Resin Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Synthetic Resin Market, By Form

8.1. Synthetic Resin Market, by Form

8.1.1. Solid

8.1.1.1. Market Revenue and Forecast

8.1.2. Liquid

8.1.2.1. Market Revenue and Forecast

8.1.3. Emulsion

8.1.3.1. Market Revenue and Forecast

8.1.4. Dispersion

8.1.4.1. Market Revenue and Forecast

Chapter 9. Global Synthetic Resin Market, By Product Type

9.1. Synthetic Resin Market, by Product Type

9.1.1. Thermosetting Resin

9.1.1.1. Market Revenue and Forecast

9.1.2. Thermoplastic Resin

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Synthetic Resin Market, By Application

10.1. Synthetic Resin Market, by Application

10.1.1. Packaging

10.1.1.1. Market Revenue and Forecast

10.1.2. Printing Inks

10.1.2.1. Market Revenue and Forecast

10.1.3. Pipes & Hoses

10.1.3.1. Market Revenue and Forecast

10.1.4. Sheets & Films

10.1.4.1. Market Revenue and Forecast

10.1.5. Paints & Coatings

10.1.5.1. Market Revenue and Forecast

10.1.6. Adhesives & Sealants

10.1.65.1. Market Revenue and Forecast

10.1.7. Electronic Fabrications

10.1.7.1. Market Revenue and Forecast

10.1.8. Transportation Components

10.1.8.1. Market Revenue and Forecast

10.1.9. Other Applications

10.1.9.1. Market Revenue and Forecast

Chapter 11. Global Synthetic Resin Market, By End Use

11.1. Synthetic Resin Market, by End Use

11.1.1. Transportation

11.1.1.1. Market Revenue and Forecast

11.1.2. Food & Beverage

11.1.2.1. Market Revenue and Forecast

11.1.3. Personal Care & Cosmetic

11.1.3.1. Market Revenue and Forecast

11.1.4. Building & Construction

11.1.4.1. Market Revenue and Forecast

11.1.5. Oil & Gas

11.1.5.1. Market Revenue and Forecast

11.1.6. Electrical & Electronics

11.1.6.1. Market Revenue and Forecast

11.1.7. Other End Uses

11.1.7.1. Market Revenue and Forecast

Chapter 12. Global Synthetic Resin Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Form

12.1.2. Market Revenue and Forecast, by Product Type

12.1.3. Market Revenue and Forecast, by Application

12.1.4. Market Revenue and Forecast, by End Use

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Form

12.1.5.2. Market Revenue and Forecast, by Product Type

12.1.5.3. Market Revenue and Forecast, by Application

12.1.5.4. Market Revenue and Forecast, by End Use

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Form

12.1.6.2. Market Revenue and Forecast, by Product Type

12.1.6.3. Market Revenue and Forecast, by Application

12.1.6.4. Market Revenue and Forecast, by End Use

12.2. Europe

12.2.1. Market Revenue and Forecast, by Form

12.2.2. Market Revenue and Forecast, by Product Type

12.2.3. Market Revenue and Forecast, by Application

12.2.4. Market Revenue and Forecast, by End Use

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Form

12.2.5.2. Market Revenue and Forecast, by Product Type

12.2.5.3. Market Revenue and Forecast, by Application

12.2.5.4. Market Revenue and Forecast, by End Use

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Form

12.2.6.2. Market Revenue and Forecast, by Product Type

12.2.6.3. Market Revenue and Forecast, by Application

12.2.6.4. Market Revenue and Forecast, by End Use

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Form

12.2.7.2. Market Revenue and Forecast, by Product Type

12.2.7.3. Market Revenue and Forecast, by Application

12.2.7.4. Market Revenue and Forecast, by End Use

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Form

12.2.8.2. Market Revenue and Forecast, by Product Type

12.2.8.3. Market Revenue and Forecast, by Application

12.2.8.4. Market Revenue and Forecast, by End Use

12.3. APAC

12.3.1. Market Revenue and Forecast, by Form

12.3.2. Market Revenue and Forecast, by Product Type

12.3.3. Market Revenue and Forecast, by Application

12.3.4. Market Revenue and Forecast, by End Use

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Form

12.3.5.2. Market Revenue and Forecast, by Product Type

12.3.5.3. Market Revenue and Forecast, by Application

12.3.5.4. Market Revenue and Forecast, by End Use

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Form

12.3.6.2. Market Revenue and Forecast, by Product Type

12.3.6.3. Market Revenue and Forecast, by Application

12.3.6.4. Market Revenue and Forecast, by End Use

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Form

12.3.7.2. Market Revenue and Forecast, by Product Type

12.3.7.3. Market Revenue and Forecast, by Application

12.3.7.4. Market Revenue and Forecast, by End Use

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Form

12.3.8.2. Market Revenue and Forecast, by Product Type

12.3.8.3. Market Revenue and Forecast, by Application

12.3.8.4. Market Revenue and Forecast, by End Use

12.4. MEA

12.4.1. Market Revenue and Forecast, by Form

12.4.2. Market Revenue and Forecast, by Product Type

12.4.3. Market Revenue and Forecast, by Application

12.4.4. Market Revenue and Forecast, by End Use

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Form

12.4.5.2. Market Revenue and Forecast, by Product Type

12.4.5.3. Market Revenue and Forecast, by Application

12.4.5.4. Market Revenue and Forecast, by End Use

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Form

12.4.6.2. Market Revenue and Forecast, by Product Type

12.4.6.3. Market Revenue and Forecast, by Application

12.4.6.4. Market Revenue and Forecast, by End Use

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Form

12.4.7.2. Market Revenue and Forecast, by Product Type

12.4.7.3. Market Revenue and Forecast, by Application

12.4.7.4. Market Revenue and Forecast, by End Use

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Form

12.4.8.2. Market Revenue and Forecast, by Product Type

12.4.8.3. Market Revenue and Forecast, by Application

12.4.8.4. Market Revenue and Forecast, by End Use

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Form

12.5.2. Market Revenue and Forecast, by Product Type

12.5.3. Market Revenue and Forecast, by Application

12.5.4. Market Revenue and Forecast, by End Use

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Form

12.5.5.2. Market Revenue and Forecast, by Product Type

12.5.5.3. Market Revenue and Forecast, by Application

12.5.5.4. Market Revenue and Forecast, by End Use

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Form

12.5.6.2. Market Revenue and Forecast, by Product Type

12.5.6.3. Market Revenue and Forecast, by Application

12.5.6.4. Market Revenue and Forecast, by End Use

Chapter 13. Company Profiles

13.1. BASF SE

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Dow Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. SABIC (Saudi Basic Industries Corporation)

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. LG Chem

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. LyondellBasell Industries Holdings B.V.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Mitsui Chemicals, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Covestro AG

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Evonik Industries AG

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. INEOS Group

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Arkema S.A.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others