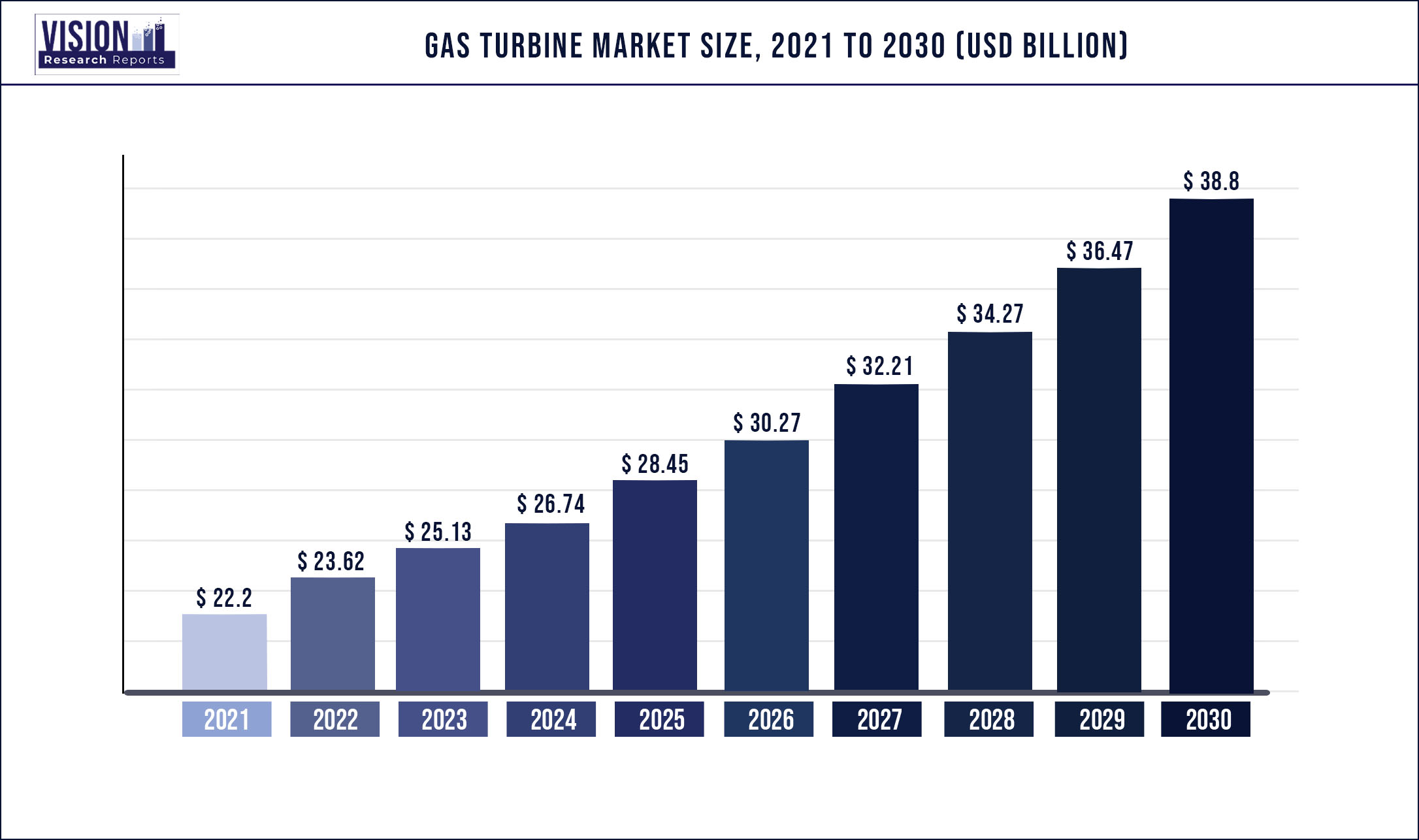

The global gas turbine market was valued at USD 22.2 billion in 2021 and it is predicted to surpass around USD 38.80 billion by 2030 with a CAGR of 6.4% from 2022 to 2030

Report Highlights

Supportive policies majorly determine the increasing demand for gas turbines in developing markets, such as Combined Heat and Power (CHP) support scheme executed by Germany.

Rapid technological advancements in the energy industry, combined with a shift in focus toward distributed power production technologies, are propelling the worldwide market forward. This market is predicted to expand rapidly during the forecast period, owing to increased government backing for power production technologies that minimize carbon dioxide (CO2) emissions around the world.

>200 MW emerged as one of the most significant segments in this market with a revenue share of more than 65.0% in 2021. It is likely to be the fastest-growing segment during the forecast period. The rising power generation operations around the world, as well as the move from coal to gas-based power plants in some of the world's major countries, are driving demand in this category.

The combined cycle turbines sector accounted for the largest revenue share of approximately 72.0% in 2021 and is anticipated to continue its dominance in the near future. This technology category is expected to increase at a faster rate in the coming years. These turbines use less fuel to produce the same amount of energy and eliminate transmission and distribution losses.

The Power & utility sector accounted for the largest revenue share of approximately 81.0% in 2021. Increased demand for power generation is being driven by the expansion in population and urbanization around the world, which is boosting the use of gas turbines in the power and utility sectors.

Asia Pacific emerged as the largest market share of more than 31.0% of the market in terms of revenue as of 2021. During the forecast period, the area led by China, Japan, Indonesia, Thailand, and India is expected to grow at the quickest rate. The Asia Pacific region's regional need for electricity is being driven by rapid urbanization and the emergence of a middle class.

The rising demand for LNG is primarily driven by the shale gas reserve and technological development in extraction and mining technology which are consistently lowering the operational cost of gas extraction in the region. Further, the North American region has witnessed large-scale commissioning of gas-based power

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 22.2 billion |

| Revenue Forecast by 2030 | USD 38.80 billion |

| Growth rate from 2022 to 2030 | CAGR of 6.4% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Technology, capacity, end-use, region |

| Companies Covered | Siemens Energy; Mitsubishi Power, Ltd.; Kawasaki Heavy Industries, Ltd.; Solar Turbines Incorporated; and Ansaldo Energia |

Capacity Insights

>200 MW emerged as one of the most significant segments in this market with a revenue share of more than 65.05% in 2021. It is likely to be the fastest-growing segment during the forecast period. The rising power generation operations around the world, as well as the move from coal to gas-based power plants in some of the world’s major countries, are driving demand in this category.

The need for power generation is expanding due to an increase in power generation activities around the world as a result of the rising demand for energy due to population growth and fast urbanization. The rise of the power generation business, combined with a greater emphasis on generating electricity from renewable energy sources, is the primary driver for gas turbines, particularly those with capacities above 200 MW.

The reduced size of the turbine allows for easier maintenance and operation, which is a crucial reason for the 200 MW turbine's success. Because of its smaller size, the product is lighter, making it perfect for offshore locations where the power to weight ratio is a key factor in selecting whether or not to build a turbine unit. The oil and gas industry is expected to restore its impetus in the near future. Because of their compliance with operational and environmental circumstances, small turbines are frequently used in the oil and gas industry.

Technology Insights

The combined cycle turbines sector accounted for the largest revenue share of more than 72.13% in 2021 and is anticipated to continue its dominance in the near future. This technology category is expected to increase at a faster rate in the coming years. These turbines use less fuel to produce the same amount of energy and eliminate transmission and distribution losses. Combined cycle turbines are known to be extremely efficient, allowing systems to achieve efficiencies of 60 to 80 percent.

Strict regulations for coal plants, low gas prices, and the integration of increasing amounts of renewable energy are driving the switch to combined cycle gas turbine technology. CCPPs complement solar and wind power by being able to start and stop fast, allowing them to compensate for changes in renewable energy power.

Government initiatives that encourage the use of sustainable fuels for electricity generation and reduce greenhouse gas emissions are likely to boost demand for natural gas-fired power plants over coal-fired power plants. Furthermore, the industry is expected to be propelled by falling gas costs and the finding of shale gas reserves during the forecast period.

End-use Insights

The Power & utility sector accounted for the largest revenue share of approximately 80.06% in 2021. Increased demand for power generation is being driven by the expansion in population and urbanization around the world, which is boosting the use of gas turbines in the power and utility sectors. Another important driver for the gas turbine company in the power generation sector is the focus on establishing an environmentally friendly form of power generation.

Heavy industries, specialty chemical production, glass and cement manufacture, pharmaceutical, and sugar mills are all part of the industrial segment. Due to strict pollution regulations, gas turbines are seeing growing demand in the industrial sector. Low natural gas prices are also helping to boost demand for gas turbines in industrial settings. The demand is mostly driven by past increases in industrial activity around the world.

Regional Insights

The Asia Pacific emerged as the largest market share of more than 31.2% for the gas turbine market in terms of revenue as of 2021. During the forecast period, the region led by China, Japan, Indonesia, Thailand, and India is expected to grow at the quickest rate. The Asia Pacific region's regional need for electricity is being driven by rapid urbanization and the emergence of a middle class. The presence of growing economies such as India and China, as well as low-cost raw materials and labor, are tempting multinational businesses to expand their operations in this region.

North America led by the U.S, Mexico, and Canada is projected to grow at significant rates during the forecast period. The demand is primarily driven by the shale gas reserve and technological development in extraction and mining technology which are consistently lowering the operational cost of gas extraction in the region. Further, the North American region has witnessed large-scale commissioning of gas-based power.

Oil and gas companies have been able to generate shale gas on a commercial scale because of technological breakthroughs in completion procedures like multistage hydraulic fracturing and drilling techniques like horizontal wellbores. The aforementioned technological breakthroughs, as well as commercial shale gas production, are expected to fuel the regional market in the foreseeable period, according to trends.

Saudi Arabia is a major gas turbine end consumer in the Middle East and Africa region. This has resulted in a large number of gas turbine providers in the country, all of whom are seeking to increase their market share. Gas turbines are supplied by major OEMs such as Siemens Energy, General Electric, and Mitsubishi Power, Ltd. throughout the country.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Gas Turbine Market

5.1. COVID-19 Landscape: Gas Turbine Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Gas Turbine Market, By Technology

8.1. Gas Turbine Market, by Technology, 2022-2030

8.1.1 Open Cycle

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Combined Cycle

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Gas Turbine Market, By Capacity

9.1. Gas Turbine Market, by Capacity, 2022-2030

9.1.1. ≤200 MW

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Anod>200 MWe

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Gas Turbine Market, By End-Use

10.1. Gas Turbine Market, by End-Use, 2022-2030

10.1.1. Power & Utility

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Industrial

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Gas Turbine Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Technology (2017-2030)

11.1.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.1.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.2.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.3.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.5.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Capacity (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

Chapter 12. Company Profiles

12.1. General Electric

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Siemens Energy

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Mitsubishi Power, Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Kawasaki Heavy Industries, Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Ansaldo Energia

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Solar Turbines Incorporated

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others