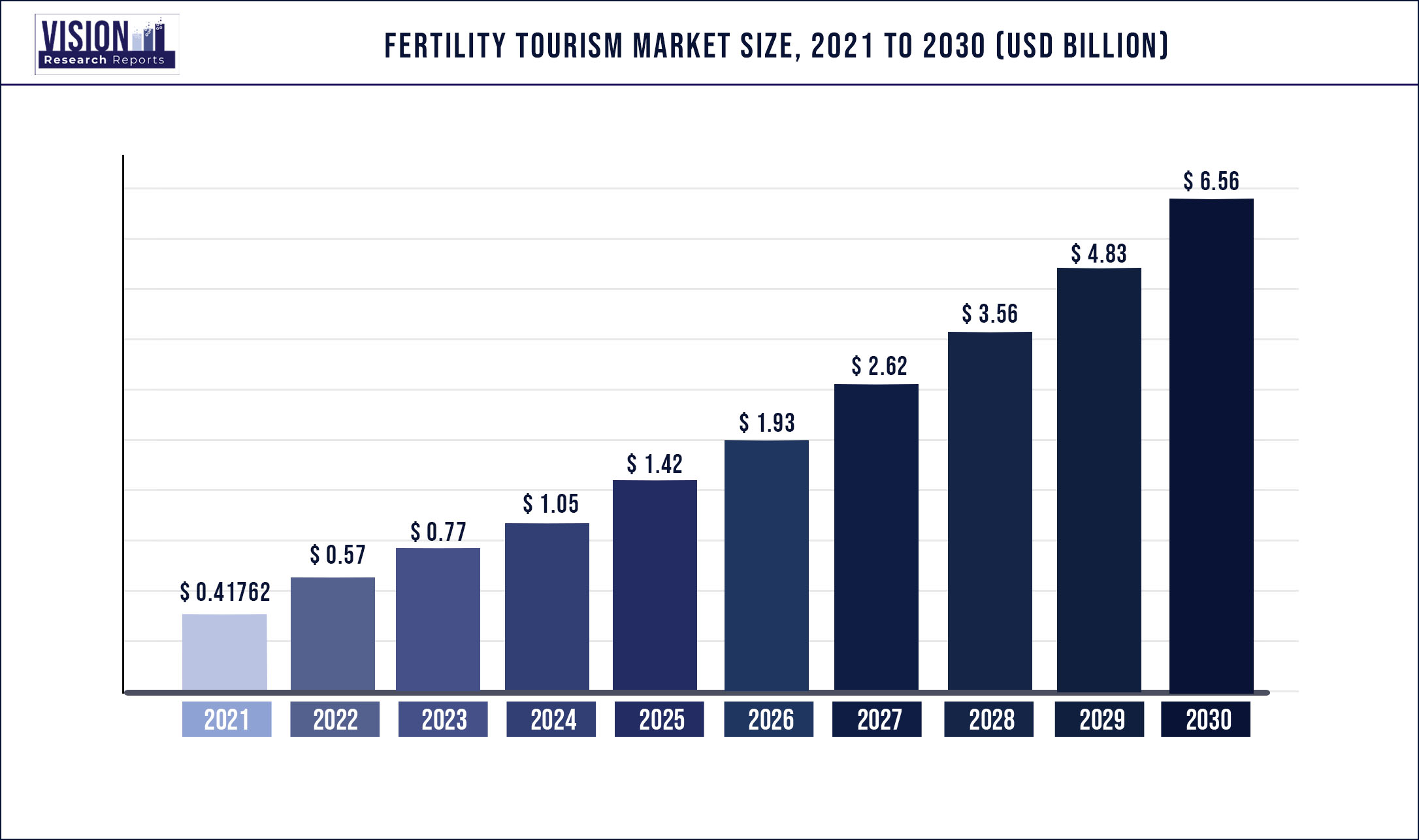

The global fertility tourism market was valued at USD 417.62 million in 2021 and it is predicted to surpass around USD 6.56 billion by 2030 with a CAGR of 35.8% from 2022 to 2030.

Lower cost of treatment in neighboring countries and a high success rate of IVF in countries such as Spain, U.S., and the U.K. are main factors due to which people are opting for reproductive tourism. Furthermore, the increasing rate of infertility due to factors such as high alcohol consumption, drug abuse, stress, and smoking is propelling the market.

Delayed pregnancy in women is favoring the market growth. Technological advancements and the introduction of IVF and various assisted reproductive technologies are likely to bode well with the market. Countries such as U.S., Spain, India, Czech Republic, are offering advanced treatments such as intracytoplasmic sperm injection, gamete intrafallopian transfer, Zygote intrafallopian transfer, and others. Many single women and gay or lesbian couples have to opt for reproductive tourism as the regulatory frameworks in their home counties do not allow them to avail treatments.

The COVID-19 pandemic adversely impacted the medical tourism industry. It shook the travel and tourism industry to its foundations. Prominent hospital service providers suffered heavy losses in 2020, as COVID-19 pandemic travel restrictions negatively affected medical services aimed at medical tourists. A sharp decline in the number of patient arrivals due to travel bans and strict regulations heavily impacted the fertility tourism industry.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 417.62 million |

| Revenue Forecast by 2030 | USD 6.56 billion |

| Growth rate from 2022 to 2030 | CAGR of 35.8% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Age Group, country |

| Companies Covered | San Diego Fertility Center; IVF-Life; Barcelona IVF; Eva Fertility Clinics; The Surrey Park Clinic; Bumrungrad International Hospital; Assisted Reproduction and Gynecology Centre; Sincere IVF Center; Alpha IVF & Women’s Specialists; Genesis IVF; Manchester Fertility Services Ltd; Apollo Fertility |

Age Group Insights

The 35-44 segment dominated the market with a share of 42.6% in 2021. The high incidence of infertility in this age group is a key factor in the growth of the segment. The cost and anonymity of ART-assisted treatments are the main reasons for travel. Additionally, the availability of more donors offered by international clinics, as well as the success rates advertised contribute to the segment growth.

The risk of pregnancy complications increases with age. Miscarriage and chromosomal abnormalities are more common in fetuses after the age of 35. In addition, the risk of pregnancy complications such as gestational diabetes, placenta previa (the placenta covering part of or all of the cervix), cesarean section, and stillbirth is also higher among older women. Thus, many women between the age group 35 to 44 seek treatment abroad.

The 45-54 segment is set to witness significant growth during the forecast period. High spending capacity and world-class treatment facilities in developed countries are primary factors for the growth of the segment. Furthermore, the efficient and reliable regulatory frameworks in international countries, such as U.S. and U.K. are increasing the influx of patients in the age group 45-54 to these countries.

Country Insights

Turkey dominated the market with a share of 42.19% in 2021. The availability of world-class IVF treatment services at a lower cost than in the U.S. and other European countries is responsible for the growth of the market in Turkey. Furthermore, the country witnessed a high influx of medical visitors in 2021, which rendered a dominating position to Turkey. According to the Turkish Statistical Institute, the country reported an increase of 61% in the arrival of international patients in 2021.

The market in Spain is likely to witness a notable growth rate due to the increasing number of patients from other European countries, rapid developments in fertility tourism, and the rising number of international fertility clinics. Thailand is one of the popular destinations for medical tourism. Its popularity as a tourist destination is augmenting its market growth. The growing number of private institutions, improvements in the overall healthcare infrastructure, and lower treatment prices all contribute to the country’s growth in reproductive tourism.

In recent years, the number of Chinese couples traveling overseas for IVF treatment has increased. The abolition of the one-child policy in China resulted in many older couples traveling to Thailand and Malaysia for IVF treatment. Both the countries are focussing on attracting Chinese patients. To compete with world-class medical centers and hospitals across Asia & other regions, Malaysia is forging a niche in fertility treatments. The country’s fertility centers also claim success rates that are well ahead of the global average.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Fertility Tourism Market

5.1. COVID-19 Landscape: Fertility Tourism Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global Fertility Tourism Market, By Age group

8.1.Fertility Tourism Market, by Age group Type, 2020-2027

8.1.1. 18 - 24

8.1.1.1.Market Revenue and Forecast (2016-2027)

8.1.2. 25 - 34

8.1.2.1.Market Revenue and Forecast (2016-2027)

8.1.3. 34 - 44

8.1.3.1.Market Revenue and Forecast (2016-2027)

8.1.4. 46 - 54

8.1.4.1.Market Revenue and Forecast (2016-2027)

Chapter 9. Global Fertility Tourism Market, Regional Estimates and Trend Forecast

9.1.North America

9.1.1. Market Revenue and Forecast, by Age group (2016-2027)

9.1.2. U.S.

9.1.3. Rest of North America

9.1.3.1.Market Revenue and Forecast, by Age group (2016-2027)

9.2.Europe

9.2.1. Market Revenue and Forecast, by Age group (2016-2027)

9.2.2. UK

9.2.2.1.Market Revenue and Forecast, by Age group (2016-2027)

9.2.3. France

9.2.3.1.Market Revenue and Forecast, by Age group (2016-2027)

9.2.4. Rest of Europe

9.2.4.1.Market Revenue and Forecast, by Age group (2016-2027)

Chapter 10.Company Profiles

10.1.San Diego Fertility Center

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2.IVF-Life

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3.Barcelona IVF

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4.Eva Fertility Clinics

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5.The Surrey Park Clinic

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6.Bumrungrad International Hospital

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7.Assisted Reproduction and Gynecology Centre

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8.Sincere IVF Center

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9.Alpha IVF & Women’s Specialists

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10.Genesis IVF

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1.About Us

12.2.Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others