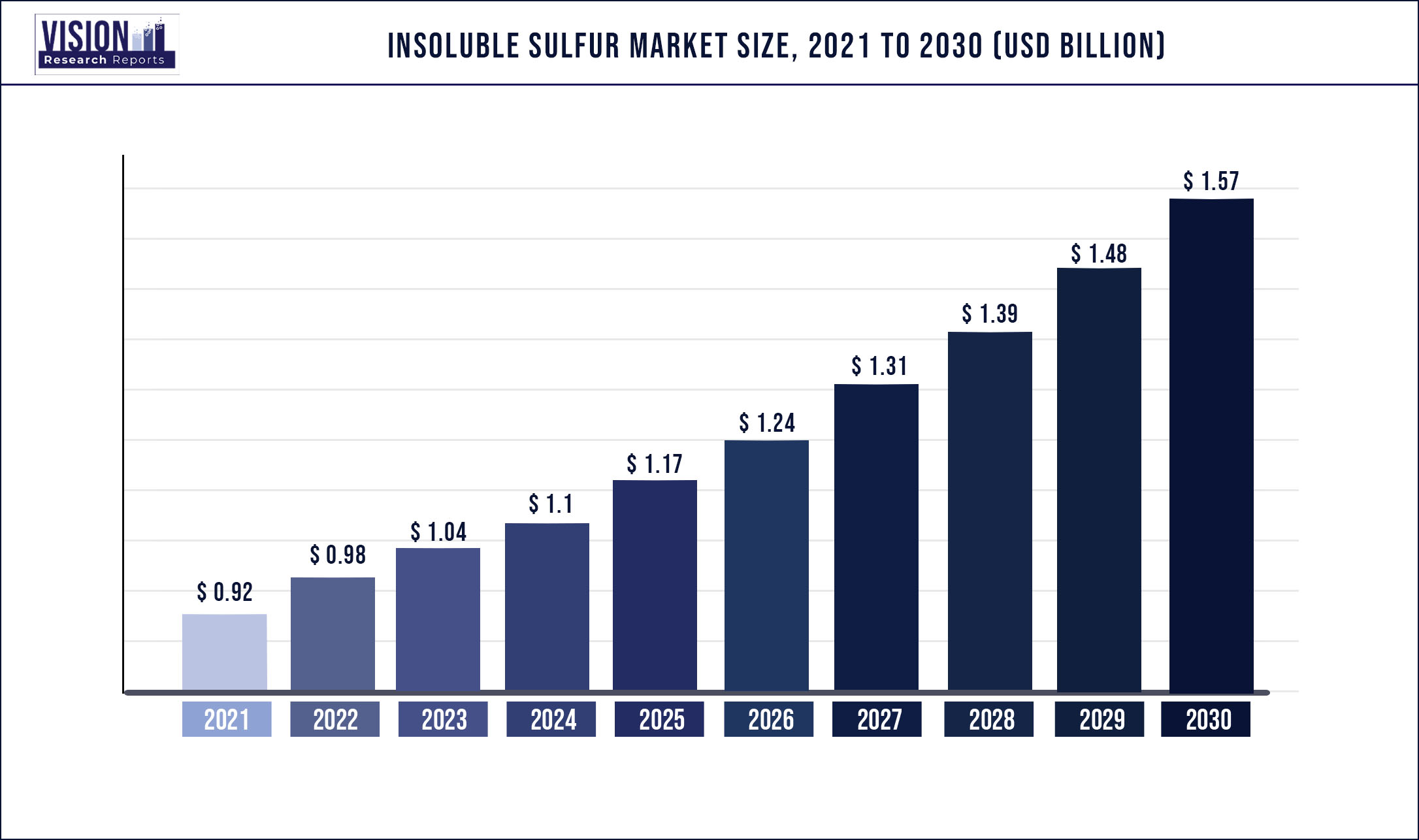

The global insoluble sulfur market size was estimated at around USD 0.92 billion in 2021 and it is projected to hit around USD 1.57 billion by 2030, growing at a CAGR of 6.12% from 2022 to 2030.

Report Highlights

Rising demand for the product from global multinational tire manufacturers is projected to remain the key factor driving industry growth. Insoluble sulfur is a key element used in the rubber processing sector as it acts as an excellent vulcanizing agent.

However, the recent global pandemic has caused disruptions in the value chain of the rubber industry, in terms of feedstock procurement and distribution. The first quarter of 2022 observed significant downfall in the product consumption in the tire manufacturing sector. However, the market is projected to pick up pace by the end of 2022 and the product demand in is anticipated to start reflecting steady growth by the end of 2021.

In addition, Asia Pacific was observed to be the key consumer of various rubber products due to fast pace industrialization across China, India, Thailand, Japan, South Korea and multiple other Asian countries. The requirement for the product was also observed to be steadily growing from the footwear manufacturers in the region. China, followed by India, Vietnam, and Indonesia are the leading producers of footwear in the region which generates heavy demand for insoluble sulfur to maintain production consistency.

Moreover, looking at the high market opportunity, leading product formulators, such as Eastman Chemical Company, Oriental Carbon & Chemicals Ltd., and Nynas AB, have been focusing on expanding their current product holding as well as establish long-term relations with the end-use markets, especially tire manufacturers, to increase their market presence and simultaneously cater a broader customer base.

Europe has reflected a surge in the number of automobiles manufactured as well as number of vehicles on road since 2016. This has directly led to increased demand for tire replacements in the region as well as new product manufacturing to cater to the growing needs, especially from countries, such as Germany, Italy, France, and U.K. This eventually led to increasing demand for insoluble sulfur from the sector across these countries and the trend is likely to project similar patterns from 2022 to 2030 across these countries.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 0.92 billion |

| Revenue Forecast by 2030 | USD 1.57 billion |

| Growth rate from 2022 to 2030 | CAGR of 6.12% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Grade; application; region |

| Companies Covered |

Eastman Chemical Company; Nynas AB; Oriental Carbon & Chemical Ltd.; Lions Industries; Shikoku Chemicals Corp. |

Grade Insights

In terms of volume, regular grade led the market with a share of 66.2% in 2021. This is attributable to the high usage of the product across all rubber compound producing sectors. In addition, the regular grade product is majorly the one with no additive mixtures and is commercially considered as the most primary form of insoluble sulfur. Regular form is manufactured by all major industry participants and is highly used as a vulcanizing agent. According to EC regulations, the substance is considered non-hazardous, however, for personnel handling the substance at the workplace, is advised to follow preliminary safety precautions.

In terms of revenue, high dispersion grade is estimated to account for the major share by 2030 due to the widespread usage of the substance for application in tire production on account of its key characteristics, such as excellent dispersibility and high thermal stability. It usually contains around 20% of insoluble sulfur in powder form, which is oil treated. It usually has lower concentrations of insoluble sulfur as compared to the other grades and is typically composed of polymers, such as various dispersing agents, SBR, and EPDM among others.

The high stability grade segment is projected to register the fastest CAGR from 2022 to 2030 as this product grade exhibits similar properties to that of high dispersion grade, which includes a reflection of high thermal stability. However, this form is typically mixed with various additives to enhance their performance, in terms of thermal stabilization of the product, which is done by adding ash-less stabilizing agents like esters, phenols, and carboxylic acid. The upgraded product has high demand by rubber producers due to high-performance productivity and lower costing compared to other counterparts.

Application Insights

In terms of volume, tire manufacturing application led the market with a share of over 93% in 2021. This is attributed to high product demand from the rapidly growing tire manufacturing sector across the globe. Tire producers are highly reliant on insoluble sulfur formulators as it is one of the key feedstock essential for producing high-quality performance products.

Multiple companies including Eastman Chemical Company, Oriental Carbon & Chemicals Ltd., and more are focusing on producing high quality products, which are easy to use by the tire manufacturers and can eventually lead to shorter production time as well as provide high-performance goods. Increased productivity and reduced timelines eventually decrease the cost bearing of the companies and are therefore considered a crucial factor for the utilization of the product.

Furthermore, in terms of industrial application, the substance is broadly utilized as a vulcanizing/crosslinking agent across the rubber formulation sector due to its non-blooming characteristic. This enables high resistance to reversion, which is also reflected at elevated temperatures. In addition, they also display properties, such as improved dispersibility and flow ability, which make them suitable for use in several industrial rubber processing sectors.

Regional Insights

Asia Pacific led the market and accounted for over 49.9% of the global revenue share in 2021. The region will retain its leading position throughout the forecast years due to the increasing number of rubber processors in the region, majorly across countries, such as China, India, Thailand, Japan, and South Korea. Major companies are shifting their production bases to Asia Pacific due to eased regulations, surplus availability of land, skilled & low cost labor, and positive trade affairs with economically strong nations.

In addition, countries, such as Japan, India, Thailand, South Korea, and Indonesia, are rapidly becoming major hubs for automobile manufacturing, which has led to high consumption of rubber in tire manufacturing applications across the region. China is the major contributor to the rubber manufacturing sector, which is also a key exporter of rubber products across Asian countries. The demand is currently disrupted in terms of material procurement and distribution due to the global pandemic. However, it is projected that the industry shall eventually recover by end of 2021, thereby boosting demand for insoluble sulfur in rubber compound formulations over the forecast period.

The automotive sector in Europe is one of the most crucial industries with companies, such as DAF Trucks, BMW Group, Ford, Fiat Chrysler Automobiles, and Daimler, leading the regional market. The industry is highly innovative and is constantly evolving, thereby generating numerous growth opportunities for various component manufacturers, tire producers, and more.

In North America, U.S. has gained traction, in terms of the rubber industry, with rapid imports of rubber from China, Germany, Thailand, and Japan. This reflects the heavy consumption of rubber by the tire manufacturing sector in the country. Furthermore, U.S. also dominates the heavy trucks, buses, and commercial vehicle sectors, which utilizes high-performance tires on periodic intervals. This is projected to result in increased product consumption in North American regional market.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Insoluble Sulfur Market

5.1. COVID-19 Landscape: Insoluble Sulfur Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Insoluble Sulfur Market, By Grade

8.1. Insoluble Sulfur Market, by Grade, 2022-2030

8.1.1. High Dispersion

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. High Stability

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Regular Grade

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Insoluble Sulfur Market, By Application

9.1. Insoluble Sulfur Market, by Application, 2022-2030

9.1.1. Tire Manufacturing

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Industrial Application

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Footwear

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Insoluble Sulfur Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Grade (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Grade (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Grade (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Grade (2017-2030)

10.2.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Grade (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Grade (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Grade (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Grade (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Grade (2017-2030)

10.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Grade (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Grade (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Grade (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Grade (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Grade (2017-2030)

10.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Grade (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Grade (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Grade (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Grade (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Grade (2017-2030)

10.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Grade (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Grade (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. Eastman Chemical Company

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Nynas AB

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Oriental Carbon & Chemical Ltd.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Lions Industries

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Shikoku Chemicals Corp.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others