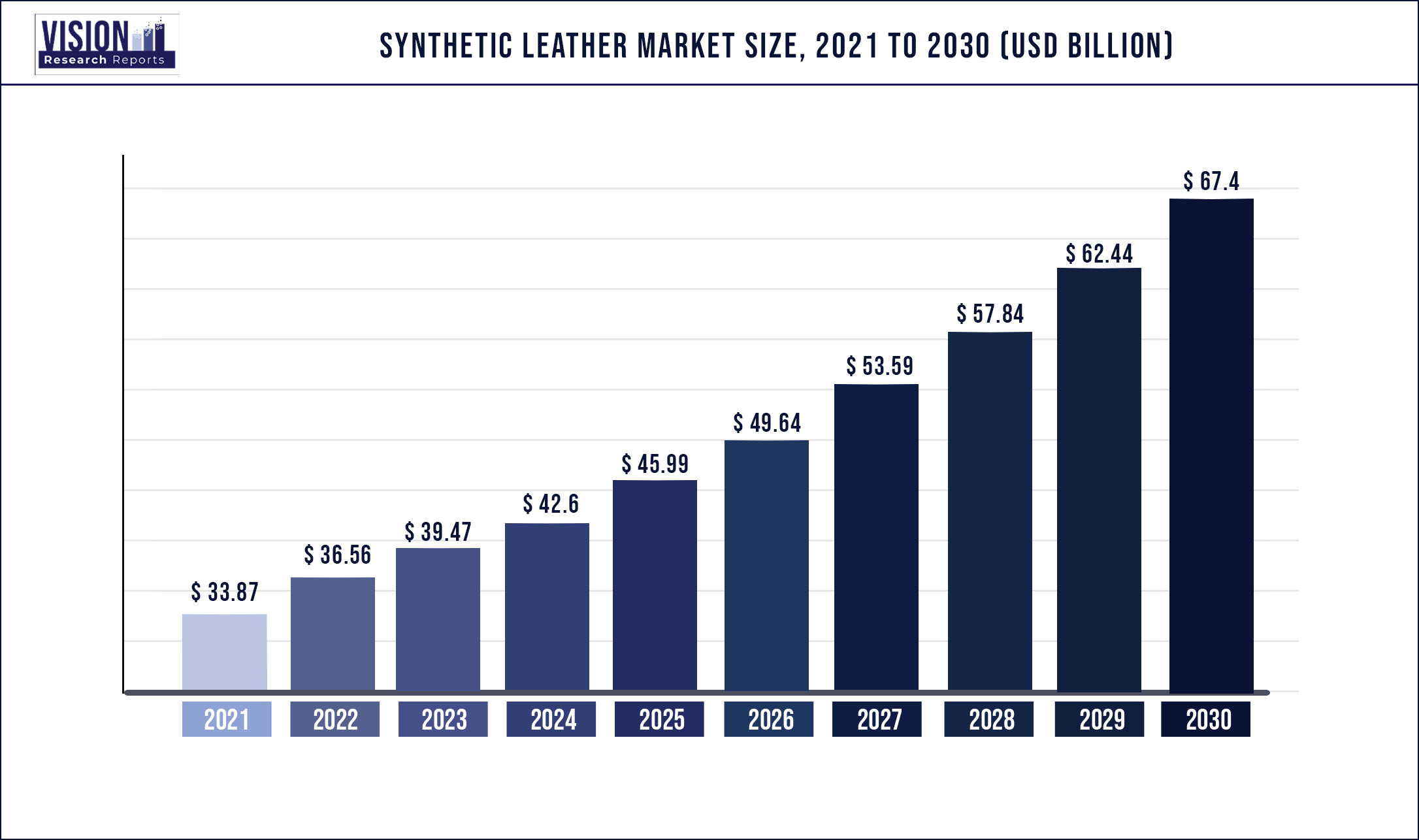

The global synthetic leather market was valued at USD 33.87 billion in 2021 and it is predicted to surpass around USD 67.4 billion by 2030 with a CAGR of 7.95% from 2022 to 2030.

Report Highlights

The expanding product application scope in footwear has been a major factor driving the market. Furthermore, the increased significance of animal rights and growing awareness regarding that, as laid forth by various groups, and strict legislation prohibiting the use of real leather are driving the demand for synthetic leather.

Synthetic leather has many advantages, including a high gloss surface, durability, strength, UV resistance, and ease of maintenance. Additionally, synthetic leather products are less expensive so they continue to appeal to consumers, particularly those in the medium and upper-income level groups. However, in some places, like Japan, the product is competing with Fumikodata, which is a vegan material that looks like real leather. In 2021, polyurethane (PU) was the most popular product category, and it is predicted to expand at the fastest CAGR during the forecast period.

PVC is expected to grow slowly on account of its properties, such as lesser durability and sticky finish. The footwear application segment is predicted to increase significantly in the coming years owing to cheaper prices and changing environmental circumstances in various places, which require the use of different types of footwear. The demand for synthetic leather in the footwear market is being sustained by rising disposable income levels in developing markets. Furthermore, the trend of mixing athletic shoes into an everyday lifestyle is boosting product demand.

Footwear was the largest application segment in 2021. Due to the increased demand from emerging nations, the footwear sector has witnessed significant growth in recent years, although consumer spending in the U.S. and several European countries has slowed slightly due to the global recession. There has been a strong demand from countries such as China, India, Thailand, South Korea, Vietnam, and other South Asian countries. This is expected to have a major influence on synthetic leather demand in the Asian market.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 33.87 billion |

| Revenue Forecast by 2030 | USD 67.4 billion |

| Growth rate from 2022 to 2030 | CAGR of 7.95% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, application, region |

| Companies Covered |

Kuraray Co., Ltd.; H.R. Polycoats Pvt. Ltd.; Alfatex Italia SRL; Filwel Co., Ltd.; Yantai Wanhua Synthetic Leather Group Co., Ltd.; San Fang Chemical Industry Co., Ltd.; Mayur Uniquoters Limited; Teijin Limited; Nan Ya Plastics Corporation |

Type Insights

The PU synthetic leather segment led the market and accounted for more than 55.02% share of the global revenue in 2021. It has been witnessing promising growth, in terms of product quality, variety, and yield. Polyurethane is waterproof, softer and lighter than real leather, and can be dry cleaned and torn easily than real hides. It also remains unaffected by sunlight. In addition, it is an eco-friendly substitute for vinyl-based products as it does not emit dioxins. All these factors are expected to augment its demand further.

The PVC synthetic leather segment is expected to witness slow growth during the forecast period. PVC was the first form of synthetic leather created in 1920. It was initially produced with carcinogenic chemicals and proved to be an ideal material for applications in furnishing and household items. PVC faced significant competition from PU as PVC gave a sticky feel and was unable to retain the body heat. As a result, its demand decreased in the clothing and bag application segment. The bio-based product consists of polyester polyol and has 70-75% renewable content. It is softer and has better scratch resistance properties than PU and PVC. Key companies in the global market are focusing on the development of new products through collaboration with polyol producers. Rapid industrialization and constant R&D will continue to supplement the segment growth in the upcoming years.

Application Insights

The footwear segment led the market and accounted for more than 30.11% of the global revenue in 2021. Its application is getting nearer to genuine leather, which is increasingly replacing the applications in handbags, briefcases, car furnishings, and clothing. Rising income levels and economic growth, especially in emerging nations, have fueled the demand for footwear. In addition, the segment is led by variations occurring in climatic conditions of different regions, which need different types of footwear.

Synthetic leather is widely used to manufacture shoe uppers, shoe lining, and soles for sports shoes, formal shoes, flip flops, soccer shoes, sandals, slippers, and boots. These shoes also are cost-effective, environmentally friendly, and long-lasting. Synthetic leather shoes possess higher water resistance as compared to real leather shoes, which can get stained due to exposure to certain elements. Faux leather shoes are durable enough to be used for a longer period when walking or running.

The increasing athleisure trend of incorporating athletic shoes into the daily lifestyle is also expected to propel segment growth. The price of faux leather footwear products is three times cheaper than the ones made from animal hide, which also boosts the segment growth. The furnishing industry is also one of the major application areas for synthetic leather as it has become more affordable than animal hides.

There is a wide range of synthetic leather materials available in the market that serve varied requirements of the furnishing industry, in terms of color, texture, and fabric look. Moreover, such artificial alternatives can be used in marine furnishing as it is saltwater resistant. Faux leather is used in cars, trucks, motorcycles, buses, and agricultural vehicles as it is lighter than animal hides. Polyurethane is the most widely used material in the automotive sector as it is non-sticky and softer than other products. The wallets, bags, and purses segment is estimated to witness significant growth over the coming years due to the high product demand. The usage of faux leather enables the production of lightweight, breathable, scratch- and water-proof, and easy-to-maintain bags.

The application of synthetic leather in manufacturing wallets, bags, and purses has increased significantly in recent years. Synthetic leather is extremely popular since it is softer than natural leather and has high durability. Synthetic leather wallets, bags, and purses are easy to maintain as they are lightweight, breathable, waterproof, and scratchproof. The lower cost of synthetic leather has also been a major factor in driving the demand in this market. Baggit, Solo, ZARA, Lavie world, and KENNETH COLE PRODUCTIONS, INC. are just a few of the brands that use synthetic leather to create a wide selection of elegant and trendy bags. With the evolving textile technology, consumers are preferring vegan fashion, which refers to adopting non-leather products. Thus, synthetic leather serves as the most suitable alternative in textile applications. PU synthetic leather is also used in clothing where it is used to create spandex and add buoyancy to competitive swimsuits.

Regional Insights

The Asia Pacific dominated the market and accounted for over 40.24% share of the global revenue in 2021. China, India, and South Korea are expected to be the major growth-driving economies in APAC. Rising disposable income, coupled with the increasing population, will provide numerous opportunities for the market. China is one of the prominent markets for leather in terms of production and sales. However, the outbreak of coronavirus has severely affected the country’s manufacturing output. Several manufacturers have either closed or slowed down their operations to contain the spread of the virus. Limited production in the manufacturing industry due to a halt or slowdown in operations, limitations on the supply and transportation in the country, and infrastructure slowdown are anticipated to negatively affect the demand for synthetic leather from the end-use application in the near future.

The market in North America is expected to grow at a slow rate on account of the saturation of larger domestic fashion brands. There have been growing concerns from animal rights organizations such as PETA, WWF, and a few others, resulting in growth restraints in the leather market. The demand for synthetic leather goods in the region has increased as a result of this. The European market witnessed significant growth owing to the flourishing automobile and consumer appliances sectors in the region. Amid the global crisis, governments in the region are focusing on bio-based, low-cost, and long-lasting products. The market for synthetic leather in this region is expected to grow as a result of this.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Synthetic Leather Market

5.1. COVID-19 Landscape: Synthetic Leather Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Synthetic Leather Market, By Type

8.1. Synthetic Leather Market, by Type, 2022-2030

8.1.1. PU Synthetic Leather

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. PVC Synthetic Leather

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Bio-based Leather

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Synthetic Leather Market, By Application

9.1. Synthetic Leather Market, by Application, 2022-2030

9.1.1. Furnishing

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Automotive

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Footwear

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Wallets, Bags & Purses

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Clothing

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Synthetic Leather Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2017-2030)

10.2.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2017-2030)

10.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2017-2030)

10.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2017-2030)

10.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. Kuraray Co., Ltd.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. H.R. Polycoats Pvt. Ltd.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Alfatex Italia SRL

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Filwel Co., Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Yantai Wanhua Synthetic Leather Group Co., Ltd.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. San Fang Chemical Industry Co., Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Mayur Uniquoters Limited

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Teijin Limited

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Nan Ya Plastics Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others