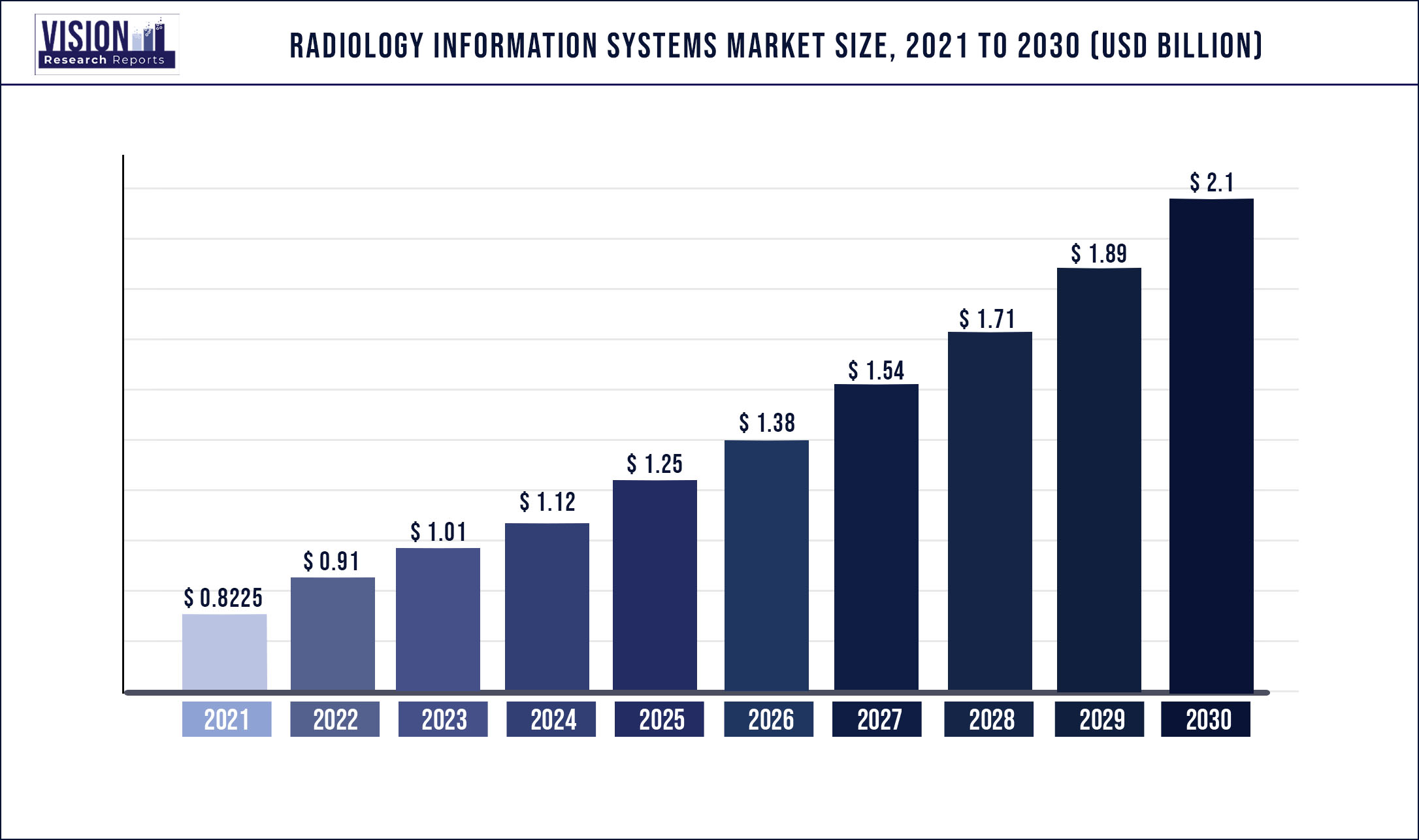

The global radiology information systems market size was estimated at around USD 822.5 million in 2021 and it is projected to hit around USD 2.1 billion by 2030, growing at a CAGR of 10.98% from 2022 to 2030.

Market growth is driven by the factors such as the increasing incidences of chronic diseases and the adoption of advanced technologies in healthcare facilities. The growing usage of digital healthcare infrastructure, which helps collect and manage information generated by hospitals, clinics, and institutes, has enhanced the efficiency and effectiveness of their services.

The integration of Artificial Intelligence (AI) into radiology information system (RIS) offers lucrative growth opportunities for the market. This will result in smoother workflows, better patient care, and consistent support for radiologists. It also helps radiologists to deliver a coordinated ecosystem experience to make faster, more accurate, and more consistent diagnoses. Additionally, government initiatives to increase the adoption of RIS are expected to boost market growth.

An increasing number of medical imaging tests for various diseases is anticipated to drive the growth of the market. As per Harvard Health, around 80 million CT scans were performed in the U.S. annually. Furthermore, the number of radiology labs and increasing installations of MRI and CT scans have created the demand for RIS in hospitals.

COVID-19 slowed the growth of the market. This was mainly due to the decline in the number of non-urgent medical imaging procedures during the first wave. However, patient volumes recovered strongly in the second half. Many government organizations recommended radio-imaging tests for the detection of black fungus among COVID-19 patients. This positively impacted growth of the market in 2021.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 822.5 million |

| Revenue Forecast by 2030 | USD 2.1 billion |

| Growth rate from 2022 to 2030 | CAGR of 10.98% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Deployment mode, product, end-use, region |

| Companies Covered |

Oracle; General Electric Company; IBM; Koninklijke Philips N.V.; Siemens Healthineers AG; All scripts Healthcare, LLC; Epic Systems Corporation; McKesson Corporation; MedInformatix, Inc.; eRAD; Pro Medicus, Ltd |

Deployment Mode Insights

Based on deployment mode, the RIS market is segmented into, web-based, on-premise, and cloud-based. The web-based segment dominated the market with a share of 77.6% in 2021. Web-based RIS is designed to evolve clinical and business needs across the continuum of care and help connect patient information to any required destination. For instance, McKesson’s RIS features a wide range of Electronic Health records (EHR) and offers cloud-based and server-based solutions, enhancing physician workflow and quality care.

The cloud-based segment is expected to have a significant growth rate during the forecast period. Compared to the direct purchase model, cloud-hosted services are very affordable. Instead of purchasing the entire model, consumers can subscribe to the latest version at a low price. Since data is stored on external servers, cloud-based systems are easily accessible online. Cloud-based RIS can be integrated with Artificial Intelligence (AI) algorithms to form comprehensive software. Such AI tools allow physicians to provide accurate and faster diagnosis and can be integrated with any third-party AI tool.

Small to medium-sized hospitals that cannot afford to spend on high-end hardware are particularly well suited for the cloud-based RIS due to their low cost. Additionally, cloud-based RIS allows doctors and medical professionals to control, who has access to personal data, thereby ensuring greater safety. On the other hand, the on-premise segment is expected to register slow growth during the forecast period.

Product Insights

Based on the product, the market is bifurcated into, integrated RIS and standalone RIS. The integrated RIS segment dominated the overall market in 2021. RIS and PACS have their database, especially, if both systems are obtained from separate vendors. However, integrated RIS includes RIS-PACS solution with a single worklist generated during registration improving workflow processes across the business platform. The growth of integrated RIS has simplified and streamlined workflows within radiology departments, allowing staff to focus on the task at hand.

Traditionally, radiology service providers used RIS to track individual images and associated data. However, with the extensive use of EHR platforms and the wide adoption of digitized images and PACS systems, radiology departments include a comprehensive clinical workflow of the entire medical facility within the RIS.

The standalone RIS segment is expected to grow owing to increasing government initiatives to boost the adoption of RIS. For instance, in February 2020, the Government of Uttarakhand partnered with KareXpert Technologies. Under the terms of the agreement, the company would expand its RIS/PACS, HIMS, EMR/EHR.telemedicine, and other services in the Nainital district.

End-Use Insights

In terms of end-use, the market is segmented into hospitals & clinics, outpatient department, and others. Hospitals and clinics held the maximum revenue share in 2021. The major installation of RIS is in hospitals to maintain the patient record in the form of a database that consists of comprehensive data for scheduling, patient tracking, image tracking, and result reporting.

Big healthcare IT corporations are involved in the integration of all hospital database that connects all the systems and equipment of a care setting. For instance, Infosys HIS focuses mainly on the EMR and IT-driven clinical transformation to maximize value for products by including RIS, Laboratory Information System (LIS), Pharmacy Information System (PIS), and Practice Management System (PMS).

The outpatient department (OPD) is expected to show considerable growth during the forecast period. This can be attributed to the increase in the number of outpatient visits. Furthermore, a gradual shift of patients towards outpatient settings and improving health coverage are favoring the growth of the segment.

Regional Insights

North America led the overall market with a revenue share of 40.7% in 2021. The U.S. market growth can be attributed to the advancement in the RIS, an increase in the number of radiologists, and the introduction of new software systems by current providers. The launch of comprehensive RIS with integrated PACS has made the medical imaging procedure systematic and easier resulting in patient compliance and further leading to regional growth.

The Asia Pacific, on the other hand, is expected to register the highest CAGR during the forecast period. The rising number of outsourcing services in the Asia Pacific along with growing awareness about the importance of workflow management at hospitals, clinics, and diagnostic laboratories is responsible for the demand for RIS in the region.

Europe is projected to become the second largest region during the forecast period, owing to the early adoption of advanced technologies and the increasing prevalence of diseases in this region. The market in MEA is likely to propel owing to improving health infrastructure and rising investment in healthcare IT.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Radiology Information Systems Market

5.1. COVID-19 Landscape: Radiology Information Systems Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Radiology Information Systems Market, By Deployment Mode

8.1. Radiology Information Systems Market, by Deployment Mode, 2022-2030

8.1.1 Web-based

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. On-premise

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Cloud-based

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Radiology Information Systems Market, By Product

9.1. Radiology Information Systems Market, by Product, 2022-2030

9.1.1. Integrated RIS

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Standalone RIS

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Radiology Information Systems Market, By End-Use

10.1. Radiology Information Systems Market, by End-Use, 2022-2030

10.1.1. Hospitals & Clinics

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Outpatient Department (OPD)

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Radiology Information Systems Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.1.2. Market Revenue and Forecast, by Product (2017-2030)

11.1.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Product (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Product (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.2.2. Market Revenue and Forecast, by Product (2017-2030)

11.2.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Product (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Product (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Product (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Product (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.3.2. Market Revenue and Forecast, by Product (2017-2030)

11.3.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Product (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Product (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Product (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Product (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.4.2. Market Revenue and Forecast, by Product (2017-2030)

11.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Product (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Product (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Product (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Product (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.5.2. Market Revenue and Forecast, by Product (2017-2030)

11.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Product (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Deployment Mode (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Product (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

Chapter 12. Company Profiles

12.1. Oracle

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. General Electric Company

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. IBM

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Koninklijke Philips N.V.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Siemens Healthineers AG

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. All scripts Healthcare, LLC

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Epic Systems Corporation

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. McKesson Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. MedInformatix, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. eRAD

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others