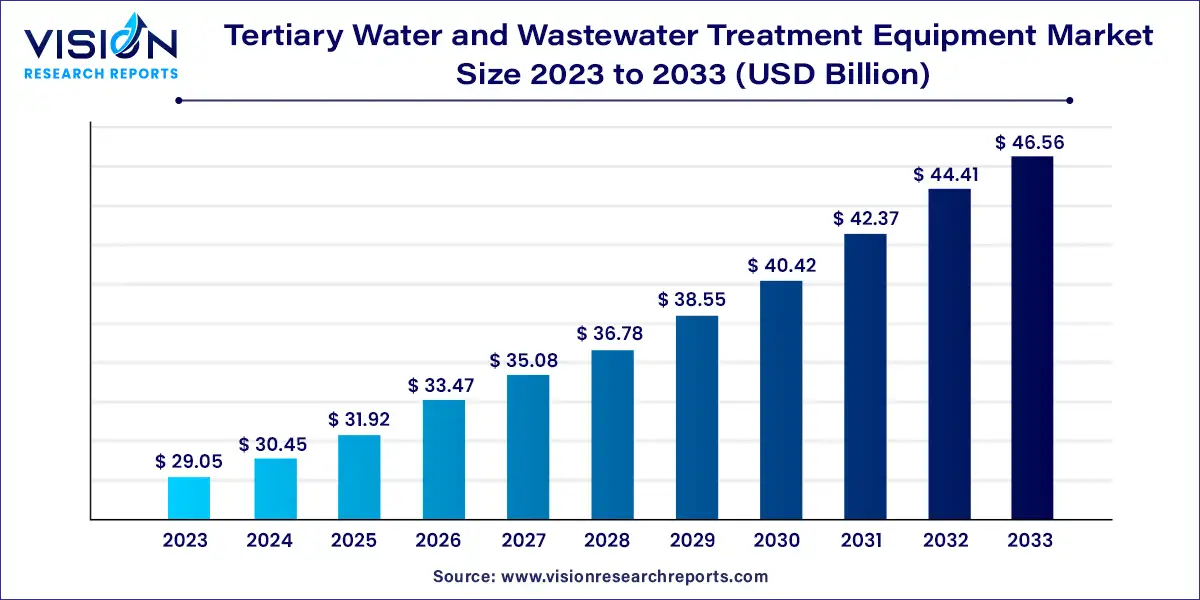

The global tertiary water & wastewater treatment equipment market size was estimated at USD 29.05 billion in 2023 and it is expected to surpass around USD 46.56 billion by 2033, poised to grow at a CAGR of 4.83% from 2024 to 2033.

The tertiary water and wastewater treatment equipment market plays a crucial role in ensuring the effective purification of water resources. As global concerns about water scarcity and environmental pollution continue to escalate, the demand for advanced treatment solutions is on the rise.

The growth of the tertiary water and wastewater treatment equipment market is propelled by an increasing water pollution level due to industrialization and urbanization have heightened the demand for advanced treatment solutions capable of effectively removing contaminants. Additionally, stringent regulatory standards imposed by governments worldwide regarding wastewater discharge and water quality parameters are driving the adoption of tertiary treatment technologies. Moreover, rising awareness among consumers, industries, and policymakers about the importance of clean water is fueling investments in tertiary treatment infrastructure. These factors collectively contribute to the expansion of the tertiary water and wastewater treatment equipment market, ensuring the availability of clean and sustainable water resources for communities and industries globally.

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2023 | 36% |

| Revenue Forecast by 2033 | USD 46.56 billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.83% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In terms of equipment, the filter segment held the largest market share of 36% in terms of revenue, in 2023. Filters primarily aid in the removal of leftover suspended materials in the wastewater. When leftover toxins are found in wastewater, activated carbon filters them out by absorbing the poisons and removing them from the wastewater.

Chlorination is the technique of introducing a precise quantity of chlorine to the water to produce a residue sufficiently powerful to eradicate bacteria, viruses, and cysts. Chlorination has improved sanitation by minimizing the number of bacteria and viruses in the water, preventing recontamination with minimal effort, and it incurs very low costs.

Tertiary clarifiers are frequently used to improve the removal of phosphate, suspended particles, metals, and microorganisms. The techniques for filtering treated wastewater employing fast filters and contact clarifiers, which are most often utilized in both domestic and international practices, are similar in design to the filters used for water treatment.

The municipal segment held a maximum share of 67% in terms of revenue, in 2023 and is likely to continue to dominate the market over the forecast period. Increasing urban population, rising investment, and favorable government policies promoting infrastructure development are projected to witness tremendous demand for wastewater treatment systems in municipal sectors of developing markets including Turkey, China, India, Thailand, and Bangladesh. These factors are projected to propel the growth of the tertiary water & wastewater treatment equipment industry. For instance, in May 2023, WABAG signed an agreement with the Ghaziabad Nagar Nigam (GNN) to provide DOB service, which includes designing, building, and operation of the 40 MLD tertiary treatment reverse osmosis facility.

The industrial application segment presents a wide application scope for fresh and processed water in several industries including chemical, paper & pulp, food & beverages, mining, and refineries. Rapid urbanization, technological advancements, and a rising number of production units are resulting in high demand for fresh and processed water.

The Asia Pacific region held the largest revenue share of 36% of the global tertiary water & wastewater treatment equipment market in 2023. The improving economy of emerging markets, including China, India, Thailand, Indonesia, and Malaysia is forcing governments to frame supportive policies to promote investments in the extraction of natural resources, including crude oil and natural gas. High penetration of nitrogenous fertilizer manufacturing units in Australia, China, and India considering easy access to raw materials is expected to play a key role in increasing the demand for tertiary treatment methods over the forecast period.

The robust presence of oil & gas reserves in Brazil, Columbia, Venezuela, and Argentina is expected to have a positive impact on the market. Furthermore, airport expansions and the development of large-scale commercial structures, especially in Brazil and Columbia, are anticipated to drive the demand over the forecast period.

The demand for potable water in the Middle East & Africa is expected to drive the growth of the disinfection market in the region. In addition, advancements in disinfection technologies, coupled with low-cost equipment, are expected to drive market growth. The use of membrane bioreactors in the region is expected to increase due to high levels of toxicity in municipal water. Increasing refurbishment of dysfunctional treatment plants in the economy, such as Oranjeville Wastewater Treatment and Leeuwkuil Waste Water Treatment, is expected to drive the growth of the region's tertiary water & wastewater treatment equipment industry. Furthermore, rising industrialization in the region is expected to propel market growth over the forecast period.

By Equipment

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Tertiary Water And Wastewater Treatment Equipment Market

5.1. COVID-19 Landscape: Tertiary Water And Wastewater Treatment Equipment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Tertiary Water And Wastewater Treatment Equipment Market, By Equipment

8.1. Tertiary Water And Wastewater Treatment Equipment Market, by Equipment, 2024-2033

8.1.1. Tertiary Clarifier

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Filter

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Chlorination Systems

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Tertiary Water And Wastewater Treatment Equipment Market, By Application

9.1. Tertiary Water And Wastewater Treatment Equipment Market, by Application, 2024-2033

9.1.1. Municipal

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Industrial

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Tertiary Water And Wastewater Treatment Equipment Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Equipment (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. WesTech Engineering, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Veolia Group

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Membracon

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Xylem, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Pentair plc

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Lamor Corporation AB

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Calgon Carbon Corporation

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Evoqua Water Technologies Corporation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Ecologix Environmental Systems, LLC

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Pure Aqua Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others