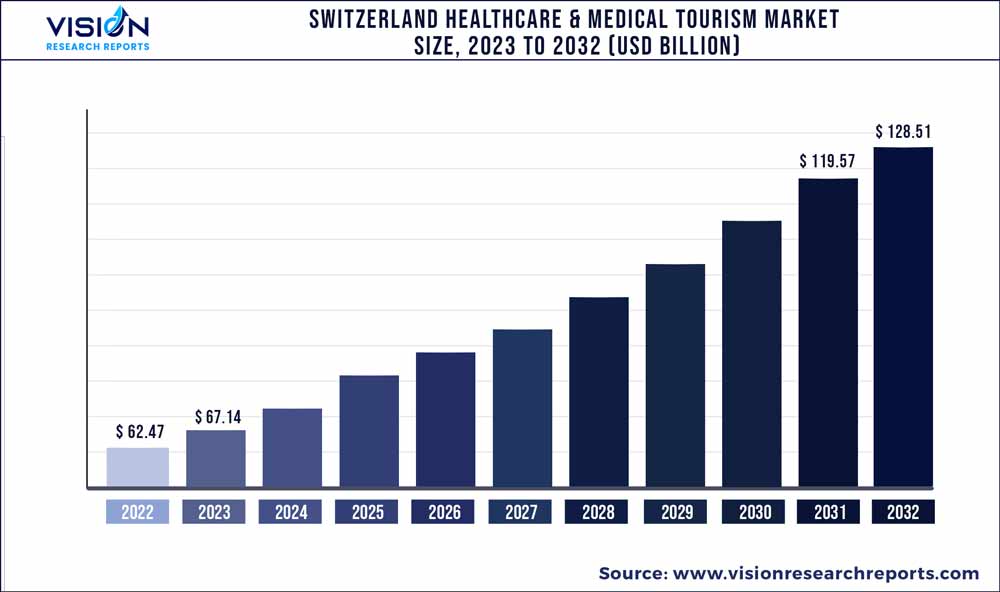

The Switzerland healthcare & medical tourism market size was estimated at around USD 62.47 billion in 2022 and it is projected to hit around USD 128.51 billion by 2032, growing at a CAGR of 7.48% from 2023 to 2032.

Key Pointers

Report Scope of the Switzerland Healthcare & Medical Tourism Market

| Report Coverage | Details |

| Market Size in 2022 | USD 62.47 billion |

| Revenue Forecast by 2032 | USD 128.51 billion |

| Growth rate from 2023 to 2032 | CAGR of 7.48% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Klinik Hirslanden; Swiss Medica XXI Century S.A.; Biologic Aesthetic Dentalcare; Berit Klinik; Clinique de Genolier; Clinique de Montchoisi; Hirslanden Clinique Cecil; Private Clinic Mentalva; Rehabilitation Clinic Zihlschlacht; Grand Resort Bad Ragaz; Clinica Sant’Anna; The Waldhotel; Swiss Medical Network; The Swiss Leading Hospital; Privatklinik Hohenegg AG; Klinik Im Park; Private Clinic Meiringen; Hirslanden Klinik Aarau; Pyramide am See Clinic; Salem-Spital; Schmerzklinik Basel; Klinik Beau-Site; Clinique La Colline; SW!SS REHA; Berit Klinik; BESAS Bern Hospital Center for Geriatric Medicine; cereneo Schweiz AG; CLINIC BAD RAGAZ; LEUKERBAD CLINIC; Clinique de Maisonneuve; Clinique Valmont; Hochgebirgsklinik Davos; Hof Weissbad AG; Klinik Schloss Mammern; Oberwaid AG; Rehaklinik Dussnang AG; Salina Rehabilitation Clinic |

The increasing adoption of initiatives to promote medical tourism, along with the high quality of medical care, is expected to boost the growth of the market. The Switzerland healthcare industry has established a reputation for good and efficient healthcare services. Although there is a regional disparity in healthcare-related satisfaction among citizens, the overall scenario seems to be positive in the country. Moreover, the established healthcare system in the localities enables the health industry to focus on the incoming medical tourists.

Switzerland is one of the major medical tourism destinations, and efforts are being made to improve medical tourism services. Switzerland Tourism (ST) took the initiative to partner with hospitals and clinics, with a focus on the quality of infrastructure, medical expertise, and location in a relaxing environment and natural setting. In 2019, ST successfully partnered with 26 hospitals and clinics in the region, and with the help of its 33 regional offices worldwide, it offers its partners an opportunity to increase their visibility in foreign markets. Moreover, in 2020, ST launched its magazine and website, contributing to its marketing strategy and further plans to participate in various events in Russia, China, and Gulf countries to showcase Switzerland's health tourism facilities. Such activities have helped establish Switzerland as a medical tourist destination on the global platform.

Switzerland is home to numerous medical offices, hospitals, and wellness facilities that provide patient-centered care.H+ Swiss Hospitals is a leading association in Switzerland comprising both public and private hospitals, clinics, and institutions for special care. It has 263 hospitals, clinics, and institutes for special care, spread across 369 different locations.

Even though the cost of medical care is high compared to other European countries, Switzerland has always been a popular destination for medical tourism. This can be attributed to the well-established healthcare infrastructure with the presence of trained healthcare professionals, high-quality care, high patient privacy standards, and beautiful locations.

Access to technologically advanced medical devices, diagnostic procedures, and robot-assisted minimally invasive surgeries, the availability of luxurious facilities are the primary factors for patients visiting Switzerland for medical treatment. For example, Hirslanden Klinik Aarau provides surgical robotic procedure services for international patients. Innovations in surgical techniques can help in reducing the cost of medical treatment in Switzerland. As per the Organization for Economic Co-operation and Development (OECD), Switzerland has one of the longest durations of hospital stay. Technological advancements in minimally invasive surgeries can result in a significant reduction in length of stay and in-patient costs.

End-use Insights

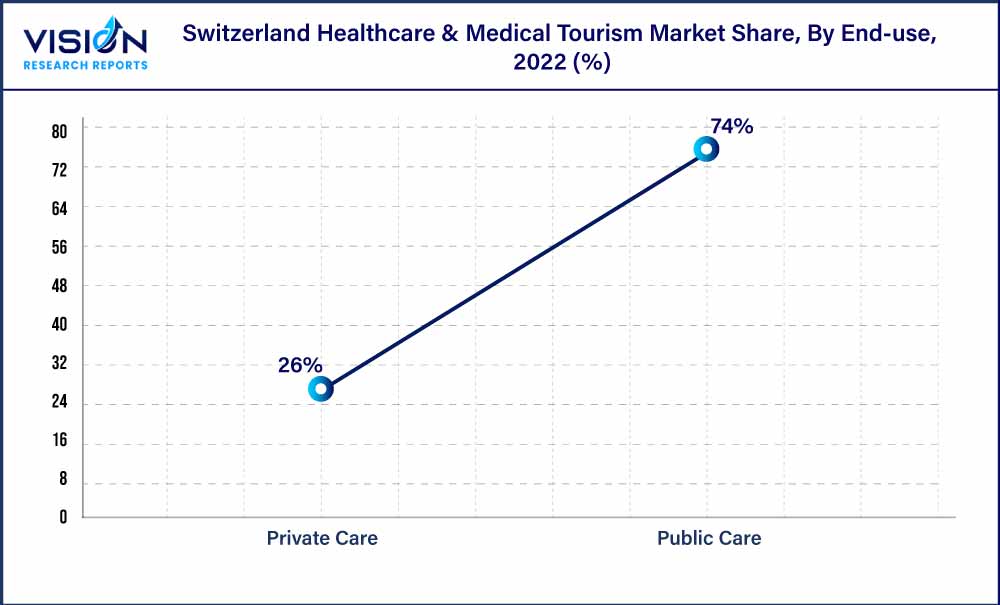

In terms of end-use, the public care segment held the largest revenue share of 74% in 2022. This is attributed to strong government support and increased healthcare spending. Medical tourists have given a major boost to the country’s medical tourism industry, and they prefer public centers as compared to private care providers. Initiatives by Switzerland Tourism such as business partnerships to support targeted marketing campaigns contribute to the increase in medical tourists.

The private care segment is anticipated to grow at the fastest CAGR of 8.14% during the forecast period. The presence of large private hospital groups with dozens of private clinics and hospitals at various sites with world-class healthcare facilities is favoring the demand for private hospitals in Switzerland. For instance, Hirslanden Private Hospital Group comprises 17 private hospitals across various locations in Switzerland. Similarly, the Swiss leading hospitals are a network of 18 private hospitals and 236 doctors across Switzerland. These hospitals are renowned for their medical expertise and quality among international patients. The growing network of these large hospitals by the establishment of more clinics and centers is fueling the growth of the private care segment.

Medical tourists coming from Gulf countries have given a major boost to the country’s medical tourism industry. Switzerland Tourism is taking active steps and measures such as collaboration with clinics and sponsorships to attract medical tourists to Switzerland. For instance, in 2020, Switzerland Tourism generated USD 7.2 million through business partnerships to support targeted marketing campaigns. However, the high cost of medical care, high tariffs for surgical procedures, and increased out-of-pocket expenses are important factors restricting the segment growth.

Service Insights

In terms of service, the radiology segment held the largest revenue share of 25% in 2022. Among various techniques, Computed Tomography (CT) has observed an increase due to its application in minimally invasive surgeries, such as percutaneous biopsy and percutaneous abscess drainage, along with diagnostics. Health services are benefiting from the availability of innovative products in the market, thus increasing the efficiency of treatment.

The service segment faces certain challenges such as a shortage of local healthcare workers due to the inadequate supply of workforce from training institutes, difficulty in maintaining work-life balance due to overwork, and a continuous increase in demand for healthcare services. Specifically, a significant shortage of nurses in long-term care facilities is a concern, considering the continuously increasing geriatric population in the country.

The cardiovascular treatment segment is anticipated to register the fastest CAGR of 8.85% over the forecast period. Switzerland offers a wide range of cardiovascular treatment services, including diagnosis, prevention, and intervention for various cardiovascular conditions. Switzerland boasts of highly skilled healthcare professionals and renowned cardiovascular specialists who are trained in the latest techniques and advancements in cardiovascular care. The country's hospitals and clinics are equipped with state-of-the-art technology and facilities to provide cutting-edge treatments.

Switzerland Healthcare & Medical Tourism Market Segmentations:

By End-use

By Service

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Switzerland Healthcare & Medical Tourism Market

5.1. COVID-19 Landscape: Switzerland Healthcare & Medical Tourism Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Switzerland Healthcare & Medical Tourism Market, By End-use

8.1. Switzerland Healthcare & Medical Tourism Market, by End-use, 2023-2032

8.1.1. Private Care

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Public Care

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Switzerland Healthcare & Medical Tourism Market, By Service

9.1. Switzerland Healthcare & Medical Tourism Market, by Service, 2023-2032

9.1.1. Radiology

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Orthopedics

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Aesthetic Medicine

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Cardiovascular Treatment

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Pain Management

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Fertility And Gynecology Treatment

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Gastroenterology

9.1.7.1. Market Revenue and Forecast (2020-2032)

9.1.8. Dental Treatment

9.1.8.1. Market Revenue and Forecast (2020-2032)

9.1.9. Others

9.1.9.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Switzerland Healthcare & Medical Tourism Market, Regional Estimates and Trend Forecast

10.1. Switzerland

10.1.1. Market Revenue and Forecast, by End-use (2020-2032)

10.1.2. Market Revenue and Forecast, by Service (2020-2032)

Chapter 11. Company Profiles

11.1. Klinik Hirslanden

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Swiss Medica XXI Century S.A.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Biologic Aesthetic Dentalcare

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Berit Klinik

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Clinique de Genolier

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Clinique de Montchoisi

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Hirslanden Clinique Cecil

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Private Clinic Mentalva

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Rehabilitation Clinic Zihlschlacht

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Grand Resort Bad Ragaz

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others