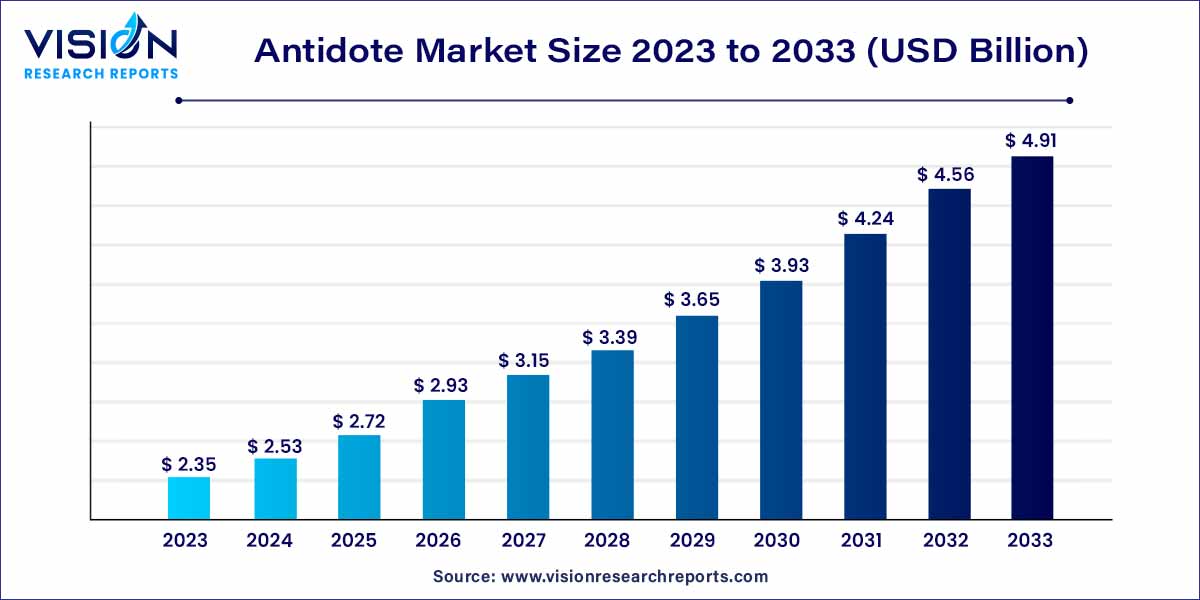

The global antidote market size was estimated at around USD 2.35 billion in 2023 and it is projected to hit around USD 4.91 billion by 2033, growing at a CAGR of 7.66% from 2024 to 2033.

The antidote market exhibits promising growth prospects, propelled by several key factors contributing to its expansion. One primary driver is the escalating incidence of poisonings and toxic exposures, necessitating a continuous demand for effective antidotes. Advances in medical research and technology are fostering the development of innovative antidote formulations, enhancing their efficacy and safety profiles. Additionally, heightened public awareness regarding toxicological risks is driving preventive measures and spurring the adoption of antidotes as a critical component of emergency response protocols. The market's growth is further facilitated by strategic collaborations within the pharmaceutical industry, fostering research and development initiatives aimed at addressing emerging toxins. As the healthcare landscape evolves, the antidote market is poised for sustained growth, driven by a convergence of scientific advancements, increased awareness, and the pressing need for swift and efficient interventions in the face of toxic exposures.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 4.91 billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.66% |

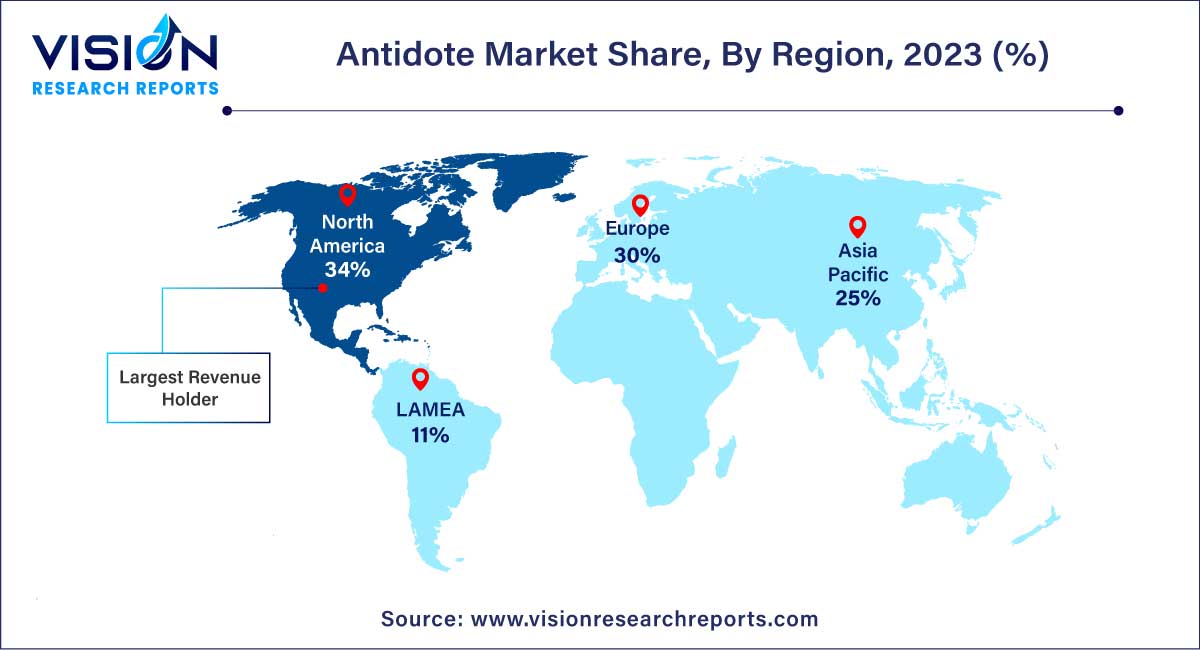

| Revenue Share of North America in 2023 | 34% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Chemical antidote segment held the largest market share of 43% in 2023. Chemical antidotes offer targeted and rapid treatment for specific toxins, ensuring effectiveness and minimizing complications. Administered by trained professionals, they act immediately, reducing long-term health effects and providing predictable emergency outcomes. Their precise dosing and customization enhance their therapeutic value, making them indispensable in specialty care settings for countering poisoning and toxic exposures. Moreover, key players in the market are offering novel chemical antidote for treatment of various conditions including drug overdose. For instance, Hikma Pharmaceuticals PLC, offers Narcan (naloxone HCl) 4mg for the treatment of opioid overdoses. These factors are fueling the segment.

Pharmacological segment is predicted to grow with significant CAGR over the forecast period. Majority of existing antidote only partially counteract the effects of toxins. They target the body's tissues, inducing symptoms that are completely opposite to those caused due to poisoning poison. Compared to physical and chemical antidote, pharmacological antidote pose no harm. Cyanide and amyl nitirate, barbiturates and picrotoxin or amphetamine are few available pharmacological antidotes. For instance, ACHE inhibitor- morphine is a pharmacological antidote that facilitates rapid and complete elimination of toxins by restoration of normal function. These factors collectively contribute to the robust growth of the antidote market.

Injectable segment had the largest market share of 43% in 2023. Antidote injections offer quick, precise, and targeted treatment by effectively countering toxins or drug effects. They counteract the toxic effects of various substances, making them invaluable in critical situations. In addition, they directly target the underlying toxicity in cases of poisoning, overdose, or toxic exposures. Antidote injections are highly specific, specifically designed to neutralize the effects of particular toxins, ensuring precise and effective treatment. Their use provides a standardized approach, reducing the risk of errors in dosage or administration. When typically administered by healthcare professionals, antidote injections play a crucial role in preventing or mitigating severe organ damage that might occur due to toxic exposures. Such capabilities are driving the segment growth.

Oral segment is expected to grow at a significant CAGR during the study period. Oral delivery of antidotes has gained attention attributed to the high acceptability associated with the dosage form. Oral antidotes provide several advantages, such as reduced pain and discomfort as they eliminate the need for injections, making them more acceptable to patients. In some cases, patients can self-administer oral antidotes, which is crucial when immediate treatment is required before professional medical help is available.

Hospital pharmacies segment captured the maximum market share of 54% in 2023. This growth can be attributed to various factors, including the enhanced accessibility of antidote treatment options and medications offered through hospital pharmacies. Patients are experiencing greater convenience in obtaining their prescribed medications and associated products from hospital pharmacies, which is fueling the demand for these services. Furthermore, the increasing involvement of hospital pharmacies in delivering patient education and offering advice on antidote treatment regimens is expected to play a major role in the expansion of this segment.

Online pharmacies segment is predicted to grow with significant CAGR over the forecast period. The ease, adaptability, and convenience offered by online medication purchases play a significant role in propelling this segment. Moreover, the discounts provided by online pharmacies serve as a compelling incentive for patients to opt for online medication purchases. They also provide valuable information on antidotes, potential side effects, and interactions.

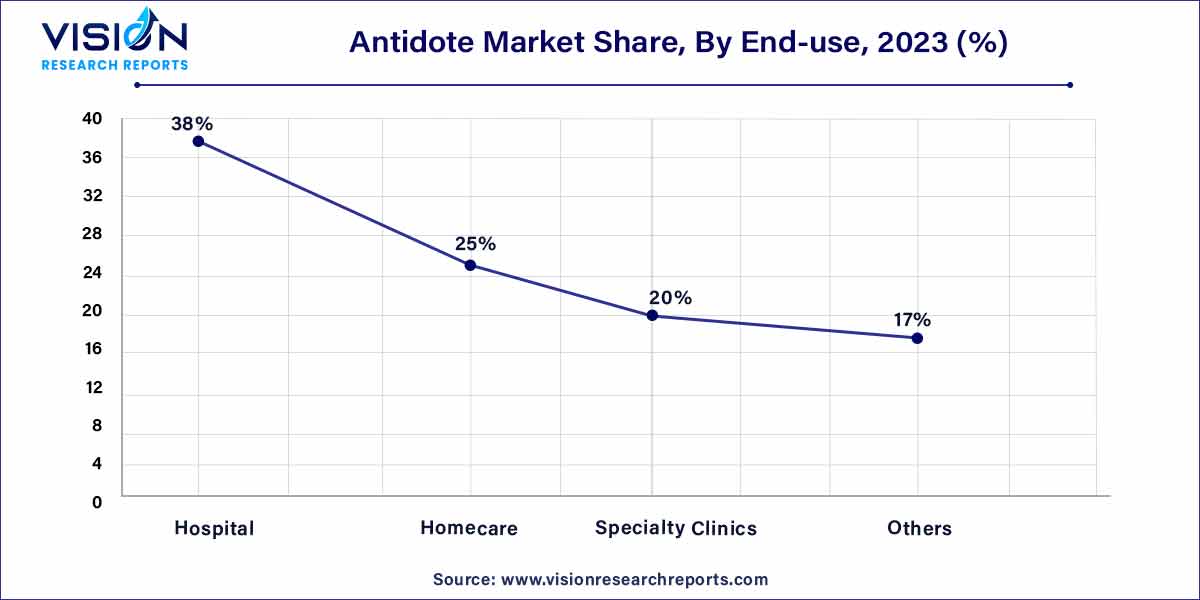

Hospitals segment accounted the highest share of 38% in 2023. The number of antidote treatments conducted in hospitals surpasses that of any other healthcare facility, primarily due to favorable reimbursement systems and the prevalence of hospitals as primary care providers in many developing countries.

For instance, the rate of hospitalization for psychodysfunctional and narcotic poisoning in geriatric patients increased by 3.97 fold from 5.03 in 1999 to 25.00 in 2020 per 100,000 individuals. Additionally, the increasing influx of individuals, particularly in rural regions, and the ease of access to hospitals, are expected to elevate the need for antidote in hospitals further. Therefore, this surge in demand is set to drive growth within this segment.

North America accounted for the largest revenue share of 34% in 2023 attributed to various factors such as a rise in burden of poisoning and presence of major operating players. For instance, according to the NCPC, estimates in 2021, 1 poison exposure case is reported in every 15 seconds in the U.S. poison control centers. Some of the major players operating in the antidote market are Pfizer Inc., Endo International plc, and Baxter International, Inc. The presence of these leading players in the antidote market is expected to increase the availability of antidote in the region. In addition, increasing healthcare spending and improved medical facilities is also driving regional growth.

Asia Pacific is estimated to grow at the fastest CAGR during the forecast period attributed to local presence of leading antidote companies and increase in R&D investment. There has been an increase in R&D investment by APAC countries, such as China and Japan, which has led to a growth in development of antidote. Moreover, the cost of clinical trials in developing economies such as China and India is lower than that in developed economies.

By Type

By Route of Administration

By Distribution Channel

By End Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Antidote Market

5.1. COVID-19 Landscape: Antidote Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Antidote Market, By Type

8.1. Antidote Market, by Type, 2024-2033

8.1.1. Chemical Antidote

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Physical Antidote

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Pharmacological Antidote

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Antidote Market, By Route of Administration

9.1. Antidote Market, by Route of Administration, 2024-2033

9.1.1. Oral

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Topical

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Injectable

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Antidote Market, By Distribution Channel

10.1. Antidote Market, by Distribution Channel, 2024-2033

10.1.1. Hospital Pharmacies

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Retail Pharmacies

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Online Pharmacies

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Antidote Market, By End Use

11.1. Antidote Market, by End Use, 2024-2033

11.1.1. Hospital

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Homecare

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Specialty Clinics

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Antidote Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.1.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.4. Market Revenue and Forecast, by End Use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End Use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End Use (2021-2033)

Chapter 13. Company Profiles

13.1. Pfizer Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Hikma Pharmaceuticals PLC

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Dr. Reddy’s Laboratories Ltd

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Mylan N.V.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Fresenius Kabi AG

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Zydus Lifesciences Ltd.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Endo International plc

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Novartis AG

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Baxter International, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Emergent BioSolutions Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others