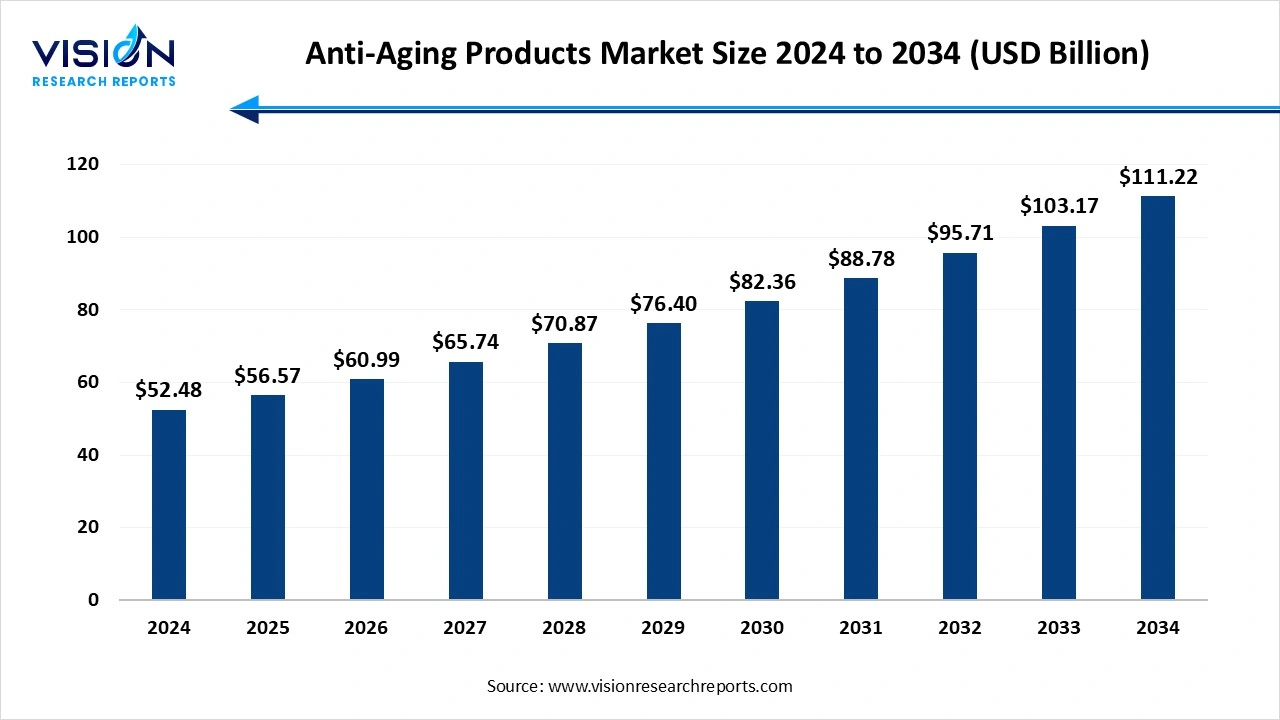

The global anti-aging products market size was accounted for USD 52.48 billion in 2024 and is expected to exceed around USD 111.22 billion by 2034, growing at a CAGR of 7.80% from 2025 to 2034.

The global anti-aging products market is a rapidly expanding sector driven by increasing consumer awareness of skincare, rising disposable incomes, and advancements in dermatological science. This market encompasses a wide range of products, including creams, serums, supplements, and devices designed to reduce visible signs of aging, such as wrinkles, fine lines, and age spots. Key growth factors include the growing elderly population, demand for organic and natural ingredients, and technological innovations in product formulations. Major players in the industry focus on continuous product innovation, strategic partnerships, and targeted marketing to maintain a competitive edge.

North America contributed 31% of the global revenue in the anti-aging product market in 2024. The United States and Canada are the leading contributors in this region, with consumers showing a high preference for premium and scientifically advanced anti-aging products. Furthermore, a high level of awareness regarding skincare routines and anti-aging treatments supports the market's growth in North America.

The Asia Pacific anti-aging products market is projected to experience a compound annual growth rate (CAGR) of 9.3% between 2025 and 2034. Countries such as China, Japan, South Korea, and India are the major markets within this region. South Korea, in particular, is recognized as a global hub for innovative skincare products and beauty trends, which significantly influence consumer preferences across the region. Moreover, the popularity of K-beauty products, which emphasize youthful, flawless skin, further propels the demand for anti-aging solutions.

Moisturizers, creams, and lotions contributed to 40% of the total revenue in the global anti-aging products market in 2024. Formulated with ingredients like collagen, ceramides, and natural oils, these products help maintain skin moisture, enhance elasticity, and protect the skin barrier. Available in various textures, from lightweight lotions for oily skin to rich creams for dry or mature skin, they cater to diverse consumer preferences. As multifunctional skincare solutions gain popularity, many of these products now offer additional benefits, such as sun protection, brightening effects, and antioxidant defense.

The demand for facial serum is projected to increase at a compound annual growth rate (CAGR) of 9.2% between 2025 and 2034. These serums are enriched with potent compounds like retinol, hyaluronic acid, and vitamin C, targeting visible signs of aging such as fine lines, wrinkles, and uneven skin tone. Their ability to provide quick, noticeable results has made them an essential part of modern skincare routines, appealing to consumers seeking effective, targeted solutions for youthful, radiant skin.

Hypermarkets and supermarkets contributed to 33% of the total revenue generated by the anti-aging products industry in 2024. These large retail outlets provide extensive shelf space for various brands, from affordable mass-market products to premium skincare solutions. The visibility of anti-aging products in supermarkets and hypermarkets, combined with frequent promotional offers, discounts, and in-store marketing, encourages impulse purchases and makes these products easily accessible to a diverse consumer base.

The online/e-commerce sector is projected to experience a compound annual growth rate (CAGR) of 9.5% between 2025 and 2034. Consumers can easily compare different brands, read detailed product descriptions, and make informed purchase decisions with just a few clicks. E-commerce platforms also provide access to exclusive online-only deals, subscription options, and fast delivery services, making them highly attractive to tech-savvy consumers. Direct-to-consumer (DTC) skincare brands have gained significant traction in this space, leveraging social media and digital marketing strategies to reach a global audience.

By Product

By Distribution Channel

By Regional

Anti-Aging Products Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Anti-Aging Products Market

5.1. COVID-19 Landscape: Anti-Aging Products Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Anti-Aging Products Market, By Product

8.1. Anti-Aging Products Market, by Product

8.1.1. Facial Serum

8.1.1.1. Market Revenue and Forecast

8.1.2. Moisturizer, Creams, & Lotions

8.1.2.1. Market Revenue and Forecast

8.1.3. Eye Care Products

8.1.3.1. Market Revenue and Forecast

8.1.4. Facial Cleanser & Exfoliators

8.1.4.1. Market Revenue and Forecast

8.1.5. Facial Masks & Peels

8.1.5.1. Market Revenue and Forecast

Chapter 9. Anti-Aging Products Market, By Distribution Channel

9.1. Anti-Aging Products Market, by Distribution Channel

9.1.1. Supermarkets & Hypermarkets

9.1.1.1. Market Revenue and Forecast

9.1.2. Pharmacy/Drugstores

9.1.2.1. Market Revenue and Forecast

9.1.3. Specialty Beauty Stores

9.1.3.1. Market Revenue and Forecast

9.1.4. Online/E-commerce

9.1.4.1. Market Revenue and Forecast

9.1.5. Others

9.1.5.1. Market Revenue and Forecast

Chapter 10. Anti-Aging Products Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product

10.1.2. Market Revenue and Forecast, by Distribution Channel

Chapter 11. Company Profiles

11.1. L'Oréal Group

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Estée Lauder Companies

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Procter & Gamble (P&G)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Shiseido Co., Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Johnson & Johnson

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Amorepacific Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Beiersdorf AG

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Kiehl's (L'Oréal Group)

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. La Prairie

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others