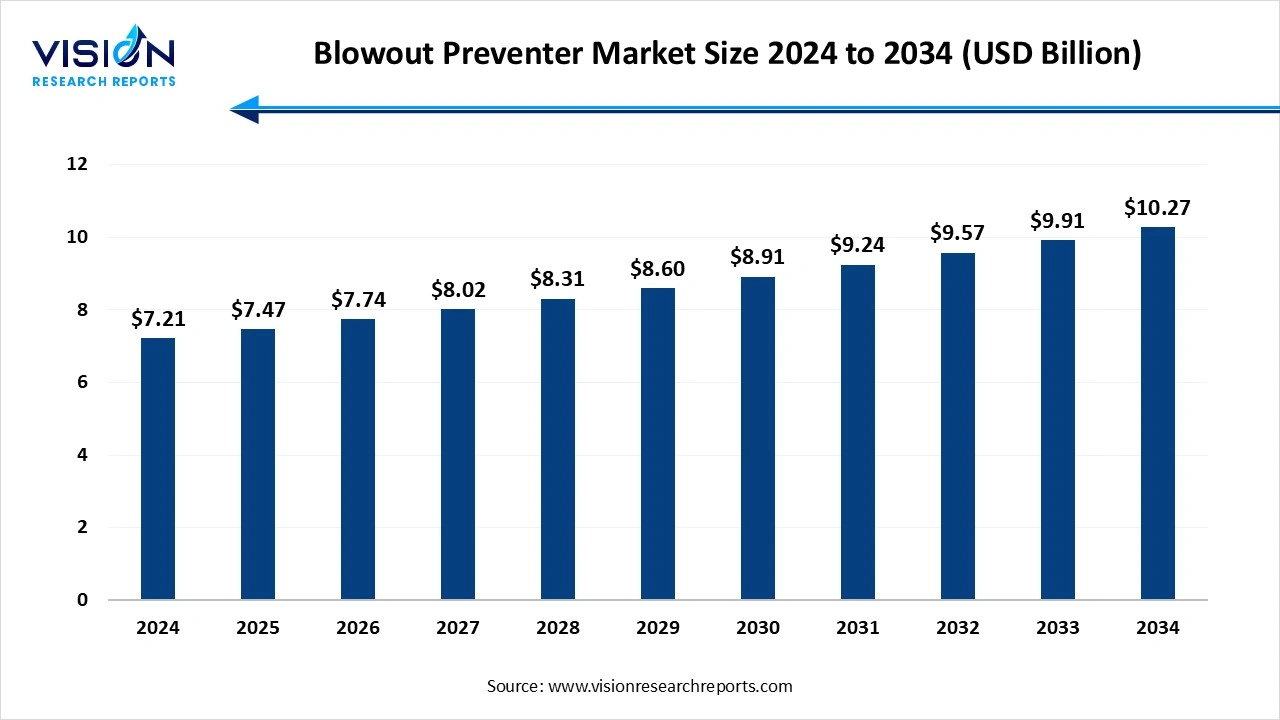

The global blowout preventer market size was reached at around USD 7.21 billion in 2024 and it is projected to hit around USD 10.27 billion by 2034, growing at a CAGR of 3.60% from 2025 to 2034.

Key Pointers

Key PointersThe blowout preventer (BOP) market plays a critical role in the global oil and gas industry by ensuring safety and operational control during drilling activities. Blowout preventers are high-pressure safety devices designed to prevent the uncontrolled release of crude oil or natural gas from a well, particularly during drilling operations. With increasing exploration and production activities across both offshore and onshore fields, the demand for advanced and reliable BOP systems has grown significantly. Technological advancements and the rising complexity of deepwater drilling are driving the adoption of more robust and automated blowout preventer systems to minimize risk and enhance operational efficiency.

The growth of the blowout preventer market is primarily driven by the expansion of oil and gas exploration and production activities across the globe. With increasing global energy demand, there has been a surge in offshore and deepwater drilling projects, especially in regions such as the Gulf of Mexico, the North Sea, and offshore Brazil. These high-risk environments necessitate the use of advanced blowout preventers to ensure the safety and integrity of drilling operations.

Another significant factor contributing to market growth is the stringent regulatory landscape governing the oil and gas industry. Following incidents like the Deepwater Horizon spill, governments and regulatory bodies have enforced more rigorous safety standards, compelling companies to invest in reliable blowout prevention systems. Moreover, technological innovations such as real-time monitoring, remote operation, and automated control systems are enhancing the functionality of BOPs, making them more attractive to operators focused on safety, efficiency, and compliance.

One of the prominent trends in the blowout preventer market is the rising adoption of subsea blowout preventers, particularly in deepwater and ultra-deepwater drilling operations. As exploration activities shift toward more challenging offshore environments, the demand for subsea BOPs has increased due to their ability to operate under high-pressure, high-temperature (HPHT) conditions. These systems offer enhanced well control and are equipped with advanced features such as multiple rams, shear-seal capabilities, and remote operability.

Another notable trend is the growing focus on BOP system automation and digitalization. Operators are moving toward intelligent blowout preventer systems that incorporate data analytics, machine learning, and remote control technologies. These smart BOPs can predict potential failures, optimize maintenance schedules, and reduce human intervention, leading to safer and more cost-effective operations. In addition, companies are investing in the retrofitting and upgrading of aging blowout preventers to meet new regulatory requirements and performance benchmarks.

One of the key challenges facing the blowout preventer market is the high cost associated with the development, installation, and maintenance of BOP systems. These systems are highly complex, engineered for extreme pressure and temperature conditions, and must comply with stringent industry regulations. As a result, the initial capital investment for new blowout preventer units, particularly subsea BOPs, is substantial.

Another major challenge is the technological and operational complexity involved in integrating BOPs with modern digital infrastructure. While there is a push toward automation and real-time monitoring, retrofitting existing rigs with advanced systems can be technically difficult and costly. Furthermore, the industry faces risks related to BOP malfunctions, which, despite advancements, continue to occur due to design flaws, inadequate testing, or operational errors. Any failure in a BOP system can lead to catastrophic events, environmental damage, and legal liabilities, intensifying the pressure on manufacturers and operators to ensure flawless performance.

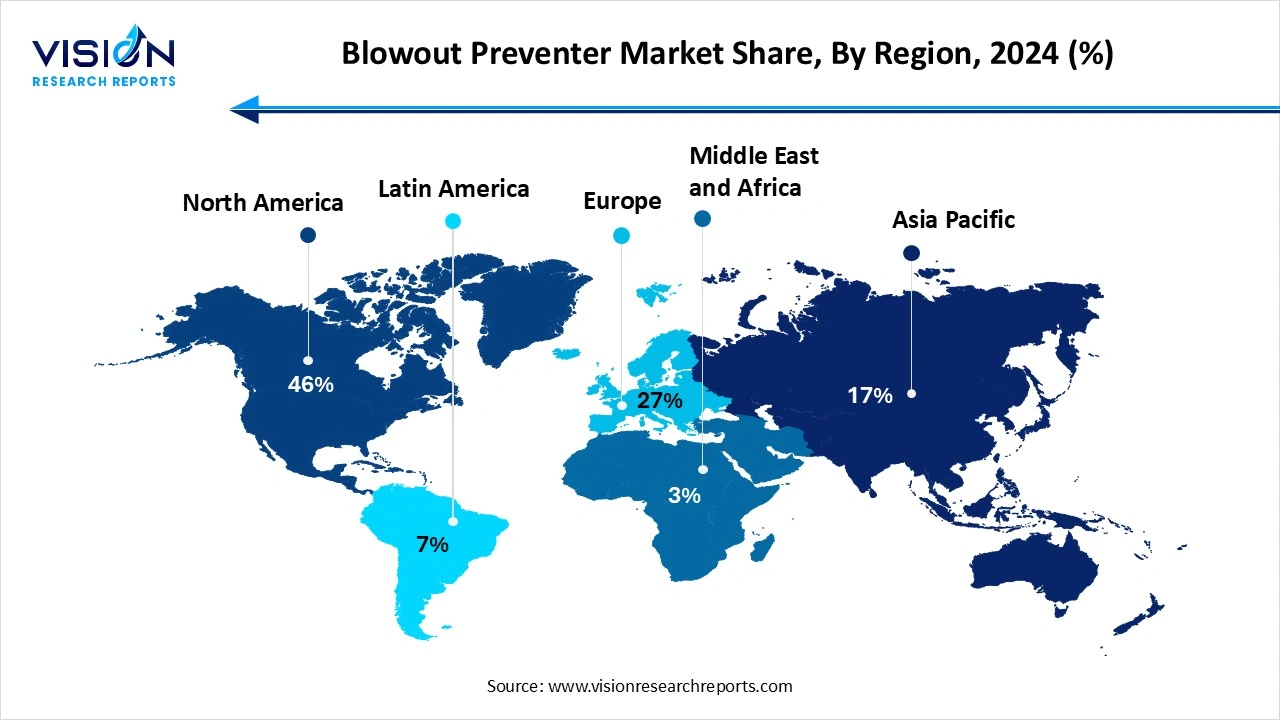

The North America blowout preventer market led the global industry, capturing the largest revenue share of more than 46% in 2024. The United States, in particular, stands out as a major contributor, driven by robust shale gas and tight oil production, especially in regions like the Permian Basin, Eagle Ford, and Bakken formations. Additionally, the Gulf of Mexico remains a hotspot for offshore exploration and drilling, necessitating the use of high-performance and reliable BOP systems to maintain well control and ensure safety in deepwater and ultra-deepwater operations.

Europe’s blowout preventer market is witnessing notable growth, propelled by rising energy insecurity and shifting geopolitical dynamics. The decline in natural gas output and growing concerns over supply stability have intensified the focus on domestic oil and gas exploration. As a result, nations such as Norway and the United Kingdom are ramping up hydrocarbon production efforts, driving greater demand for reliable and technologically advanced blowout preventer systems to ensure operational safety and energy resilience.

Europe’s blowout preventer market is witnessing notable growth, propelled by rising energy insecurity and shifting geopolitical dynamics. The decline in natural gas output and growing concerns over supply stability have intensified the focus on domestic oil and gas exploration. As a result, nations such as Norway and the United Kingdom are ramping up hydrocarbon production efforts, driving greater demand for reliable and technologically advanced blowout preventer systems to ensure operational safety and energy resilience.

The ram blowout preventer segment held the highest revenue market share, exceeding 50% in 2024, based on type. These BOPs use steel rams that move inward to seal the wellbore, making them suitable for high-pressure drilling activities. The market for ram BOPs is driven by their ability to accommodate different configurations such as blind rams, shear rams, and pipe rams, which enhance their utility across various well control scenarios.

The annular blowout preventers hold a significant share in the market due to their unique design and ability to seal around any object in the wellbore or even close off an open hole. Annular BOPs use a rubber or elastomeric sealing element that can conform to a wide range of shapes and sizes, offering flexibility that ram BOPs cannot. This makes them particularly valuable during tripping operations and initial well control stages. Their compatibility with various drilling tools and adaptability to different borehole conditions make annular BOPs an essential component in any BOP stack.

The oil and gas segment dominated the market by end-use, contributing over 89% in 2024, of the total revenue share. In the upstream segment of the oil and gas industry, blowout preventers are essential equipment designed to seal, control, and monitor oil and gas wells to prevent blowouts, which are uncontrolled releases of crude oil or natural gas. As exploration and production activities expand into deeper and more complex offshore and onshore reservoirs, the demand for advanced BOP systems has increased significantly.

The oil and gas industry's ongoing investments in deepwater and ultra-deepwater projects, coupled with the growing emphasis on safety standards and regulatory compliance, continue to drive the adoption of blowout preventers. With increasing global energy demand and the continuous need for reliable hydrocarbon sources, drilling activities have intensified, particularly in regions such as the Middle East, North America, and Africa. This has necessitated the use of technologically sophisticated BOP systems capable of withstanding extreme operating conditions.

By Type

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Blowout Preventer Market

5.1. COVID-19 Landscape: Blowout Preventer r Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Blowout Preventer Market, By Type

8.1. Blowout Preventer Market, by Type, 2024-2033

8.1.1. Annular Blowout Preventers

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Ram Blowout Preventers

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Hybrid Blowout Preventers

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Blowout Preventer Market, By End Use

9.1. Blowout Preventer Market, by End Use, 2024-2033

9.1.1. Oil & Gas

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Geothermal

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Mining

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Pharmaceutical Water Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by End Use (2021-2033)

Chapter 11. Company Profiles

11.1. Schlumberger Limited

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Baker Hughes Company

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Halliburton Company

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. National Oilwell Varco, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Weatherford International plc

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. The Weir Group PLC

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Dril-Quip, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Uztel S.A.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Control Flow Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Rongsheng Machinery Manufacture Ltd.

11.10. Nexus Pharmaceuticals

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others