The global tallow market size was estimated at around USD 8.15 billion in 2022 and it is projected to hit around USD 15.5 billion by 2032, growing at a CAGR of 6.64% from 2023 to 2032. The tallow market in the United States was accounted for USD 0.7 million in 2022.

Key Pointers

Report Scope of the Tallow Market

| Report Coverage | Details |

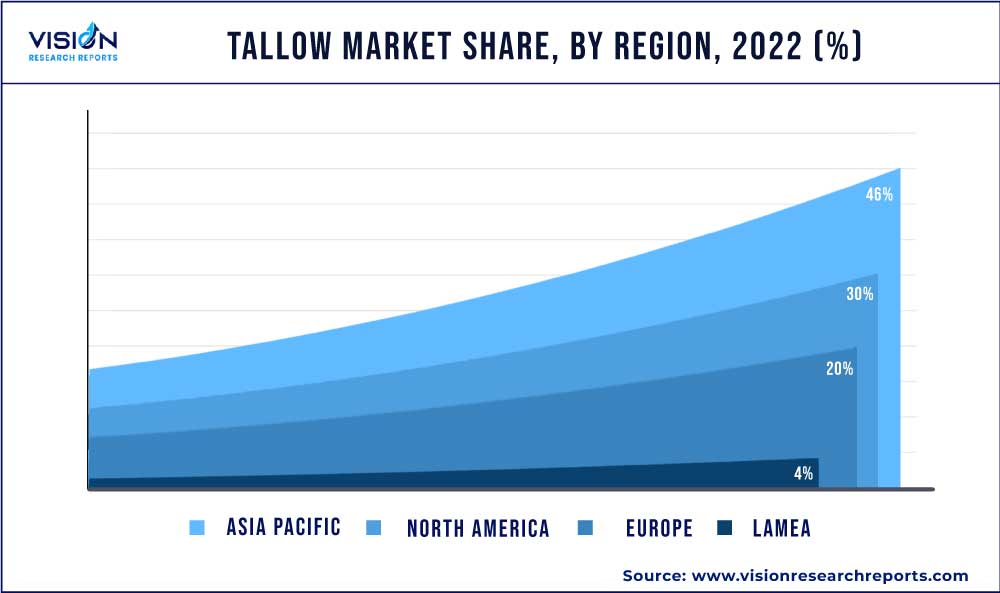

| Revenue Share of Asia Pacific in 2022 | 46% |

| CAGR of North America from 2023 to 2032 | 6.66% |

| Revenue Forecast by 2032 | USD 15.5 billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.64% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Saria SE & Co. KG; Darling Ingredients; Cargill; Ajinomoto Co. Inc; Vantage Specialty Chemicals; Jacob Stern & Sons Inc; Australian Tallow Producers; Parchem; Baker Commodities Inc.; Cailà & Parés |

The market growth for tallow is majorly driven by factors, such as the rising consumption of meat products coupled with the rising usage of tallow in the pharmaceutical and cosmetic industry. There is an increased demand for meat and meat products. This trend has led to higher production levels in the meat industry, resulting in a greater supply of tallow as a byproduct. The availability of tallow from meat processing facilities can influence its market demand and utilization in various industries. Furthermore, the increasing number of industrial meat processing facilities is another key factor driving product demand.

These facilities handle large volumes of animal carcasses and generate substantial amounts of fat byproducts. Tallow, being a valuable and versatile component, is extracted and utilized for various purposes, including industrial applications and animal feed. In addition, tallow is utilized in the production of various cosmetics and skincare products. It possesses excellent moisturizing and emollient properties, making it beneficial for skin hydration and nourishment. Tallow's natural fatty acid composition makes it compatible with the skin's lipid barrier, aiding in moisturization and protection. The UK-based skincare company Remnant Beauty offers lard-based night cream and tallow-balm moisturizer.

Animal Source Insights

The cattle/bovine segment held the largest share of 47% in terms of revenue in 2022. Easy availability of cattle/bovine-based tallow is the primary factor driving the growth of the segment. This availability can make beef tallow a more economically viable option compared to other types of tallow, especially in regions where beef and mutton consumption and production are prevalent. Flavor & ingredient manufacturer, Synergy offers a wide range of beef flavors including roasted beef, steak, pan juice, and tallow flavors.

The sheep/goat tallow segment will witness the fastest CAGR of 7.14% from 2023 to 2032. Sheep tallow possesses distinct characteristics that make it desirable for specific applications. Compared to other animal fats, sheep tallow has a higher melting point, which makes it suitable for products that require solid fats, such as candles and soaps. Its higher stearic acid content contributes to the hardness and stability of the end products.

Application Insights

The food & beverage segment held the largest share of 35% in terms of revenue in 2022. Factors, such as higher shelf stability coupled with ideal preservative properties, are driving the demand for the segment. Considering the increasing concerns about the health risks associated with trans fats, tallow has been explored as a potential alternative to partially hydrogenated oils, which are a significant source of trans fats. Tallow can serve as a natural, non-hydrogenated fat option in food manufacturing, providing functional properties without any negative health implications of trans fats.

On the other hand, the pharma, personal care & cosmetics segment showcased a significant CAGR of 6.24% during the forecast period. The growing consumer preference for natural and sustainable ingredients has driven the demand for tallow owing to its renewable nature. It is derived from animal sources, and when sourced responsibly, it can be considered a byproduct of the meat industry, reducing waste and promoting sustainability.

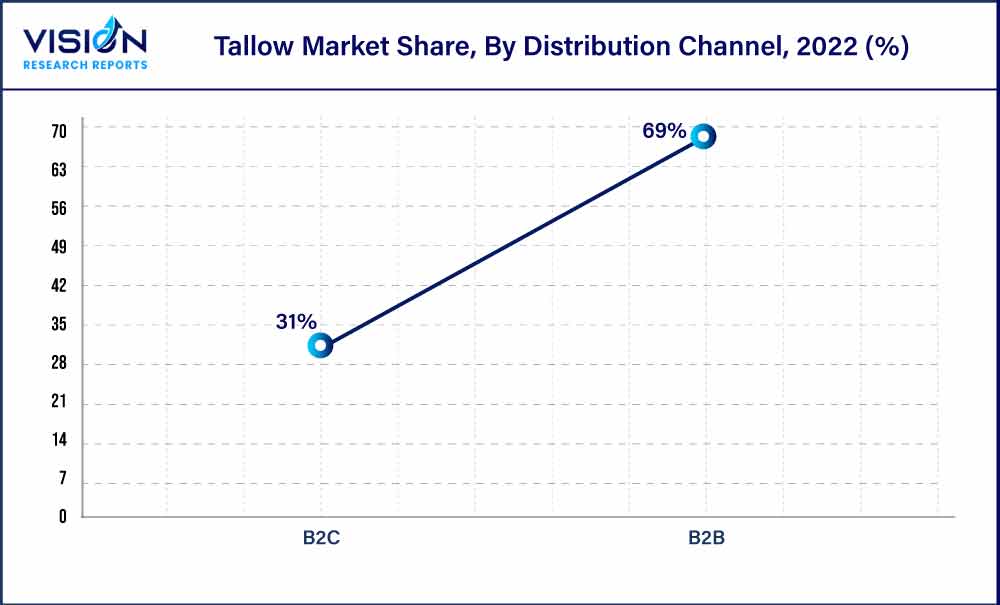

Distribution Channel Insights

The distribution channel segment is bifurcated into the B2B and B2C segment. The B2B segment held the largest share of 69% in 2022. The product demand in the B2B sector from food manufacturers arises from the need for specific fat properties, such as stability at high temperatures for frying applications or as an ingredient in baked goods. Tallow has applications in the food processing and production sector. It is commonly used in the manufacturing of shortenings, margarine, and cooking oils. It can provide functional benefits, such as enhancing flavor, improving texture, and increasing the shelf life of food products.

The B2C segment is anticipated to grow at a CAGR of 6.23% during the forecast period. The increasing consumer interest in natural and organic products has sparked a growing product demand. As a natural product, tallow is preferred by individuals seeking alternative cooking ingredients or those interested in traditional food preparation methods. The demand for natural and organic options is likely driving the demand for tallow in these markets.

Regional Insights

In terms of region, the Asia Pacific region held a dominant revenue share of 46% in 2022. Tallow is a common ingredient in the production of soaps, detergents, and other personal care products. The growth of the personal care industry in Asia Pacific is driving the demand for tallow. In addition, tallow is a cost-effective ingredient compared to some alternatives used in soap and detergent production. Its availability as a byproduct of the meat industry can make it a readily accessible and affordable option for manufacturers, especially in regions with a strong livestock sector.

Furthermore, the market for tallows in Australia & New Zealand showcased a significant CAGR of 4.53% over the forecast period owing to the easy availability of bovine for tallow manufacturing. The North America region is expected to witness a CAGR of 6.66% owing to the high demand for tallow in the feed industry in the United States. The increasing demand for meat and dairy products, coupled with the growth of the livestock industry, contributes to the need for tallow as a feed ingredient.

Tallow Market Segmentations:

By Animal Source

By Application

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Animal Source Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Tallow Market

5.1. COVID-19 Landscape: Tallow Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Tallow Market, By Animal Source

8.1. Tallow Market, by Animal Source, 2023-2032

8.1.1 Cattle/Bovine

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Sheep/Goat

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Pig

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Tallow Market, By Application

9.1. Tallow Market, by Application, 2023-2032

9.1.1. Food & Beverage

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Animal/Pet Feed

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Pharma, Personal Care & Cosmetics

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Tallow Market, By Distribution Channel

10.1. Tallow Market, by Distribution Channel, 2023-2032

10.1.1. B2B

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. B2C

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Tallow Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Animal Source (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 12. Company Profiles

12.1. Saria SE & Co. KG

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. PayPal Holdings, Inc.

12.2.1. Company Overview

12.2.2. Darling Ingredients

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Cargill

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Ajinomoto Co. Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Vantage Specialty Chemicals

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Jacob Stern & Sons Inc

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Australian Tallow Producers

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Parchem

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Baker Commodities Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Cailà & Parés

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others