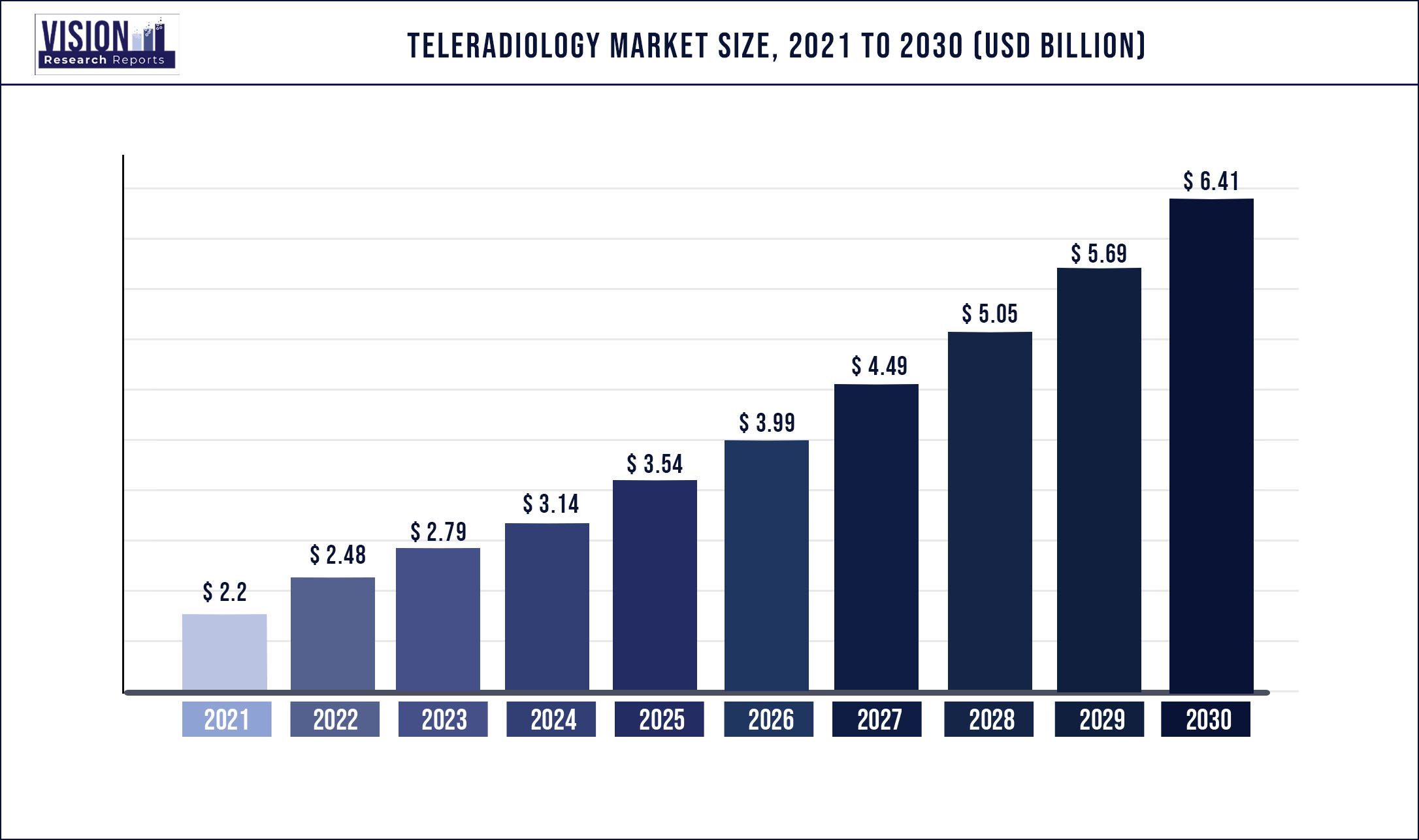

The global teleradiology market was valued at USD 2.2 billion in 2021 and it is predicted to surpass around USD 6.41 billion by 2030 with a CAGR of 12.62% from 2022 to 2030.

Report Highlights

The growing prevalence of chronic disorders, the introduction of technologically advanced diagnoses, and an increasing need for teleradiology for emergencies and second opinions are stimulating demand for teleradiology services.

The shortage of radiologists coupled with a continuously rising demand for imaging procedures is also expected to drive market growth. Although, the number of radiology equipment installed in the countries such as the U.K., U.S., and Singapore has increased over years; however, it is unable to meet the rising demand for diagnostics imaging. For instance, as per the NHS report, the average waiting time for an MRI test is reported to be 22 days in England in the year 2021.

In addition, legislative amendments made by the various governments worldwide for diagnostic imaging services will enhance the growth of this market during the forecast period. For instance, amendments in Australia’s Health Insurance Act 1973 for diagnostic imaging have enabled Medicare funding for these diagnostic imaging services since March 2008. This has allowed better access to diagnostic imaging for various conditions. North America was the major regional market in 2021 and accounted for 39.09% of the global share due to the factors, such as the higher amount of funding for R&D, patient awareness levels, and cancer prevalence.

Aging is considered as the greatest risk factor for developing degenerative disorders of the joints, such as osteoporosis. Thus, the growing geriatric population, globally, is expected to be a high-impact rendering driver of the market. Osteoarthritis and osteoporosis are some of the most common disorders in the population aged over 70 years. The growing prevalence of these disorders is leading to an increase in the economic burden on many countries, thereby growing demand for teleradiology.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 2.2 billion |

| Revenue Forecast by 2030 | USD 6.41 billion |

| Growth rate from 2022 to 2030 | CAGR of 12.62% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, report type, end-use, region |

| Companies Covered |

Virtual Radiologic (vRad); Agfa-Gevaert Group; ONRAD, Inc.; Ever light Radiology; 4ways Healthcare Ltd.; Ram Soft, Inc.; USARAD Holdings, Inc.; Koninklijke Philips N.V., Matrix (Teleradiology Division of Radiology Partners), Medica Group PLC., 5C Network |

Product Insights

Based on product, the market is segmented into nuclear radiology, X-ray, MRI, CT, and ultrasound. The X-ray segment dominated the market in 2021 and is expected to expand at the fastest CAGR during the forecast period. Economical pricing, high usage in primary diagnosis, and the introduction of innovative systems, such as filmless x-ray systems, are some of the factors responsible for the segment’s dominance. Moreover, this technique finds wide applications in various healthcare domains, such as orthopedics, cardiovascular diagnostics, chest imaging, cancer screening, and dental imaging.

Computed Tomography (CT) segment is also expected to witness significant growth during the forecast period. CT provides faster and clearer images of complex body organs, such as the brain, cardiac cavities, and lungs, which contribute to its growth. Increasing technological advancements and digitalization in this field are also expected to support the growth of this segment. For instance, in March 2019, Siemens Healthineers, and GE Healthcare, launched a Go platform cardiac CT scanner.

The ultrasound market segment is also expected to grow at a healthy rate during the forecast period. The ability of ultrasound in accessing critical health parameters quickly, without radiation exposure, makes it an important technology in a limited resource setting. Moreover, teleradiology-based ultrasound devices are being extensively used to deliver training and education programs to health workers in remote areas. For instance, Philips in collaboration with PURE (non-profit organization) delivers training on the usage of tele-ultrasound technology to healthcare workers in Rwanda, Africa.

Report Type Insights

Based on report type, the market is segmented into preliminary reports and final reports. The preliminary report segment held the largest market share of 65.21% in 2021 and is expected to continue its dominance throughout the forecast period. Preliminary reports are a general practice in emergency care, as it is generated at a much faster rate than final reports and economical. Providers get improved insurance coverage at hospitals and imaging centers during non-business hours. Thus, it is anticipated to grow at a faster rate.

However, many providers are now inclined towards final reads, due to accurate and in-depth results with reduced errors. Medicare policies are shifting from more reimbursement to final read and preliminary reads with extensive radiologist’s reports than traditional preliminary reads.

Growing competition in teleradiology services has led to technological advancements that make it simpler for off-site radiologists to communicate with the facilities for which they read, thus encouraging teleradiology providers to deliver more final reads. This contributes to the high CAGR of the final report segment, during the forecast period. The time consumed by these reports is more and the cost associated with it eventually raises, accounting for its smaller market size.

End-Use Insights

Hospitals held the largest market share in the teleradiology market in 2021 and are expected to grow at a significant rate during the forecast period. Hospitals use teleradiology services for urgent care, primary diagnosis, and secondary opinion. However, teleradiology services are generally preferred in emergency care. For instance, if a patient visits a hospital with severe head trauma during the absence of a neuroradiologist, then teleradiology services help in quicker diagnosis and promptly delivering treatment.

Therefore, the rising number of emergency visits in hospitals is expected to drive market growth during the forecast period. In addition, hospitals save the cost of hiring radiologists by adopting teleradiology services. For instance, the Yorkshire Imaging Collaborative, an initiative of the hospital trust, collaborated with Agfa Healthcare to launch a diagnostic image-sharing platform named, XERO Exchange Network, in 2020. These enabled radiologists to make quick diagnoses of around 3.0 million patients

The radiology Clinics segment is expected to grow at the fastest rate during the forecast period. Fatty pays for radiologists coupled with rising imaging costs is the factor expected to drive the segment growth during the forecast period. According to the NCBI report, the average monthly pay of an Indian radiologist (5-year experience) is approximately USD 5000, and around 10-15% of the salary is added to the total bill of each scan. Therefore, the rising demand to reduce healthcare costs is expected to aid the market growth in the long run.

Ambulatory Imaging Center (AIC) market is also expected to grow at a healthy rate during the forecast period. The rising demand for imaging procedures, cost-effectiveness, and shortage of radiologists are the major factors contributing to the growth of the Segment. The major problem faced during an imaging procedure is the time taken for its diagnosis. For instance, as per the NCBI report, in the UK the average time taken by a radiologist in a normal setting to report MRI is 21 days. AICs help in reducing this diagnosis time and hence leading to its adoption for various imaging procedures.

Regional Insights

North America held the largest market share of 39.11% in 2021 and is likely to maintain its dominance throughout the forecast period. The growing target population base, increasing prevalence of chronic disorders, and presence of major market players in the region are the major factors, contributing to the market growth. In addition, developed infrastructure, supportive government initiatives, and increasing demand for efficient radiology solutions are likely to further drive the regional market.

Asia Pacific is expected to witness the fastest CAGR of 13.82% during the forecast period. This can be attributed to the large unmet healthcare needs coupled with the rapidly expanding healthcare infrastructure in the region. In developing economies such as India and China a major proportion of the population resides in rural areas where they have limited access to healthcare, as most of the advanced care facilities are established in urban areas.

Therefore, hospitals and organizations are looking to tap this unexploited market considering the benefit at the bottom of the pyramid. This is expected to increase the demand for cost-effective diagnostic interventions such as teleradiology services, especially in countries with inefficient coverage policies.

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Teleradiology Market

5.1. COVID-19 Landscape: Teleradiology Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Teleradiology Market, By Product

8.1. Teleradiology Market, by Product, 2022-2030

8.1.1 X-ray

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Ultrasound

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Magnetic Resonance Imaging (MRI)

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Computed Tomography (CT)

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Nuclear Imaging

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Teleradiology Market, By Report Type

9.1. Teleradiology Market, by Report Type, 2022-2030

9.1.1. Preliminary Reports

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Final Reports

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Teleradiology Market, By End-Use

10.1. Teleradiology Market, by End-Use, 2022-2030

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Ambulatory Imaging Center

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Radiology Clinics

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Teleradiology Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.1.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.2.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.3.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-Use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Report Type (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-Use (2017-2030)

Chapter 12. Company Profiles

12.1. Virtual Radiologic (vRad)

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Agfa-Gevaert Group

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. ONRAD, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Ever light Radiology

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. 4ways Healthcare Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Ram Soft, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. USARAD Holdings, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Koninklijke Philips N.V.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Matrix (Teleradiology Division of Radiology Partners)

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Medica Group PLC

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others