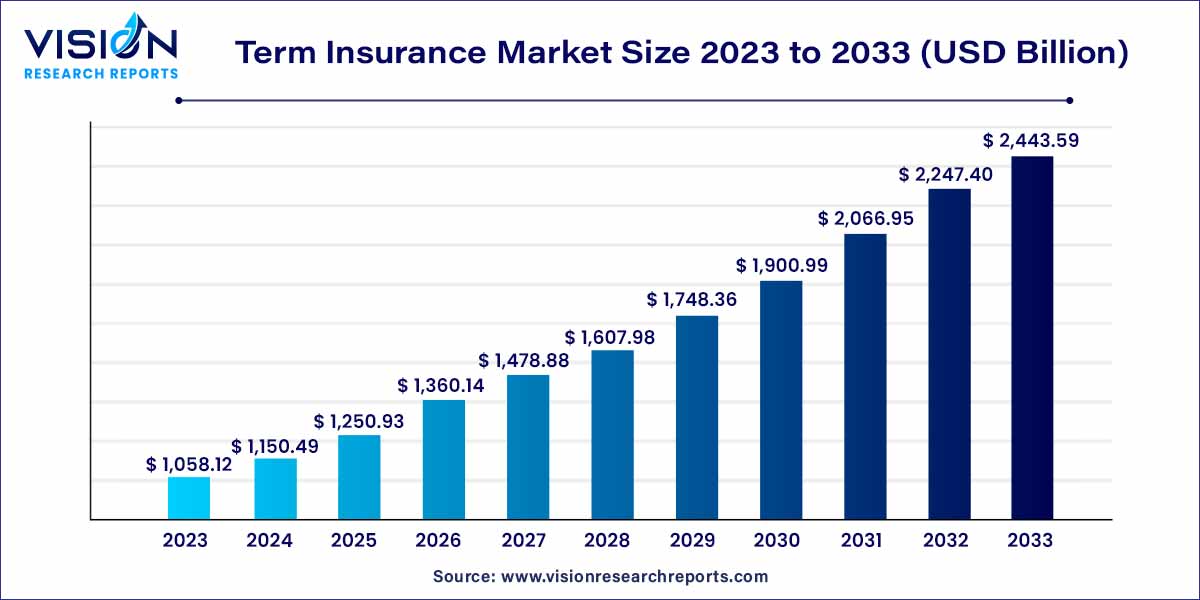

The global term insurance market was surpassed at USD 1,058.12 billion in 2023 and is expected to hit around USD 2,443.59 billion by 2033, growing at a CAGR of 8.73% from 2024 to 2033.

The term insurance market encompasses a significant segment within the broader insurance industry, offering a distinctive approach to providing financial protection for individuals and their families. This form of life insurance is characterized by its simplicity, affordability, and focused coverage, making it a popular choice among consumers seeking risk mitigation without the complexities often associated with other insurance products.

The growth of the term insurance market is propelled by several key factors. Increasing awareness of the importance of financial planning and the need for comprehensive risk coverage has significantly contributed to the market's expansion. As individuals recognize the necessity of safeguarding their families' financial well-being, the simplicity and transparency of term insurance make it an attractive option. Affordability is another driving factor, with the straightforward structure of term insurance policies often resulting in lower premiums compared to other life insurance products. Demographic shifts, especially the rise of a financially conscious younger population, further fuel the demand for term insurance. Insurers' commitment to innovation and customization, offering options such as critical illness or disability riders, enhances the market's adaptability to diverse consumer needs. With these factors in play, the term insurance market is poised for sustained growth as it continues to address the evolving preferences of individuals seeking accessible and straightforward risk coverage.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 2,443.59 billion |

| Growth Rate from 2024 to 2033 | CAGR of 8.73% |

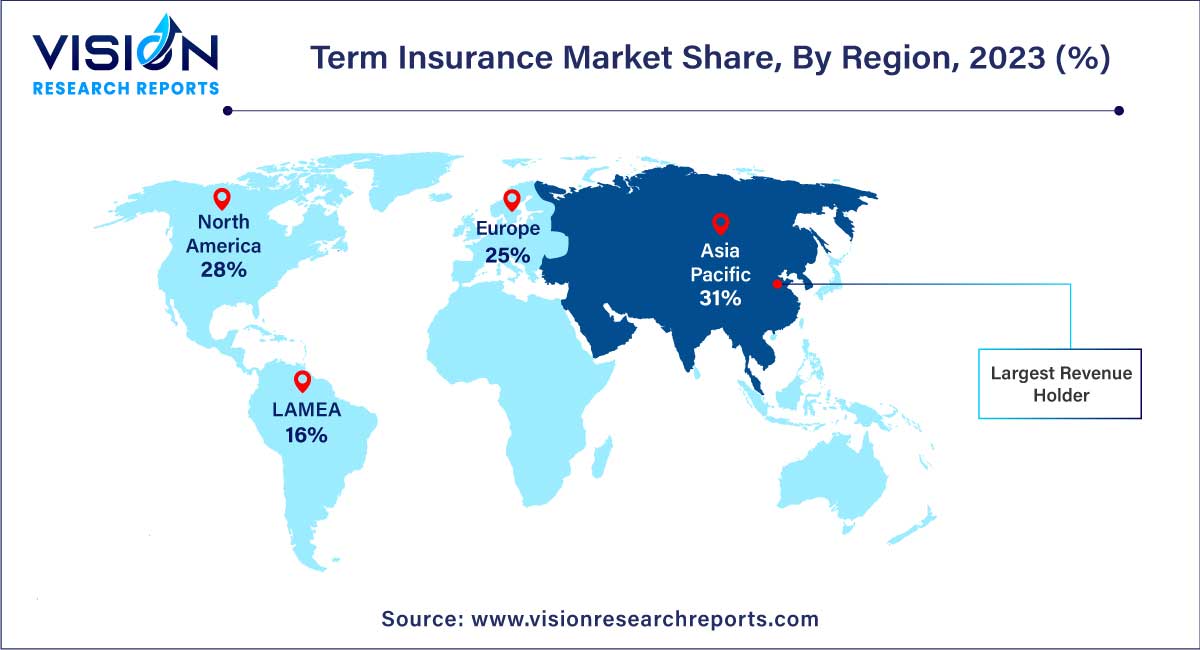

| Revenue Share of Asia Pacific in 2023 | 31% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The individual-level term life insurance segment dominated the market with the highest revenue share of 76% in 2023. Individual-level term insurance is a personalized life insurance product that offers coverage for a specified term, often ranging from 10 to 30 years. What sets it apart is that the premiums are determined based on the individual's health, age, and lifestyle factors. This unique approach tailors the policy to the insured person's specific circumstances, ensuring that they receive the most cost-effective coverage. The increasing demand for individualized financial protection, combined with the ease of customization, has fueled the segment's growth.

The group-level term insurance segment is anticipated to grow significantly over the forecast period. Group-level term insurance is a specialized form of life insurance designed for members of a particular group, such as employees within a company. It offers a collective coverage arrangement where the premiums and benefits are determined based on the characteristics and needs of the entire group. This results in more affordable rates for individual members due to the group's size and shared risk. The growth in this segment is primarily driven by the cost-efficiency it offers, making it an attractive employee benefit for businesses and organizations. Moreover, the ease of enrollment is further enhancing the segment's adoption.

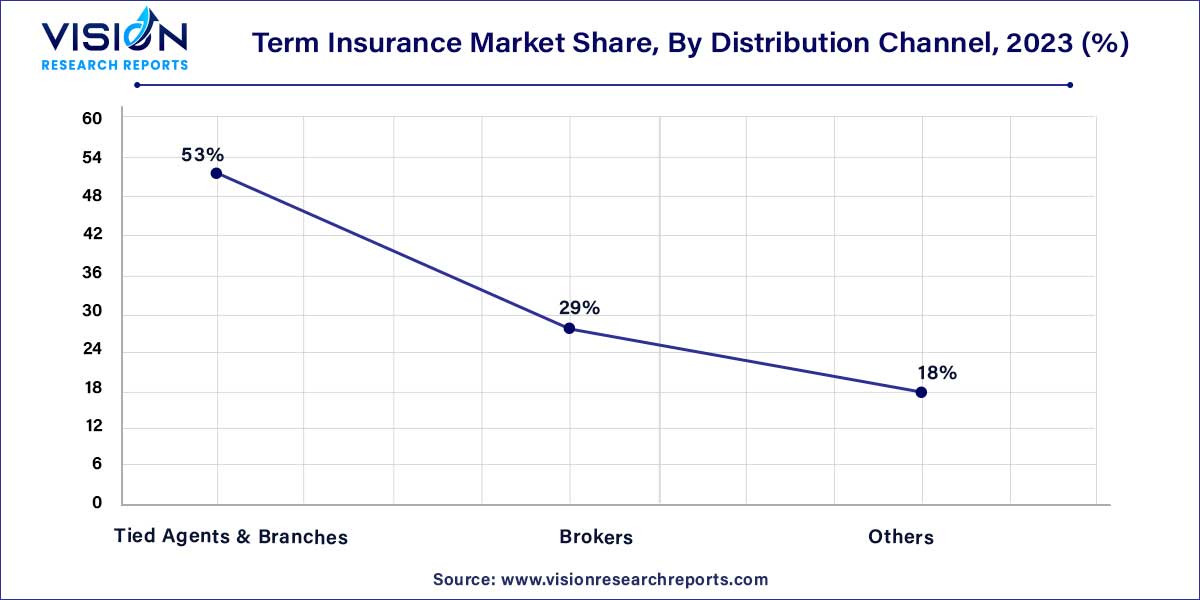

The tied agents & branches segment held the largest revenue share of 53% in 2023. Tied agents are playing a pivotal role as distribution channels in the market. These agents, exclusively affiliated with a single insurance company, are gaining prominence due to their in-depth product knowledge, personalized customer service, and strong brand association. Their deep client relationships, honed over time, foster trust, and client loyalty. Tied agents are instrumental in simplifying complex insurance options, making term insurance more accessible and comprehensible, thereby driving the growth of this segment.

The brokers segment is anticipated to register significant growth over the forecast period. Brokers serve as a significant distribution channel in the market. They offer unbiased advice and access to a wide range of insurance products from multiple providers. Their role in comparing options and finding tailored coverage solutions has gained popularity, especially as consumers seek greater customization and competitive pricing. This transparency and choice, coupled with the increasing consumer demand for comprehensive coverage, are driving the growth of brokers as a prominent and trusted distribution channel in the market.

Asia Pacific dominated the market with revenue share of 31% in 2023. The Asia Pacific region is witnessing significant growth in the market due to its large and diverse population, especially in emerging economies such as India and China. With aging demographics, awareness of the importance of life insurance is on the rise. Moreover, the presence of numerous life insurance companies in the region, coupled with government support and the embrace of digital technologies, is creating substantial opportunities for new product development and overall industry advancement.

Europe is predicted to grow at the remarkable CAGR over the forecast period. The market in Europe is experiencing significant growth due to a combination of factors. Regulatory changes, economic uncertainties, and an aging population have prompted individuals to seek financial security, driving increased demand for term insurance. Technological advancements and market competition have also played a pivotal role in the sector's expansion. This growth is indicative of a region increasingly recognizing the importance of term insurance as a valuable tool for financial planning and protection.

By Type

By Distribution Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Term Insurance Market

5.1. COVID-19 Landscape: Term Insurance Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Term Insurance Market, By Type

8.1. Term Insurance Market, by Type, 2023-2032

8.1.1. Individual Level Term Life Insurance

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Group Level Term Life Insurance

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Decreasing Term Life Insurance

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Term Insurance Market, By Distribution Channel

9.1. Term Insurance Market, by Distribution Channel, 2023-2032

9.1.1. Tied Agents & Branches

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Brokers

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Term Insurance Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 11. Company Profiles

11.1. MetLife Services and Solutions, LLC.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Aegon Life Insurance Company Limited

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Prudential Financial, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. The Northwestern Mutual Life Insurance Company

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. State Farm Mutual Automobile Insurance Company

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Massachusetts Mutual Life Insurance Company

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. American International Group, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Lincoln National Corporation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. John Hancock

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. China Life Insurance (Overseas) Company Limited

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others