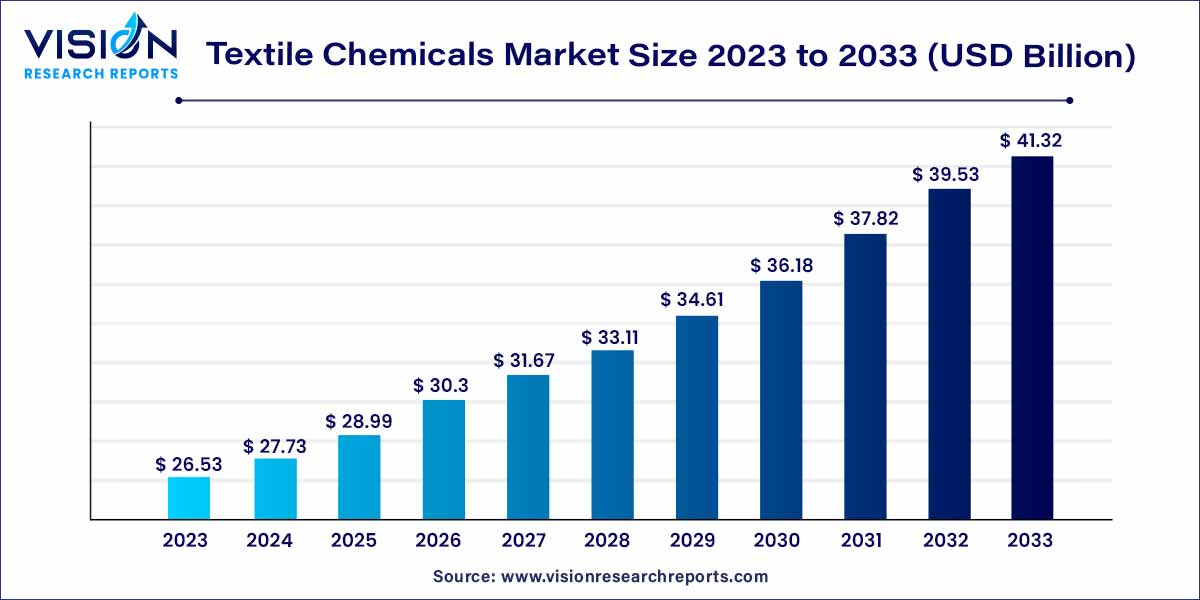

The global textile chemicals market size was estimated at around USD 26.53 billion in 2023 and it is projected to hit around USD 41.32 billion by 2033, growing at a CAGR of 4.53% from 2024 to 2033.

The textile chemicals market, a dynamic sector within the broader textile industry, plays a pivotal role in shaping the quality, functionality, and sustainability of textile products. As an integral component of the manufacturing process, textile chemicals contribute significantly to achieving desired aesthetic and performance attributes in fabrics. This overview provides a comprehensive insight into the key facets defining the landscape of the textile chemicals market.

The growth trajectory of the textile chemicals market is propelled by a confluence of factors contributing to its dynamic expansion. Foremost among these drivers is the escalating demand for high-performance and functionally enhanced textiles, fueled by evolving consumer preferences and industry trends. Technological advancements in textile manufacturing processes and the development of innovative chemical formulations further augment market growth, offering solutions that cater to the ever-changing landscape of fashion and textile applications. Additionally, the industry's increasing emphasis on sustainable practices amplifies market expansion, as eco-friendly dyeing solutions, water-saving finishing processes, and green chemistry gain prominence. The interplay of these factors, coupled with a competitive landscape fostering innovation and strategic collaborations, positions the textile chemicals market on a robust growth trajectory, poised to meet the demands of a discerning and environmentally conscious market.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 41.32 billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.53% |

| Revenue Share of Asia Pacific in 2023 | 58% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The coating process segment dominated the market with a revenue share of more than 72% in 2023. In the coating process, textiles are treated with specialized chemicals to impart specific functionalities and attributes. This can include enhancing resistance to elements such as water or fire, improving durability, or introducing innovative features like antimicrobial properties. The coating process is a critical step in meeting the diverse and evolving demands of industries such as technical textiles, where tailored functionalities are paramount. Innovations in coating technologies continue to drive this segment, offering solutions that not only meet functional requirements but also align with sustainability objectives.

Pretreatment is another integral facet of the textile manufacturing process, setting the foundation for subsequent treatments. This stage involves preparing the textile substrate by removing impurities, such as oils, waxes, and natural contaminants, ensuring a clean and receptive surface for further treatments like dyeing and finishing. Pretreatment processes contribute significantly to the quality and appearance of the final textile product, impacting factors such as color consistency and adhesion of subsequent treatments. In addition to enhancing the aesthetic qualities of textiles, effective pretreatment is essential for optimizing the efficiency of subsequent chemical applications, thus playing a pivotal role in overall manufacturing efficiency.

The coating and sizing chemicals segment led the market with a revenue share of 51% in 2023. Coating chemicals are meticulously formulated to provide textiles with specific attributes, ranging from water repellency and flame resistance to durability and enhanced color vibrancy. These chemicals create a protective layer on the textile surface, offering tailored solutions for diverse applications, including technical textiles and fashion fabrics. Innovations in coating technologies continue to drive this segment, responding to the industry's demand for textiles with advanced functionalities.

Sizing chemicals, on the other hand, are integral to the weaving process, contributing to the strength and resilience of yarns. Applied to warp yarns before weaving, sizing agents improve their smoothness and cohesion, preventing breakage during the intricate weaving process. This not only enhances the efficiency of textile production but also ensures the quality and integrity of the final fabric. Sizing chemicals are fundamental in optimizing the weaving process, allowing for the creation of textiles with precise characteristics and performance attributes.

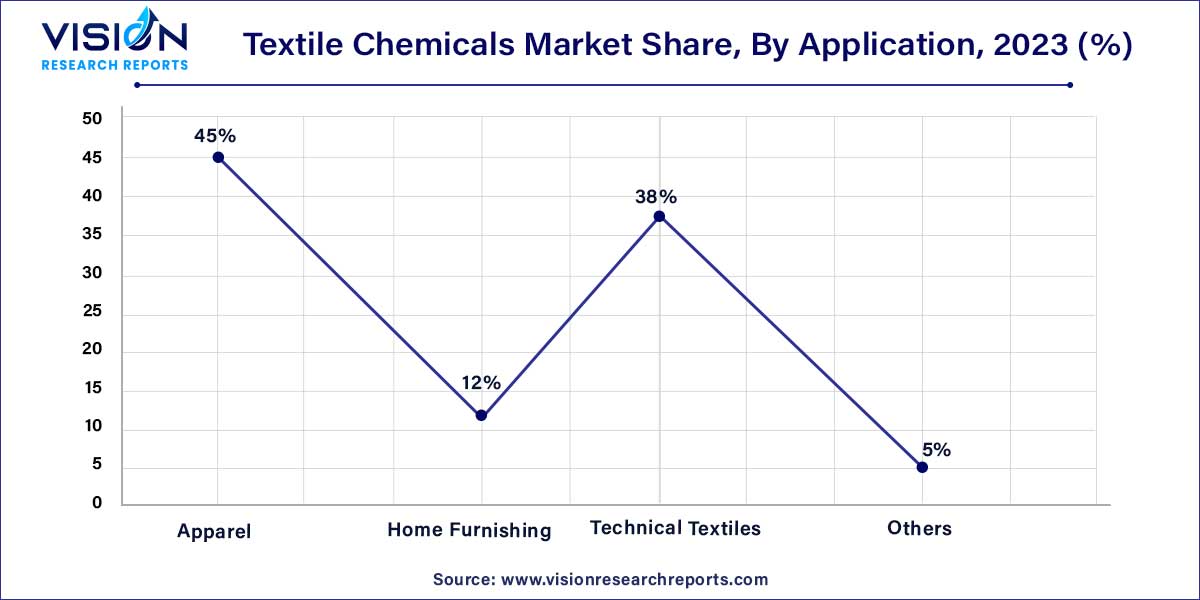

The apparel applications segment held the largest revenue share of 45% in 2023. In the apparel, textile chemicals play a crucial role in shaping the aesthetics, durability, and functionality of garments. Innovations in dyeing and finishing processes contribute to the vibrant colors and unique textures found in modern fashion. Additionally, textile chemicals enhance the performance characteristics of apparel, including aspects such as water repellency, stain resistance, and wrinkle-free finishes. The dynamic nature of the fashion industry constantly propels the textile chemicals market to evolve, ensuring that textiles not only meet the demands of style but also align with the lifestyle needs of the discerning consumer.

Home furnishings represent another cornerstone of textile chemical applications, influencing the comfort and visual appeal of living spaces. Textile chemicals contribute to the production of upholstery fabrics, curtains, and bedding materials, infusing them with qualities like softness, colorfastness, and resistance to wear. The demand for aesthetically pleasing and durable home textiles has driven the development of specialized chemical formulations that cater to the unique requirements of this segment. Additionally, the growing awareness of environmental sustainability has spurred the creation of eco-friendly textile chemicals, aligning with the preferences of consumers who seek responsible choices for their living spaces.

Asia Pacific dominated the market with a revenue share of more than 58% in 2023. In Asia-Pacific, particularly in countries like China and India, robust textile manufacturing industries contribute significantly to market growth. The region serves as a manufacturing hub, driven by the availability of raw materials, skilled labor, and a vast consumer base. The textile chemicals market in Asia-Pacific is characterized by a focus on cost-effective production methods and a growing emphasis on sustainable practices in response to environmental concerns.

The impact of COVID-19 on the Europe textiles industry was severe which negatively impacted the growth of the product market in Europe. However, favorable government support, the adoption of digitalization and sustainability, and the creation of robust supply chains are anticipated to improve market growth in Europe during the forecast period.

Evonik Industries AG introduced TEGO®Cycle additives in May 2023 with the goal of turning waste plastic into useful polymers. These additives, which address the recycling needs of textile chemicals and enable their sustainable reutilization, include odor absorbers, antifoams, processing aids, and wetting agents.

Archroma and Somelos teamed up in June 2023 to promote environmentally friendly cotton processing. Their partnership intends to implement a finishing procedure and a water-saving dye that prevents the production of effluent. This project demonstrates their dedication to the sustainability of the textile industry and their development of environmentally friendly solutions to preserve resources and improve environmental cleanliness.

By Process

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Process Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Textile Chemicals Market

5.1. COVID-19 Landscape: Textile Chemicals Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Textile Chemicals Market, By Process

8.1. Textile Chemicals Market, by Process, 2024-2033

8.1.1 Pretreatment

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Coating

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Treatment Of Finished Products

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Textile Chemicals Market, By Product

9.1. Textile Chemicals Market, by Product, 2024-2033

9.1.1. Coating & Sizing Chemicals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Colorants & Auxiliaries

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Finishing Agents

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Surfactants

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Denim Finishing Agents

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Textile Chemicals Market, By Application

10.1. Textile Chemicals Market, by Application, 2024-2033

10.1.1. Apparel

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Home Furnishing

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Technical Textiles

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Textile Chemicals Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Process (2021-2033)

11.1.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Process (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Process (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Process (2021-2033)

11.2.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Process (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Process (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Process (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Process (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Process (2021-2033)

11.3.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Process (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Process (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Process (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Process (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Process (2021-2033)

11.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Process (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Process (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Process (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Process (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Process (2021-2033)

11.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Process (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Process (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Kiri Industries Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. OMNOVA Solutions Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. German Chemicals Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. AB Enzymes.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Organic Dyes and Pigments.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Govi N.V.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Resil Chemicals Pvt. Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. LANXESS

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Dow.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. BASF SE

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others