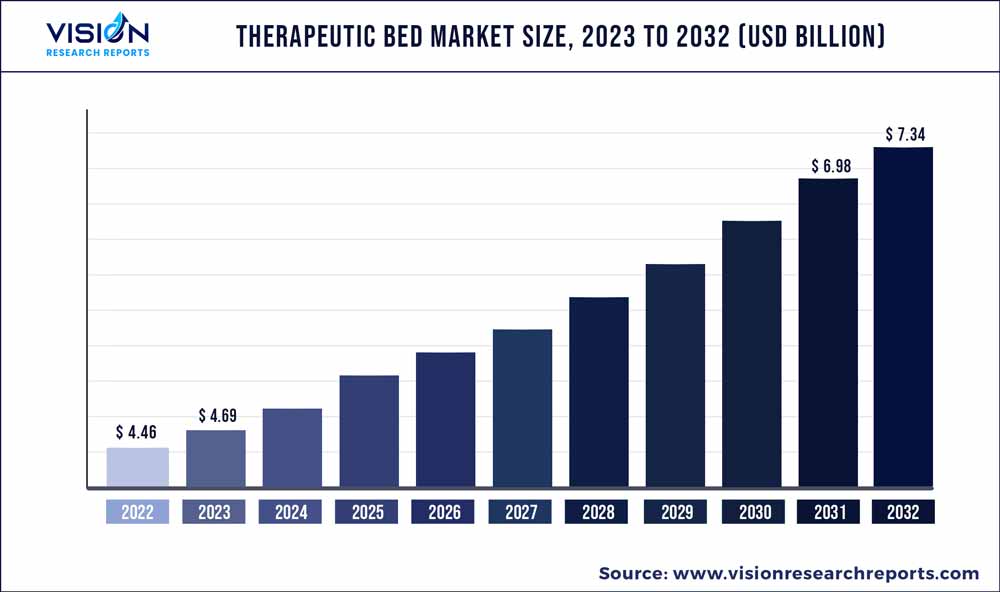

The global therapeutic bed market size was estimated at around USD 4.46 billion in 2022 and it is projected to hit around USD 7.34 billion by 2032, growing at a CAGR of 5.11% from 2023 to 2032. The therapeutic bed market in the United States was accounted for USD 299.9 million in 2022.

Key Pointers

Report Scope of the Therapeutic Bed Market

| Report Coverage | Details |

| Revenue Share of Europe in 2022 | 36% |

| Revenue Forecast by 2032 | USD 7.34 billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.11% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Hill Rom, Inc. (Baxter); Stryker Corporation; Invacare Corporation; Medline Industries; Medical Depot.Inc.; GF Health Products, Inc.; Centromed Ltd.; Arjo; Amico Group of Companies; Bakare Beds Ltd.; Gendron, Inc.; Hard Manufacturing Company Inc |

Key drivers expected to contribute to market growth include rising geriatric population, increase in disease burden, high unmet medical needs in emerging & low-growth economies, and increase in public & private healthcare expenditure to improve the number of beds to patient ratio. Moreover, rising demand for bariatric surgeries, ambulatory surgeries, inpatient surgeries, and critical care services for preoperative and postoperative procedures is also expected to boost the market over the forecast period.

The global need for therapeutic beds has risen significantly because of the COVID-19 outbreak and increased hospital admissions. Beginning in March 2020, the massive surge of the COVID-19 significantly impacted hospitals. In addition, the change from standard beds to specialty COVID-19 beds with additional hygiene measures, as well as pressure on the number of beds, which originated primarily from the need to anticipate sufficient capacity in the ICU, have all contributed to market growth. As a result, due to the pandemic in 2020, sales of therapeutic beds significantly increased. According to FDA in October 2020, due to the COVID-19 public health emergency, there has been a high demand for mattresses, hospital beds, and stretchers to enhance healthcare capacity in healthcare systems & local hospitals via temporary expansion sites. To address the same, manufacturers from several industries, who are not traditionally associated with medical devices manufacturing, are looking for resources to market and produce these devices for the healthcare community, which, in turn, the market is expected to grow at a significant pace over the forecast period.

The prevalence of chronic diseases, such as urological disorders, cancer, cardiovascular disorders, neurovascular diseases, and other chronic problems, is increasing, resulting in a considerable increase in hospital admission rates, which is expected to boost the market growth. Moreover, as a result of high blood pressure, obesity, and smoking, a large percentage of the population is currently in danger of developing chronic diseases. According to the WHO, chronic diseases are responsible for 60% of all fatalities worldwide, and every year, 17.9 million people die as a result of cardiovascular disorders. According to the same source, cancer is the leading cause of death globally, accounting for nearly one in every six deaths. As a result, increasing hospitalization, coupled with an increase in chronic illnesses, is likely to boost therapeutic bed installations, resulting in market growth.

Furthermore, the increasing population of obese people is also anticipated to boost the therapeutic beds market growth. Bariatric beds are specifically designed to handle obese patients. Incidence of obesity has increased significantly in the past few years, especially among the aged groups, which augments the difficulty of handling and moving obese patients. For instance, as per WHO, in 2016, more than 1.9 billion adults were overweight, out of which, around 650 million people were obese. These factors are expected to increase the demand for bariatric procedures. Similarly, as per the report published by the CDC in 2020, the rates of obesity rose considerably among adults from 33.7% to 39.6% between the years 2015 & 2016 and 2019 & 2020. During this time the rates of severe obesity also increased from 5.7% to 7.7%. As prevalence of obesity is increasing, the number of bariatric surgeries is also likely to increase, which is expected to directly drive the market.

Product Insights

Based on product, the market has been segmented into clinical beds, household beds and accessories. Clinical beds are further segmented into regular beds, ICU beds, pediatric beds, birthing beds, bariatric beds, low air loss beds and others. Clinical beds segment held the largest share of around 49% in 2022. High ICU admission rates, owing to an increase in the number of accidents, an ageing population, and outbreaks of life-threatening infectious diseases, are all driving to the segment's rise. Clinical therapeutic beds are specially designed beds intended to be used in controlled clinical environments such as nursing homes, diagnostic laboratories, and outpatient clinics. These beds have features such as electronic elevation, side railings, and wheels, which further enable portability, height adjustment, & patient protection. The overall objective of these beds is to provide greater comfort to patients and improve healthcare delivery.

However, the household beds segment is expected to grow at the highest CAGR during the forecast period. A rapid shift in consumer preferences toward long-term care settings along with impact of Covid-19 outbreak are expected to increase the demand for therapeutic beds. Additionally, rising geriatric population, technological advancements along with increasing prevalence chronic disorders, are all driving to the segment's rise. Household beds are intended to be used in nonclinical settings, such as assisted living facilities, hospice, and home care setting. These beds are intended for use in long-term recovery of patients, especially in postsurgical recoveries.

Application Insights

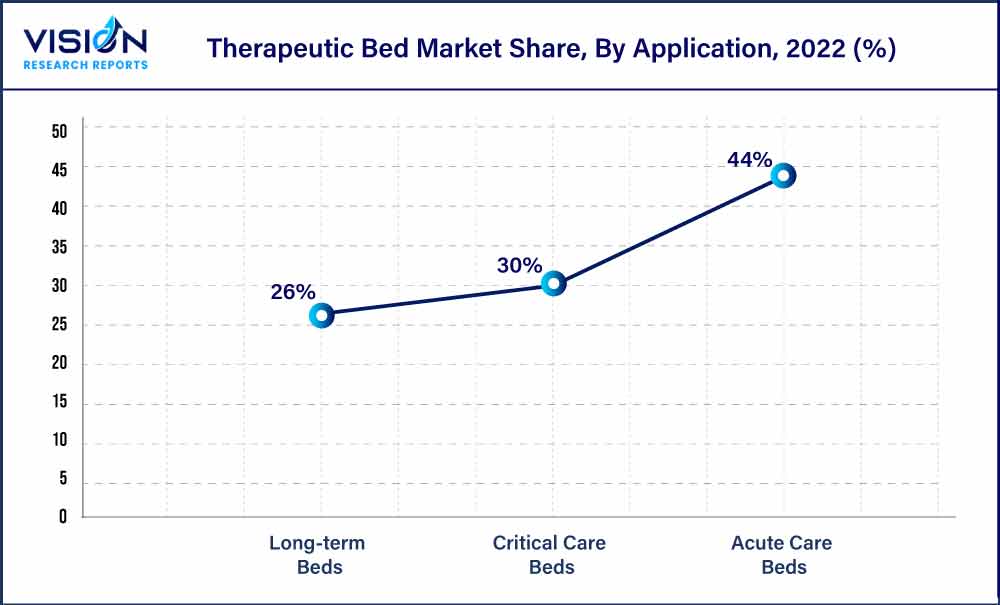

Based on application, the market has been segmented into acute care based therapeutic bed, critical care based therapeutic bed and long-term based therapeutic bed. Acute care beds segment held the largest share of around 44% in 2022. Short-stay hospital beds, such as general pediatric, medical/surgical, psychiatric, obstetric, and other short-stay specialty beds, are referred to as acute care beds. This can be attributed to their multifunctional applications such as manage labor (maternity), provide treatment to the injury, reduce the severity of mental illness, protect against exacerbation or complications, and perform diagnostic or therapeutic procedures. Moreover, the global acute care therapeutic beds segment is predicted to be fueled by an increase in the number of accidents, which would lead to more hospital admissions for emergency and elective care.

However, the long-term beds segment is expected to grow at the highest CAGR during the forecast period. The growing prevalence of chronic conditions, such as coronary heart diseases, which at a certain time require surgical removal and critical care along with technological advancements are anticipated to help this segment grow over the forecast period. Long-term assistance patients who require long-term care due to chronic disabilities and a diminished level of independence in everyday activities are accommodated in therapeutic beds. According to an article published by Kaiser Family Foundation in January 2020, long-term care facility costs account for the majority of Medicare beneficiaries' yearly out-of-pocket spending. Furthermore, the growing geriatric population in countries such as India and China, as well as increasing number of hospital admissions, are projected to drive segment growth.

End-use Insights

Based on end use, the market is segmented into hospitals & clinics, reproductive care centers and others. The hospitals & clinics segment has dominated the overall market of around 48% in 2022. The rising rate of hospitalization due to recent outbreaks of COVID-19 pandemics, the growing number of well-furnished, well-equipped, and advanced infrastructure hospitals, as well as an ageing population and rising prevalence of chronic diseases, are expected to propel the segment forward. Hospitals offer superior care to patients and provide reimbursements for certain procedures, which are further contributing to segment growth. Hospital also witnesses a significantly high inflow of patients for a number of surgeries, such as bariatric surgery, as compared to other healthcare settings, owing to ease of handling any emergencies that may arise during surgical procedures and availability of a broad range of treatment options.

On the contrary, other segments is expected to grow at the highest compound annual growth rate from 2023 to 2032. Elderly care facilities, emergency care, home care settings, and nursing institutions are some of the other end-use segments. The reducing length of hospital stay shifts focus to home healthcare, emergency care, and other facilities. The increasing demand for home healthcare for postsurgical recovery and other long-term ailments is anticipated to help in reducing the length of stay. This method reduces all the hassles hospitals must go through in inpatient management and also lowers the cost for patients. Thus, the shifting focus toward home care settings, emergencies, and other facilities is boosting the purchase of specialized beds, thereby driving market growth.

Regional Insights

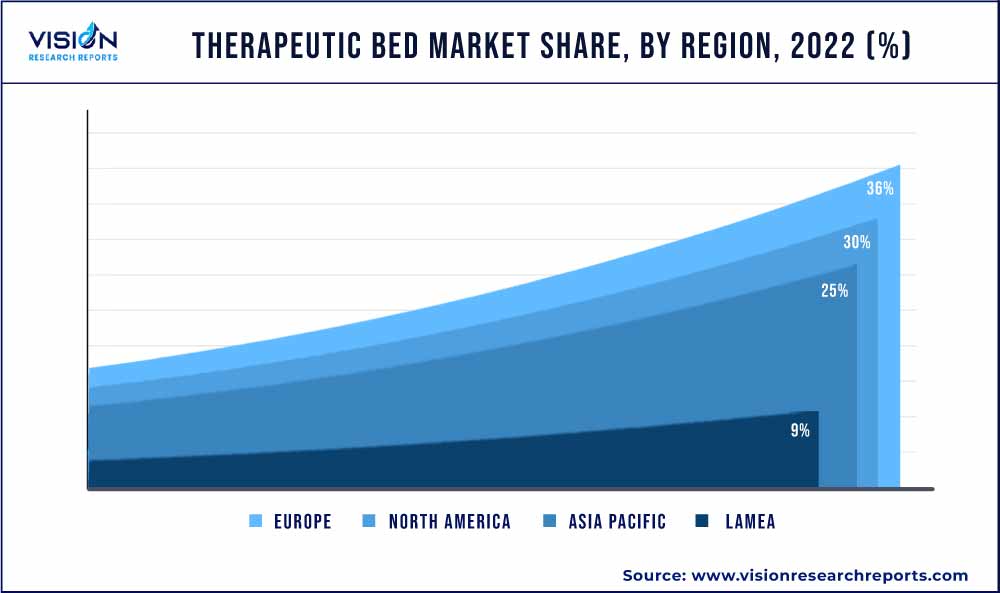

Europe commanded the largest share of the market in 2022 with the share of around 36%. Europe is one of the most developed regions globally with advanced technologies & well-established infrastructure. Market growth in this region can be attributed to the increasing number of road accidents & surgical procedures, presence of various key players, and introduction of technologically advanced products. According to EU’s Annual Accident Report 2021 published by European Road Safety Observatory, an estimated 18,800 people died in road accidents in the previous year, accounting for a 17% decrease from the previous year. This means that in 2021, over 4,000 fewer persons died due to road accidents in the EU than in 2020.The availability of robust distribution channels and ease of access to healthcare technologies are among factors further encouraging adoption of therapeutic beds in Europe. Moreover, the impact of COVID-19 is expected to boost market growth. Over 2.7 million patients have been hospitalized due to COVID-19 in Europe alone since the start of the coronavirus pandemic.

The Asia Pacific region is anticipated to witness a robust growth rate over the forecast period. Increasing per capita income and economic development and the presence of high unmet needs of the huge population pool in this region is expected to contribute toward significant growth. Emerging economies, such as India and China, are the most lucrative markets due to increasing patient pool, improving public and private reimbursement infrastructure, and constant development of healthcare facilities. Increasing awareness about rehabilitation equipment, growing number of physicians, and supportive government programs & policies are expected to boost growth in this region In addition, increase in the number of hospitalizations and advancements in clinical development framework of developing economies are some of the other factors aiding market growth in the region.

Therapeutic Bed Market Segmentations:

By Product

By Application

By End-use

By Regional

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others