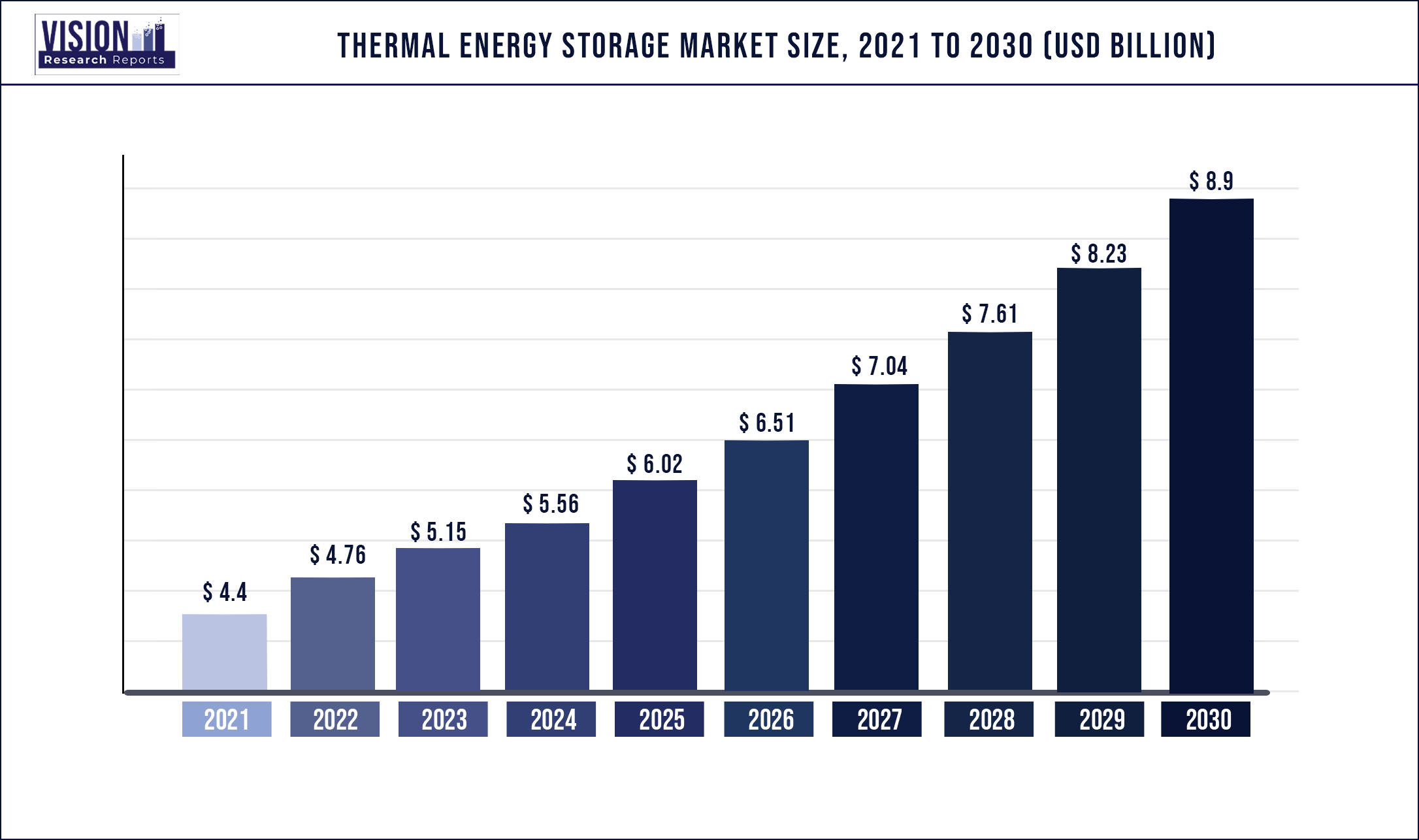

The global thermal energy storage market was valued at USD 4.4 billion in 2021 and it is predicted to surpass around USD 8.9 billion by 2030 with a CAGR of 8.14% from 2022 to 2030.

Report Highlights

Rising demand for cost competitive and efficient energy sources is likely to boost the market growth over the forecast period.

The market is primarily driven by the use of thermal energy storage as a major renewable option for electricity generation. Heat stored by seasonal and short-term thermal energy storage systems helps balance the variations in the production and distribution of renewable electricity in a cost-effective manner. Moreover, it is a sustainable energy source and causes no adverse environmental impact. Growing adoption of renewable energy is expected to positively influence the market growth.

Several thermal energy storage equipment manufacturers and service providers adopt strategies, such as collaborations, joint ventures, partnerships, agreements, and new product development, to cater to the changing technological requirements of different end users, thereby enhancing their foothold across the market. Major manufacturers include Evapco Inc.; Ice Energy; Caldwell Energy Company; and Abengoa Solar, S.A. The manufactured systems include ice thermal energy systems, heating terminals, heating pump chillers, heat exchangers, solar steam systems, air conditioning systems, heliostats, and parabolic trough collectors.

The global market is characterized by high competition and market players are focusing on forward integration by establishing their presence in manufacturing as well as distribution. Distributors in the value chain include thermal energy storage stations and plants, combined heat power (CHP) plants, microgrids, and cogeneration power plants as well as district energy, district heating and cooling, and process cooling.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 4.4 billion |

| Revenue Forecast by 2030 | USD 8.9 billion |

| Growth rate from 2022 to 2030 | CAGR of 8.14% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product type, technology, storage material, application, end user, region |

| Companies Covered |

BrightSource Energy Inc.; SolarReserve LLC; Abengoa SA; Terrafore Technologies LLC; Baltimore Aircoil Company; Ice Energy; Caldwell Energy; Cryogel; Steffes Corporation |

Product Type Insights

Sensible heat storage accounted for the largest revenue share of 46.5% in 2021. This can be attributed to rising demand for solar thermal systems, along with applicability across large scale HVAC systems. Provision of reversible charging and discharging facility for an infinite number of cycles is a key feature of the technology that will further enhance the product penetration.

The thermochemical heat storage segment is anticipated to exhibit the fastest CAGR of 14.3% over the forecast period. In this storage, the heat stored by different mediums is released when a reverse reaction takes place between them. Thermochemical storage systems provide high energy density as compared to latent or sensible heat storage systems. This form of heat storage is preferable for long-term storage as losses do not occur overtime, but only during charging and discharging phases.

Technology Insights

Molten salt technology occupied the largest revenue share of 32.2% in 2021 and is expected to witness significant growth over the forecast period. The growth of the segment can be attributed to its high technological efficiency, along with its usage in several solar energy projects. Molten salt is used to store the heat collected by means of solar troughs and solar towers. The heat collected by means of this technology is used to enable steam turbines by converting it to superheat steam.

Ice-based technology is anticipated to grow at a significant rate over the forecast period. Ice is used in ice storage air conditioning for the storage of thermal energy. The process is highly feasible as the heat of fusion of water is sufficiently high and can contain approximately 317,000 BTU or 334 mega joules (MJ) of energy in one metric ton of water. This energy is equivalent to approximately 26.5 ton-hours or 93 kWh. This application can be utilized to provide chilled water and air conditioning to a large number of commercial and residential buildings.

End-user Insights

The industrial segment accounted for the largest revenue share of 39.98% in 2021 and is projected to maintain its lead over the forecast period. Rising spending on infrastructure development and establishment will propel the demand for HVAC systems, which, in turn, will drive the industrial segment. Furthermore, growing adoption of these systems across several industries using large quantities of hot water for economic purposes will boost the segment growth.

The utilities segment is expected to witness the fastest growth over the forecast period. The segment comprises public services, such as broadband internet, transportation, telephone, sewage, water, natural gas, and electricity. Thermal energy is utilized to provide these public services at an extremely low cost. Cogeneration plants are employed to derive thermal energy and then convert it to the required form of energy.

The residential and commercial segment held a significant market share in 2021. Thermal energy plants are utilized to generate electrical energy to suffice the energy demand of the residential and commercial sectors. Electrical storage heaters and home storage units are also employed to store thermal energy in order to provide residential and commercial buildings with heating and cooling capacity as required.

Storage Material Insights

Molten salt accounted for the largest revenue share of 35.11% in 2021 owing to its usage as a thermal energy storage medium across several applications, including concentrated solar power plants. The molten salt stores solar energy for longer durations, thereby overcoming the short energy cycle restraint of thermal energy storage. Growing demand for concentrated solar power technology is expected to positively influence the TES market growth.

Water is the most commonly utilized material to store heat energy as it has a heat capacity of 4.2 J/(cms.K), which is considered to be one of the highest. It is often utilized in systems such as heat storage tanks, pebbles, concrete, and hot rocks. The steam generated is then utilized to power the turbines, which eventually generate low cost and efficient electricity.

Application Insights

The district heating and cooling segment accounted for the largest revenue share of 36.7% in 2021. The application of district cooling and heating is utilized to distribute the generated power in order to suffice commercial and residential requirements. This distributed energy is utilized for water heating, space heating, and air conditioning. The stored power is derived in cogeneration plants by burning biomass and fossil fuels. Various systems utilized for the generation of energy for district heating and cooling applications include central solar power and boiler stations.

The power generation segment is anticipated to witness the highest growth over the forecast period. Rising demand for uninterrupted and cost-efficient power supply from off grid and remote areas will drive the segment. Introduction of several government schemes regarding electricity generation from solar power plants will boost the power generation segment growth. The renewable power generation supplier receives retail electricity price for each unit generated and the extra power sold back to the grid under the feed-in tariff scheme.

Thermal energy is utilized for process heating and cooling application in order to change the chemical and physical properties of the desired material. Heat treatment is utilized for metalworking, industrial, and manufacturing processes. These processes require extreme cooling and heating in order to harden or soften the desired material. Various types of process include quenching, normalizing, tempering, strengthening, precipitation, case hardening, and annealing.

Regional Insights

Europe accounted for the largest revenue share of 31.27% in 2021 and is projected to maintain its lead over the forecast period. The region is characterized by a large number of thermal energy storage systems, which are utilized for space heating, water heating, district heating and cooling, and power generation. Spain is the largest contributor to the regional market growth owing to the large number of operational TES projects across the country, along with presence of major players, such as Abengoa Solar.

The government of Europe has developed a model which stores and distributes the energy as per the density of population in a specific region. This model is widely known as the European model. The federal government of Germany heavily invests in advanced research for the electrical energy storage field, pertaining to the storage field’s use in solar panels utilized for residential purposes.

The Engineering and Physical Sciences Research Council (EPSRC), UK, established the SUPERGEN Energy Storage Hub, for the research & development in energy storage technologies. The organization comprises of the participation of 7 universities & 14 companies. The various companies involved in this organization include, EDF Energy, Highview Power Storage, National Grid, Scottish & Southern Energy (SSE), UK Power Networks, PNU Power, Johnson Matthey, GDF SUEZ (UK), Department for Transport UK, Sharp Laboratories of Europe Ltd., Nexeon Ltd., Jaguar Land Rover, Energy Technologies Institute (ETI), and Arup (Ove Arup and Partner Ltd.) UK.

North America accounted for the second largest revenue share in 2021 owing to reduction in requirement for more extensive generation equipment during peak hour demand. Positive outlook towards renewable based power generation, along with increasing research and development activities aimed at energy storage systems, will augment the U.S. market growth.

The U.S. government is actively investing in renewable energy plants in order to achieve a future with sustainable energy. According to IEA, the government of the U.S. has introduced multi-year extension on tax credits for installation and operation of energy plants employing renewable energy, such as concentrating solar power (CSP), and thermal energy storage stations. Supportive government environment policies for the installation and operation of renewable energy plants & power stations are thereby boosting the regional demand for thermal energy storage.

The Government of the State of New York has established the Battery and Energy Storage Technology (NY-BEST) commercialization and test center in Rochester. The facility encompasses an area of 18,000 sq. ft. and costed approximately USD 23 million. The facility includes a collaboration of Rensselaer Polytechnic Institute, Troy, and Cornell University, Ithaca, which pull their resources together for validating various forms of energy storage for residential & commercial use.

The market in the Asia Pacific is anticipated to expand at the highest CAGR of 14.3% over the forecast period. Developing nations such as China, India, South Korea, Japan, Indonesia, and Malaysia are witnessing rapid growth in urbanization and population. These developing nations have many unreliable power grids and fundamental infrastructure systems. This factor is expected to compel industry participants to invest in these nations, and thus boost the growth of installations of thermal energy storage and distribution grids.

In India, the solar energy system capacity addition in 2019-20 was greater than that of all other energy sources, both renewable and conventional. The onshore wind energy capacity also experienced an increase in the region. Coal and wind energy added 4.6GW and 1.7GW respectively in 2019-20. The developing nation is expected to witness a rise in its thermal energy storage systems over the forecast period.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Thermal Energy Storage Market

5.1. COVID-19 Landscape: Thermal Energy Storage Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Thermal Energy Storage Market, By Product Type

8.1. Thermal Energy Storage Market, by Product Type, 2022-2030

8.1.1. Sensible Heat Storage

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Latent Heat Storage

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Thermochemical Heat Storage

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Thermal Energy Storage Market, By Technology

9.1. Thermal Energy Storage Market, by Technology, 2022-2030

9.1.1. Molten Salt Technology

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Electric Thermal Storage Heaters

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Solar Energy Storage

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Ice-based Technology

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Miscibility Gap Alloy Technology

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Thermal Energy Storage Market, By Storage Material

10.1. Thermal Energy Storage Market, by Storage Material, 2022-2030

10.1.1. Molten Salt

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Phase Change Material

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Water

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Thermal Energy Storage Market, By Application

11.1. Thermal Energy Storage Market, by Application, 2022-2030

11.1.1. Process Heating & Cooling

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. District Heating & Cooling

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Power Generation

11.1.3.1. Market Revenue and Forecast (2017-2030)

11.1.4. Analog, MEMS and Others

11.1.4.1. Market Revenue and Forecast (2017-2030)

11.1.5. Ice storage air-conditioning

11.1.5.1. Market Revenue and Forecast (2017-2030)

11.1.6. Others

11.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Thermal Energy Storage Market, By End-user

12.1. Thermal Energy Storage Market, by End-user, 2022-2030

12.1.1. Industrial

12.1.1.1. Market Revenue and Forecast (2017-2030)

12.1.2. Utilities

12.1.2.1. Market Revenue and Forecast (2017-2030)

12.1.3. Residential & Commercial

12.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 13. Global Thermal Energy Storage Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.1.2. Market Revenue and Forecast, by Technology (2017-2030)

13.1.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.1.4. Market Revenue and Forecast, by Application (2017-2030)

13.1.5. Market Revenue and Forecast, by End-user (2017-2030)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.1.6.2. Market Revenue and Forecast, by Technology (2017-2030)

13.1.6.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.1.6.4. Market Revenue and Forecast, by Application (2017-2030)

13.1.7. Market Revenue and Forecast, by End-user (2017-2030)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.1.8.2. Market Revenue and Forecast, by Technology (2017-2030)

13.1.8.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.1.8.4. Market Revenue and Forecast, by Application (2017-2030)

13.1.8.5. Market Revenue and Forecast, by End-user (2017-2030)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.2.2. Market Revenue and Forecast, by Technology (2017-2030)

13.2.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.2.4. Market Revenue and Forecast, by Application (2017-2030)

13.2.5. Market Revenue and Forecast, by End-user (2017-2030)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.2.6.2. Market Revenue and Forecast, by Technology (2017-2030)

13.2.6.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.2.7. Market Revenue and Forecast, by Application (2017-2030)

13.2.8. Market Revenue and Forecast, by End-user (2017-2030)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.2.9.2. Market Revenue and Forecast, by Technology (2017-2030)

13.2.9.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.2.10. Market Revenue and Forecast, by Application (2017-2030)

13.2.11. Market Revenue and Forecast, by End-user (2017-2030)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.2.12.2. Market Revenue and Forecast, by Technology (2017-2030)

13.2.12.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.2.12.4. Market Revenue and Forecast, by Application (2017-2030)

13.2.13. Market Revenue and Forecast, by End-user (2017-2030)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.2.14.2. Market Revenue and Forecast, by Technology (2017-2030)

13.2.14.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.2.14.4. Market Revenue and Forecast, by Application (2017-2030)

13.2.15. Market Revenue and Forecast, by End-user (2017-2030)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.3.2. Market Revenue and Forecast, by Technology (2017-2030)

13.3.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.3.4. Market Revenue and Forecast, by Application (2017-2030)

13.3.5. Market Revenue and Forecast, by End-user (2017-2030)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.3.6.2. Market Revenue and Forecast, by Technology (2017-2030)

13.3.6.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.3.6.4. Market Revenue and Forecast, by Application (2017-2030)

13.3.7. Market Revenue and Forecast, by End-user (2017-2030)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.3.8.2. Market Revenue and Forecast, by Technology (2017-2030)

13.3.8.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.3.8.4. Market Revenue and Forecast, by Application (2017-2030)

13.3.9. Market Revenue and Forecast, by End-user (2017-2030)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.3.10.2. Market Revenue and Forecast, by Technology (2017-2030)

13.3.10.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.3.10.4. Market Revenue and Forecast, by Application (2017-2030)

13.3.10.5. Market Revenue and Forecast, by End-user (2017-2030)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.3.11.2. Market Revenue and Forecast, by Technology (2017-2030)

13.3.11.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.3.11.4. Market Revenue and Forecast, by Application (2017-2030)

13.3.11.5. Market Revenue and Forecast, by End-user (2017-2030)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.4.2. Market Revenue and Forecast, by Technology (2017-2030)

13.4.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.4.4. Market Revenue and Forecast, by Application (2017-2030)

13.4.5. Market Revenue and Forecast, by End-user (2017-2030)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.4.6.2. Market Revenue and Forecast, by Technology (2017-2030)

13.4.6.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.4.6.4. Market Revenue and Forecast, by Application (2017-2030)

13.4.7. Market Revenue and Forecast, by End-user (2017-2030)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.4.8.2. Market Revenue and Forecast, by Technology (2017-2030)

13.4.8.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.4.8.4. Market Revenue and Forecast, by Application (2017-2030)

13.4.9. Market Revenue and Forecast, by End-user (2017-2030)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.4.10.2. Market Revenue and Forecast, by Technology (2017-2030)

13.4.10.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.4.10.4. Market Revenue and Forecast, by Application (2017-2030)

13.4.10.5. Market Revenue and Forecast, by End-user (2017-2030)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.4.11.2. Market Revenue and Forecast, by Technology (2017-2030)

13.4.11.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.4.11.4. Market Revenue and Forecast, by Application (2017-2030)

13.4.11.5. Market Revenue and Forecast, by End-user (2017-2030)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.5.2. Market Revenue and Forecast, by Technology (2017-2030)

13.5.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.5.4. Market Revenue and Forecast, by Application (2017-2030)

13.5.5. Market Revenue and Forecast, by End-user (2017-2030)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.5.6.2. Market Revenue and Forecast, by Technology (2017-2030)

13.5.6.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.5.6.4. Market Revenue and Forecast, by Application (2017-2030)

13.5.7. Market Revenue and Forecast, by End-user (2017-2030)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Product Type (2017-2030)

13.5.8.2. Market Revenue and Forecast, by Technology (2017-2030)

13.5.8.3. Market Revenue and Forecast, by Storage Material (2017-2030)

13.5.8.4. Market Revenue and Forecast, by Application (2017-2030)

13.5.8.5. Market Revenue and Forecast, by End-user (2017-2030)

Chapter 14. Company Profiles

14.1. QIAGEN

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. BD

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. bioMérieux SA

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. F. Hoffmann-La Roche, Ltd.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Hologic, Inc. (Gen-Probe)

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Abbott

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Quidel Corp.

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Siemens Healthineers AG

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Bio-Rad Laboratories, Inc.

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Danaher Corp.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others