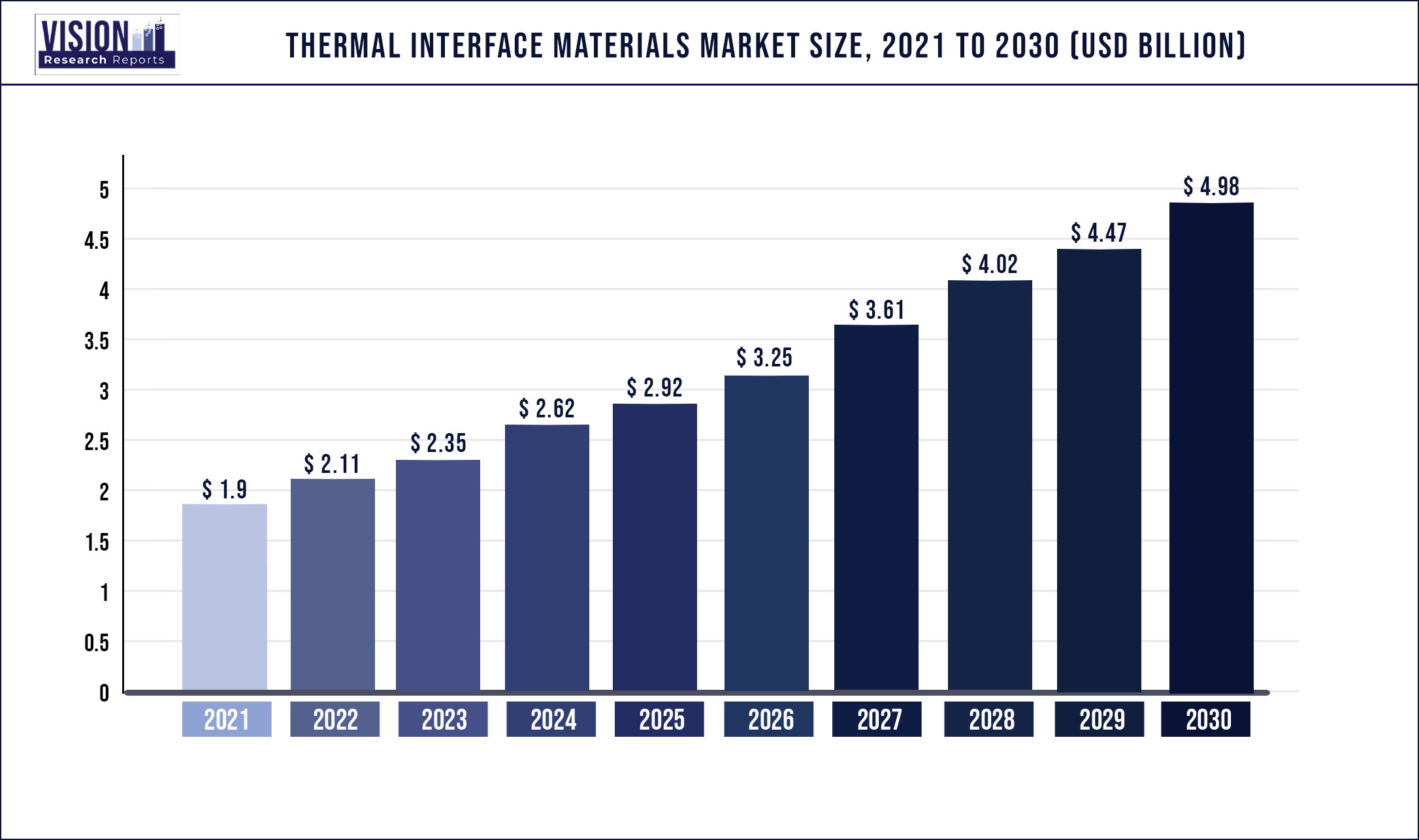

The global Thermal Interface Materials market size was estimated at around USD 1.9 billion in 2021 and it is projected to hit around USD 4.98 billion by 2030, growing at a CAGR of 11.3% from 2022 to 2030.

The increasing use of electrical equipment and electronic gadgets is expected to boost the market for thermal interface materials during the forecast period.

The rising demand for high-grade specifications in electronic devices due to the increased need in terms of consumer electronics and technology innovation is expected to support the growth of thermal interface materials. Moreover, the growing demand for the latest technological gadgets and specialty electronics for high-end operations is expected to augment the market in the projected time.

Commercial availability and enhanced performance characteristics of the products to reduce the heat transfer are likely to support the demand. Thermal interface materials conduct more heat than air, which it displaces as a substance to fill the imperfection between the physical contact of solid surfaces. These materials can also extract waste heat generated when a semiconductor electronic device is used to its maximum potential. Increased use of electronic devices in various areas such as consumer goods, and automobiles and the use of smart devices in the household, commercial, and industrial operations are expected to augment the growth of thermal interface materials during the forecast period.

The COVID-19 pandemic impacted the increased use of smart devices and electrical appliances by consumers. As a result, production and demand for thermal interface materials have increased. During the pandemic, however, supply chain disruption caused by governmental restrictions had a minor negative impact on the market.

The market is highly competitive for a variety of reasons, including the high level of innovation in terms of product innovation and performance, the remarkable impact of e-commerce on the shopping experience, and product substitutes.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1.9 billion |

| Revenue Forecast by 2030 | USD 4.98 billion |

| Growth rate from 2022 to 2030 | CAGR of 11.3% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, application, region |

| Companies Covered | The 3M Company, Henkel, Indium Corporation, Fujipoly, The Dow Chemical Company, Honeywell International Inc., SIBELCO, Shin-Etsu |

Product Insights

Thermal greases and adhesives led the market with a share of over 34.2% in 2021, owing to their widespread usage in consumer products and high thermal resistance. The elastomeric pads are expected to have a significant share in the market on account of their easy assembly as compared to greases. The handling mechanism is also improved with elastomeric pads as fewer chances of weakening the interface resistance exist.

Compared to other product segments, phase change materials are expected to have a high compounded annual growth rate of 11.8%. As the demand for cooler buildings grows, it finds its most common application in construction. The material acts as a heat storage device, absorbing heat in the summer and storing it for use in the winter to manage temperature differences.

Elastomeric pads are expected to register significant growth during the forecast period, owing to their easy handling and installation techniques used for thermal conductivity in electrical and electronic components. However, limited application scope and high unit cost of the products are expected to hamper the growth in the estimated time frame.

These interface materials are majorly used for applications of indispensable gels, gap filling and insulating pads, adhesive tapes, and greases. These are selected based on their toughness, environmental & chemical resistance, hardness, tensile strength, and thermal conductivity. Moreover, compatibility with electronic and mechanical gadgets is considered.

Application Insights

The computers application segment accounted for a significant share of over 24.5% in 2021 on account of increasing utilization in office end-use. The affordable prices of desktops have revolutionized the demand and supply of the product. As the number of people working from home has increased, the upgrading, sales, and installation figures of the PC market have also risen post-pandemic.

The telecom application segment for product utilization is expected to witness significant demand in the estimated time, owing to the increasing preference for a digital and cashless economy. The banks, e-commerce, utilities, and media are reliant on the telecom industry for their business and are its lifeline. Thus, the telecom application segment is likely to support the industry growth in the projected time.

Higher thermal insulation, dissipation, and conductance are all challenges in medical electronics and other industries, and the products address them. Polymer matrix composites, metal matrix composites, and carbon composites are the three broad categories. Furthermore, technological advancements in the product are expected to boost growth by providing better thermal management solutions.

The material’s other application is found in medical devices, industrial machinery, consumer durables, and automotive electronics, among others. Additionally, the advanced cockpit technology makes the material ideal for aerospace components. The recent advancements in military and aerospace applications have led engineers to address the increased thermal management issues.

Regional Insights

Asia Pacific dominated the market in 2021 with over 38.1% of the market share due to a large base of manufacturing zones. Besides the manufacturing base, reduction in corporate tax, GST, rising household incomes, consumer health awareness, changing lifestyles, and government policies are expected to propel the industry growth in this region.

Despite Europe being a major market for the automotive industry and medical device manufacturing, the product is expected to lose revenue. This is due to the recent pandemic outbreak, which has caused manufacturing activities to a halt as supply and demand for vehicles have collapsed.

The sales in the automotive sector could only be made through refurbishment or maintenance of vehicles, as more trucks and vans are used for supplying essentials across the region. However, the government’s continuous focus on the healthcare and automotive industry by encouraging FDI from Asian manufacturers can help revive the business during the forecast period.

The current pandemic situation has acutely affected the medical devices segment in the U.S. since the region imported about USD 24 billion worth of medical goods from China in the first half of 2021. There is a significant fall in production, which is expected to affect U.S. manufacturers and assemblers. However, the healthcare segment remains promising in the U.S. and is expected to drive thermal interface material demand during the forecast period.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Thermal Interface Materials Market

5.1. COVID-19 Landscape: Thermal Interface Materials Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Thermal Interface Materials Market, By Product

8.1. Thermal Interface Materials Market, by Product, 2022-2030

8.1.1. Tapes and films

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Elastomeric Pads

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Greases and adhesives

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Phase change materials

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Metal-Based

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Thermal Interface Materials Market, By Application

9.1. Thermal Interface Materials Market, by Application, 2022-2030

9.1.1. Telecom

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Computer

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Medical devices

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Industrial machinery

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Consumer durables

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Automotive electronics

9.1.6.1. Market Revenue and Forecast (2017-2030)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Thermal Interface Materials Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. The 3M Company

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Henkel

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Indium Corporation

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Fujipoly

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. The Dow Chemical Company

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Honeywell International Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. SIBELCO

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Shin-Etsu

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others