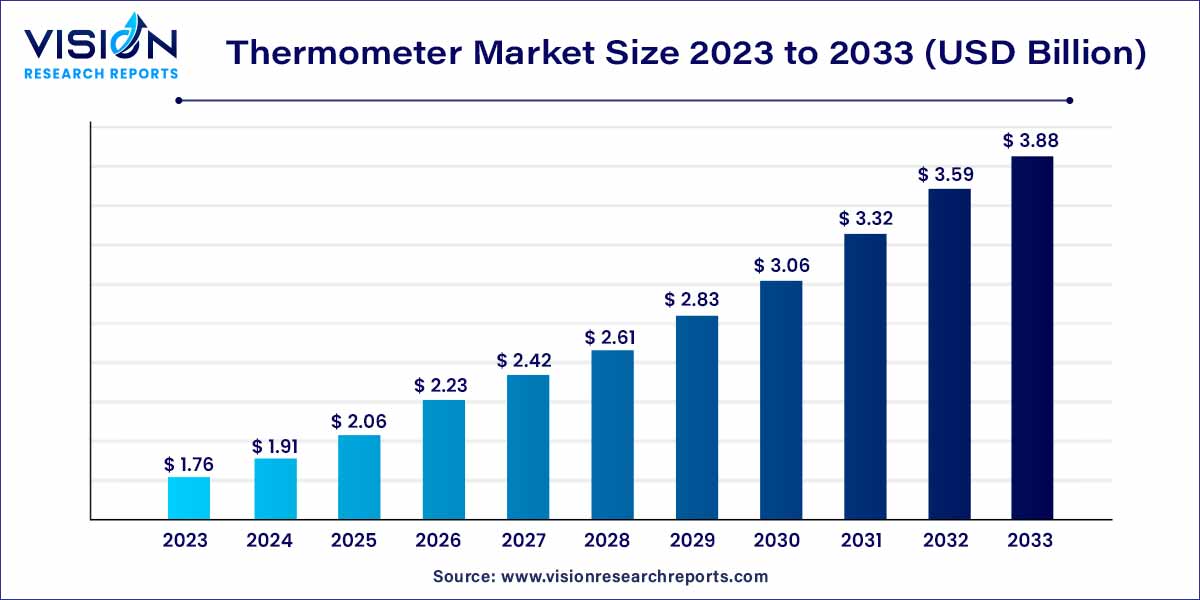

The global thermometer market size was estimated at around USD 1.76 billion in 2023 and it is projected to hit around USD 3.88 billion by 2033, growing at a CAGR of 8.24% from 2024 to 2033. The thermometer market is driven by the rise in the prevalence of infectious diseases and medical conditions such as dengue and malaria as well as a surge in public awareness about the significance of body temperature monitoring.

The thermometer market is witnessing significant growth and innovation in recent years, driven by advancements in technology, increasing healthcare awareness, and the rising demand for accurate temperature measurement solutions across various industries. Thermometers have evolved beyond their traditional role in healthcare settings to encompass a diverse range of applications, including industrial, automotive, food processing, and meteorology, among others.

The growth of the thermometer market is propelled by various factors contributing to its expansion. Advancements in technology, particularly in sensor technology and wireless connectivity, have revolutionized thermometer design, enhancing their precision and functionality. Additionally, the increasing emphasis on healthcare awareness, particularly amidst global health crises, drives demand for accurate temperature monitoring solutions, boosting the adoption of digital thermometers for clinical and home use. Beyond healthcare, thermometers find diverse applications in industries such as manufacturing, food processing, and environmental monitoring, further driving market growth. Moreover, stringent food safety regulations and environmental monitoring initiatives contribute to the growing demand for thermometers in ensuring compliance and maintaining product quality. With continuous innovation and competition among manufacturers, the thermometer market is poised for sustained growth as stakeholders seek to meet evolving customer needs and explore new opportunities for market expansion.

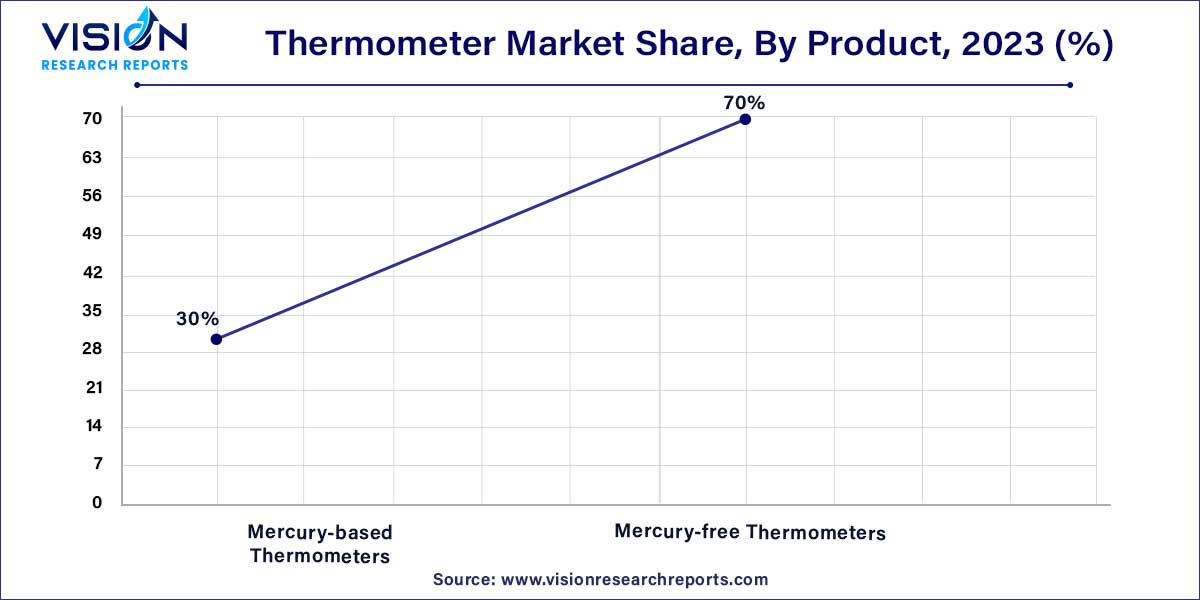

In 2023, the mercury-free thermometers segment emerged as the leader in the market, capturing the largest revenue share at 70%. It is projected to maintain this position, exhibiting the fastest Compound Annual Growth Rate (CAGR) of 10.5% throughout the forecast period. This segment encompasses digital thermometers, infrared radiation thermometers, and other variants. The adoption of mercury-free thermometers, particularly infrared radiation thermometers and digital thermometers, is expected to surge significantly due to their ability to deliver more precise readings and their lack of association with the environmental hazards posed by mercury.

On the contrary, mercury-based thermometers are renowned for their user-friendliness and are commonly used in laboratory settings. However, since 2001, approximately 20 states have enforced bans on the use of mercury-based thermometers, particularly in medical applications, owing to the toxic effects of mercury. Anticipated stricter regulations regarding the utilization of these devices in various sectors are likely to further limit the prevalence of mercury-based thermometers. For example, Analytical Technology and Control Limited (ATCT) have announced their decision to cease supplying ASTM-approved mercury-based thermometers to customers, opting instead to provide spirit-filled thermometers as replacements

In 2023, the medical segment took the lead in the market, capturing the largest revenue share of 29%. This dominance can be attributed to the presence of well-established healthcare infrastructure and the high incidence of diseases necessitating body temperature assessment. A key driver of this segment's growth is the continual technological advancements in thermometers. For instance, A&D Company, Limited, has introduced the Instant Read Digital Ear thermometer, featuring one-button operation and 10 memory recalls, facilitating easy measurements in just one second with an LCD display.

The industrial segment is poised to experience a notable Compound Annual Growth Rate (CAGR) of 8.65% during the forecast period. This growth is anticipated due to the specific temperature maintenance requirements in industries such as pharmaceuticals, chemicals, and biotechnology throughout various stages of product development. Industrial thermometers are selected based on factors such as type, size, configurations, display options, features, applications, and operating environments. Additionally, the presence of key players like Microtemp Electrics Co., Ltd.; Endress+Hauser Management AG; and LumaSense Technologies, Inc. is expected to further bolster overall market growth in this segment. These factors collectively contribute to the anticipated growth of the industrial segment during the forecast period.

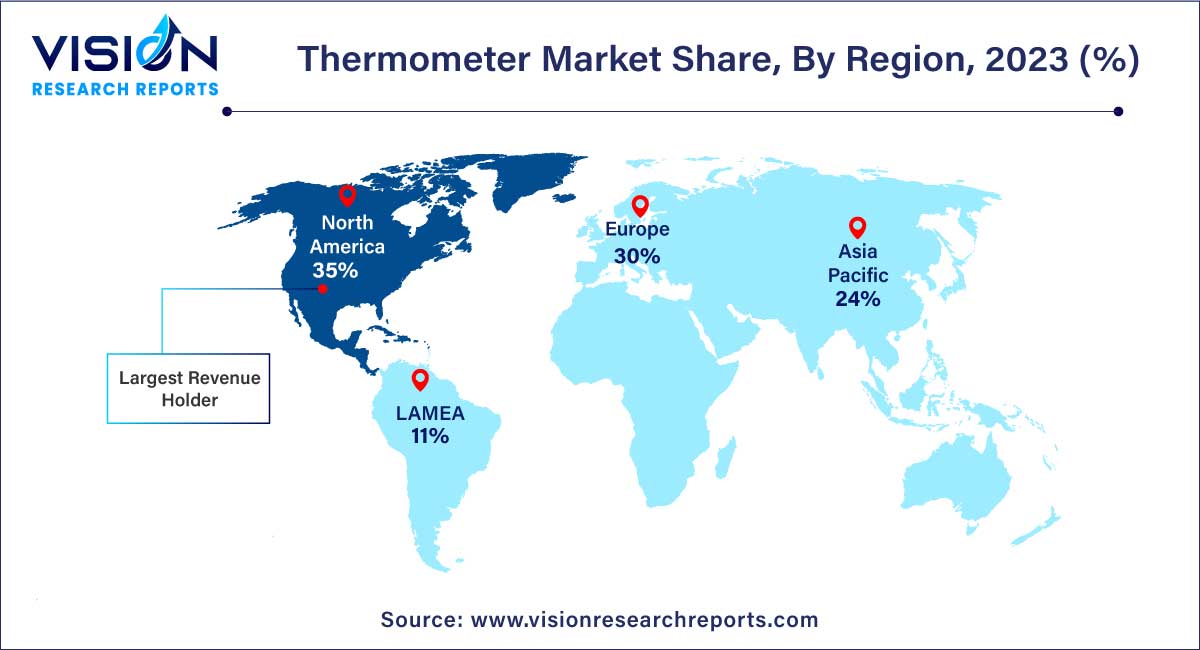

In 2023, North America emerged as the dominant force in the market, commanding a substantial revenue share of 35%. This supremacy can be attributed to factors such as the growing geriatric population and higher healthcare expenditure within the region. Additionally, healthcare camps and government initiatives aimed at raising awareness about infectious diseases and promoting better health practices are expected to further propel market growth.

Furthermore, the availability of technologically advanced products and the presence of major key players like 3M, Medline Industries, Welch Allyn, Inc., America Diagnostics Corporation, and A&D Medical are also significant contributors to the market's expansion in North America.

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Thermometer Market

5.1. COVID-19 Landscape: Thermometer Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Thermometer Market, By Product

8.1. Thermometer Market, by Product, 2024-2033

8.1.1. Mercury-based Thermometers

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Mercury-free Thermometers

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Infrared Radiation Thermometers

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Digital Thermometers

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Thermometer Market, By Application

9.1. Thermometer Market, by Application, 2024-2033

9.1.1. Medical

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Industrial

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Food

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Laboratory

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Thermometer Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Medline Industries, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Welch Allyn

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Medtronic

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. OMRON Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. America Diagnostics Corporation

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. 3M Company

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Microlife Corporation

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Briggs Healthcare

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Exergen Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Terumo Corporation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others