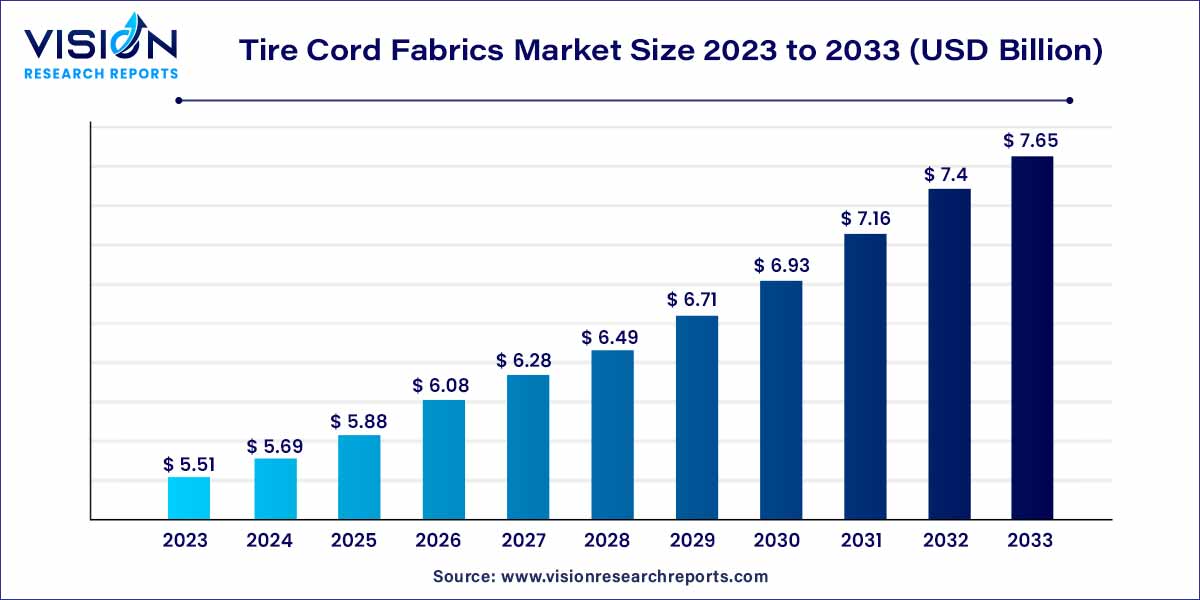

The global tire cord fabrics market size was estimated at around USD 5.51 billion in 2023 and it is projected to hit around USD 7.65 billion by 2033, growing at a CAGR of 3.34% from 2024 to 2033.

The growth of the tire cord fabrics market is propelled by several key factors. Firstly, the expanding automotive industry, driven by increasing global population and rising disposable incomes, plays a pivotal role in the market's upward trajectory. As vehicle production surges, the demand for high-performance and durable tires equipped with advanced cord fabrics follows suit. Additionally, the emphasis on fuel efficiency and sustainability in the automotive sector fuels the adoption of innovative tire technologies, thereby boosting the market. Moreover, the growing awareness regarding road safety and the need for reliable tire reinforcements contribute significantly to the market's expansion. Furthermore, advancements in tire cord fabric materials, such as the development of high-strength synthetic fibers, enhance overall tire performance, further driving market growth. In essence, the tire cord fabrics market thrives on the synergies between automotive industry dynamics, technological advancements, and an increasing emphasis on safety and sustainability.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 7.65 billion |

| Growth Rate from 2024 to 2033 | CAGR of 3.34% |

| Revenue Share of Asia Pacific in 2023 | 52% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The polyester segment accounted for the largest revenue share of 61% in 2023. Polyester tire cords find wide-ranging applications in the production of passenger car tires owing to their low shrinkage, high strength, and low-cost properties. The material is also witnessing growing adoption as a constituent for the manufacturing of hybrid tire cord fabrics.

The rayon segment is expected to expand at a CAGR of 3.83% during the forecast period. The main factor contributing to the popularity of rayon tire cord is its cost-effectiveness. Compared to alternative materials like nylon or polyester, rayon is relatively inexpensive to produce. The process involves converting cellulose from wood pulp into fibers through chemical treatment. This process is less complex and costly than the production of synthetic fibers like nylon or polyester. As a result, rayon tire cord offers a cost-effective solution for tire manufacturers without compromising on performance.

The radial segment held the largest revenue share of 76% in 2023 and is expected to expand at the fastest CAGR of 3.46% during the forecast period. Radial tires are seeing a higher adoption due to their durability, stability, temperature performance, wear resistance, and superior fuel efficiency. In radial tires, the steel belts are aligned at a 90-degree angle with the tread line, allowing the sidewall and the tread of the tire to function independently. Thus, radial tires exhibit low sidewall flex and more ground contact. Radial tires are widely used in passenger cars and light commercial vehicles.

The bias tire segment is projected to expand at a steady CAGR over the forecast period, owing to its low-cost property and its suitability for rough terrain and ability to carry heavy loads. However, properties such as high rolling resistance value and reduced wear resistance, along with susceptibility to overheating, are expected to restrain segment growth. Bias tires consist of nylon belts that run at a 30 to 45-degree angle with the tread line.

The passenger cars segment anticipated the maximum market share of 79% in 2023 and is further expected to expand at the fastest CAGR of 3.53% through 2032. Factors such as growing demand for passenger cars in developing economies, coupled with the rising demand for durable, fuel-efficient tires, are primarily responsible for segment growth. Growing regulatory support for the adoption of EVs is anticipated to have a positive impact on demand for tire cord fabrics over the forecast period. For instance, the Government of Canada, under the Incentives for Zero-Emission Vehicles (iZEV) Program, offers rebates of up to USD 5,000 on the purchase of designated EV models.

Tire replacement costs account for a major portion of the overall operating costs of major transport organizations and fleet operators. Thus, even a small improvement in the tire lifecycle has the potential to generate significant cost savings. Thus, growing product utilization in the production of commercial vehicle tires is projected to have a positive impact on the overall market growth.

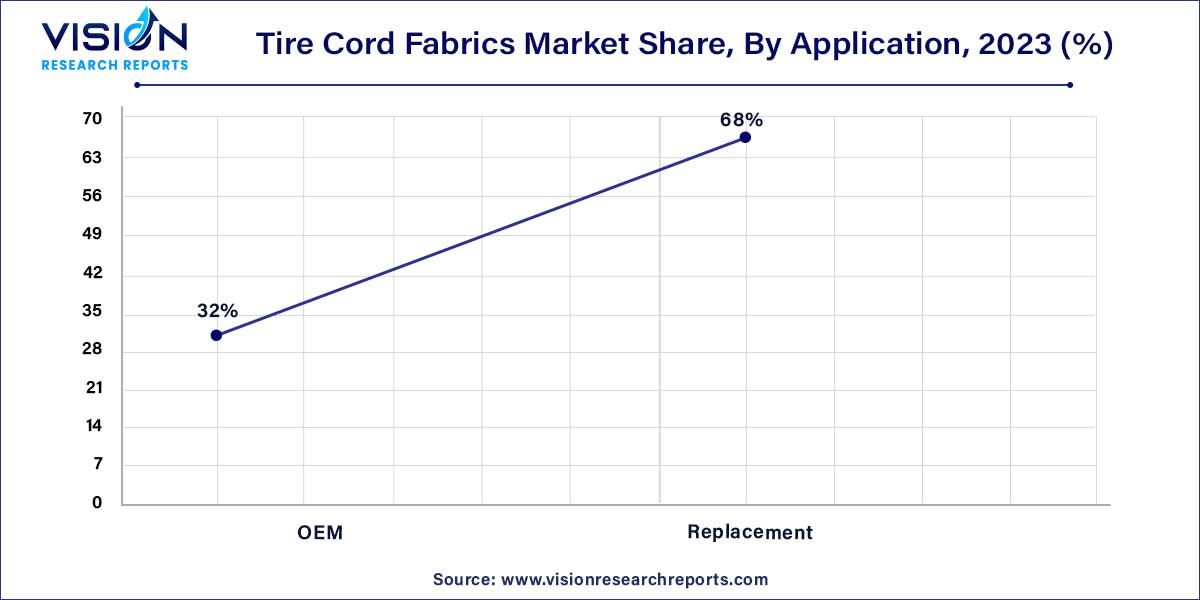

The replacement segment had the largest market share of 68% in 2023 and is anticipated to grow at the fastest CAGR of 3.47% during the forecast period. Increased consumer awareness about the rolling resistance and growing demand for radial tires are some of the major factors driving segment growth. Commercial vehicles are a major factor driving the growth of the replacement segment. Vehicles such as trucks, container carriers, and buses carry heavy loads over a longer distance, with the tires thus exhibiting more wear than passenger cars. Commercial replacement tires are generally made of nylon fabrics owing to wear resistance.

The OEM segment is also projected to grow at a significant pace over the forecast period. Growing emphasis on reducing vehicular emissions and the adoption of stringent emission norms are driving the demand for fuel-efficient tires with lower rolling resistance. Furthermore, demand for motorcycles in Asia and Africa is further expected to boost the market. The rising popularity of SUVs also has a positive impact on segment growth. Major SUV manufacturers include high-performance sports tires as part of the standard original equipment. They are manufactured using aramid tire cord fabric, owing to its superior strength-to-weight ratio.

Asia Pacific dominated the market with a revenue share of 52% in 2023; moreover, the region is expected to expand at the fastest CAGR of 3.93% during the forecast period. Factors such as the local availability of major raw materials such as natural rubber, coupled with a significant increase in demand for passenger cars in the past decade, are primarily responsible for the regional segment growth.

The tire cord fabric demand in Brazil is expected to expand at a notable CAGR over the forecast period. Growing demand for fuel-efficient cars is anticipated to be a major driving factor for the industry in this economy. Furthermore, a sharp increase in mining and logging activities are projected to generate significant demand for replacement tires, thereby favorably impacting the regional market.

North America accounted for 16.87% of the global revenue share in 2023. Growing penetration of electric cars is the primary factor driving product demand. Furthermore, the growing regulatory support for reducing vehicular emissions is projected to have a favorable impact on growth. The presence of major automotive and tire manufacturing companies and a rising focus on reducing greenhouse gas emissions are some of the major factors propelling product demand in the region.

By Material

By Tire Type

By Vehicle Type

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Tire Cord Fabrics Market

5.1. COVID-19 Landscape: Tire Cord Fabrics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Tire Cord Fabrics Market, By Material

8.1. Tire Cord Fabrics Market, by Material, 2024-2033

8.1.1. Nylon

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Polyester

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Rayon

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Tire Cord Fabrics Market, By Tire Type

9.1. Tire Cord Fabrics Market, by Tire Type, 2024-2033

9.1.1. Radial

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Bias

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Tire Cord Fabrics Market, By Vehicle Type

10.1. Tire Cord Fabrics Market, by Vehicle Type, 2024-2033

10.1.1. Passenger Cars

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Commercial Vehicles

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Tire Cord Fabrics Market, By Application

11.1. Tire Cord Fabrics Market, by Application, 2024-2033

11.1.1. OEM

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Replacement

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Tire Cord Fabrics Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Material (2021-2033)

12.1.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.1.4. Market Revenue and Forecast, by Application (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Material (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Material (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Material (2021-2033)

12.2.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.2.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.2.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Material (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Material (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Material (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Material (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Material (2021-2033)

12.3.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.3.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.3.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Material (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Material (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Material (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Material (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Material (2021-2033)

12.4.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.4.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.4.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Material (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Material (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Material (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Material (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Material (2021-2033)

12.5.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.5.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Material (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Material (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Tire Type (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Application (2021-2033)

Chapter 13. Company Profiles

13.1. Indorama Ventures Public Company Limited

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Kolon Industries Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. SRF Ltd.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. TEIJIN LIMITED

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Century Enka Limited

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others