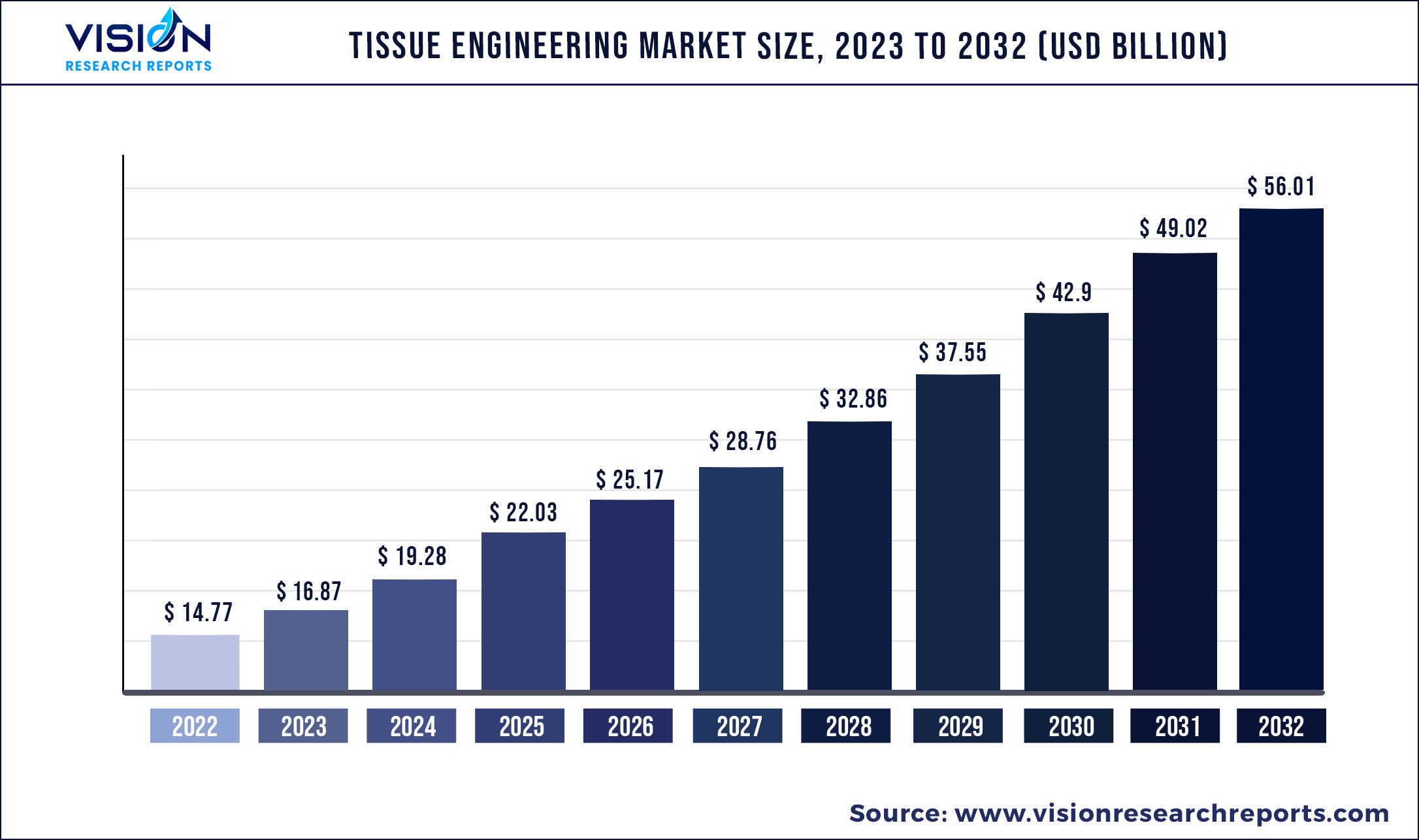

The global tissue engineering market was estimated at USD 14.77 billion in 2022 and it is expected to surpass around USD 56.01 billion by 2032, poised to grow at a CAGR of 14.26% from 2023 to 2032.

Key Pointers

Report Scope of the Tissue Engineering Market

| Report Coverage | Details |

| Market Size in 2022 | USD 14.77 billion |

| Revenue Forecast by 2032 | USD 56.01 billion |

| Growth rate from 2023 to 2032 | CAGR of 14.26% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

The potential of tissue engineering procedures in treating irreversible damage of tissues has boosted the market growth. In addition, a rise in demand for regenerative medicine and tissue engineering procedures to treat damaged tissues further supplements this growth.

Tissue engineering provides alternatives to surgical reconstruction, transplants, and other mechanical devices that are used to repair damaged tissues. The market for tissue engineering is also driven by a continuous increase in the need for effective regenerative treatments owing to a rise in the prevalence of diabetes, obesity, and other disorders due to lifestyle changes, aging population, and growing trauma cases.

Technological advancements in the field of 3D tissue engineering, such as replacement of embryo cells with stem cells, organ-on-a-chip technology, and use of 3D bioprinters that can efficiently design in vitro implants, are expected to enhance growth. In addition, an increase in government funding for medical and academic research activities would enhance the growth of the market for tissue engineering throughout the forecast period.

For instance, the April 2019 published list for funding for various research, condition, and disease categories (RCDC) from National Institutes of Health (NIH), (U.S.) indicate that funding for stem cell research and regenerative medicine was USD 1.8 and USD 1.0 billion respectively in 2018. The NIH estimates for funding in 2020 for these two areas correspond to USD 1.7 billion, and USD 915 million respectively.

Stem cell therapies have significant potential as therapeutics across various clinical applications. This has resulted in substantial global investments in research and clinical translation. Rapid advances in stem cell research aid in improved disease management. Thus, with an increase in the incidence of cancer, diabetes, and other chronic disorders, research on stem cells has increased.

Researchers are reprogramming stem cells to restore the normal function of an organ or design an artificial organ transplant using cultured stem cells. Stem cells find use in various applications; hence, the tissue engineering market is expected to achieve the benefitted outcome. For example, advanced reprogramming technologies that make use of stem cells are expected to replace artificial pacemakers.

Regional Insights

North America accounted for the largest revenue share in 2019 due to a rise in awareness for stem cell therapy as well as a growing geriatric population. Moreover, advanced technology for diagnosis and treatment of chronic disorders, availability of private and government funding, and high healthcare spending promotes a larger share of the regional market for tissue engineering.

The U.S. is estimated to account for a significant revenue share owing to the availability of government funds as well as high investments by private organizations. The U.S. Department of Health launched the “2020: A New Vision” initiative to bring regenerative medicine and stem cell therapy at the forefront of healthcare. The transformative impact of using regenerative medicine clinically is of utmost importance in technological innovation and progress in translation.

Tissue Engineering Market Segmentations and Key Players:

| By Application | Key Players |

|

Cord blood & Cell Banking Cancer GI, Gynecology Dental Skin & Integumentary Urology Orthopedics, Musculoskeletal, & Spine Neurology Cardiology & Vascular Others |

Medtronic plc Zimmer Biomet Holdings, Inc Allergan plc Athersys, Inc ACell, Inc. Organogenesis Holdings Inc Tissue Regenix Group plc Stryker Corporation RTI Surgical, Inc. Integra LifeSciences Corporation ReproCell, Inc. Baxter International, Inc. |

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Tissue Engineering Market

5.1. COVID-19 Landscape: Tissue Engineering Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global Tissue Engineering Market, By Application

8.1.Tissue Engineering Market, by Application Type, 2023-2032

8.1.1. Cord blood & Cell Banking

8.1.1.1.Market Revenue and Forecast (2020-2032)

8.1.2. Cancer

8.1.2.1.Market Revenue and Forecast (2020-2032)

8.1.3. GI, Gynecology

8.1.3.1.Market Revenue and Forecast (2020-2032)

8.1.4. Dental

8.1.4.1.Market Revenue and Forecast (2020-2032)

8.1.5. Skin & Integumentary

8.1.5.1.Market Revenue and Forecast (2020-2032)

8.1.6. Urology

8.1.6.1.Market Revenue and Forecast (2020-2032)

8.1.7. Orthopedics, Musculoskeletal, & Spine

8.1.7.1.Market Revenue and Forecast (2020-2032)

8.1.8. Neurology

8.1.8.1.Market Revenue and Forecast (2020-2032)

8.1.9. Cardiology & Vascular

8.1.9.1.Market Revenue and Forecast (2020-2032)

8.1.10. Others

8.1.10.1.Market Revenue and Forecast (2020-2032)

Chapter 9. Global Tissue Engineering Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Application (2020-2032)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Application (2020-2032)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Application (2020-2032)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Application (2020-2032)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Application (2020-2032)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Application (2020-2032)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Application (2020-2032)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Application (2020-2032)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Application (2020-2032)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Application (2020-2032)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Application (2020-2032)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Application (2020-2032)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Application (2020-2032)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Application (2020-2032)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Application (2020-2032)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Application (2020-2032)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Application (2020-2032)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Application (2020-2032)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Application (2020-2032)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Application (2020-2032)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Application (2020-2032)

Chapter 10.Company Profiles

10.1. Medtronic plc

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. Zimmer Biomet Holdings, Inc

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. Allergan plc

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. Athersys, Inc

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. ACell, Inc.

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. Organogenesis Holdings Inc

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. Tissue Regenix Group plc

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8. Stryker Corporation

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9. RTI Surgical, Inc.

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10. Integra LifeSciences Corporation

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others