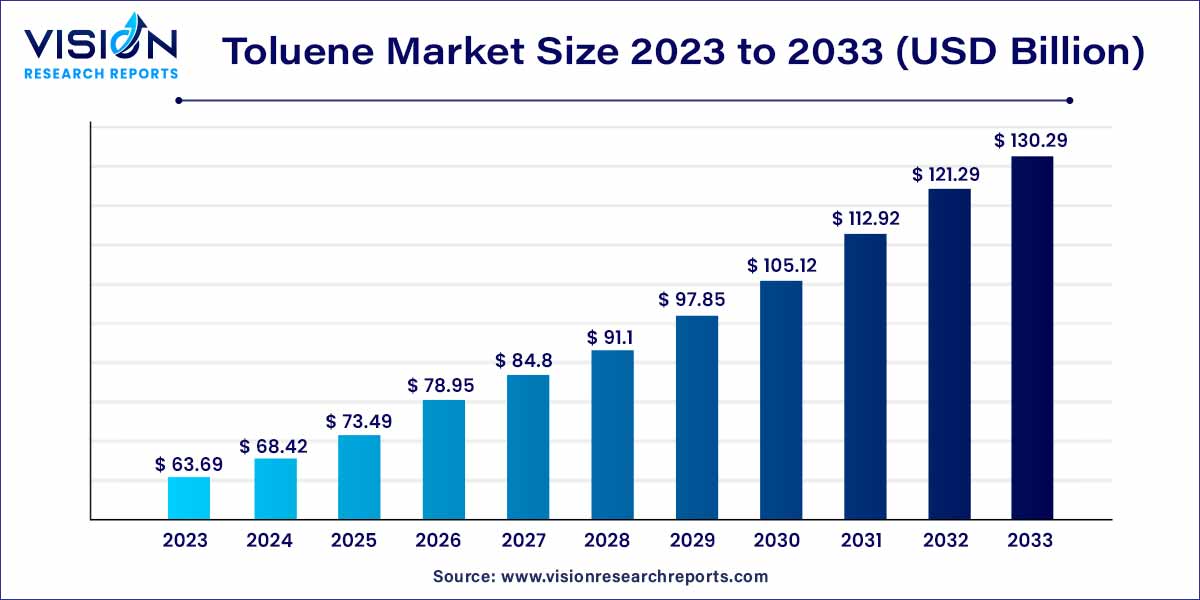

The global toluene market size was surpassed at USD 63.69 billion in 2023 and is expected to hit around USD 130.29 billion by 2033, growing at a CAGR of 7.42% from 2024 to 2033. This can be attributed to its growing use as a solvent in the chemical industry during the production of several chemical compounds, including benzoic acid, phenol, nitrobenzene, and benzyl chloride.

Toluene, a versatile aromatic hydrocarbon, holds a prominent position in the global chemical industry. As a key raw material in the production of various chemicals and fuels, the toluene market plays a vital role in driving economic growth and industrial development worldwide. This overview delves into the dynamics shaping the toluene market, highlighting key factors driving its growth and prevalent market trends.

The growth of the toluene market is underpinned by several key factors driving its expansion. Firstly, the increasing demand from a wide range of end-use industries, including petrochemicals, automotive, construction, and pharmaceuticals, serves as a significant growth driver. This demand is propelled by factors such as economic growth, urbanization, and industrialization, which stimulate the consumption of toluene-based products. Additionally, the versatility of toluene as a raw material in the production of various chemicals and fuels contributes to its sustained demand. Furthermore, the shift towards bio-based alternatives and renewable sources of toluene presents new opportunities for market growth, as companies explore sustainable solutions to meet environmental and regulatory requirements. Overall, the combination of expanding end-use applications, growing industrialization, and a focus on sustainability is expected to fuel the continued growth of the toluene market in the coming years.

The solvent application dominated the market, holding the highest revenue share of 31% in 2023. This dominance is attributed to its outstanding properties, such as low viscosity and relatively low toxicity compared to other solvents. Common solvent applications of the product encompass paints and coatings, adhesives, printing inks, pharmaceuticals, cleaning agents, fragrances, and perfumes, among others.

In the realm of paints and coatings, the product serves as a solvent in the formulation of paints, varnishes, lacquers, and other coatings. It facilitates the dissolution of resins and pigments, with the solvent evaporating during drying. Similarly, in adhesive applications, it aids in dissolving adhesive components and promotes adhesion to various surfaces.

Within the rubber and polymer industry, the product enhances the processing and compounding of rubber and polymer materials, thereby improving their workability and performance. Furthermore, in pharmaceuticals, it functions as a solvent in certain pharmaceutical preparations, assisting in the formulation of liquid medications and coatings for solid dosage forms.

TDI, a significant chemical derived from the product, plays a crucial role across various industries. TDI finds primary utilization in the production of flexible polyurethane foams, prized for their versatility and comfort. Key applications of TDI include flexible polyurethane foam, automotive interiors, mattresses and bedding, as well as packaging and insulation, among others.

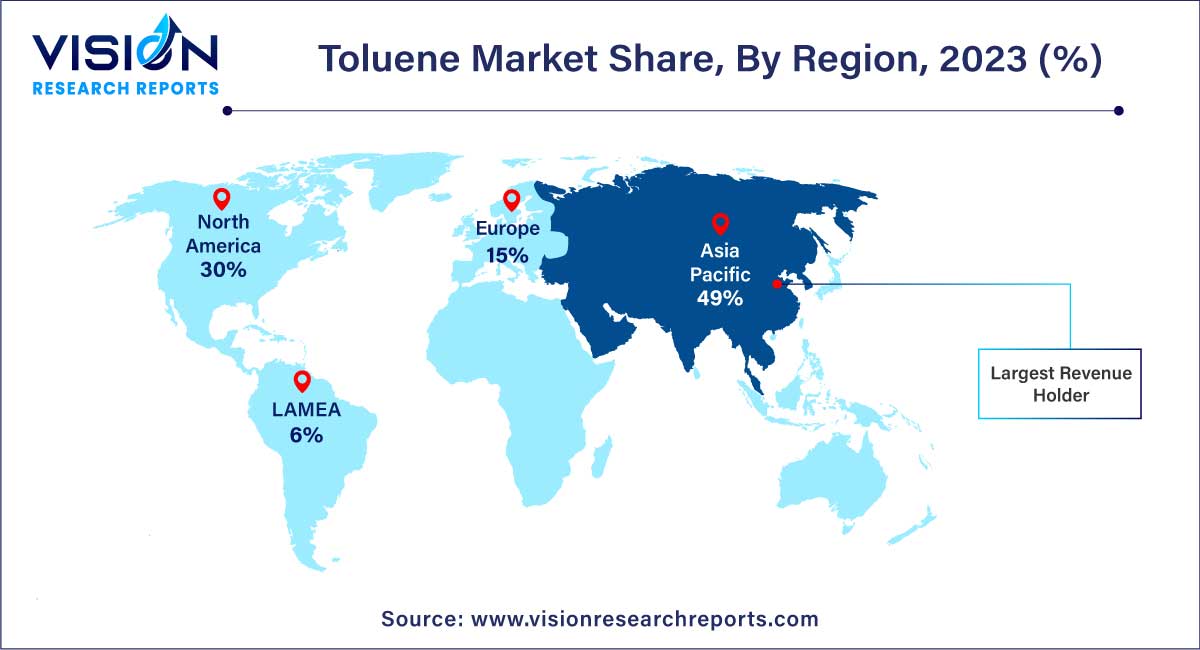

The Asia Pacific region asserted its dominance in the product market, capturing the highest revenue share of 49% in 2023. This dominance is attributed to the increasing utilization of downstream derivatives of the product in sectors such as automobiles, oil & gas, and construction within the region. Countries like China, India, and Japan are expected to maintain their leadership positions in the global market throughout the forecast period, primarily due to the ongoing expansion of their manufacturing sectors.

Furthermore, economic expansion, rapid industrialization, and growing demand for petrochemicals and consumer goods have propelled the consumption of the product across various applications in the region. Additionally, the surge in automotive production and consumption in nations like China and India has fueled the demand for the product as a gasoline additive. Toluene's ability to enhance the octane rating of gasoline makes it invaluable in meeting stringent fuel quality standards and improving fuel efficiency.

China stands out as a major global manufacturer of paints, coatings, and adhesives, with continuous growth anticipated in these industries, driving the product market within the country. Moreover, in the union budget for 2021-22, the Indian government allocated USD 32.2 million to the Chemicals and Petrochemicals department. The government's focus on implementing a production-linked incentive (PLI) scheme in the chemical sector aims to bolster chemical manufacturing in the country, thereby positively impacting India's toluene market and fostering growth in the years to come.

Insights into Key Toluene Companies: The market is fiercely competitive, with several prominent players operating on a global scale. These industry leaders command a significant market share, while smaller regional players also contribute to overall supply.

Companies are increasingly shifting towards manufacturing bio-based products in response to environmental concerns, sustainability goals, and growing demand for eco-friendly alternatives. For instance, in September 2022, Covestro introduced bio-based polyether polyols derived from renewable feedstock. This innovation enables the company to offer renewable TDI and methylene diphenyl diisocyanate (MDI) for the production of polyurethane foams.

By Toluene Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others