The global transformer oil market was surpassed at USD 2.54 billion in 2022 and is expected to hit around USD 7.98 billion by 2032, growing at a CAGR of 12.13% from 2023 to 2032. The transformer oil market in the United States was accounted for USD 0.3 billion in 2022.

Key Pointers

Report Scope of the Transformer Oil Market

| Report Coverage | Details |

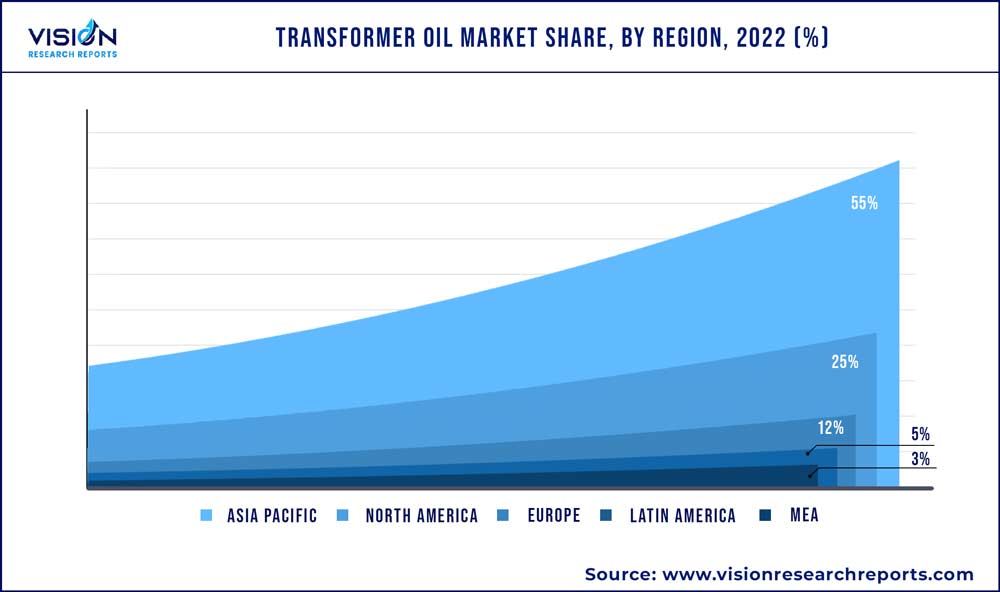

| Revenue Share of Asia Pacific in 2022 | 55% |

| Revenue Forecast by 2032 | USD 7.98 billion |

| Growth Rate from 2023 to 2032 | CAGR of 12.13% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | China Petroleum & Chemical Corporation; Cargill Inc.; Shell Plc.; Nynas AB; Ergon, Inc.; Engen Petroleum Ltd. |

This is attributed to the growing power sector across the globe along with advancements of electric grids in emerging countries. Every power and distribution transformer contains dielectric insulating fluid that has strong electricity resistance and the ability to keep the transformer cooler. Bio-based products are more fire resistant than other types of products, thus expected to witness the highest growth over the forecast period.

Since bio-based oils are fully non-toxic, which further facilitates disposal, they provide reliable and cleaner products. The demand for bio-based products is also anticipated to grow as a result of the increase in installation of transformers occurring around the world. The power utilities are also focusing on upgrading the safety and performance of both new and existing transformers, which is predicted to boost the demand for bio-based products globally.

Stringent regulation imposed by government bodies concerning energy wastage is expected to be the major challenge for product demand. For instance, the U.S. Environmental Protection Agency has set up some strict regulations on demand for oil to control electricity wastage. Additionally, developed and developing economies are shifting towards green and environmental-friendly technologies, thus expected to restrain the growth of products based on minerals.

Product Insights

Mineral-based oils dominated the market with a revenue share of over 77% in 2022. This is attributed to its wide range of applications in capacitors, circuit breakers, and high compatibility. Mineral-based products are utilized in conditioning and shielding transformers, switchgear, and boilers. Additionally, it can be used for thermal transfer and to safeguard the interior field winding of transformers. Such wide usage of mineral-based oils is expected to drive growth over the forecast period.

Bio-based products have recently gained demand in the market. They perform better than other products as they are eco-friendly. Bio-based products use vegetable oil as a feedstock. This kind of oil does not contain halogens, silicone, and petroleum hydrocarbons. They are non-toxic and can quickly degrade in case of leakage or spill, which is expected to create opportunities for the growth of bio-based products in the market.

Products produced from wax-free naphthenic mineral oil have various advantages such as low cost, easy availability, high efficiency, and thermal cooling capacity. However, non-biodegradability that results in environmental pollution and handling risk associated is projected to restrain the naphthenic-based mineral oil products demand over the projected period.

Rating Insights

The 100 MVA to 500 MVA segment dominated the market with a revenue share of over 23% in 2022. This is attributed to its application in large-scale industrial settings, such as power plants, refineries, and manufacturing facilities. These transformers are designed to handle significant amounts of electrical power and are crucial components in the generation, transmission, and distribution of electrical power. Also, they are suited for power distribution in areas with large populations owing to their capability in handling high voltages, making them ideal to transfer power from the source to the desired destination.

The <100 MVA segment held the second largest position and is predicted to grow at a CAGR of 12.03% over the forecast period. This is attributed to its application in a variety of power distribution systems to step down or step up the voltage of electrical power, allowing it to be transmitted over long distances.

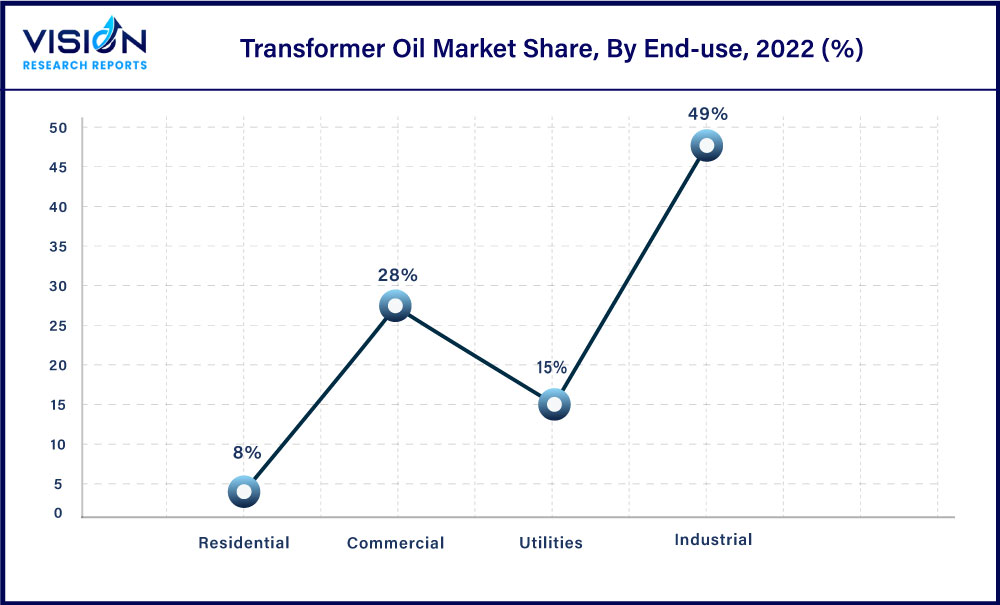

End-use Insights

The industrial segment dominated the market with a revenue share of over 49% in 2022. This is attributed to the growing industrialization across the globe leading to an increased number of transformers. Industrial end-use includes transformers used in chemicals, food processing, steel, and automotive industries. Industrial processes require different types of electrical machinery that operate at discrete voltage levels. Power generation facilities typically generate electricity at high voltages, requiring the use of three-phase distribution transformers.

Thus, the advancing steel and chemical manufacturing industries worldwide have increased demand for transformers used in them which in turn will drive the demand for transformer oils used for the efficient functioning of these transformers.

The residential segment is expected to grow at the highest CAGR of 12.73% over the forecast period. This is attributed to the growing residential areas across the globe owing to the increasing global population. The residential end-use segment includes transformers used in villas, apartments, and residential housing. In residential spaces and villas, typically single-phase transformers are used for individual homes, and three-phase distribution transformers for larger residential areas.

Regional Insights

Asia Pacific dominated the market with a revenue share of over 55% in 2022. This is attributed to the rise in the demand for electricity in developing countries such as China, India, Japan, and Australia. Additionally, the growth of the commercial and industrial sectors is anticipated to increase the number of substations, which, in turn, will fuel the demand for transformers in the near future.

Increasing investment in the power sector is enabling Chinese manufacturers to penetrate the market. Moreover, significant growth in renewable capacity in countries such as India and China is fuelling the demand for the sub-transmission segment. The presence of strong domestic manufacturers is a major challenge for foreign markets to enter the Asia Pacific region.

Growth of the industrial and manufacturing sectors in the U.S. and Canada is driving the market in North America. Technical upgradation, modernization in existing transformers, and the decline of the crude oil market are anticipated to drive the market in the country.

Transformer Oil Market Segmentations:

By Product

By Transformer Oil Rating

By Transformer Oil End-Use

By Transformer Oil Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Transformer Oil Market

5.1. COVID-19 Landscape: Transformer Oil Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Transformer Oil Market, By Product

8.1. Transformer Oil Market, by Product, 2023-2032

8.1.1 Mineral-based Oils

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Silicone-based Oils

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Bio-based Oils

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Transformer Oil Market, By Transformer Oil Rating

9.1. Transformer Oil Market, by Transformer Oil Rating, 2023-2032

9.1.1. <100 MVA

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. 100 MVA to 500 MVA

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. 501 MVA to 800 MVA

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. >800 MVA

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Transformer Oil Market, By Transformer Oil End-Use

10.1. Transformer Oil Market, by Transformer Oil End-Use, 2023-2032

10.1.1. Utilities

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Industrial

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Residential

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Commercial

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Transformer Oil Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.1.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.2.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.3.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.4.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.5.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Transformer Oil Rating (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Transformer Oil End-Use (2020-2032)

Chapter 12. Company Profiles

12.1. China Petroleum & Chemical Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Cargill Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Shell Plc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Nynas AB

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Ergon, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Engen Petroleum Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others