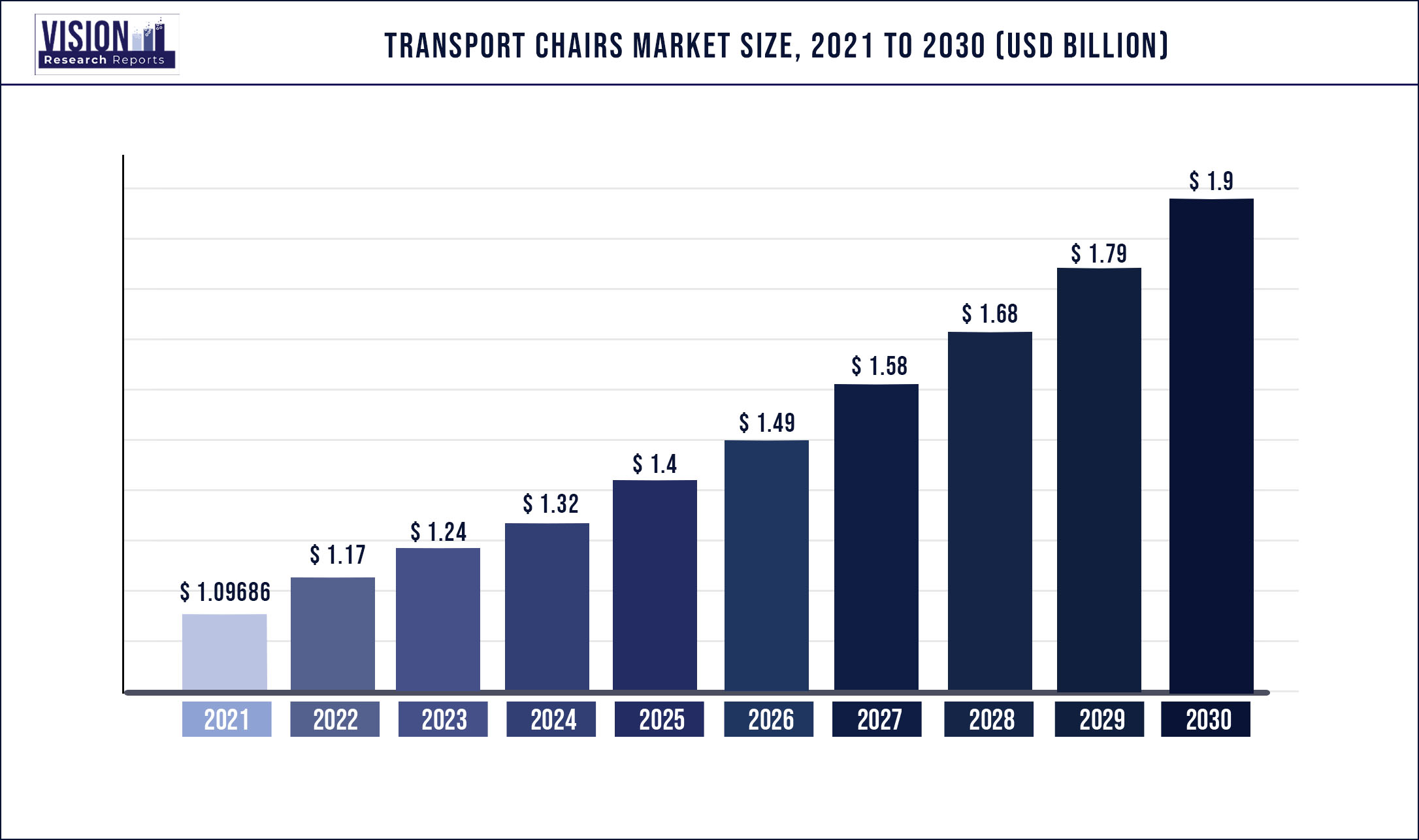

The global transport chairs market was estimated at USD 1,096.86 million in 2021 and it is expected to surpass around USD 1.9 billion by 2030, poised to grow at a CAGR of 6.29% from 2022 to 2030

Report Highlights

The transport chairs are equipment that is used to move patients with physical disabilities. There are many different features and attachments available for chairs, including cup holders, footrests, armrests, bags, totes, and pouches. The growing prevalence of osteoporosis and arthritis in adults is one of the major factors anticipated to propel the market. In addition, the growing geriatric population is anticipated to promote industry expansion. In the United States, there are more than 50 million senior citizens, or 16.5% of the population.

It is anticipated that the geriatric population in some Asian and Latin American nations will be quadrupled by 2050. The frame materials used for manufacturing transport chairs are generally of two types: Aluminium and steel; out of which, Aluminium is mostly used because of its better qualities like low weight, high malleability, and ductility. In healthcare facilities, the industry is expected to serve as a key revenue-generating center. Healthcare facilities are backed by hospitals, nursing homes, and specialty clinics, where the requirement for patient transportation equipment is increasing due to the rising number of geriatric patients and cases of accidents, arthritis, and osteoporosis.

The onset of the pandemic adversely affected the medical devices supply chain. Persons with disabilities were disproportionately affected by the health, social and economic impacts of COVID-19, as outlined by the Secretary-General of WHO in his policy brief A Disability-Inclusive Response to COVID-19. However, all those months witnessed high demand for patient transportation in hospitals and other healthcare facilities as the geriatric and disabled population was more vulnerable to COVID-19 and had to undergo various treatments. Although the medical devices supply chain was affected badly and it was difficult to meet the increased demand, the industry managed to meet the demands successfully.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1,096.86 million |

| Revenue Forecast by 2030 | USD 1.9 billion |

| Growth rate from 2022 to 2030 | CAGR of 6.29% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Category, frame materials, end-use |

| Companies Covered | Carex Health Brands, Inc.; Stryker; Drive Medical Design & Manufacturing; Graham-Field Health Frame Materialss Inc.; Invacare; Medline Industries; Sunrise Medical LLC; Karman Healthcare; NOVA |

Category Insights

The adult population segment accounted for the largest share of more than 47.7% in 2021 and is anticipated to witness steady growth over the forecast period. This can be attributed to the increasing incidence of arthritis, osteoporosis, etc. The geriatric population category is anticipated to register a significant CAGR from 2022 to 2030. This is brought on by the rise in the population of elderly people. For instance, in the U.S., there are 255,369,678 adults. According to Urban Institute, the number of people aged 65 years and above in the U.S. will double over the next four decades, reaching 80 million by 2040.

The increasing geriatric population coupled with the rising cases of falls in the elderly is projected to boost the demand for mobility aids during the forecast period. The greatest risk factor for the emergence of chronic diseases is aging. As a result, the prevalence of chronic illnesses like diabetes, Cardiovascular Diseases (CVDs), arthritis, and other lifestyle disorders is anticipated to increase along with the growing aging population, fueling industry expansion. Key target populations for personal mobility equipment like transport wheelchairs are the elderly population and people with limb limitations.

Frame Materials Insights

Based on frame materials, the global industry has been further bifurcated into Aluminium and steel. In 2021, the Aluminium frame materials segment dominated the industry and accounted for the maximum share of more than 61.6% of the global revenue due to the high demand for these chairs. Although steel is cheaper than Aluminium, it absorbs heat and is more prone to corrosion. Aluminium is more malleable and ductile than steel, which is 2.5 times denser to be exact. It can be bent or extruded into a variety of different forms or profiles without cracking or breaking. Aluminium chairs are highly preferred for smooth patient transportation.

Aluminium has a better strength-to-weight ratio than mild steel, which results in a reduction in the mobility device’s overall weight. Transport chairs are mostly moved by the patient’s caretaker. In many cases, the chairs have to be carried along with the patient wherever needed, and hence the less heavy chair is preferred. In addition, Aluminium is corrosion-resistant, which increases the durability and quality of the chair making it highly durable. Therefore, throughout the forecast period, these factors are anticipated to fuel the Aluminium segment growth.

End-use Insights

The healthcare facilities segment accounted for the maximum share of more than 65.07% in 2021. The primary healthcare facility type where the use of transfer chairs is greatest is hospitals. Hospitals end-use dominated the healthcare facilities segment in 2021. The majority of mobility equipment is utilized in hospitals for a patient’s physical movements. Hospital settings are preferable healthcare settings for treating serious illnesses, congenital problems, spinal cord trauma, and accidents involving the brain. For instance, A minimum stay of 11 days is required for spinal cord injuries, after which the patient is typically sent to a rehabilitation facility.

However, the hospital inpatient and outpatient care costs have increased, which may hamper the segment growth. The healthcare facilities segment will register a significant CAGR during the forecast period. The growing prevalence of osteoporosis & arthritis, accessibility of technologically advanced portable mobility aids, and the growing geriatric population are the key factors driving the segment growth. Public spaces, and notable airports, are anticipated to remain the second-most lucrative end-use segment over the projection period due to the rising travel rates, faster travel times, and improved accessibility for people with disability.

Regional Insights

North America held the dominant share of over 41.94% of the global revenue in 2021. The growing elderly population and the existence of a favorable reimbursement mechanism are responsible for this expansion. Throughout the forecast period, the regional market is expected to be driven by the increasing frequency of illnesses linked to lifestyle. In addition, the regional sector is expanding as a result of the presence of major companies, a sophisticated healthcare infrastructure, high levels of disposable income, and significant lifestyle changes. Due to the rising geriatric population, which signals a significant socioeconomic burden in this region. Asia Pacific is predicted to be the fastest-growing regional market over the projection period.

The region’s workforce is expected to shrink and public healthcare spending & the use of specialist medical chairs will subsequently rise. The U.S. Census Bureau’s research indicates that Japan has the world’s largest proportion of elderly people. Furthermore, it is anticipated that the market would rise as a result of the presence of international organizations like the United Nations Population Fund, which intends to support such nations in establishing and putting into practice national programs and policies. In addition, increasing discretionary income and ongoing R&D activities by major regional players to develop innovative products are expected to bolster the region’s growth over the coming years.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Transport Chairs Market

5.1. COVID-19 Landscape: Transport Chairs Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Transport Chairs Market, By Category

8.1. Transport Chairs Market, by Category, 2022-2030

8.1.1 Adult

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Geriatric

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Pediatric

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Transport Chairs Market, By Frame Material

9.1. Transport Chairs Market, by Frame Material, 2022-2030

9.1.1. Aluminium

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Steel

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Transport Chairs Market, By End-use

10.1. Transport Chairs Market, by End-use, 2022-2030

10.1.1. Healthcare Facilities

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Public Facilities

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Transport Chairs Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Category (2017-2030)

11.1.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.1.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Category (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Category (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Category (2017-2030)

11.2.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.2.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Category (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Category (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Category (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Category (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Category (2017-2030)

11.3.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.3.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Category (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Category (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Category (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Category (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Category (2017-2030)

11.4.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Category (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Category (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Category (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Category (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Category (2017-2030)

11.5.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Category (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Category (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Frame Material (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 12. Company Profiles

12.1. Carex Health Brands, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Stryker

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Drive Medical Design & Manufacturing

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Graham-Field Health Frame Materialss, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Invacare

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Medline Industries

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Sunrise Medical LLC

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Karman Healthcare

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. NOVA

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others