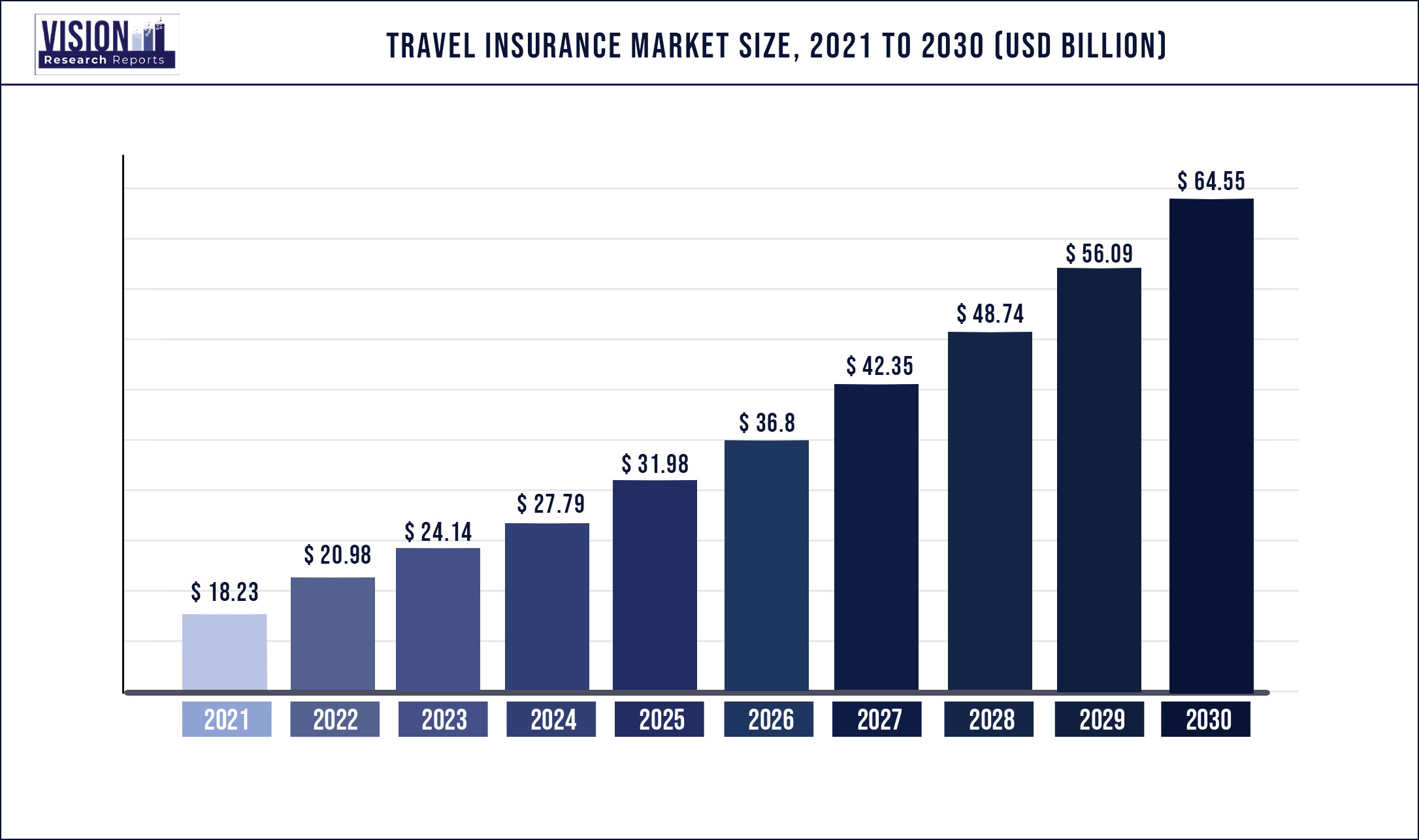

The global travel insurance market was valued at USD 18.23 billion in 2021 and it is predicted to surpass around USD 64.55 billion by 2030 with a CAGR of 15.08% from 2022 to 2030.

Report Highlights

The demand for travel insurance is poised to skyrocket on the account of growth in the tourism industry due to the factors such as easy internet travel bookings, extensive media coverage of various holiday types, an increase in disposable income, and enhanced package holidays.

The increasing adoption of various technological advancements, such as AI-based applications, the usage of Big Data, and Blockchain, is expected to create growth opportunities for travel providers in the global market. Moreover, the travel insurance market is witnessing a rise in popularity owing to benefits such as COVID-19 medical coverage, and 24/7 emergency services.

Many industries across the world were severely impacted due to the COVID-19 pandemic. However, the travel insurance market experienced significant growth owing to a surge in the demand for travel insurance services and products post-pandemic. The pandemic has accelerated the need for travel insurance among the general population, resulting in the creation of various open-source data portals and dashboards to inform citizens about the number of coverage included in travel insurance, the number of active cases, and infection rate, and recovery rate.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 18.23 billion |

| Revenue Forecast by 2030 | USD 64.55 billion |

| Growth rate from 2022 to 2030 | CAGR of 15.08% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Insurance Coverage, distribution channel, end-users, and region |

| Companies Covered |

Allianz; American International Group, Inc.; AXA; ASSICURAZIONI GENERALI S.P.A.; USI Insurance Services, LLC; battleface; Insure & Go Insurance Services Limited; Seven Corners Inc.; Travel Insured International; Zurich; Delphi Financial Group, Inc.; Ping An Insurance (Group) Company of China, Ltd. |

Insurance Coverage Insights

The market is segmented based on insurance coverage into single-trip travel insurance, annual multi-trip travel insurance, and long-stay travel insurance. The single-trip travel insurance segment dominated the market with a share of 61.11% and is expected to register the highest CAGR of 16.05% during the forecast period. The growth of the single-trip travel insurance segment can be attributed to the factors such as loss of baggage, emergency dental treatment costs, personal liability cover, fire cover, trip interruption or cancellation, missed flight connection, and many more such services.

Furthermore, the annual multi-trip travel insurance segment is projected to expand at a CAGR of 16.34% during the forecast period. The segment growth can be attributed to the increasing demand among business people, travelers, and other groups who go on multiple trips in a year.

Distribution Channels Insights

Based on distribution channels, the market is segmented into insurance intermediaries, insurance companies, banks, insurance brokers, and insurance aggregators. The insurance companies segment dominated the market with a revenue share of 35.88% in 2021 and is projected to retain its position during the forecast period. The growth of this segment can be attributed to the factors such as increasing consolidating risk among numerous policyholders and the setting up of premiums according to the likelihood that a specific occurrence will occur and will lead to typical financial loss.

Furthermore, the banks' segment is expected to witness the fastest CAGR of 19.8% during the forecast period. The increasing insurance sales and underwriting by banks across the regions such as Europe, Asia, and Australia is driving the market growth in this segment.

End-Users Insights

Based on end-users, the market is segmented into education travelers, business travelers, senior citizens, family travelers, and others. The other sub-segment further comprises individuals and groups. The senior citizens segment accounted for the largest revenue of USD 5,925.5 million in 2021 and is projected to expand at a CAGR of 15.9% during the forecast period. The services offered like emergency evacuation, subsidies on tickets, trip cancellation coverage, and coverage for luggage loss are fueling the market growth of this segment.

Moreover, the business travel insurance segment accounted for a significant market share of USD 2,724.1 million in 2021 and is expected to expand at the highest CAGR of 18.6% during the forecast period. This growth can be attributed to the significant decrease in business travel plans and the surge in numbers of business trips in recent years, which are the key factors driving the growth of this segment.

Regional Insights

Europe dominated the market with a share of 37.12% in 2021 and is anticipated to expand at a CAGR of over 16.3% during the forecast period. Factors such as increasing travel & tourism led to the growth of wealth, modern communication, and peace among the neighboring. According to a survey conducted in June 2020, covering 2,636 respondents and 87 different third-country nationals, by the Research and Statistical Department of SchengenVisaInfo.com, 62% of travelers intended to visit Europe soon after the European governments reopened the borders due to the COVID-19 pandemic.

Asia-Pacific is expected to expand at the fastest CAGR of 17.7% during the forecast period. The market growth across the region can be attributed to the increasing advancement of travel insurance policies related to medical, increased agility, and security. For instance, in September 2021, the government of Singapore announced the first two vaccinated travel lanes with Brunei and Germany. The travelers using these lanes would not need to follow strict restrictions and only need to undertake routine COVID-19 tests.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Travel Insurance Market

5.1. COVID-19 Landscape: Travel Insurance Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Travel Insurance Market, By Insurance Coverage

8.1. Travel Insurance Market, by Insurance Coverage, 2022-2030

8.1.1 Single-trip Travel Insurance

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Annual Multi-trip Travel Insurance

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Long-stay Travel Insurance

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Travel Insurance Market, By Distribution Channel

9.1. Travel Insurance Market, by Distribution Channel, 2022-2030

9.1.1. Insurance Intermediaries

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Insurance Companies

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Banks

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Insurance Brokers

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Insurance Aggregators

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Travel Insurance Market, By End-Users

10.1. Travel Insurance Market, by End-Users, 2022-2030

10.1.1. Education Travelers

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Business Travelers

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Senior Citizens

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Family Travelers

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Travel Insurance Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.1.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.1.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.2.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.3.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.5.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-Users (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Insurance Coverage (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Distribution Channel (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-Users (2017-2030)

Chapter 12. Company Profiles

12.1. Allianz

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. American International Group, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. AXA

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. ASSICURAZIONI GENERALI S.P.A.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. USI Insurance Services, LLC

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. battleface

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Insure & Go Insurance Services Limited

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Seven Corners Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Travel Insured International

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Zurich

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others