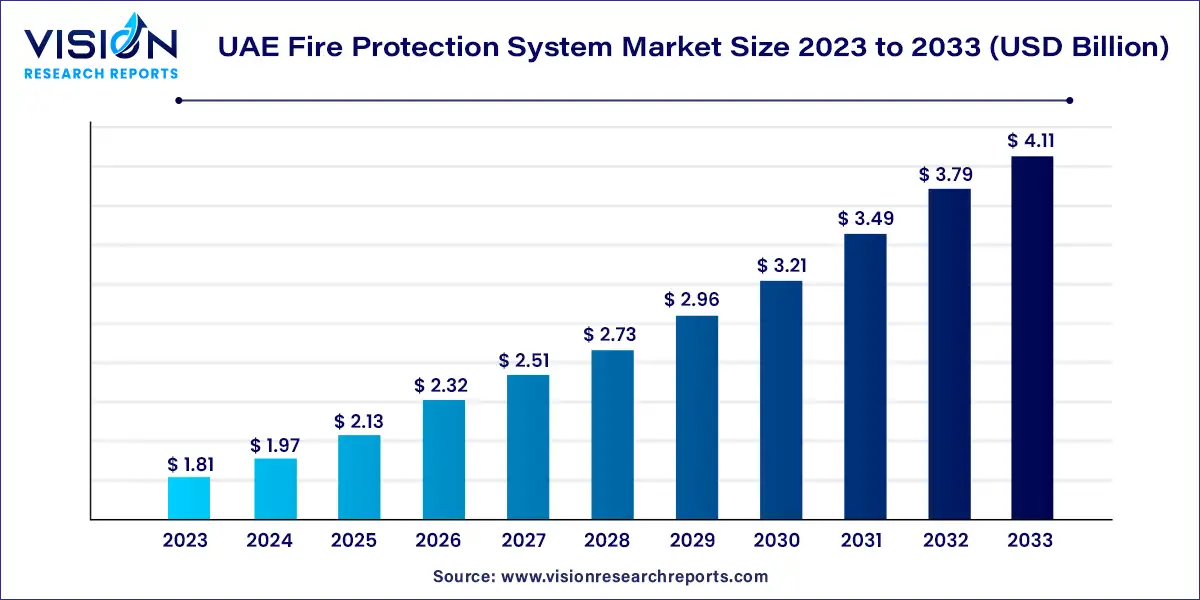

The UAE fire protection system market was estimated at USD 1.81 billion in 2023 and it is expected to surpass around USD 4.11 billion by 2033, poised to grow at a CAGR of 8.53% from 2024 to 2033.

The United Arab Emirates (UAE) boasts a thriving economy and a rapidly growing infrastructure, making fire protection systems a critical component of its development. As urbanization continues to accelerate and industries expand, the demand for robust fire safety solutions has increased significantly. This overview delves into the dynamics shaping the UAE's fire protection system market, including key trends, market drivers, challenges, and opportunities.

| Report Coverage | Details |

| Market Size in 2023 | USD 1.81 billion |

| Revenue Forecast by 2033 | USD 4.11 billion |

| Growth rate from 2024 to 2033 | CAGR of 8.53% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Amongst the product segment, fire detection accounted for the largest market share of nearly 54% in 2023. The segment's growth is attributed to factors prioritizing safety and compliance with fire safety regulations in the UAE. The UAE's rapid urbanization and construction activities have led to an increase in residential, commercial, and industrial buildings. This surge in construction creates a higher demand for advanced fire detection systems to ensure early detection and prevention of fire incidents. Moreover, rising awareness about the importance of fire safety and the need for modern and efficient fire detection technologies among businesses and homeowners contribute to expanding the UAE fire detection market. As companies and individuals seek cutting-edge fire detection solutions that integrate with smart building technologies, the segment is poised to grow.

The fire response segment is expected to grow considerably over the forecast period. The UAE's rapid urbanization and infrastructural expansion have increased demand for advanced fire safety solutions across residential, commercial, and industrial sectors. As the country continues to witness substantial construction activities, there is a heightened emphasis on adopting state-of-the-art fire response technologies to mitigate potential fire hazards. Moreover, the rising adoption of smart technologies, Internet of Things (IoT) applications, and artificial intelligence in fire response systems has revolutionized the industry, making it more efficient and effective. The integration of these technologies enables real-time monitoring, early detection, and rapid response to fire emergencies, contributing to the segment’s growth.

Amongst the service, installation and design services segment accounted for the largest market share of over 52% in 2023. The segment has been proactive in capitalizing on the booming construction industry in the UAE, which has led to an increased demand for fire protection systems in residential, commercial, and industrial projects. The demand for expert fire protection services has increased significantly in the UAE due to rapid urbanization and infrastructure development. Professional fire protection companies such as Fireman Safety Services offer end-to-end installation services, ensuring the seamless integration of fire safety systems into buildings. This is driving the demand for installation and design services in the market.

The managed service segment is expected to register the second highest CAGR over the forecast period. The increasing focus on safety and regulatory compliance has prompted businesses and organizations to seek professionally managed services for their fire protection needs. Outsourcing fire protection management allows companies to concentrate on their core operations while ensuring their fire safety systems are expertly monitored and maintained.

Amongst the application segment, the commercial sector accounted for the largest market share of over 59% in 2023. The rapid growth of commercial infrastructure, including skyscrapers, shopping malls, and business centers, necessitates robust fire safety measures. Furthermore, stringent government regulations and safety standards in the UAE push businesses to invest in comprehensive fire protection systems to ensure compliance and safeguard their assets and employees. Additionally, rising awareness among business owners about the potentially catastrophic consequences of fire incidents on their reputation and operations has led to a proactive approach to adopting modern fire protection solutions. Hence, the market is witnessing a substantial upswing with increased demand for fire detection, suppression, and prevention systems tailored to meet the fire safety requirements of the commercial sector.

The industrial sector is expected to register the highest CAGR over the forecast period. The industrial sector is witnessing a rise in the adoption of specialized fire suppression systems tailored to address specific hazards. These may include foam-based systems for flammable liquid fires, deluge systems for high-risk areas, and dry chemical systems for combustible dust hazards. Furthermore, water mist fire suppression systems are gaining popularity in industrial settings due to their effectiveness in suppressing fires while minimizing water wastage. These systems atomize water into fine droplets, creating a cooling effect and suppressing the fire by reducing oxygen availability. All these factors are expected to drive the demand for fire protection systems in the industrial sector.

By Product

By Service

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on UAE Fire Protection System Market

5.1. COVID-19 Landscape: UAE Fire Protection System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. UAE Fire Protection System Market, By Product

8.1. UAE Fire Protection System Market, by Product, 2024-2033

8.1.1 Fire Detection

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Fire Suppression

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Fire Response

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Fire Analysis

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Fire Sprinkler System

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. UAE Fire Protection System Market, By Service

9.1. UAE Fire Protection System Market, by Service, 2024-2033

9.1.1. Managed Services

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Installation And Design Services

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Maintenance Services

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. UAE Fire Protection System Market, By Application

10.1. UAE Fire Protection System Market, by Application, 2024-2033

10.1.1. Commercial

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Industrial

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Residential

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. UAE Fire Protection System Market, Regional Estimates and Trend Forecast

11.1. UAE

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Service (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Bristol Fire Engineering LLC.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Honeywell International Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Johnson Controls.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. MMJ.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. NAFFCO.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Robert Bosch Middle East FZE

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. SFFECO.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others