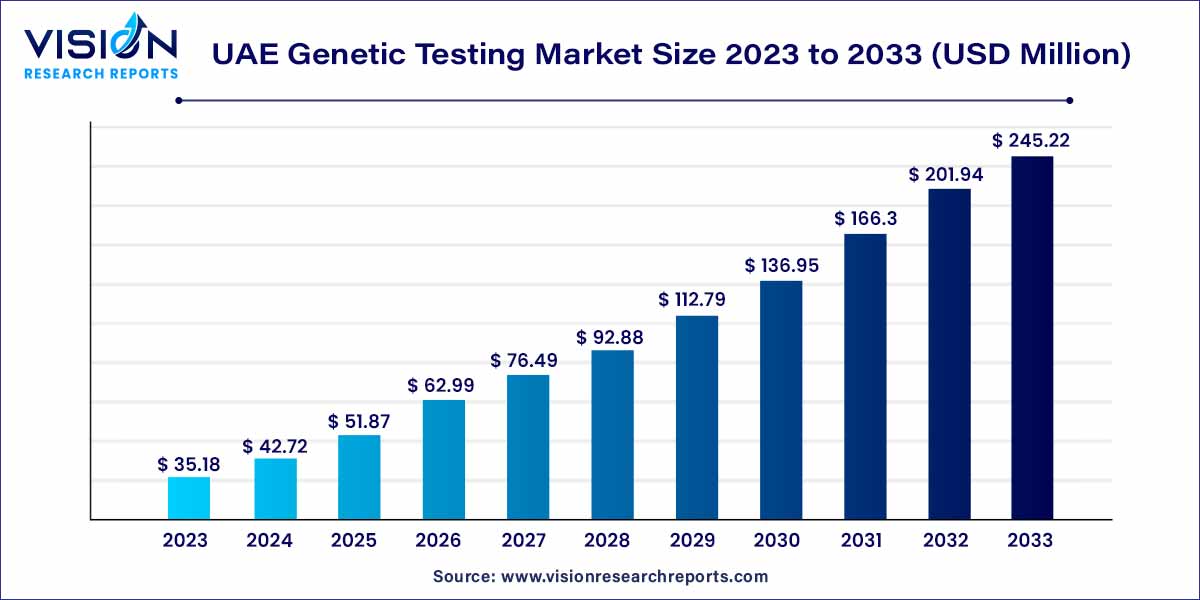

The UAE genetic testing market size was estimated at around USD 35.18 million in 2023 and it is projected to hit around USD 245.22 million by 2033, growing at a CAGR of 21.43% from 2024 to 2033.

The field of genetic testing in the United Arab Emirates (UAE) has witnessed significant advancements in recent years, playing a crucial role in healthcare and personalized medicine. This article aims to provide an insightful overview of the genetic testing market in the UAE, exploring key aspects such as growth factors, market trends, challenges, and future prospects.

The genetic testing market in the UAE is witnessing substantial growth propelled by various key factors. Firstly, there has been a notable surge in public awareness regarding the significance of genetic testing, as individuals increasingly recognize the role genetics plays in determining health outcomes. Additionally, proactive government initiatives in the UAE, aimed at enhancing overall healthcare standards, have significantly contributed to the expansion of genetic testing programs. Furthermore, technological advancements in genetic testing methodologies have played a pivotal role in making these services more accurate, accessible, and cost-effective. These combined factors create a favorable environment for the sustained growth of the genetic testing market in the United Arab Emirates.

| Report Coverage | Details |

| Market Size in 2023 | USD 35.18 million |

| Revenue Forecast by 2033 | USD 245.22 million |

| Growth rate from 2024 to 2033 | CAGR of 21.43% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

The next-generation sequencing (NGS) segment held the highest revenue share of 48% in 2023 and is expected to witness the highest growth during the forecast period. In the global healthcare sector, NGS is steadily being integrated into clinical laboratory analysis, testing, and disease diagnoses. Increased genome mapping programs, expanded applications of NGS, increasing healthcare expenditure, and technological advancements in sequencing technology are all propelling the NGS market.

For instance, in May 2020, Group 42 (G42), has collaborated with InterSystems to install InterSystems TrakCare Lab Enterprise (TCLE). TCLE will automatically report and conveniently submit PCR results to the Abu Dhabi Health Services Company (SEHA) and the Dubai Health Authority (DHA). These factors have contributed to the segment’s growth.

The ancestry & ethnicity application segment held the highest revenue share of 52% in 2023. Genetic ancestry screening, wherein genetic information is utilized to identify recent progenitors' geographic origins, has gained popularity. Furthermore, these tests reveal information about a person's ancestors and can help people connect with distant relatives, such as fourth or fifth cousins. In addition, the cost associated with these tests has reduced significantly and it has entered into the “direct to consumer” segment which is now referred to as recreational genetics.

Health and wellness segment is anticipated to witness significant CAGR of 21.85% during the forecast period. Predictive genetics testing and consumer/wellness genomics are in high demand due to the growing focus on healthy lifestyles and increased healthcare awareness campaigns. Hereditary testing can help forecast future disease risks and provide information and statistics about a child's genetic makeup. Furthermore, testing is useful for persons who have a family history of genetic disorders.

The offline channel segment held the highest revenue share share of 57% in 2023 owing to the integration of new molecular testing technologies, allowing the testing industry to expand at a rapid pace. As a result, a large number of private diagnostic testing laboratories are now offering a wide range of genetic testing services. A new trend in the supply of private molecular genetic testing services, such as saliva and buccal swab collection kits being offered for over-the-counter sales by pharmacies.

However, the online channel segment is anticipated to witness the fastest growth rate during the forecast period.Hereditary testing allows clinicians and patients to understand the risks of hereditary diseases. By testing at the early stage, individuals can make informed decisions that may minimize the risk of developing certain diseases. Smartphone applications, such as ShareDNA, provide relevant information about the genetic test results, and how to interpret those results, and reduces the information required of patients to use this service.

The hospital end-use segment held the highest market share of 63% in 2023 owing to the increasing prevalence of hospitalization of patients with genetic disorders in the country. The congenital malformation is the second major cause of mortality in the UAE. According to the Center for Arab Genomics Studies' database, there are 241 genetic abnormalities within the demographic; this figure is alarming given the country's small population size.

The rising prevalence of these disorders will be responsible for high patient visits to the hospitals, which would present the industry progression while impacting the market positively. In addition, increasing accessibility to modern technology in genetic testing and favorable reimbursement policies are contributing to fueling the demand for these testing in hospitals and clinics.

Furthermore, the diagnostic laboratories segment is expected to witness significant growth over the forecast period owing to increasing partnerships and collaboration of diagnostic laboratories with several companies operating in this market. For instance, Thermo Fisher Scientific enables laboratories to conduct hereditary research by providing technologies, such as quantitative PCR and next-generation sequencing. Similarly, in March 2022, GC Labs entered into collaboration with BioLab and Biotrust to deliver its testing services to laboratories while expanding its footprints in the region’s market. These factors contribute to the segment’s revenue growth in the coming years.

By Technology Type

By Application Type

By End-use

By Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on UAE Genetic Testing Market

5.1. COVID-19 Landscape: UAE Genetic Testing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global UAE Genetic Testing Market, By Technology Type

8.1. UAE Genetic Testing Market, by Technology Type, 2024-2033

8.1.1. Next Generation Sequencing

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Array Technology - Specific to Microarray Only

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. PCR-based Testing

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. FISH

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global UAE Genetic Testing Market, By Application Type

9.1. UAE Genetic Testing Market, by Application Type e, 2024-2033

9.1.1. Ancestry & Ethnicity

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Cancer Screening

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Genetic Disease Carrier Status

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. New Baby Screening

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Traits

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Health and Wellness - Predisposition/ Risk / Tendency

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global UAE Genetic Testing Market, By Channel

10.1. UAE Genetic Testing Market, by Channel, 2024-2033

10.1.1. Online (Own Website/ App, Aggregators, Marketplace)

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Offline (Pharmacy, Own Clinics, Partner Clinics, Lab, Hospitals)

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.2. Others

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global UAE Genetic Testing Market, By End-use

11.1. UAE Genetic Testing Market, by End-use, 2024-2033

11.1.1. Hospitals & Clinics

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Diagnostic Laboratories

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Others

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global UAE Genetic Testing Market, Regional Estimates and Trend Forecast

12.1. UAE

12.1.1. Market Revenue and Forecast, by Technology Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Application Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Channel (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. Middle East Testing Services L.L.C

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Molecular Biology & Genetics Laboratory

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. NSG

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Freiburg Medical Laboratory Middle East

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. IVI MIDDLE EAST FERTILITY CLINIC

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. 23andMe, Inc

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Ancestry

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. CircleDNA

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. 24Genetics

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. MyDNA Life Australia Pty Ltd.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others