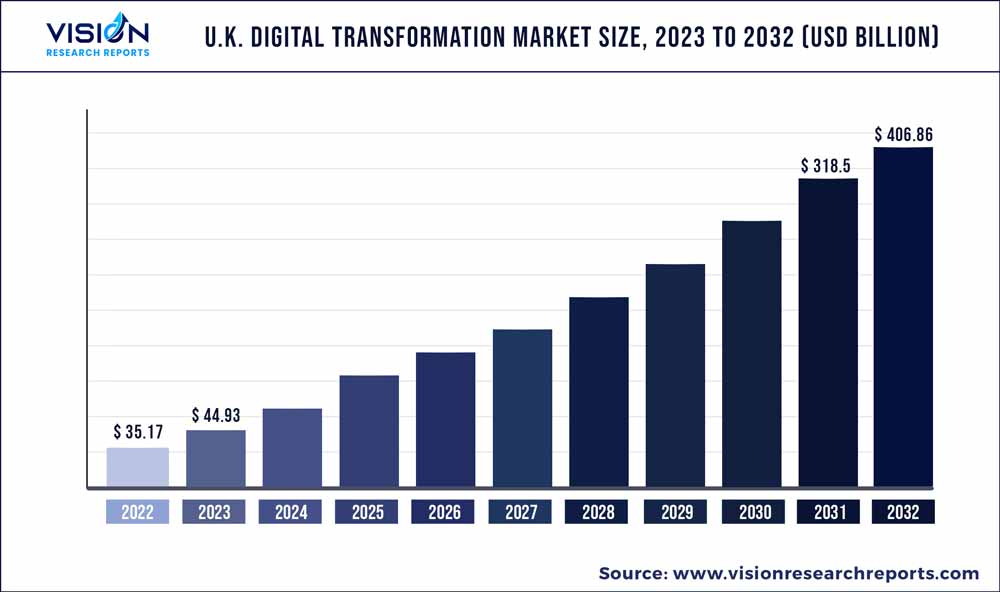

The U.K. digital transformation market was estimated at USD 35.17 billion in 2022 and it is expected to surpass around USD 406.86 billion by 2032, poised to grow at a CAGR of 27.74% from 2023 to 2032.

Key Pointers

Report Scope of the U.K. Digital Transformation Market

| Report Coverage | Details |

| Market Size in 2022 | USD 35.17 billion |

| Revenue Forecast by 2032 | USD 406.86 billion |

| Growth rate from 2023 to 2032 | CAGR of 27.74% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Accenture PLC; Adobe Inc.; Broadcom Inc.; Dell Inc.; Google LLC; Hewlett Packard Enterprise Development LP; International Business Machines Corporation; Microsoft Corporation; Oracle Corporation; SmartStream Technologies Ltd |

The outbreak of the COVID-19 pandemic positively impacted the market. The COVID-19 pandemic encouraged U.K. government departments to accelerate digital transformation and implement a policy within weeks instead of months or years. The pandemic has impelled businesses to adopt cloud technology for remote working. This has resulted in the increased adoption of cloud services to ensure business continuity. The Government Digital Service (GDS), a Government of the U.K.'s Cabinet Office unit, has built services and a central hub of coronavirus information on GOV.UK to help vulnerable people.

Digital transformation helps organizations enhance their customer retention ratios, customer experience, and brand reputation through the implementation of software. This software also helps organizations in educating and training their internal teams on numerous aspects of their organizations. Furthermore, digitally transformed businesses can become accustomed to the surging technological landscape and confront sudden industry shifts. More importantly, a substantial part of the market growth is expected to be driven by companies investing in cloud platforms, mobility, and big data technologies to build Digital Experience Platforms (DXP).

Advanced technologies such as cloud, big data, IoT, and analytics, mobility, and social media have sparked innovation and transformation in the business environment, resulting in increased revenue. Digital transformation is the adoption of digital technologies across business processes to transform the way technology and resources are used to deliver improved value to customers. In the U.K., companies have accelerated their digital transformation through cloud migrations, IoT, and by modernizing older IT infrastructure, among others. For instance, key cloud providers such as Microsoft Azure, Google Cloud, and Amazon Web Services (AWS) have invested Billions of dollars in upgrading their cloud infrastructure, from improving redundancy and security to expanding capabilities.

The widespread use of mobile devices and apps has transformed many facets of modern life. Owing to the staggering rise in the customer base of smartphone and tablet users, opportunities for employing mobile technologies have significantly increased in the U.K. in recent years. Advancements in the U.K. market include the increasing adoption of healthcare bio-sensing wearables, such as glucose sensors and digital blood pressure monitors, and patient and provider access to real-time healthcare data and information. Consumers now have access to different types of applications apps provided under digital transformation solutions due to increasing smartphone adoption.

While implementing digital technologies, the security and privacy of critical business data is a major concern, which is compounded further when businesses invest in new technologies. As IoT becomes more pervasive, organizations are demanding more robust security and privacy to prevent breaches. Challenges faced in managing digital security and privacy risks are expected to hinder the adoption of digital transformation efforts across several businesses. Security issues, including cybersecurity risks, rigid technical infrastructure and legal environments, risk management, and/or compliance problems, can jeopardize the digitization plans of a business.

Solution Insights

The analytics segment accounted for a revenue share of 36% in 2022. Analytics-based solutions have a broad scope of applications across various industries. For instance, they can be utilized for predictive maintenance systems in the manufacturing sector to help reduce downtime and increase production. The growing deluge of data, including structured, unstructured, and raw, with enormous velocity or volume, is encouraging enterprises to digitize their processes. Businesses need to focus on the idea of harnessing organizational data to enhance business value. They can implement analytics for faster and more intelligent decision-making, thereby boosting business performance largely.

The cloud computing segment is expected to grow at a CAGR of 27.62% during the forecast period. The need for faster deployment, development, delivery, and higher flexibility increases the demand for cloud computing. Companies adopt the digital transformation process to add value to the business, upgrade the IT infrastructure, and be competitive. Beyond implementing cloud solutions, a company should add new technologies that automate, speed up, and improve the business, such as machine learning, artificial intelligence, big data analytics, and the internet of things. Considering that these technologies need higher storage space and computational power, cloud computing provides an easy solution to integrate these technologies.

Service Insights

The professional service segment accounted for a revenue share of 77% in 2022. This section offers consultancy and managed services to organizations of all sizes operating in numerous sectors. Businesses that are digitizing require expert services to address problems like vendor selection or cultural transformation. As professional service providers aid in utilizing and deploying the proper resources at the proper moment, this industry is anticipated to grow.

The implementation & integration segment is expected to grow at a CAGR of 27.34% during the forecast period. It is projected that organizations will contact implementation service providers for the smooth deployment of digital solutions. Due to the difficulty of integrating and implementing digital transformation within an existing framework, it is anticipated that businesses will require appropriate help. This will fuel the segment's expansion.

Deployment Insights

The on-premise segment accounted for the highest revenue share of 52% in 2022. Several businesses choose on-premise solutions due to the ease of customizability presented during implementation. These solutions provide high-end data security and enable easy compliance with several government regulations. The on-premise deployment offers large organizations better control over confidential data. Furthermore, on-premise deployment allows organizations to install a personalized network of digital transformation that suits the organizations’ needs most efficiently and accurately.

The hosted segment is anticipated to grow at the highest CAGR of 29.92% over the forecast period. The hosted deployment segment is anticipated to witness remarkable growth owing to the flexibility provided by this deployment type. It allows users to access tools through both mobile devices and desktop computers. Additionally, it offers benefits such as low cost, easy accessibility and deployment, and reduced maintenance and upgrading efforts.

Enterprise Size Insights

The large enterprise segment accounted for the highest revenue share of 59% in 2022. Large enterprises are observed making significant investments to enhance or maintain their market position in a competitive market. Additionally, they are readily adopting technological advancements to keep themselves upgraded in the industry. They are also undertaking various strategic initiatives such as partnerships and, mergers & acquisitions to acquire new technologies.

The Small and Medium Enterprises (SMEs) segment is expected to grow at a CAGR of 28.35% over the forecast period. Small & medium enterprises are becoming aware of the advantages gained by digitizing their business. Initially reluctant to invest in technologies, it is becoming necessary for them to provide customers with better services with the increasing levels of competition. This is making it essential for SMEs to implement innovative technologies to keep their businesses at par with competitors.

End-use Insights

The BFSI segment accounted for the highest revenue share of 29% in 2022. The significant growth of this segment can be attributed to the shifting focus of banking and financial services providers toward providing customers with a better experience as the products and services within the industry are becoming commoditized. BFSI companies are constantly looking for a customer-centric approach while striving to meet customers’ needs and offering seamless assistance with technical support. The COVID-19 pandemic has changed the way banks cooperate with all their stakeholders. The demand for remote functioning abilities has increased, driving the sector to adopt digital transformation, where all processes and systems are digitally integrated to deliver a better customer experience.

The healthcare segment is anticipated to grow at the highest CAGR of 28.63% over the forecast period. Digital transformation in the healthcare sector is expected to help improve the quality of care. It can be utilized in health mapping, which helps monitor diseases and prevent them. For instance, Electronic Health Records (EHR) facilitate analytics-based decisions and diagnoses. During the COVID-19 pandemic, the industry quickly altered its processes to respond to changing and emerging health situations. Digital transformation has been enabling companies in this industry to keep up with production and follow social distancing guidelines. All these factors are driving digital transformation in the healthcare industry.

U.K. Digital Transformation Market Segmentations:

By Solution

By Service

By Deployment

By Enterprise Size

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.K. Digital Transformation Market

5.1. COVID-19 Landscape: U.K. Digital Transformation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.K. Digital Transformation Market, By Solution

8.1. U.K. Digital Transformation Market, by Solution, 2023-2032

8.1.1. Analytics

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Cloud Computing

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Mobility

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Social Media

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.K. Digital Transformation Market, By Service

9.1. U.K. Digital Transformation Market, by Service, 2023-2032

9.1.1. Professional Services

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Implementation & Integration

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.K. Digital Transformation Market, By Deployment

10.1. U.K. Digital Transformation Market, by Deployment, 2023-2032

10.1.1. Hosted

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. On-premise

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.K. Digital Transformation Market, By Enterprise Size

11.1. U.K. Digital Transformation Market, by Enterprise Size, 2023-2032

11.1.1. Large Enterprise

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Small & Medium Enterprise

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. U.K. Digital Transformation Market, By End-use

12.1. U.K. Digital Transformation Market, by End-use, 2023-2032

12.1.1. BFSI

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. Government

12.1.2.1. Market Revenue and Forecast (2020-2032)

12.1.3. Healthcare

12.1.3.1. Market Revenue and Forecast (2020-2032)

12.1.4. IT & Telecom

12.1.4.1. Market Revenue and Forecast (2020-2032)

12.1.5. Manufacturing

12.1.5.1. Market Revenue and Forecast (2020-2032)

12.1.6. Retail

12.1.6.1. Market Revenue and Forecast (2020-2032)

12.1.7. Others

12.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 13. U.K. Digital Transformation Market, Regional Estimates and Trend Forecast

13.1. U.K.

13.1.1. Market Revenue and Forecast, by Solution (2020-2032)

13.1.2. Market Revenue and Forecast, by Service (2020-2032)

13.1.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.1.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.1.5. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 14. Company Profiles

14.1. Accenture PLC

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Adobe Inc.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Broadcom Inc.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Dell Inc.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Google LLC

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Hewlett Packard Enterprise Development LP

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. International Business Machines Corporation

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Microsoft Corporation

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Oracle Corporation

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. SmartStream Technologies Ltd

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others