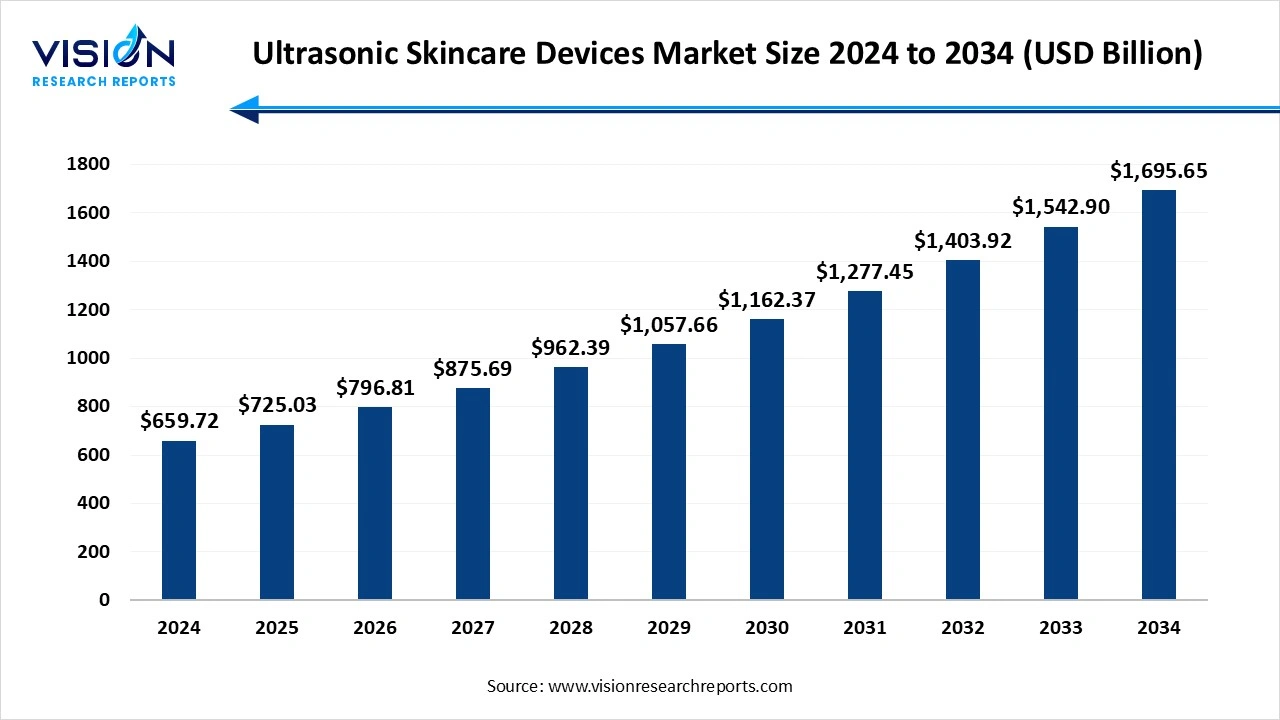

The global ultrasonic skincare devices market size was calculated at USD 659.72 billion in 2024 and it is expected to surpass around USD 1,695.65 billion by 2034, poised to grow at a CAGR of 9.90% from 2025 to 2034.

The global ultrasonic skincare devices market has witnessed significant growth in recent years, driven by increasing consumer awareness about advanced skincare technologies and the rising demand for non-invasive beauty treatments. These devices leverage high-frequency sound waves to deliver deep skin cleansing, enhanced product absorption, and anti-aging benefits, making them a popular choice among consumers seeking professional-grade skincare solutions at home. The market is further propelled by the growing preference for personalized beauty regimens, continuous product innovations by manufacturers, and the expanding e-commerce sector, which provides easy accessibility to a wide range of ultrasonic skincare devices.

One of the primary growth factors driving the ultrasonic skincare devices market is the increasing consumer awareness of advanced skincare technologies. With the rise of social media, beauty influencers, and dermatology education platforms, consumers are now more informed about the benefits of professional-grade skincare treatments. Ultrasonic skincare devices, known for their ability to deliver deep cleansing, improve blood circulation, and enhance skincare product absorption, have gained popularity among beauty enthusiasts seeking effective, non-invasive solutions.

Another critical factor fueling market growth is the continuous innovation in product design and functionality by manufacturers. Leading companies are investing in research and development to introduce advanced ultrasonic skincare devices with enhanced features such as multi-mode functionality, ergonomic designs, and smart connectivity options. These innovations not only enhance user convenience but also improve treatment efficacy, making ultrasonic skincare devices a preferred choice for at-home skincare.

North America held a 41% share of the market in 2024. Driven by high consumer awareness about skincare, widespread adoption of advanced beauty technologies, and the presence of leading manufacturers. The region's well-established healthcare and cosmetic industries also support the growing demand for ultrasonic skincare devices, particularly in the United States and Canada.

Europe follows closely, with markets such as Germany, the United Kingdom, and France showing robust growth due to the increasing popularity of non-invasive cosmetic treatments and rising disposable incomes. European consumers tend to prioritize quality and efficacy in skincare, which fuels the demand for innovative ultrasonic devices. Additionally, stringent regulatory frameworks in the region ensure high product standards, further enhancing consumer confidence.

The handheld ultrasonic skincare segment dominated the market, accounting for 72% of the total share in 2024. Handheld ultrasonic skincare devices are compact, portable, and designed for personal or professional use, allowing users to easily carry and operate them for targeted skin treatments. These devices typically utilize high-frequency ultrasonic waves to promote skin rejuvenation, enhance the absorption of skincare products, and improve overall skin texture.

Tabletop ultrasonic skincare devices are larger and usually designed for professional or clinical settings. These devices offer more powerful ultrasonic outputs and often come with multiple functionalities that can address a broader range of skin concerns. Due to their size and enhanced capabilities, tabletop devices are commonly found in dermatology clinics, beauty salons, and medical spas, where they support various skin therapies, such as deep cleansing, collagen stimulation, and improved blood circulation. Tabletop ultrasonic skincare devices are valued for their effectiveness in delivering intensive skin treatments and their ability to serve multiple clients efficiently in a professional environment.

The ultrasonic skincare devices market was led by the homecare segment, driven by rising consumer demand for cost-effective, convenient, and non-invasive skincare solutions in 2024. The shift toward at-home treatments accelerated during and after the COVID-19 pandemic, as individuals sought to maintain their skincare routines without relying on in-person services. Social media platforms like YouTube and TikTok have played a pivotal role in educating users, making ultrasonic facials more accessible to the general public. As these devices become increasingly affordable, with features such as rechargeable batteries and waterproof designs, their popularity continues to grow—especially among millennials and Gen Z consumers.

The medspa segment is projected to experience the fastest growth rate in the ultrasonic skincare devices market during the forecast period. This surge is fueled by the growing convergence of cosmetic dermatology and wellness, which is encouraging the adoption of advanced, non-invasive technologies in professional settings. Unlike traditional spas, medspas operate under medical supervision and offer specialized treatments such as ultrasound-assisted facials, sonophoresis for improved product absorption, and skin tightening using multifunctional hybrid systems.

By Product

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Ultrasonic Skincare Devices Market

5.1. COVID-19 Landscape: Ultrasonic Skincare Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Ultrasonic Skincare Devices Market, By Product

8.1. Ultrasonic Skincare Devices Market, by Product

8.1.1. Handheld Devices

8.1.1.1. Market Revenue and Forecast

8.1.2. Tabletop Devices

8.1.2.1. Market Revenue and Forecast

Chapter 9. Ultrasonic Skincare Devices Market, By End Use

9.1. Ultrasonic Skincare Devices Market, by End Use

9.1.1. Dermatology Clinics

9.1.1.1. Market Revenue and Forecast

9.1.2. Medspas

9.1.2.1. Market Revenue and Forecast

9.1.3. Homecare

9.1.3.1. Market Revenue and Forecast

9.1.4. Others

9.1.4.1. Market Revenue and Forecast

Chapter 10. Ultrasonic Skincare Devices Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product

10.1.2. Market Revenue and Forecast, by End Use

Chapter 11. Company Profiles

11.1. Panasonic Corporation

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. LG Electronics Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Philips N.V.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Project E Beauty

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Silk'n (Innovative Cosmetic Technologies Ltd.)

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Rio Beauty

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Nu Skin Enterprises, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Beurer GmbH

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Verseo

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Dr. Dennis Gross Skincare

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others