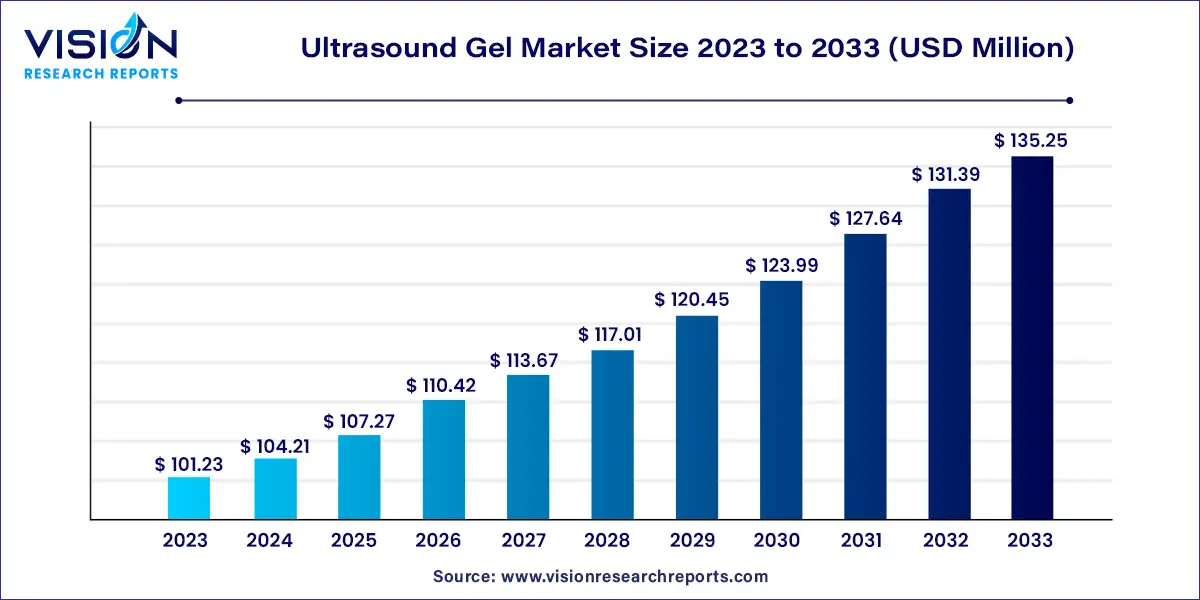

The global ultrasound gel market size was estimated at around USD 101.23 million in 2023 and it is projected to hit around USD 135.25 million by 2033, growing at a CAGR of 2.94% from 2024 to 2033.

The ultrasound gel market serves as a crucial component in medical imaging procedures, facilitating efficient transmission of ultrasound waves between the transducer and the skin. It ensures clearer and more accurate imaging results by eliminating air gaps and reducing friction. The market for ultrasound gel is driven by the increasing prevalence of various medical conditions necessitating ultrasound diagnostics, such as pregnancy monitoring, organ examination, and musculoskeletal imaging.

The ultrasound gel market is experiencing steady growth due to increased demand for ultrasound diagnostics across various medical conditions. Advancements in ultrasound technology, rising healthcare expenditure, and emphasis on patient safety are driving factors. Additionally, expanding applications of ultrasound and growing awareness about preventive healthcare contribute to market expansion. Overall, the market is poised for continued growth in the foreseeable future.

| Report Coverage | Details |

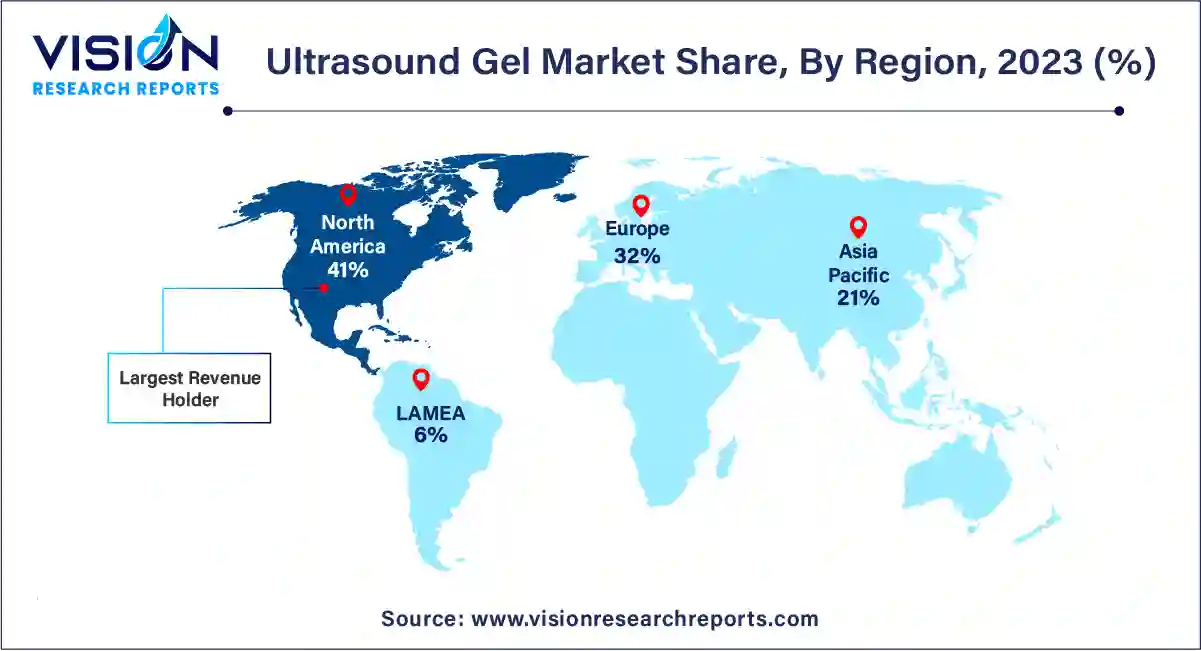

| Revenue Share of North America in 2023 | 41% |

| CAGR of Asia Pacific from 2024 to 2033 | 3.84% |

| Revenue Forecast by 2033 | USD 135.25 million |

| Growth Rate from 2024 to 2033 | CAGR of 2.94% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The hospital segment held the largest revenue share in 2023 and is expected to grow at a significant CAGR over the forecast period. The increasing number of emergency visits in hospitals reporting problems such as acute abdominal pain, chest pain, and vascular problems where ultrasound is the primary diagnostic tool is expected to drive the demand for ultrasound gels. Moreover, using the ultrasound device in follow-up visits is expected to fuel the demand curve as gel must be applied each time before examination. In November 2022, 56 (Targeted Imaging for Foetal Anomalies) TIFFA scan machines were inaugurated at 44 government hospitals in Telangana, India. This initiative is likely to propel the growth of ultrasound gel in the region.

Ambulatory centers and clinics are anticipated to grow at the speediest rate in the ultrasound gels market during the forecast period. The rising awareness about the importance of early intervention in reducing healthcare costs has increased the installation rate of ultrasounds in clinics. The availability of handheld ultrasound devices at affordable prices has further promoted their adoption rate in small-sized clinics. Therefore, the growing number of ultrasound units in clinics has contributed to the rising demand for gel in these setups.

Based on type, the market is segmented into non-sterile and sterile ultrasound gel. The non-sterile segment held the largest revenue share of 72% in 2023. Ultrasound imaging can be further classified into internal and external probe procedures. External ultrasound probe procedures can be performed on intact skin and require low cleaning and disinfection after every use, making it suitable for external probe procedures. Therefore, the increasing number of external probe procedures for diagnosing kidney, and gallbladder problems, cancers, and intestinal diseases are expected to drive segment growth. In July 2023, Imaging Solutions announced the launch of EcoVue Ultrasound Gel and Acclimate Gel Warmer as part of its single-source supply offer, showcasing its commitment to providing high-quality solutions directly to customers. EcoVue comes in single-use packets, with sterile and non-sterile options, designed to reduce cross-contamination during bottle reuse. They also come with a sterile SafeWrap for added protection.

The sterile segment is expected to grow at the fastest CAGR of 3.66% during the forecast period. These are commercially available in 20ml pocket-sized packets and used in ultrasound procedures where sterility is indicated, especially when treating open wounds and during needle guidance. The segment is expected to grow significantly due to contamination and the possibility of an infection outbreak associated with using multi-use nonsterile gel bottles. The UK Health Security Agency (UKHSA) has updated its guidelines on using sterile ultrasound gel during procedures. According to these guidelines, sterile gel should be used if an invasive procedure is likely to be performed within the next 24 hours, including procedures such as ultrasound viewing or initial assessment that are carried out before an invasive procedure.

North America dominated the market and accounted for the largest revenue share of 41% in 2023. The factors such as the presence of major market players, developed healthcare infrastructure, and streamlined reimbursement policies are expected to drive the regional market growth. In addition, the increasing acceptance of ultrasound at community-level clinics and home healthcare is expected to aid market growth.

Europe held the second-largest market share. Huge consumption of medical consumables, growing healthcare expenditure, and rising medical imaging procedures are anticipated to drive the market in the region. According to the annual statistics released by the National Health Service (NHS), from March 2022 to February 2023, over 43.0 million imaging tests were reported in England, out of which 3.33 million imaging tests were reported to have taken place in February 2023, and 0.78 million of these were diagnostic ultrasonography.

Asia Pacific is expected to grow at the fastest CAGR of 3.84% during the forecast period. Large unmet needs, developing healthcare facilities, and the presence of several small-scale domestic manufacturers, especially in countries such as China and India, are expected to boost market growth. TELE-PAPER Malaysia, one of Asia's largest thermal product manufacturers, introduced SONOMED ULTRASOUND GEL, a filtered water-based gel that can be used with any ultrasonic device. It reduces the air space, making it easy for the transducer to transmit sound waves and receive their reflections to produce precise, clear images.

By Type

By End Use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others