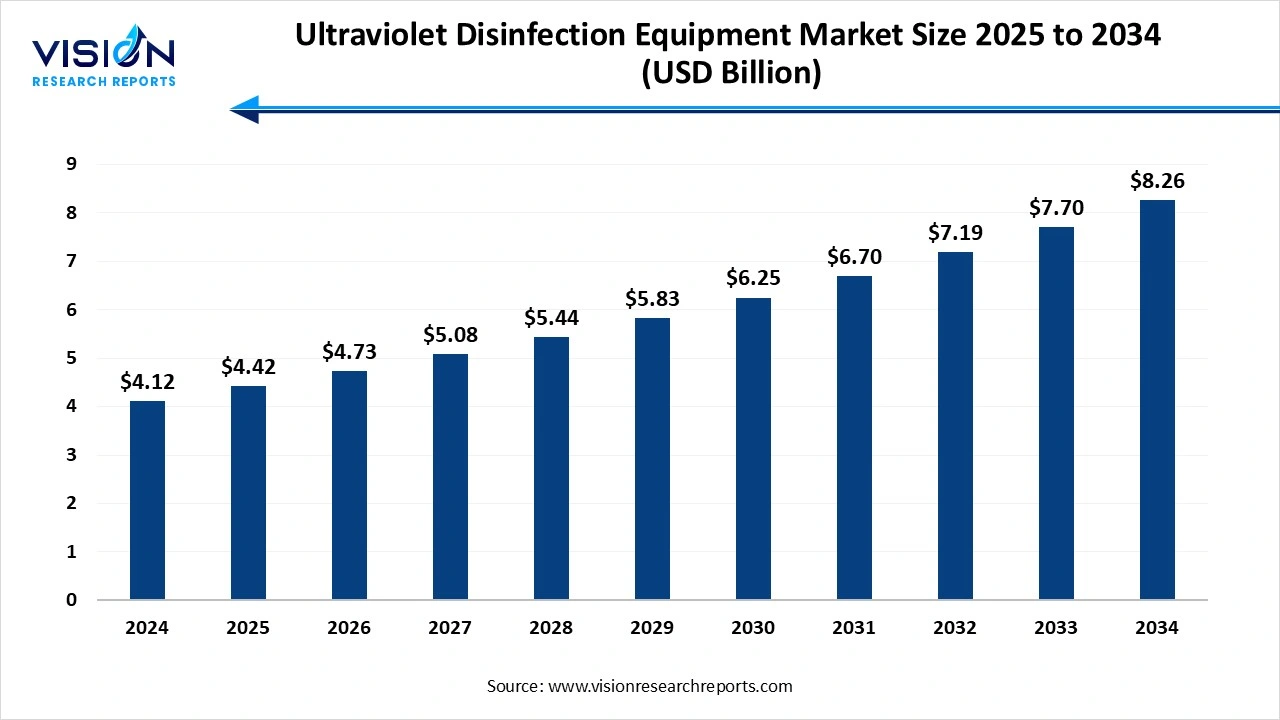

The ultraviolet disinfection equipment market size was valued at USD 4.12 billion in 2024 and is expected to grow from USD 4.42 billion in 2025, ultimately reaching approximately USD 4.42 billion by 2034, reflecting a steady CAGR of 7.2% over the forecast period. The rising prevalence of waterborne and airborne diseases, public health concerns and regulations, and technological innovation expansion of the market growth.

Equipment that utilizes ultraviolet light, particularly ultraviolet light, eliminates harmful microorganisms such as bacteria, viruses, mold, and protozoa from water, air, and surfaces without the use of chemicals. The market growth is driven by the heightened awareness of infectious disease transmission, increasing demand for non-chemical disinfection methods, growing concerns about water and air quality, and stringent government regulations are propelling market growth. The disinfectant surfaces, air, and medical equipment in hospitals, clinics, and laboratories to prevent microorganism infection.

The spread of diseases such as cholera, typhoid, and Legionnaires' disease affects to health of living organisms, UV disinfection equipment prevents their infection. The increasing incidence of healthcare-associated infections is prompting healthcare facilities to adopt UV-based solutions for sterilizing surfaces and reducing transmission risk.

Riverside Healthcare invested in a new UV disinfection robot to enhance patient safety and reduce healthcare-associated infections (HAIs). This robot utilizes ultraviolet (UV) light to disinfect surfaces and equipment, providing a chemical-free and sustainable solution.

The government is implementing increasingly stringent regulations regarding the quality of drinking water and treated wastewater, increasing the demand for UV technology. The regulatory bodies in the U.S. Environmental Protection Agency approve UV disinfection for its use against chlorine-resistant microorganisms and the lack of harmful by-products. The International Organization of Standardization and national bodies in the German Institute for Standardization are continuously developing and updating standards for UV disinfection equipment performance, safety, and testing protocol.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.12 billion |

| Revenue Forecast by 2034 | USD 8.26 billion |

| Growth rate from 2025 to 2034 | CAGR of 7.2% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered |

Xylem Inc., Trojan Technologies Group ULC., Halma PLC, Calgon Carbon Corporation, Atlantic Ultraviolet Corporation, Evoqua Water Technologies LLC, Advanced UV, Inc., American Ultraviolet, Atlantium Technologies LTD., Dr. Hönle AG, Lumalier Corporation, Xenex, ENAQUA, S.I.T.A. Srl, Hitech Ultraviolet Pvt. Ltd. |

The UV-C LEDs are free from harmful mercury, eliminating disposal concerns and reducing environmental impact. This aligns with global efforts to phase out mercury, highlighted by initiatives like the Minamata Convention. The small size of UV-C LED allows for integration into innovative and compact disinfection systems, opening the door for new applications in consumer products, medical devices, and portable disinfection units, which will drive the market growth. The integration of AI and IoT in technology, especially in sectors like water treatment and sanitation, offers significant growth avenues.

The UV disinfection systems, especially the advanced model with specialized components like UV lamps, reactors, and monitoring systems, can have a high upfront cost. The high cost of installing water treatment plants, the high upfront investment can be a barrier for small and medium-sized enterprises. UV lamps require periodic replacement, adding to the ongoing operational costs. The requirement for specialized maintenance and repair expertise, the competitive pricing advantage of chemical alternatives, such as chloride-based disinfection, which can be cheaper to install and maintain, can hinder the wider adoption of UV technology in price-sensitive markets.

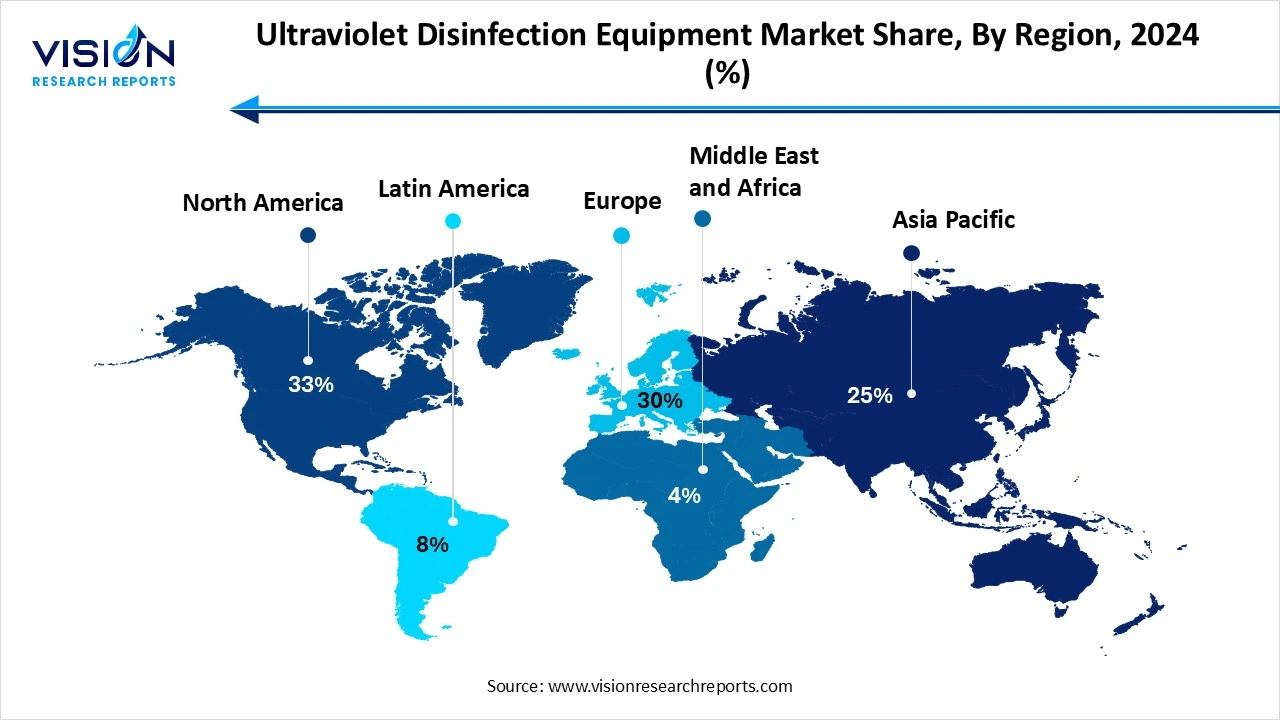

North America led the global ultraviolet disinfection equipment market, capturing a 33% share of the total revenue in 2024. The region in which robust environmental regulations and health standards, particularly concerning water quality and public health. Drive the adoption in water treatment, industrial processes, and healthcare facilities. The North America region is adopting advanced disinfection technologies, smart monitoring systems. The regions focus on research and development of more efficient, scalable, and cost-effective UV disinfection solutions. In these regions, the country invested heavily in innovation in wastewater treatment, including the integration of UV disinfection systems. Innovation towards the healthcare system, UV disinfection for air and surface sterilization, is contributing to the demand for these systems.

United States Ultraviolet Disinfection Equipment Market Trends

The United States is a major contributor to the ultraviolet disinfection equipment market. The stringent regulations drive the adoption of UV disinfection systems, advanced infrastructure, and well-developed infrastructure for water treatment and healthcare. UV technology is widely used in municipal water treatment facilities, healthcare institutions, and heating, ventilation, and air conditioning systems in the U.S. Manufacturers are actively involved in research and development to enhance UV disinfection systems. Recent innovations focus on energy-efficient UV lamps, advanced oxidation processes, UV LED technology, IoT-enabled smart systems for real-time monitoring and data analytics, and improved disinfection efficiency.

Why is Asia Pacific Significantly Growing in the Ultraviolet Disinfection Equipment Market?

Asia Pacific expects significant growth in the market during the forecast period. The rapid urbanization and increasing population awareness towards water treatment, where UV disinfection provides a highly efficient and chemical-free solution. UV disinfection plays an important role in freshwater resources, healthcare facilities, commercial species, and residential applications. Governments in the region are actively implementing and enforcing stricter regulations on water quality, wastewater discharge, and public health, necessitating the adoption of advanced disinfection technologies.

China Ultraviolet Disinfection Equipment Market Trends

China is growing in the ultraviolet disinfection equipment market. The innovations towards smart cities and clean technology in different sectors, such as municipal water treatment, industrial wastewater treatment, and residential disinfection. Regulations have been implemented to ensure the safety, efficacy, and standardization of UV technologies, covering manufacturing, testing, and application.

Why did the UV Lamp Segment Dominate the Ultraviolet Disinfection Equipment Market?

The UV lamps segment held the largest share of the global ultraviolet disinfection equipment market, accounting for 38% of the total revenue in 2024. The UV lamp component is more the essential components, directly emitting the UV-C light that inactivates bacteria, viruses, and other pathogens. The increasing demand for UV lamps in municipal, industrial, residential, and healthcare settings drives the market growth. The replacement of the UV lamp is available with a limited operational lifespan. The innovations in lamp technology have increased efficiency, more attractive for new applications, and prompted end users to retrofit existing systems.

The Quartz sleeves segment is the fastest-growing in the ultraviolet disinfection equipment market during the forecast period. The Quartz sleeves are crucial for protecting UV lamps from direct contact with water, preventing physical damage and potential contamination of the treated environment. Maintaining the optional UV output plays a role in regulating the operating temperature of UV lamps, ensuring stable thermal conditions that are essential for efficient UV-C light emission and ultimately effective disinfection. Quality quartz sleeves are designed to be durable, contributing to the overall longevity and performance of the UV disinfection system. The rising demand for advanced UV systems, founding, and replacement needs drive the market growth.

How the Water and Wastewater Treatment Application Segment hold the Largest Share in the Ultraviolet Disinfection Equipment Market?

The water and wastewater treatment application segment dominated the market, capturing a 48% share of the total revenue in 2024. The rising demand for clean water, increasing world population, and rapid urbanization have significantly increased the demand for efficient wastewater treatment solutions. UV disinfection is crucial in treating municipal drinking water and wastewater to eradicate harmful microorganisms such as bacteria, viruses, and protozoa, which can cause waterborne diseases. The national initiative in India has government-led programs like Clean Ganga and Smart Cities that encourage the use of advanced water treatment technologies, including UV disinfection. The growing public health concern, focus on water reuse and recycling, and technological innovation drive the market growth.

The surface disinfection segment is expected to register the highest CAGR throughout the forecast period. The wide use in hospitals, such as implementing UV systems to disinfect operating rooms, patient rooms, and medical equipment, to combat hospital-acquired infections. Deploying in airports, train stations, and shopping malls for automated and efficient sanitization, and utilizing in the food and beverages industry, drives the market growth. The shift towards chemical-free methods, UV disinfection offers a residue-free and environmentally friendly alternative to traditional chemical disinfections, with its high effectiveness and technological advancement expansion of the market growth.

The municipal end-use segment dominated the market in 2024, accounting for a 41% share of the total revenue. The municipalities are responsible for providing safe drinking water and treating wastewater to meet stringent environmental discharge regulations. Growing concern over waterborne disease and public health, and stringent government regulation. Governments worldwide are implementing stricter regulations and standards for water quality and wastewater discharge. With the increased need for sustainable water management, municipal authorities are investing in advanced UV systems to upgrade their infrastructure.

The commercial sector segment is the fastest-growing in the market during the forecast period. The commercial sector, encompassing offices, retail spaces, hospitality, and transportation, faces increasing demand for maintaining a high level of cleanliness and safety for consumers. With the focus on safe environments, businesses are actively investing in UV solutions to create safer environments, especially in high-traffic and public areas. The demand for compact, automated, and energy-efficient UV devices is rising across commercial establishments as part of broader efforts to maintain cleanliness and comply with safety regulations.

By Component Type

By Application

By End use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Component Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Ultraviolet Disinfection Equipment Market

5.1. COVID-19 Landscape: Ultraviolet Disinfection Equipment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Ultraviolet Disinfection Equipment Market, By Component Type

8.1. Ultraviolet Disinfection Equipment Market, by Component Type

8.1.1 UV Lamps

8.1.1.1. Market Revenue and Forecast

8.1.2. Ballasts/Controller Units

8.1.2.1. Market Revenue and Forecast

8.1.3. Quartz Sleeves

8.1.3.1. Market Revenue and Forecast

8.1.4. Reactor Chambers

8.1.4.1. Market Revenue and Forecast

8.1.5. Others

8.1.5.1. Market Revenue and Forecast

Chapter 9. Global Ultraviolet Disinfection Equipment Market, By Application

9.1. Ultraviolet Disinfection Equipment Market, by Application

9.1.1. Water & Wastewater Treatment

9.1.1.1. Market Revenue and Forecast

9.1.2. Air Treatment

9.1.2.1. Market Revenue and Forecast

9.1.3. Surface Disinfection

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global Ultraviolet Disinfection Equipment Market, By End use

10.1. Ultraviolet Disinfection Equipment Market, by End use

10.1.1. Municipal

10.1.1.1. Market Revenue and Forecast

10.1.2. Residential

10.1.2.1. Market Revenue and Forecast

10.1.3. Commercial

10.1.3.1. Market Revenue and Forecast

10.1.4. Industrial

10.1.4.1. Market Revenue and Forecast

Chapter 11. Global Ultraviolet Disinfection Equipment Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Component Type

11.1.2. Market Revenue and Forecast, by Application

11.1.3. Market Revenue and Forecast, by End use

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Component Type

11.1.4.2. Market Revenue and Forecast, by Application

11.1.4.3. Market Revenue and Forecast, by End use

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Component Type

11.1.5.2. Market Revenue and Forecast, by Application

11.1.5.3. Market Revenue and Forecast, by End use

11.2. Europe

11.2.1. Market Revenue and Forecast, by Component Type

11.2.2. Market Revenue and Forecast, by Application

11.2.3. Market Revenue and Forecast, by End use

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Component Type

11.2.4.2. Market Revenue and Forecast, by Application

11.2.4.3. Market Revenue and Forecast, by End use

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Component Type

11.2.5.2. Market Revenue and Forecast, by Application

11.2.5.3. Market Revenue and Forecast, by End use

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Component Type

11.2.6.2. Market Revenue and Forecast, by Application

11.2.6.3. Market Revenue and Forecast, by End use

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Component Type

11.2.7.2. Market Revenue and Forecast, by Application

11.2.7.3. Market Revenue and Forecast, by End use

11.3. APAC

11.3.1. Market Revenue and Forecast, by Component Type

11.3.2. Market Revenue and Forecast, by Application

11.3.3. Market Revenue and Forecast, by End use

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Component Type

11.3.4.2. Market Revenue and Forecast, by Application

11.3.4.3. Market Revenue and Forecast, by End use

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Component Type

11.3.5.2. Market Revenue and Forecast, by Application

11.3.5.3. Market Revenue and Forecast, by End use

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Component Type

11.3.6.2. Market Revenue and Forecast, by Application

11.3.6.3. Market Revenue and Forecast, by End use

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Component Type

11.3.7.2. Market Revenue and Forecast, by Application

11.3.7.3. Market Revenue and Forecast, by End use

11.4. MEA

11.4.1. Market Revenue and Forecast, by Component Type

11.4.2. Market Revenue and Forecast, by Application

11.4.3. Market Revenue and Forecast, by End use

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Component Type

11.4.4.2. Market Revenue and Forecast, by Application

11.4.4.3. Market Revenue and Forecast, by End use

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Component Type

11.4.5.2. Market Revenue and Forecast, by Application

11.4.5.3. Market Revenue and Forecast, by End use

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Component Type

11.4.6.2. Market Revenue and Forecast, by Application

11.4.6.3. Market Revenue and Forecast, by End use

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Component Type

11.4.7.2. Market Revenue and Forecast, by Application

11.4.7.3. Market Revenue and Forecast, by End use

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Component Type

11.5.2. Market Revenue and Forecast, by Application

11.5.3. Market Revenue and Forecast, by End use

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Component Type

11.5.4.2. Market Revenue and Forecast, by Application

11.5.4.3. Market Revenue and Forecast, by End use

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Component Type

11.5.5.2. Market Revenue and Forecast, by Application

11.5.5.3. Market Revenue and Forecast, by End use

Chapter 12. Company Profiles

12.1. Xylem Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Trojan Technologies Group ULC.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Halma PLC

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Calgon Carbon Corporation

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Atlantic Ultraviolet Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Evoqua Water Technologies LLC

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Advanced UV, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. American Ultraviolet

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Atlantium Technologies LTD.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Dr. Hönle AG

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others