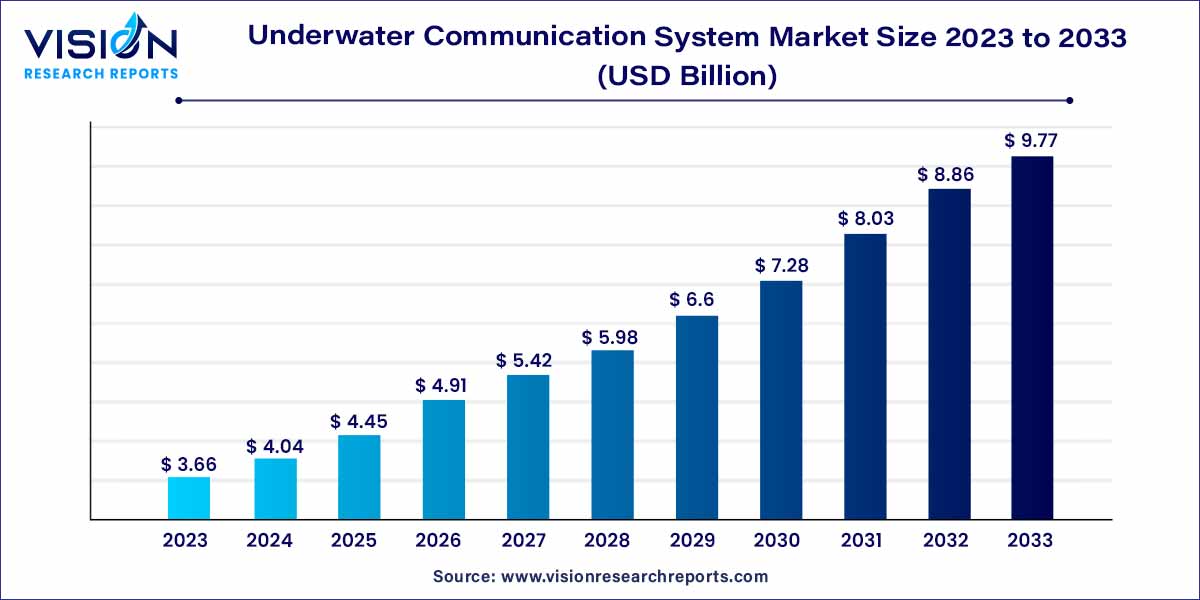

The global underwater communication system market size was estimated at around USD 3.66 billion in 2023 and it is projected to hit around USD 9.77 billion by 2033, growing at a CAGR of 10.32% from 2024 to 2033. One of the primary drivers of the industry's expansion is the rise in defense spending by different governments. Global defense spending has increased due to threats, security concerns, and concerns over contested areas.

The underwater communication system market is experiencing notable expansion, fueled by advancements in technology and the escalating demand for efficient communication solutions in submerged environments. This market encompasses a spectrum of applications, ranging from underwater exploration and research to defense operations and offshore energy activities.

The growth of the underwater communication system market is propelled by several key factors. Technological advancements play a pivotal role, with ongoing innovations in acoustic modems, signal processing, and underwater sensors enhancing the overall efficiency and reliability of communication systems beneath the water's surface. The expanding applications in diverse industries, including offshore oil and gas, defense, environmental monitoring, and scientific research, are driving increased investments in underwater communication solutions. Moreover, the rising demand for autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) is creating a substantial market pull. As industries increasingly operate in challenging underwater environments, the need for robust communication systems capable of transmitting data, commands, and information in real-time becomes paramount. Additionally, the growing emphasis on underwater surveillance and security is contributing to the market's upward trajectory. The synergy of these factors positions the underwater communication system market for significant growth, providing a foundation for sustained innovation and market expansion.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 9.77 billion |

| Growth Rate from 2024 to 2033 | CAGR of 10.32% |

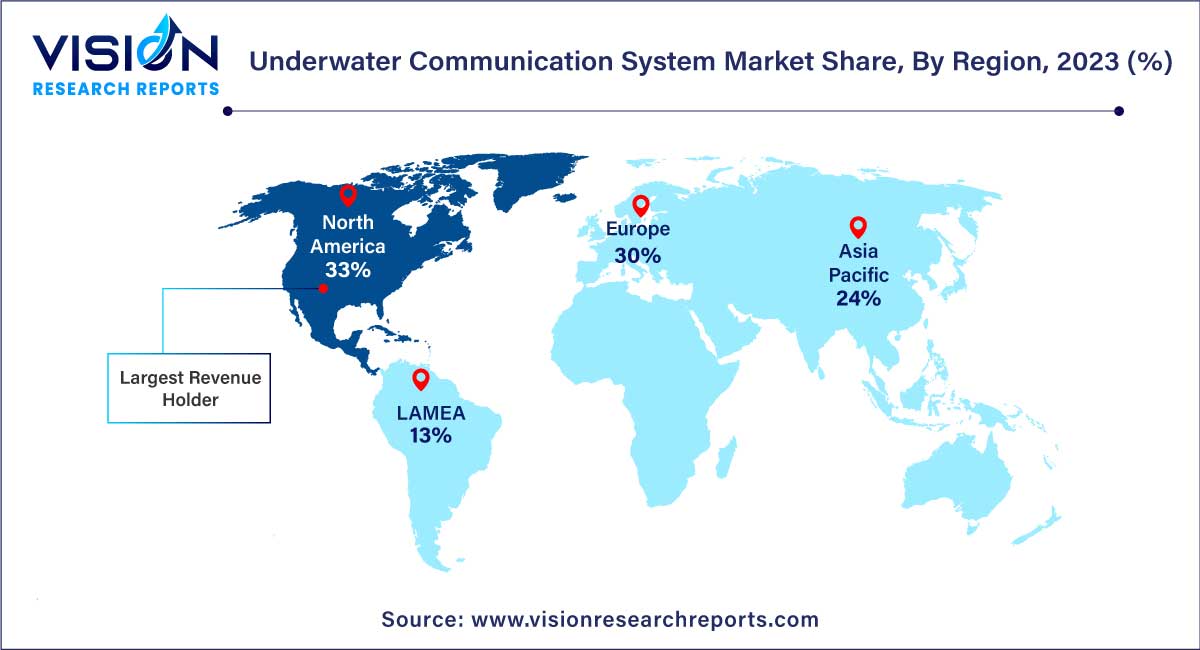

| Revenue Share of North America in 2023 | 33% |

| CAGR of Asia Pacific from 2024 to 2033 | 11.25% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The hardware segment dominated with the largest revenue share of 53% in 2023. Underwater communication hardware components include LCDs, capacitors, resistors, cables & connectors, transistors, PCBs, diodes, adapters/transformers, LEDs, and push buttons.

The services segment is expected to grow at the fastest CAGR of 11.36% during the forecast period. UCS provides engineering services and maritime solutions such as systems engineering, maintenance, and technical support. SEASCAPE is a corporation that sells, manufactures, and services underwater equipment and gadgets. SEASCAPE designs develops and manufactures specialized surface and subsea products for global distribution.

The wireless segment held the largest revenue share of 65% in 2023. The segment is expected to grow at a rapid CAGR of 10.6% throughout the forecast period. Wireless communication uses water to transport data. Environmental monitoring, underwater exploration, and collecting scientific data rely on underwater wireless communications; due to the unique and severe circumstances that define underwater channels, underwater wireless communications still need to be made easier.

These situations include, for example, significant attenuation, multipath dispersion, and restricted resource usage. Nonetheless, improved communication systems based on acoustic, electromagnetic, and optical waves have evolved to address the basic and practical constraints of underwater wireless communications. Many academic and corporate researchers have recently focused on developing cutting-edge solutions for future underwater wireless communications and networks.

The hardwired communication segment is expected to grow at a significant CAGR of 9.73% over the forecast period. Hardwired communication involves the use of a cable to transport data. While many divers love being able to dive wherever they choose with the ability to communicate wirelessly, for professional divers, this is not always the most practical choice owing to the environment, scenario, and function required for the work at hand.

In terms of application, the market is classified into climate monitoring, environmental monitoring, hydrography, oceanography, pollution monitoring, and others. Among these, the environmental monitoring segment contributed the largest market share of 32% in 2023. The activities of corporations in the oil and gas sector can be monitored in terms of how they affect the environment. Environmental contamination may also be monitored and managed with these methods. Climate change is also detectable. These technologies can also predict natural catastrophes by detecting early warning indications. It minimizes the risk of such calamities occurring.

The oceanography segment is anticipated to grow at the fastest CAGR of 11.48% during the forecast period. UCS aids in the study of oceanography since they are utilized for underwater exploration and data collecting. The underwater discoveries might be valuable to the health sector and the development of current innovations. Offshore demonstration and verification tests are carried out for various experimental sea regions, such as offshore and deep sea, in conjunction with the application requirements of ocean observation.

The submarine observation network and the underwater acoustic communication network are combined to improve connection and optimization between the underwater communication network and the submarine optical cable network, as well as to increase the flexibility of the deep-sea observation network.

In terms of end-user, the market is classified into marine, military & defense, oil & gas, scientific research & development, and others. Among these, the scientific research & development segment generated the maximum market share of 33% in 2023. It is expected to grow at a CAGR of 9.8% throughout the forecast period. A UCS also aids scientific research. Autonomous underwater vehicles have also been used to locate wrecked planes and investigate the reasons for their crashes. The development of communication systems has led to the discovery of the Titanic's wreckage and hydrothermal vents in the deep ocean. These devices identify items that help in mapping and discovery underwater. They are also quite dependable for rescue operations.

The military & defense segment is expected to grow at the fastest CAGR of 11.16% during the forecast period. The military utilizes it for underwater surveillance as well as incursion detection. As opposing states may plot sabotage via the water, installing a communication system will warn the nation of the threat.

North America region led the market with the largest market share of 33% in 2023. Underwater acoustic communication is predicted to have the biggest share in North America. Due to rising security concerns in these nations, the United States is deploying unmanned underwater vehicles (UUVs) for various defense purposes, including anti-submarine warfare, security, and surveillance.

Asia Pacific is expected to grow at the fastest CAGR of 11.25% during the forecast period. It is due to various applications such as environmental monitoring, pollution monitoring, climate recording, hydrography, oceanography, aquaculture fisheries, and diving. The growing research and development activities in the region to develop new and innovative underwater communication technologies are driving the market growth of the market for underwater communication system.

By Component

By Connectivity

By Application

By End-user

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Underwater Communication System Market

5.1. COVID-19 Landscape: Underwater Communication System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Underwater Communication System Market, By Component

8.1. Underwater Communication System Market, by Component, 2024-2033

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Underwater Communication System Market, By Connectivity

9.1. Underwater Communication System Market, by Connectivity, 2024-2033

9.1.1. Hardwired

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Wireless

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Underwater Communication System Market, By Application

10.1. Underwater Communication System Market, by Application, 2024-2033

10.1.1. Climate monitoring

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Environmental monitoring

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Hydrography

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Oceanography

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Pollution monitoring

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Underwater Communication System Market, By End-user

11.1. Underwater Communication System Market, by End-user, 2024-2033

11.1.1. Marine

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Military & defence

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Oil & gas

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Scientific research & development

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Others

11.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Underwater Communication System Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by End-user (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.2.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-user (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.3.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-user (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.4.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-user (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-user (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.5.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-user (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Connectivity (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 13. Company Profiles

13.1. Kongsberg Maritime

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. L3Harris Technologies, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Thales

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Saab AB

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Teledyne Marine Technologies Incorporated.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Ultra

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Sonardyne

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Underwater Wireless Modem & Communication Devices

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Undersea Systems International, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Sea and Land Technologies Pte Ltd.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others