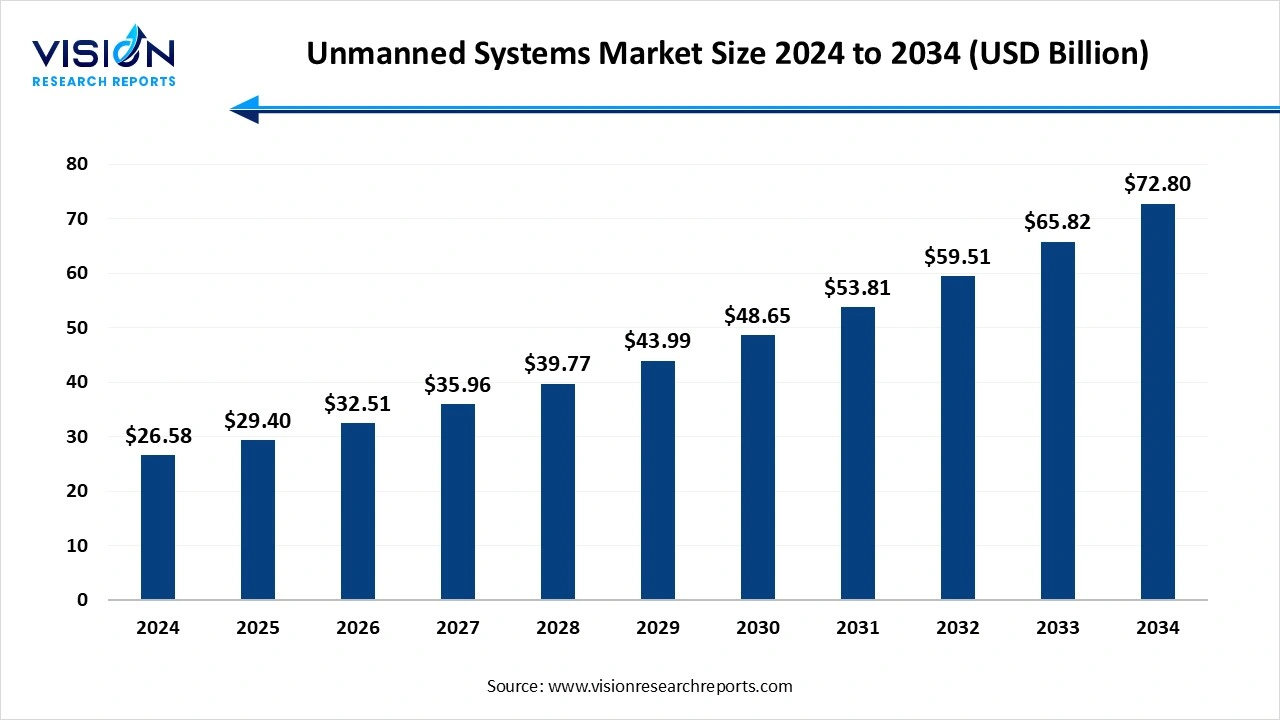

The global unmanned systems market size was estimated at around USD 26.58 billion in 2024 and it is projected to hit around USD 72.80 billion by 2034, growing at a CAGR of 10.60% from 2025 to 2034.

The unmanned systems market is experiencing rapid expansion, driven by technological advancements, increased defense spending, and growing demand for automation across various sectors. Unmanned systems, which include unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and unmanned maritime systems, are being widely adopted in defense, surveillance, agriculture, logistics, and disaster management. Their ability to operate in hazardous environments, reduce human risk, and enhance operational efficiency has positioned them as critical assets in both military and civilian applications.

Several key factors are driving the growth of the unmanned systems market. One of the primary drivers is the increasing demand for automation and remote operations across defense, commercial, and industrial sectors. In defense, unmanned systems enhance intelligence gathering, reconnaissance, and combat capabilities while reducing human casualties. In commercial sectors such as agriculture, oil and gas, and logistics, these systems enable cost-effective monitoring, inspection, and delivery services, leading to operational efficiency and improved safety. The rising need for real-time data and situational awareness is also fueling the adoption of unmanned aerial, ground, and maritime vehicles.

Another significant growth factor is the continuous advancement in technology. Innovations in artificial intelligence, machine learning, sensor fusion, and communication systems have significantly improved the autonomy, navigation, and data processing capabilities of unmanned systems. Additionally, governments around the world are investing heavily in R&D and easing regulatory restrictions to support the integration of unmanned systems into civilian airspace and public infrastructure.

The unmanned systems market is witnessing several transformative trends that are reshaping the landscape of automation and remote operations. One prominent trend is the rapid adoption of artificial intelligence (AI) and machine learning algorithms in unmanned platforms, enabling real-time decision-making, autonomous navigation, and predictive maintenance. These technologies enhance the operational efficiency of unmanned systems across various applications such as surveillance, mapping, crop monitoring, and military reconnaissance.

Another key trend is the growing emphasis on multi-domain integration, where unmanned systems across air, ground, and maritime platforms are being designed to work together in coordinated missions. This interoperability enhances mission flexibility, especially in defense and disaster response scenarios.

The unmanned systems market faces several key challenges that may hinder its full potential. One of the primary concerns is the regulatory and legal framework governing the use of unmanned systems, especially in civilian and commercial airspace. Different countries have varying standards, and the lack of harmonized global regulations makes it difficult for manufacturers and service providers to scale operations internationally.

At the same time, the market is being shaped by several important trends that are pushing innovation forward. Among the most significant is the integration of artificial intelligence and machine learning, which allows unmanned systems to process data in real time, adapt to dynamic environments, and operate autonomously with minimal human intervention. The emergence of swarm technology where multiple unmanned units operate collaboratively is also gaining attention for defense and search-and-rescue missions.

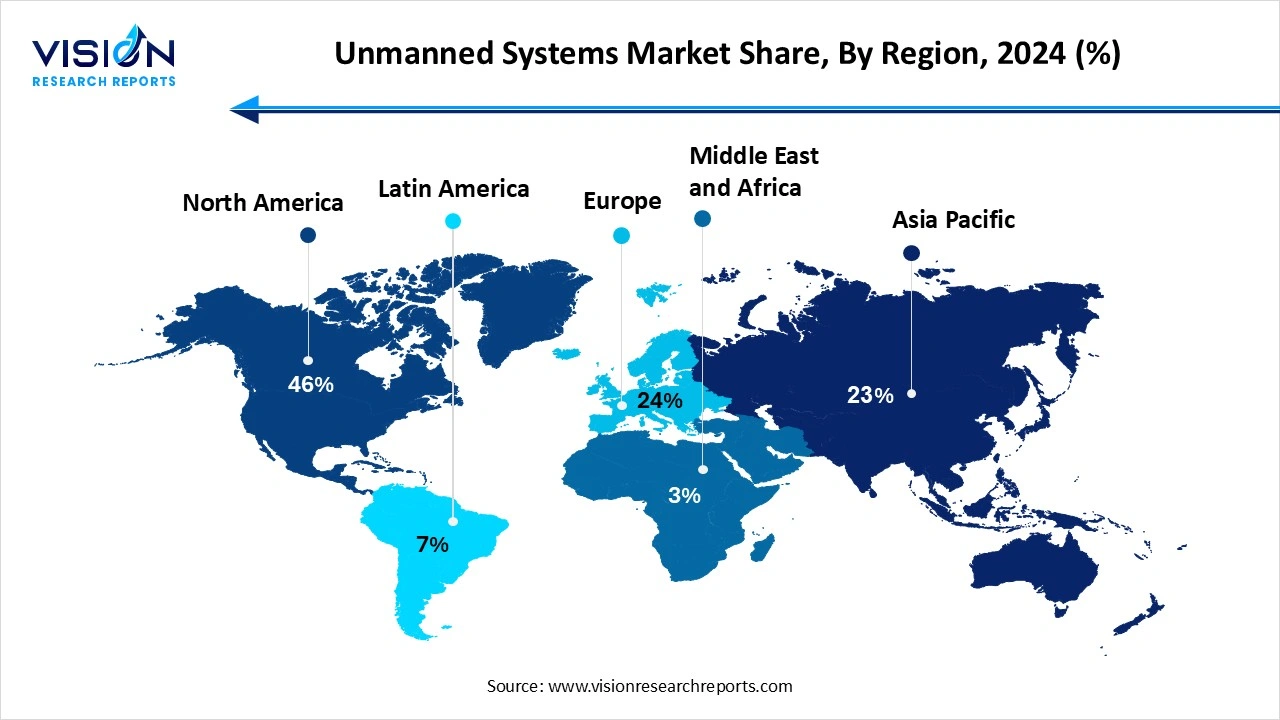

North America led the global unmanned systems industry, capturing a revenue share exceeding 46% in 2024. The United States, in particular, leads in both military and commercial adoption of unmanned systems, driven by high defense spending and supportive government initiatives. The integration of unmanned aerial and ground systems in homeland security, military surveillance, logistics, and agriculture is well-established, and ongoing technological innovation continues to fuel market growth.

The unmanned systems industry in the Asia Pacific region is projected to register the highest compound annual growth rate (CAGR) of over 14.1% between 2025 and 2034. China, India, Japan, and South Korea are among the key contributors, with increasing use of unmanned systems for border security, disaster response, and industrial automation.

The unmanned systems industry in the Asia Pacific region is projected to register the highest compound annual growth rate (CAGR) of over 14.1% between 2025 and 2034. China, India, Japan, and South Korea are among the key contributors, with increasing use of unmanned systems for border security, disaster response, and industrial automation.

The unmanned aerial vehicles (UAV) segment led the market, accounting for more than 58% of the total revenue share in 2024. UAVs are widely used for surveillance, reconnaissance, mapping, agriculture monitoring, and delivery services due to their ability to cover vast areas and reach inaccessible locations without risking human lives. In the defense sector, UAVs have become indispensable for real-time intelligence and tactical operations, while in commercial applications, they are revolutionizing industries such as logistics, construction, and environmental monitoring. Technological advancements such as improved battery life, miniaturized sensors, and autonomous flight capabilities have further enhanced the performance and utility of UAVs.

The unmanned ground vehicles (UGV) segment is projected to register the highest compound annual growth rate (CAGR) of over 13.1% between 2025 and 2034. UGVs are increasingly being used in military applications for logistics support, explosive ordnance disposal (EOD), and reconnaissance in hazardous terrains. In addition, the commercial sector is exploring UGVs for applications such as autonomous delivery, industrial inspection, and agriculture automation. The integration of advanced navigation systems, AI, and real-time communication technologies has significantly expanded the capabilities of UGVs, allowing them to perform complex tasks with minimal human supervision.

The semi-autonomous segment accounted for the largest share of the market in 2024. Semi-autonomous unmanned systems operate under partial human control, typically relying on remote commands while executing specific tasks independently. These systems are commonly used in military operations, industrial inspections, and search-and-rescue missions, where human oversight remains crucial for decision-making and risk mitigation. The primary advantage of semi-autonomous systems lies in their ability to reduce human exposure to dangerous environments while still leveraging human intelligence for complex judgments. Technological enhancements such as improved communication links, GPS navigation, and onboard sensors are enabling these systems to carry out more sophisticated operations with greater reliability and precision.

The fully autonomous segment is anticipated to experience the highest CAGR during the period from 2025 to 2034. These systems utilize artificial intelligence, machine learning, computer vision, and advanced data processing to perceive their environment, make decisions, and execute actions independently. Fully autonomous technology is gaining traction across a range of sectors including defense, agriculture, logistics, and urban mobility. For instance, autonomous drones are being used for long-range surveillance, while autonomous ground vehicles are being tested for logistics and delivery applications.

The military and law enforcement segment captured a substantial portion of the market share in 2024. In the military and law enforcement domain, unmanned systems are playing a transformative role by enhancing situational awareness, surveillance, reconnaissance, and tactical capabilities. Defense agencies across the globe are increasingly integrating unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and unmanned maritime systems into their operations to minimize human risk and improve operational efficiency in complex environments.

The commercial segment is projected to experience the highest compound annual growth rate (CAGR) from 2025 to 2034. UAVs are widely used in crop monitoring, spraying, land mapping, and inspection tasks due to their cost-effectiveness and ability to access hard-to-reach areas. In logistics and delivery, drones and autonomous ground vehicles are increasingly being deployed to streamline last-mile delivery, especially in urban settings.

By Type

By Technology

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Unmanned Systems Market

5.1. COVID-19 Landscape: Unmanned Systems Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Unmanned Systems Market, By Type

8.1. Unmanned Systems Market, by Type

8.1.1 Unmanned Aerial Vehicles

8.1.1.1. Market Revenue and Forecast

8.1.2. Unmanned Ground Vehicles

8.1.2.1. Market Revenue and Forecast

8.1.3. Unmanned Sea Vehicles

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Unmanned Systems Market, By Technology

9.1. Unmanned Systems Market, by Technology

9.1.1. Semi-Autonomous

9.1.1.1. Market Revenue and Forecast

9.1.2. Remotely Operated

9.1.2.1. Market Revenue and Forecast

9.1.3. Fully Autonomous

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global Unmanned Systems Market, By Application

10.1. Unmanned Systems Market, by Application

10.1.1. Military and Law Enforcement

10.1.1.1. Market Revenue and Forecast

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast

10.1.3. Others

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Unmanned Systems Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type

11.1.2. Market Revenue and Forecast, by Technology

11.1.3. Market Revenue and Forecast, by Application

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type

11.1.4.2. Market Revenue and Forecast, by Technology

11.1.4.3. Market Revenue and Forecast, by Application

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type

11.1.5.2. Market Revenue and Forecast, by Technology

11.1.5.3. Market Revenue and Forecast, by Application

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type

11.2.2. Market Revenue and Forecast, by Technology

11.2.3. Market Revenue and Forecast, by Application

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type

11.2.4.2. Market Revenue and Forecast, by Technology

11.2.4.3. Market Revenue and Forecast, by Application

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type

11.2.5.2. Market Revenue and Forecast, by Technology

11.2.5.3. Market Revenue and Forecast, by Application

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type

11.2.6.2. Market Revenue and Forecast, by Technology

11.2.6.3. Market Revenue and Forecast, by Application

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type

11.2.7.2. Market Revenue and Forecast, by Technology

11.2.7.3. Market Revenue and Forecast, by Application

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type

11.3.2. Market Revenue and Forecast, by Technology

11.3.3. Market Revenue and Forecast, by Application

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type

11.3.4.2. Market Revenue and Forecast, by Technology

11.3.4.3. Market Revenue and Forecast, by Application

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type

11.3.5.2. Market Revenue and Forecast, by Technology

11.3.5.3. Market Revenue and Forecast, by Application

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type

11.3.6.2. Market Revenue and Forecast, by Technology

11.3.6.3. Market Revenue and Forecast, by Application

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type

11.3.7.2. Market Revenue and Forecast, by Technology

11.3.7.3. Market Revenue and Forecast, by Application

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type

11.4.2. Market Revenue and Forecast, by Technology

11.4.3. Market Revenue and Forecast, by Application

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type

11.4.4.2. Market Revenue and Forecast, by Technology

11.4.4.3. Market Revenue and Forecast, by Application

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type

11.4.5.2. Market Revenue and Forecast, by Technology

11.4.5.3. Market Revenue and Forecast, by Application

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type

11.4.6.2. Market Revenue and Forecast, by Technology

11.4.6.3. Market Revenue and Forecast, by Application

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type

11.4.7.2. Market Revenue and Forecast, by Technology

11.4.7.3. Market Revenue and Forecast, by Application

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type

11.5.2. Market Revenue and Forecast, by Technology

11.5.3. Market Revenue and Forecast, by Application

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type

11.5.4.2. Market Revenue and Forecast, by Technology

11.5.4.3. Market Revenue and Forecast, by Application

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type

11.5.5.2. Market Revenue and Forecast, by Technology

11.5.5.3. Market Revenue and Forecast, by Application

Chapter 12. Company Profiles

12.1. Northrop Grumman Corporation.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Lockheed Martin Corporation.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. The Boeing Company.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. BAE Systems plc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Elbit Systems Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Raytheon Technologies Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. General Atomics Aeronautical Systems, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Thales Group

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. AeroVironment, Inc..

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Textron Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others