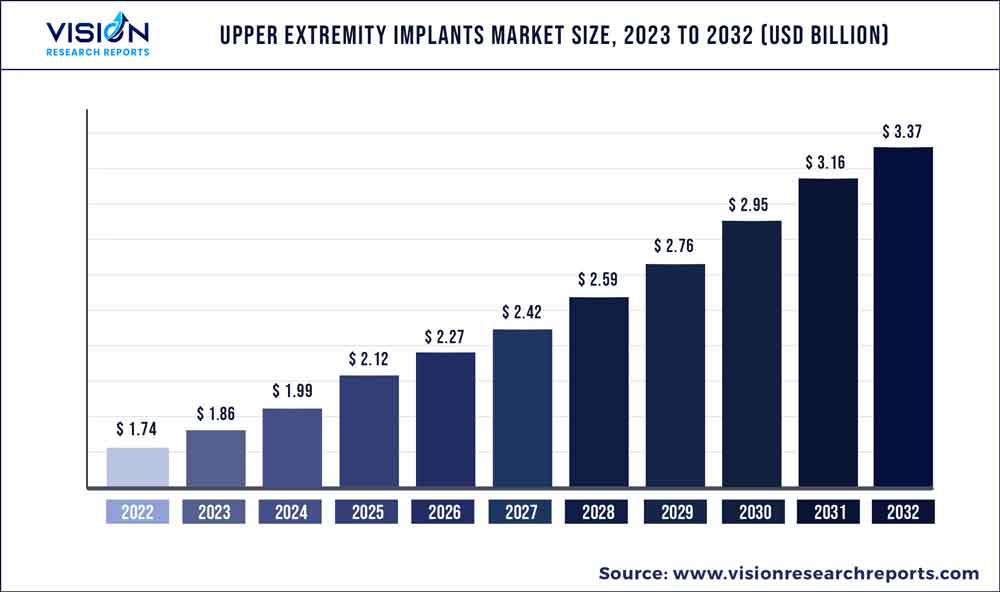

The global upper extremity implants market was valued at USD 1.74 billion in 2022 and it is predicted to surpass around USD 3.37 billion by 2032 with a CAGR of 6.84% from 2023 to 2032. The upper extremity implants market in the United States was accounted for USD 868.4 million in 2022.

Key Pointers

Report Scope of the Upper Extremity Implants Market

| Report Coverage | Details |

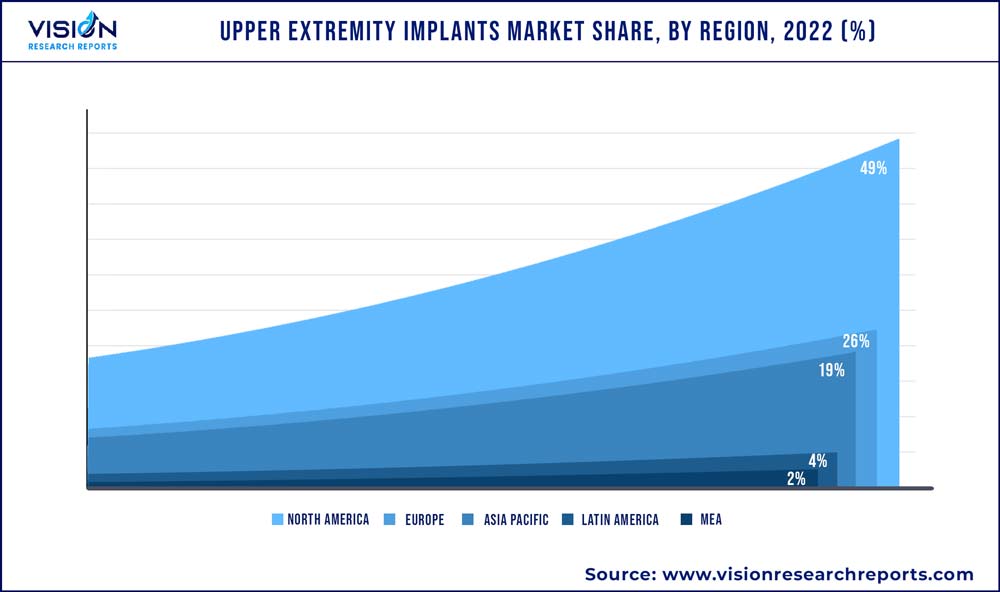

| Revenue Share of North America in 2022 | 49% |

| Revenue Forecast by 2032 | USD 3.37 billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.84% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Stryker; DePuy; Zimmer Biomet; Smith & Nephew; Medtronic; Aesculap; BioTek Instruments; Conmed; Arthrex, Inc.; Ossur; DJO Global; Acumed LLC |

The rising incidence of sports-associated injuries coupled with a higher preference for implants owing to their numerous advantages is driving the growth. In addition, the rising number of upper limb surgeries is facilitating the demand for artificial limbs and implants. For instance, according to recent data from the American Academy of Orthopaedic Surgeons, over 53,000 shoulder replacement surgeries are performed in the U.S. every year, and shoulder & elbow replacement surgeries are among the top 10 most common orthopedic surgeries.

The increasing burden of musculoskeletal disorders, sport associated injuries is expected to fuel market expansion throughout the forecast period. Some of the marketed implants for upper limb arthritis are HemiCAP Systems from Anika Therapeutics, Inc., and Zimmer Biomet shoulder replacement solutions among others. In addition, according to an article published by Johns Hopkins Medicine, approximately 30 million people take part in some organized sports, accounting for more than 3.5 million sports injuries each year in the U.S.

Moreover, the development of customized implants, rising demand for biocompatible implants with less toxic effects, and robust demand for technologically advanced prosthetics from end-users are pushing manufacturers to introduce novel products. For instance, in October 2022 Integrum announced that its revolutionary OPRA Implant System received patent approval from US Patent and Trade Organization. This system is a novel bone-anchored prostheses system in which prostheses are directly attached to the bone. The OPRA system is suitable for both upper as well as lower limbs.

The COVID-19 pandemic had a negative impact on the global upper extremity implants market owing to cancellations of surgical treatments, a reduction in fracture cases, and fewer hospital and clinic visits owing to restrictions and safety purposes. The industry players saw a decline in their revenue from implant sales due to the pandemic. But, after the pandemic, the market has started gaining momentum due to streamlining of elective surgeries. Thus, owing to the high number of fractures and bone diseases the market is likely to witness significant growth opportunities in the coming years.

Type Insights

The shoulder segment dominated the global market in 2022 and accounted for a maximum revenue share of more than 59.53%. The segment’s growth is driven by the rising number of sports injuries, shoulder dislocation, rising geriatric population, increasing incidence of osteoarthritis, fracture of the shoulder, accidents, and traumas that have led to the increasing need for upper extremities implant products. Besides, shoulder replacements account for the largest number of orthopedic extremity procedures and represent one of the profitable segments in orthopedics.

With increasing expectations of patient satisfaction, several surgeons are looking for treatment options to improve clinical outcomes. Hence, shoulder replacement or arthroplasty implant products are majorly driven by trends such as the revision of failed previous shoulder replacements in older patients, the requirement for various biomaterial implants, bone-preserving solutions, and next-generation joint arthroplasty systems.

The elbow segment is expected to grow at the fastest rate over the forecast period. The elbow segment is driven by continuous innovation in new elbow implant systems. In addition, the requirement for implant in elbow replacement for primary and revision surgery has uplifted the growth. Alternatively, hand & Wrist is expected to have lucrative growth over the forecast period with new product launches.

For instance, in March 2020, Extremity Medical announced that it has received FDA 510(k) clearance for KinematX Total Wrist Implant. This product is developed to emulate the natural wrist range of motion in people with wrist arthritis & other degenerative wrist diseases. Thus, the recent product approvals from regulatory authorities to serve evolving demand is likely to contribute to market expansion.

Biomaterial Insights

The metallic biomaterials segment held the majority of the revenue share of 40.84% in 2022. This can be attributed to advanced properties such as proper strength, fracture toughness, ductility, hardness, corrosion resistance, and biocompatibility.

Furthermore, demand for metallic materials such as stainless steels, titanium (Ti)-based alloys, Co-based alloys, and biodegradable alloys such as Mg-based alloys in the shoulder, and elbow replacement surgery has lifted the segment growth. Additionally, these materials have been approved by the U.S. FDA and are routinely used in orthopedic implants. Furthermore, new designs and conceptions of metallic biomaterials are expected to create the potential for biomedical applications in the upper extremities.

Natural biomaterials are expected to have lucrative growth at the fastest CAGR over the estimated period. Natural biomaterials have emerged as a trend in surgical procedures because of their ability for integrating and remodeling, along with bio-compatibility within the patient’s own tissue. This biomaterial offers a scaffolding or support structure that allows cells to start forming new tissue.

End-use Insights

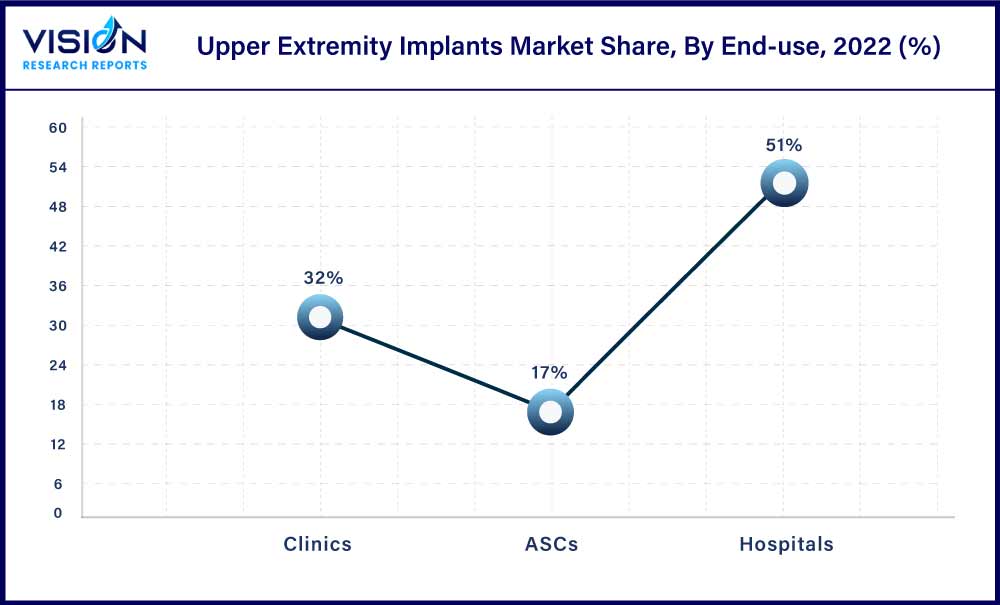

The hospital segment held the largest share of 51% in 2022. The dominance of the segment is attributed to the rising injury percentage of the different upper extremities and the requirement for operative treatment of fractures. Moreover, the rising concerns to treat upper extremities caused due to sports injuries is a factor for the overall growth. The market products offer comprehensive services to restore function and eliminate injury which has increased demand for the products in hospitals over the estimated period.

The ASCs segment is expected to show the fastest growth over the forecast period which can be attributed to increased preference for ASCs in upper extremities procedures, the rising number of new product innovations, and FDA clearance has led to the rise in market growth. The ASCs segment provides added advantages to the patient with adequate postoperative pain control, rapid patient discharge, minimal side effects, and overall cost containment.

For instance, in August 2021, the Orthopaedic Implant Company announced the launch and FDA clearance of the DRPx System. The device is the only distal radius plating system with an improved ergonomic design that meets orthopedic surgeons while saving costs with the improved financial viability of hospitals and ambulatory surgery centers (ASCs). The product is available in the United States.

Regional Insights

North America led the overall upper extremity implants industry with a share of 49% in 2022 and is anticipated to continue dominating throughout the forecast period. Factors such as rising common shoulder injuries such as included dislocations/separations, sprains/strains, contusions, and fractures. The rise in the geriatric population, increasing number of sports injuries, and presence of key participants in North America are driving regional growth. Alternatively, the presence of established healthcare facilities treating a range of conditions such as fractures, dislocations, tendonitis, and arthritis has flourished the requirement of products to a major extent.

Asia Pacific is anticipated to witness a lucrative CAGR throughout the forecast period. The increasing aging population, rising demand for orthopedics surgeries and therapies, improving access to healthcare with quality care, and reduced costs have presented new growth opportunities for companies in the APAC region with the presence of countries such as Japan, China, and India. Moreover, the rising burden of sports injuries, fractures, and a significant increase in demand for products in the region is likely to support regional expansion.

Upper Extremity Implants Market Segmentations:

By Type

By Biomaterial

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Upper Extremity Implants Market

5.1. COVID-19 Landscape: Upper Extremity Implants Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Upper Extremity Implants Market, By Type

8.1. Upper Extremity Implants Market, by Type, 2023-2032

8.1.1 Shoulder

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Elbow

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Hand & Wrist

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Upper Extremity Implants Market, By Biomaterial

9.1. Upper Extremity Implants Market, by Biomaterial, 2023-2032

9.1.1. Metallic Biomaterials

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Ceramic Biomaterials

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Polymeric Biomaterials

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Natural Biomaterials

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Upper Extremity Implants Market, By End-use

10.1. Upper Extremity Implants Market, by End-use, 2023-2032

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. ASCs

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Clinics

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Upper Extremity Implants Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.1.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.2.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.3.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Biomaterial (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 12. Company Profiles

12.1. Stryker

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. DePuy

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Zimmer Biomet

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Smith & Nephew

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Medtronic

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Aesculap

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. BioTek Instruments

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Conmed

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Arthrex, Inc

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Ossur

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others