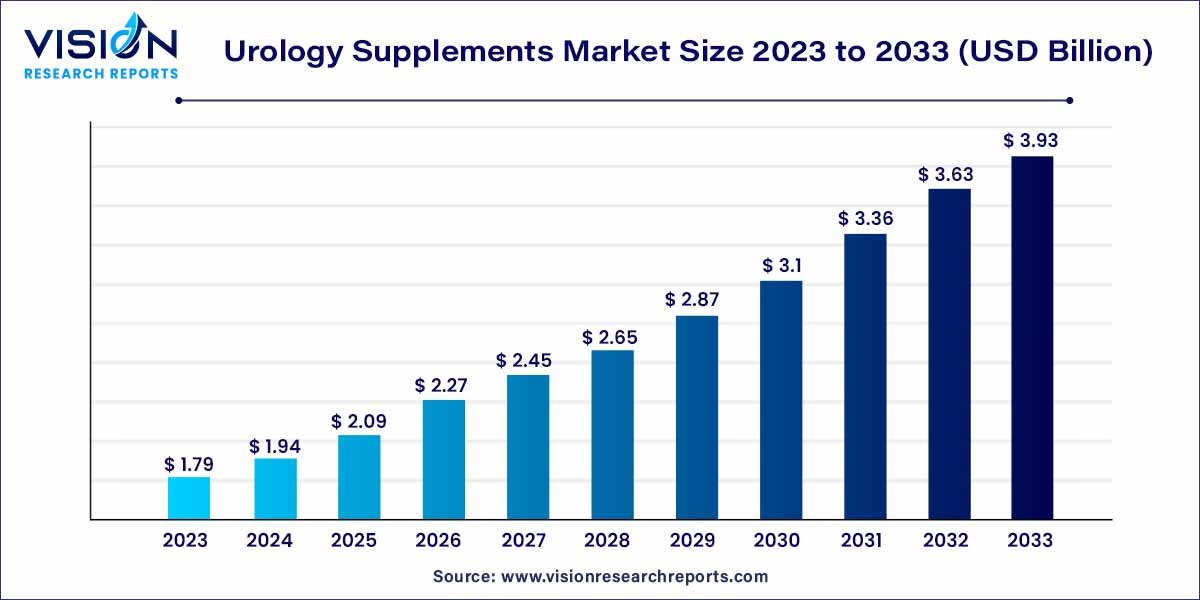

The global urology supplements market size was surpassed at USD 1.79 billion in 2023 and is expected to hit around USD 3.93 billion by 2033, growing at a CAGR of 8.18% from 2024 to 2033.

In the rapidly evolving landscape of healthcare, the urology supplements market stands as a critical segment addressing various urological conditions. This comprehensive overview delves into the key aspects of this market, shedding light on its current state, trends, and potential growth factors.

The growth of the urology supplements market is propelled by several key factors contributing to its expanding trajectory. Firstly, an aging global population has significantly increased the prevalence of urological disorders, necessitating a surge in preventive healthcare measures. Additionally, heightened awareness regarding urological health and the importance of proactive well-being has driven consumer demand for supplements. Technological advancements in formulation processes have further enhanced the efficacy of urology supplements, attracting a broader consumer base. Furthermore, the proliferation of online platforms as viable distribution channels has substantially increased accessibility to these supplements, facilitating market growth. As the market continues to evolve, these interconnected factors collectively contribute to the positive trajectory of the urology supplements sector.

In 2023, the multi-ingredient segment dominated the market share and is projected to experience a robust Compound Annual Growth Rate (CAGR) of 8.75% from 2024 to 2033. This growth is attributed to several key factors, including a heightened demand for comprehensive care products, an increasing preference for natural and holistic solutions, and the synergistic effects derived from multi-ingredient formulations. Notably, Labiana Pharmaceuticals exemplified this trend in December 2020 with the introduction of Precyst, a pioneering multi-ingredient supplement featuring D-mannose and cranberry extract. This product is specifically designed to bolster urinary system health in women, further contributing to the momentum of the multi-ingredient segment.

Conversely, the single ingredient segment is poised to register a noteworthy CAGR between 2024 and 2033. Single ingredient supplements play a crucial role in offering targeted benefits for urological health, addressing specific concerns such as prostate health support, promoting optimal urinary tract function, and managing issues like urinary incontinence. The growing consumer inclination towards tailored health solutions is a key driver behind the rising demand for single ingredient supplements in the market.

In 2023, the urinary tract infection (UTI) segment emerged as the market leader, commanding a substantial revenue share of 38%, and is poised to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This dominance is attributed to a heightened awareness surrounding UTIs and their associated risk factors, prompting increased consumer interest in preventive measures, notably the use of supplements. Given the prevalent nature of UTIs, there exists a considerable market demand for supplements aimed at both preventing and managing these infections. Notable players in this segment, such as Azo, Now Foods, and Swanson, offer products like Cranberry Caps and Urinary Tract Essentials capsules to cater to this demand.

Concurrently, the kidney health segment is projected to experience significant growth in CAGR over the forecast period. The increasing consumer awareness regarding the significance of kidney health and the impact of lifestyle factors on kidney function are key contributors to this trend. Individuals are adopting a more proactive approach to safeguarding kidney health, incorporating dietary modifications, lifestyle adjustments, and the use of supplements. This growing awareness is expected to drive the demand for urology supplements specifically designed to support and enhance kidney function and overall health.

The market segmentation based on formulation includes capsules, softgels, tablets, liquid, and others. Capsules took precedence in 2023, capturing a substantial market share of 39%. Renowned for their convenience, capsules stand out as one of the most user-friendly dosage forms for supplements. Their easy-to-swallow nature, coupled with a neutral taste and odor, renders them more palatable to consumers when compared to alternatives like tablets or powders. This user-friendly characteristic significantly contributes to the widespread preference for capsules, establishing their dominance in the market.

On the other hand, the softgels segment is poised to exhibit the swiftest Compound Annual Growth Rate (CAGR) from 2024 to 2033. Softgel capsules typically incorporate active ingredients dissolved or suspended in oil or lipid-based carriers. This unique formulation enhances the bioavailability of nutrients, facilitating superior absorption in the body compared to traditional capsules or tablets. The heightened bioavailability of softgels results in more effective nutrient delivery, fueling their popularity among consumers seeking optimal health benefits.

The market, categorized by distribution channel, comprises brick & mortar and e-commerce segments. In 2023, the brick & mortar segment took the lead, commanding a significant revenue share. This dominance is attributed to the increasing trend among medical professionals who recommend urology supplements for various health issues, including urinary tract health, prostate health, and bladder function. Such endorsements contribute to the robust performance of the brick & mortar segment in the urology supplements market.

Conversely, the e-commerce segment is poised to exhibit the highest Compound Annual Growth Rate (CAGR) from 2024 to 2033. The online market for urology supplements is experiencing noteworthy growth, driven by consumers actively taking charge of their health decisions and the continued surge in the use of e-commerce platforms. A case in point is the strategic expansion undertaken by Uqora in May 2023, extending its urinary tract health products across diverse channels to reach a broader audience within the urology supplements market. These developments signify the accelerating growth of the e-commerce segment throughout the forecast period

North America commands a substantial revenue share in the urology supplements market, fueled by several key factors. The region's growth is propelled by an increased awareness of urological health, the rising prevalence of lifestyle-related urological conditions, and the easy availability of supplement-based solutions. Moreover, the heightened consciousness regarding urological health and shifts in lifestyle choices have led to a notable increase in consumers actively seeking noninvasive and sustainable approaches to improve their overall urological well-being. This trend has, in turn, stimulated robust demand for urology supplements throughout North America.

In 2023, Asia Pacific emerged as the dominant force in the urology supplements market, securing a noteworthy revenue share of 36%. Anticipated to exhibit the fastest Compound Annual Growth Rate (CAGR) from 2024 to 2033, this region is witnessing a surge in awareness and interest in health and wellness among consumers. The population across APAC is becoming increasingly conscious of their lifestyle habits and actively seeking urology products that contribute to overall well-being. As disposable income continues to rise in APAC countries, consumers are displaying a willingness to allocate more resources towards health-enhancing products, further propelling the growth of the urology supplements market in the region.

By Type

By Application

By Formulation

By Distribution Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Urology Supplements Market

5.1. COVID-19 Landscape: Urology Supplements Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Urology Supplements Market, By Type

8.1. Urology Supplements Market, by Type, 2024-2033

8.1.1. Multi-ingredient

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Single ingredient

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Urology Supplements Market, By Application

9.1. Urology Supplements Market, by Application, 2024-2033

9.1.1. Urinary Tract infections

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Kidney Health

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Prostate Health

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Bladder Health

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Urology Supplements Market, By Formulation

10.1. Urology Supplements Market, by Formulation, 2024-2033

10.1.1. Capsules

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Softgels

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Tablets

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Liquid

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Urology Supplements Market, By Distribution Channel

11.1. Urology Supplements Market, by Distribution Channel, 2024-2033

11.1.1. Brick & Mortar

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. E-commerce

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Urology Supplements Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.1.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.2.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.3.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.4.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.5.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Formulation (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 13. Company Profiles

13.1. Theralogix

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Nature's Bounty

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Solaray

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Puritan's Pride

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Schiff Nutrition

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. ZAHLER

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Natrol, LLC.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Biotexlife

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Himalaya Wellness.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Himalayan Organics

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others